Outsourced CIO: The client experience dividend

Brought to you by Mason Stevens. A study of investment outsourcing trends among Australian financial advisers, and associated client benefits

In this special production

Mason Stevens would like to thank the following financial advisers for participating in the production of this paper:

Introduction

Welcome to this white paper that explores investment outsourcing trends among Australian financial advisers.

Welcome to this white paper that explores investment outsourcing trends among Australian financial advisers.

While successful investing is never easy, the last 3 years have proved especially complex.

Mastering the markets is not a part-time job. And yet with financial advisers already juggling so many challenges as they try to deliver quality, compliant advice and grow sustainable practices, it is becoming more and more difficult for them to devote anything other than a fraction of their time to this most complex of disciplines. This is putting both themselves, and their clients, at risk.

Little wonder then the trend towards outsourcing investment management capability – the outsourced CIO – is gathering pace both here, and around the world, among big investors and small.

I am fortunate enough to work with some of Australia’s most client-centric, forward thinking financial advisers, and while they are all very different individuals from very different businesses, they all share an absolute clarity and unshakeable belief that their proposition to clients is built on strategic advice, and deep, highly engaged relationships. Similarly, they have all recognised that augmenting their investment management capability by partnering with external experts can strengthen – rather than diminish – their reputation as a financial adviser. As well as enabling them to deliver improved investment outcomes, the ‘outsourced CIO’ frees up their time to focus on their core value-add to clients.

As such these advisers are better equipped than most, to not only weather any storms the markets may experience, but to face down whatever disruptive forces may lay in store in the future.

About This Paper

This discussion paper is a joint initiative between Mason Stevens and Ensombl.

It aims to examine the growing trend of the Outsourced CIO, and the ways the outsourcing of investment capability can – through aiding better outcomes and greater efficiencies – help advisers significantly improve the client experience – and appreciation of the value – of their advice.

We would like to thank the following advisers for their participation in the production of this paper:

Andrew Height, Managing Director and Specialist Adviser, Height Capital

Alex Hont, Partner and Certified Financial Planner, Moran Partners Financial Planning

Daniel Rake, General Manager, Freedom Financial Australia

Executive Summary

1. Improving consumer understanding of the value of financial advice is the key to increasing its uptake

2. While Investment guidance is an important source of value for consumers, it is not the only one

3. A growing number of advisers are recognising the need to add value beyond investment management

4. This is especially critical to futureproof wealth practices from future disruption, and the existential threat posed by the looming intergenerational wealth transfer

5. By working with Australian financial advisers, we have identified a wide range of individual strategies and responses being used by retirees to help mitigate inflation risk

6. Put simply, advisers need to spend more time interacting with clients

7. Their challenge however is to balance out the need to spend more time building client relationships with the often competing needs to drive down costs, maintain and build their technical knowledge, stay abreast of market developments, remain compliant, and continue to deliver high-quality investment advice and outcomes

8. The full or partial outsourcing of the investment management value chain – sometimes called the Outsourced Chief Investment Office (OCIO) – is one of the ways this balance becomes possible

9. There is a growing trend around the world towards the Outsourced CIO, among both institutional investors and small to medium wealth practices

10. External investment expertise, provided by a range of specialists, including asset managers, investment consultants, economists and researchers, can be accessed as a standalone service from a wide range of providers, or bundled product solutions

11. Legislative changes have enabled innovation in the lifetime annuity category

12. The complexity of investing means that tapping into external expertise will almost certainly deliver client outcomes compared to a DIY in-house approach

13. In Australia, managed accounts are rapidly becoming the most popular ‘bundled’ approach to the Outsourced CIO

14. Managed Accounts also offer significant efficiency savings, allowing advisers to invest more time in developing their skills, broadening their offering, and engaging with clients

15. The combination of benefits pays dividends in the form of a greatly enhanced advice experience for clients.

The Value of Advice Conundrum

The value of financial advice – what it is, and how to articulate it – is one of the most discussed, debated, and researched topics within both financial services and public policy circles.

Poor consumer understanding of the value of advice is undoubtedly one of the main reasons its uptake across the community has remained stubbornly low. As falling adviser numbers and increasing costs see advice fees climb, this ‘value misalignment’ seems set to increase further, creating a sustainability challenge for the profession, but more importantly putting individuals at heightened risk of poor decision-making in an increasingly challenging and complex economy.

If successfully communicating the value of financial advice is a conundrum, then solving the conundrum is clearly more important now than ever before.

Investment guidance underpins both the emotional and functional benefits of advice.

There is an extensive body of research suggesting clients place more value on the emotional – rather than functional – benefits of advice. The process of articulating goals, creating a plan to achieve them, and monitoring progress against those goals has been shown to have a significant and positive psychological impact, beyond mere investment returns1. But this is not to say investment advice doesn’t sit at the heart of a financial plan. On the contrary, it is the strategic advice around investments – including product mix, asset allocation, tax treatment and manager selection – that makes the achievement of client goals possible.

Of course, investment advice must be appropriate to the context. This is a legal and ethical requirement and is what drives the value of the advice.

Understanding that context and designing advice appropriately requires the adviser to therefore have a detailed and current understanding not only of their client’s circumstances and objectives but also of compliance requirements, product features, tax laws, Centrelink rules, superannuation regulations, and of course investment markets and economic trends, as well as a myriad of other factors.

Solving the advice value conundrum arguably rests, then, on advisers successfully addressing the following challenges:

1. Deciding the role of investment advice within their value proposition

2. Connecting that role to client expectations of the advice experience

3. Optimising their knowledge and capabilities to deliver this experience

4. Being able to do so in a financially sustainable way

The purpose of this paper is to examine the ways financial advisers are solving these challenges, with particular emphasis on the ways they are building, resourcing, and articulating their investment management offering within the context of a strategic advice proposition.

By augmenting local and overseas research with insights from a selection of Australian advisers, we are able to shine a light on the mindsets, propositions and business models which create a stronger alignment between the value and experience clients are seeking from advisers, and the value advisers themselves believe they should be offering.

Strengthening this alignment will in turn make wealth practices more futureproof in the face of evolving consumer preferences and uncertain competitive threats.

What clients value most about advice?

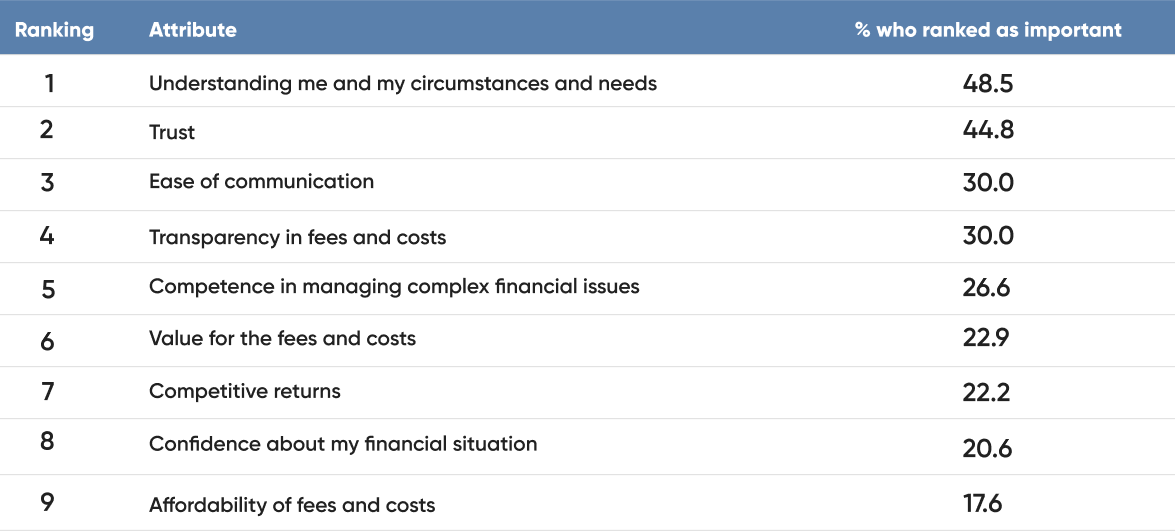

A number of recent Australian studies shed light on the aspects and outcomes of advice that are most valued by clients.

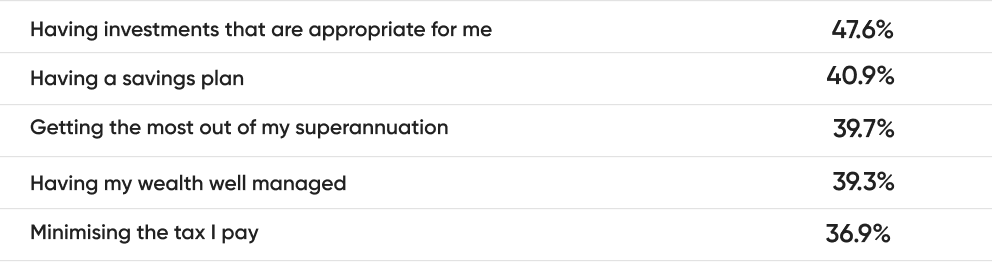

A 2019 study2 by CoreData asked a random selection of advised clients which factors they used to assess the quality of their relationship with their adviser. The ranked responses are shown in Table 1 below:

Table 1: Most valued attributes of adviser relationship

Source: Coredata

That same study also asked respondents. to rank the financial goals advice had helped them to achieve, identifying the top 5 as:

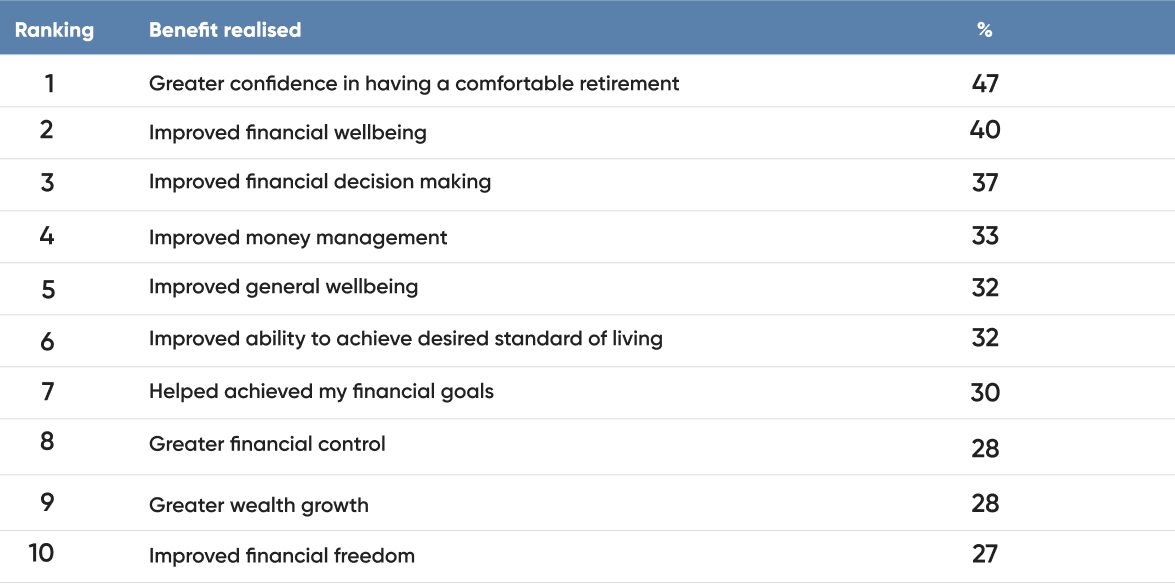

More recently, the FPA’s inaugural Value of Advice Index3, launched in October 2022, identified the top 10 key benefits clients realised from their advice relationship, as shown in Table 2.

Table 2: Top benefits clients realise from financial advice relationships

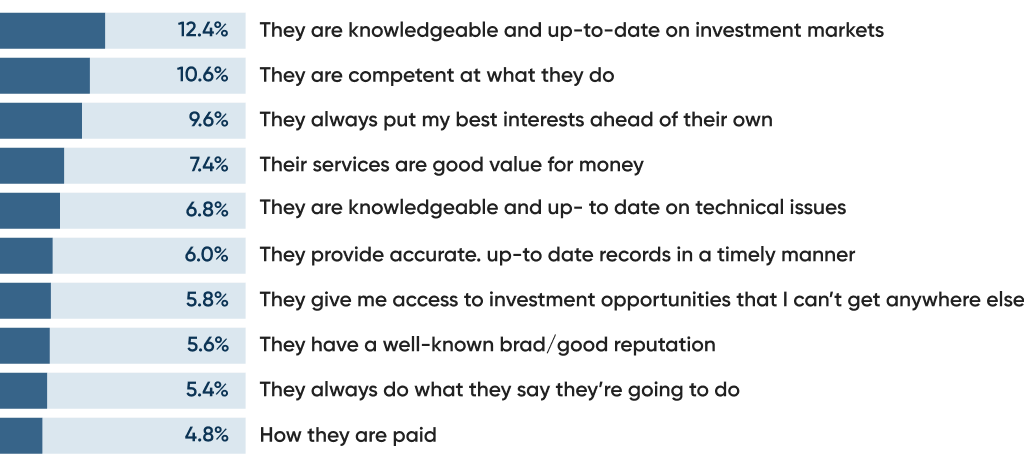

The final study worth referencing here is the Crestone State of Wealth Report4 from 2021. Their study of high and ultra-high-net-worth clients found the top 10 most valued advice aspects to be as follows:

Table 3: Aspects of financial advice most valued by HNW/UHNW clients

Source: Crestone

If we analyse all these responses and allow for overlaps, it is possible to distil them down to a short list of the categories of attributes and outcomes most valued by clients of all wealth segments:

1. Relationship management attributes (Understanding, trust, communication, building confidence)

2. Competence and expertise (understanding legislation, tax and products, access to opportunities)

3. Functional and process outcomes (designing a plan, making sound investment decisions, growing wealth)

4. Providing value for the fees charged.

Adviser Insight: Futureproofing a practice by doing it well, not doing it ourselves

“While we are really optimistic about the future of advice in Australia, there’s a lot of uncertainty and disruption still to come. Rather than being a one size fits all type of practice, we wanted to develop a proposition that was more futureproof and would allow us to operate in a higher fee segment. We see our investment strategy as the best way of differentiating ourselves. But that doesn’t mean doing it ourselves, it means doing it well.” Andrew Height

Relationships are harder to replicate – staring down the ‘robo’ threat

The research referenced above makes crystal clear the importance of the relationship aspects of advice, and advisers investing in the relationship management element of their proposition will undoubtedly reap rewards in terms of both client acquisition and retention. Importantly, relationship management is very hard to replicate, by either competitors or robots, meaning advisers who focus on the hard-to-automate human side of their proposition are more able to inoculate their practices from future competitive threats.

A US study of advice clients, released in 2022, found an overwhelming affinity for the human touch remains5. More than 90% of investors who worked with a human adviser said they wouldn’t consider switching to a robo-adviser, while at the same time, 88% of robo-adviser users said they would consider switching to a human adviser in the future.

To the extent that the take up of robo-advice in Australia lags the US significantly, it seems reasonable to assume that local investors would exhibit a similar preference.

But the children of clients may be a bigger threat.

The much-discussed intergenerational wealth transfer is underway around the world. According to research by Griffith University6, the amount of wealth that is ripe for transfer in Australia over the coming years is around $3.5 trillion. And while the majority of transfer is likely at least a decade away, around half a trillion in wealth is currently sitting with individuals aged 80 or older, with transfer therefore imminent. Experts estimate Gen Xers will inherit just over half (57%) of this wealth, with Millennials set to collect the bulk of the rest.7

While this should represent an enormous opportunity for advisers, it is actually shaping as an existential threat, partly because of the complex dynamics of parent-child relationships, and partly because of the different financial behaviours and attitudes that characterise younger clients.

US research8 suggests around two-thirds of ‘inheritors’ will discard their parent’s advisers, either appointing their own or exiting the advice system altogether. Concern over the potential loss of this wealth is echoed in the recent finding that 59% of UK financial advisers fear the health of their entire business is at stake.9

Key to addressing this challenge is to focus more on building relationships with younger generations within client families.10

As Tasmanian adviser Jason Chequer summarised:

“Advisers need to focus as much on the family as they do the investments. Without spending significant time understanding the hopes and fears of each generation, the transfer will probably be unsuccessful.”

The penny is dropping

Unsurprisingly, investing time and effort into building client relationships, rather than the functional, aspects of their proposition has been made the top priority by many advisers.

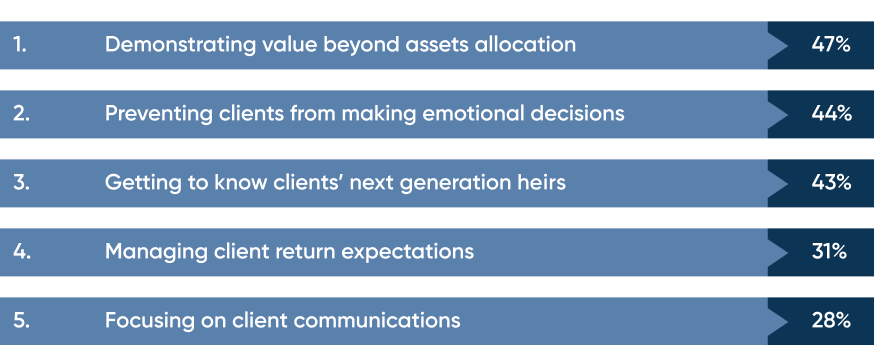

A 2020 global11 survey that asked financial advisers to identify the top 5 skills they needed to improve on found that relationship-building, communication, and client decision-making were all top priorities.

Figure 2: Top 5 skills advisers say they need to improve

Source: Nataxis

Building relationships means more client face time

It is clear, if not obvious, that an adviser’s time creates the most value when it is spent building and maintaining trusted relationships. These relationships may be with clients and/or prospective clients and in-person or virtual.

There is no universally agreed upon benchmark as to what percentage of an adviser’s time should be ‘face time’, although some industry observers believe it should be as high as 80%.

Australian research by Virtual Business Partners12showed a positive correlation between adviser ‘face time’ and income, with the highest-paid advisers spending over half their time in client meetings, and around a third on business development (and just 4% on investment management).

Maintaining this benchmark would leave precious little opportunity to stay on top of all the other demands on their time, including:

1. Professional development

2. Compliance, and

3. General administration.

And, if they are a practice principal as well as an adviser, those demands will also include:

1. Staff

2. Marketing and client communication

3. Technology

4. General management of the business, including profitability, proposition development, and process design

An impossible equation for advisers to solve?

The golden ratio for financial advisers is seemingly one that balances out the need to spend more time building client relationships with the often competing needs to drive down costs, maintain and build their technical knowledge, stay abreast of market developments, remain compliant, and continue to deliver high-quality investment advice and outcomes.

Whilst at first glance this may seem an unsolvable equation, in truth it is one being actively and successfully solved every day by Australian advisers, through the power of outsourcing.

Adviser Insight: the danger in being an effective adviser and a part time investment expert

“As an adviser, there’s so many areas we need to be on top of. We are trying to be experts in insurance, estate planning, and Centrelink, and superannuation, and aged care and retirement incomes, whilst also trying to be an investment specialist. When you are responsible for say $500 million or more of a client’s investments, if you get that wrong by one percent, or even half a percent, that’s a multi-million-dollar impact across our clients.

For us it didn’t pass the ‘can I sleep at night test’ because even the dedicated investment managers get it wrong sometimes. And they do it full time, we were only going to spend about 10% of our time because of everything else we needed to stay across.

It’s already a hard game to be good at, without making it harder by only doing it ‘part time’. So bringing in external expertise was a no brainer really.” Daniel Rake

Outsourcing within advice practices

Outsourcing has been used by successful advice practices for many years.

Examples range from automation, through ‘internal outsourcing’, where practice management functions are allocated away from advisers, to outsourcing to external third parties. Functions commonly outsourced to third parties include specialised capabilities such as paraplanning, compliance, technology management, and marketing, and those where there is a cost-saving such as client administration.

Offshoring some of these functions is not uncommon.

The main economic benefits of external outsourcing are derived from:

1. Freeing up the adviser to spend more time building and maintaining client relationships

2. Realising cost savings by tapping into scale benefits offered by larger external providers

3. Outsourced functions being performed to a higher standard, leading to better client outcomes and

greater client satisfaction

4. Lower error rates and less rework.

When considered in the context of a field as complex and dynamic as investment management, it is clear the potential benefits of outsourcing are equally applicable.

Advisers, practice owners, and even large institutional investors are increasingly recognising this, and collectively are driving a worldwide trend towards more outsourcing of investment capability – from basic asset allocation and portfolio construction guidance, through active fund management, to the full-blown outsourcing of the Chief Investment Officer (CIO) function.

Adviser Insight: Outsourcing to external experts allows us to be always on

“Our Investment Committee meets quarterly with a subcommittee that meets weekly and on an ad hoc basis as needed. We also use Microsoft teams as a channel for the committee members to throw ideas around and make any urgent decisions.

Plugging this kind of approach into our framework of external experts allows us to be always on and to be able to move quickly and efficiently, in a way that we believe gets better client outcomes and offers a more consistent experience to our clients. It’s an approach we couldn’t possibly hope to take without outsourcing key aspects of the process.” Alex Hont

Adviser Insights: Outsourcing to strengthen an internal capability

“As far as we are concerned, even though we have outsourced extensively, we view ourselves as having an internal investment capability, with the help of external experts. Ultimately we still apply our own process and philosophy to portfolio construction, but in a way which is more efficient and guided by expert insights.” Andrew Height

Outsourcing of investment capabilities – a growing trend

Investing is highly regulated, highly complex, and expensive. It is also challenging to do well and is becoming increasingly treacherous.

It is also an area where the stakes are high, from multi-billion-dollar pension funds to an individual’s life savings.

As the complexity, cost and challenges of investing continue to grow so too are the number of investors and financial professionals choosing to outsource investment capabilities. This is a trend playing out globally, among both institutional investors and financial advisery firms.

The capabilities outsourced can include those across all pillars of investment management:

1. Objectives

— Mission goals

— Investment objectives and constraints

2. Governance

— Governance (including risk management and compliance)

— Roles and responsibilities

— Investment policy design

3. Investment philosophy

— Beliefs

— Strategic asset allocation

— Investment policy statement

4. Investment strategy and implementation

— Asset class design

— Manager research and selection

— Product design

— Portfolio implementation

• Construction

• Trading

• Rebalancing

•Reporting

5. Ongoing management

— Manager monitoring

— Performance management

— Talent management and development

Institutions are adopting the Outsourced Chief Investment Office (OCIO) model

At an institutional level, the amount of money managed with full or partial discretion by Outsourced Chief Investment Office doubled between 2013 and 2020 (FT) to over $2 trillion USD, with growth continuing to accelerate.13

While the size of mandates outsourced varies, the vast majority are under $1 billion. In the US, more than half of such mandates are for under $100 million14, a figure which some may find surprisingly low.

Research by Cerulli15 found the growing OCIO trend among institutions was underpinned by a range of drivers including:

1. a lack of internal resources

2. the need to improve governance

3. the need for timelier decision making

4. deeper due diligence

5. greater oversight of portfolio risks

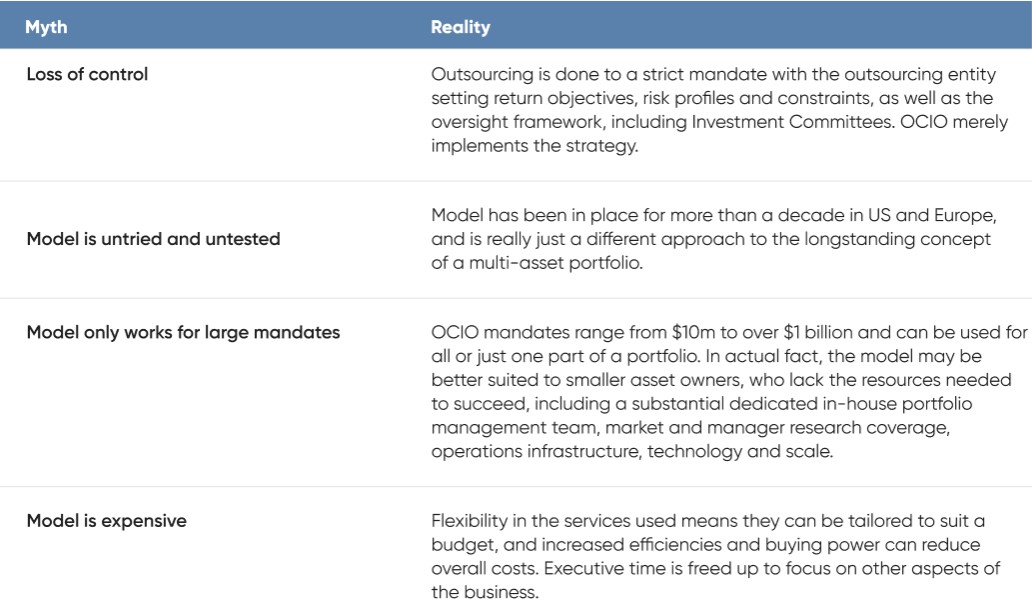

The myths about OCIOs are being debunked

The continuing strong growth of the OCIO model flies is in defiance of the sceptics and the objections regularly raised about investment outsourcing. Regarded as articles of faith by some, and myths by others, there is no doubt these objections are largely being overcome in contemporary OCIO models, as can be seen below.

Table 4: Debunking myths around investment outsourcing

The same objections have historically held back adviser outsourcing of investments

The objections brought up at an institutional level are equally applicable at a financial adviser level, and indeed research does reveal that the main reasons US advisers are reluctant to outsource investment capabilities are cost (65%) and perceived loss of control (48%).16

But that same research revealed that reluctance to be declining, with outsourcing at an adviser level becoming increasingly popular, and extraordinarily high satisfaction levels among those who do:

1. 98% of outsourcing advisers said it allows them to deliver better investment solutions to their clients, and

2. 91% said their growth of Assets Under Management had accelerated since outsourcing.

In this context, the growth in the number of advisers outsourcing investment capabilities is understandable.

In the US, the proportion of Registered Investment Advisers outsourcing investment management grew from just over one quarter (27%) in 2020 to just under one-third (32%) in 2022.17

The benefits of the outsourced CIO for wealth practices

As mentioned above, the growing popularity of the outsourced CIO function (outsourced investment management) among financial advisers reflects the fact that many of the benefits are equally applicable to smaller wealth firms as they are to institutional managers.

The complexity of investing means that the reviewing of investment policies and asset allocation during quarterly investment committee meetings no longer cuts the mustard. These are high impact decisions.

An outsourced CIO provider, by contrast, works to establish an improved, robust governance process for organisations, with the provider assuming daily oversight of all investments. Outsourced CIO providers will have the superior resources, expertise, and implementation capabilities to provide day to day attention, with complete transparency.

A wealth practice is better served focusing its time on its client’s holistic financial goals and its overall business objectives, than on day-to-day investment portfolio management. Yet both demand stringent, around-the-clock attention, which is where the outsourced CIO can step in.

A reputable outsourced CIO provider will not only have a dedicated team of in-house specialists to provide daily oversight and strategic advice, but also offer improved access to best-in-class investment managers on a global scale. A leading outsourced CIO provider will be able to extensively research and rate thousands of investment managers and opportunities to find those ideally suited to an organisation’s portfolio.

Outsourcing investment management should also open up access to a much wider range of specialised investment opportunities, including alternatives and private placements, allowing advisers to meet the needs of more sophisticated clients.

Adviser Insight: External expertise allows separation of advice and investment offerings

“We deliberately wanted to create a separation between our advice and the investment offering, so we created a separate business with its own AFSL, and to ensure robust governance we created an Investment Committee comprising a mix of internal and external members.

We went looking for an external Chief Investment Officer and settled on one who runs his own Investment Consulting business. For us he’s the ideas guy, and also a gatekeeper, who helps steer us away from certain paths. The other external member of the committee is from the investment consulting arm of one of the big research houses, so they bring with them a second opinion.

Whichever consultants you use they are going to bring their own biases, whether that towards certain funds, or asset classes, or investment styles. So having two externals is a way of ensuring we get differentiated ideas, you could almost say it’s a form of diversification. This approach gets us better insights and better client outcomes.” Andrew Height

Advisers are rethinking their core proposition

Relative to institutional investors, there is an additional layer of resistance to overcome with financial advisers – that being the extent to which advisers see investment management as their core proposition.

There is clear evidence that attitudes in this area are changing, with US research confirming a continued decline in the share of advisers who view investment management as their primary business proposition. The 2021 survey18 by FlexShares found that only 33% of advisers identified investment management and research was their primary business proposition. This compares with 45% of advisers in 2016 and 56% in 2014 who identified investments as their central value proposition.

What does Australian research on investment outsourcing show?

Locally there are plenty of data points to suggest that Australian financial advisers are also embracing the benefits of outsourced investment management in growing numbers.

This outsourcing is occurring in two main ways:

1. As a service or consultancy (the Outsourced CIO), where expertise is accessed on a standalone basis and used in conjunction with a variety of investments (including asset consultants, researchers, portfolio managers, and independent Investment Committee members), and

2. Via solutions that ‘bundle’ this same breadth of expertise together with a product or service structure (such as Managed Accounts)

Evidence suggests both methods of outsourcing are growing in popularity.

2019 research by Investment Trends19 highlighted the trend was underway when it reported that the proportion of advisers directly involved in investment selection fell from 56 per cent to 53 per cent over the prior, with a growing proportion utilising model portfolios, managed accounts, and multi-manager funds.

Commenting on the findings at the time, a spokesperson for Investment Trends observed:

“More planners are choosing to outsource investment selection to focus their time and effort in areas they believe they can deliver more value to clients.

“Our research shows outsourcers perform better in key business metrics compared to those who do not – they typically have significantly larger client books and advise on higher levels of new client inflows.” Viola Wang, Investment Trends.

Wang further commented that the findings highlighted a “trend among planners to move from being investment pickers to asset allocators”.

Fast forwarding to 2022, the Adviser Ratings Landscape Report20 revealed this trend had continued, and that the majority of licensees and advisers were outsourcing at least some aspects of their investment management proposition.

Specifically, they reported that 74% of licensees and 45% of practices actively use third-party expert researchers and/or investment consultants. The same report also found that over 80% of licensees have a formal Investment Committee, and in many cases, the membership of these committees would comprise one or more of these external experts.

For most practices outsourcing investment capability, the Investment Committee is the formal mechanism that brings together the practice and the external expertise.

Adviser Insights: Investment committees strengthen connection to decisions

“Even before we went down the MDA path, we had an Investment Committee with external, independent members. I think it makes it easier to explain to clients what you have done with a portfolio, compared to using models offered by bigger licensees, where you are disconnected from the decision making.” Andrew Height

Adviser Insights: Investment Committee plays a broad role

“We cater to a wide range of clients and so we have a broad investment offering across the whole spectrum of sophistication. We see everyone from disciples of the Barefoot Investor to clients seeking the Ferrari, the fully tailored, active solutions, and the Investment Committee plays a role in constructing the offerings across this spectrum as well as composition of the APLs associated with each offering.

That external expertise also helps us when we negotiate with managers too, meaning we are frequently in a position to benefit from scale discounts, which of course we pass onto clients.” Daniel Rake

In terms of bundled investment management outsourcing, two of the main approaches are model portfolios and managed accounts.

Adviser Insight: The economics of smaller firms using external experts

“In a small firm, with less resources, it can be easy to miss market indicators and lose touch. Our external experts ensure we always have a real time perspective. In our view, the viability of engaging external experts is driven by Funds under Management rather than the number of advisers in the firm, meaning even smaller firms can go down this path.” Andrew Height

Adviser Insight: Bundled expertise – more accessible for smaller firms

“For smaller practices, the viability of accessing external expertise from a cost and resource perspective can be challenging. Organising regular Investment Committee meetings, minutes, actions, managing relationships with platforms, all on top of your day job as an adviser can be tough. You could look to join forces with other firms who share your investment philosophy and process. Alternatively, you could work with a provider who bundles up all that expertise along with a product solution in a cost-effective way. There are a few such providers in the market, and they generally have access to a huge range of direct investments and funds, so there’s no real conflict of interest.” Daniel Rake

Model portfolios

Model portfolios have been popular with advisers for more than a decade.

Model portfolios are benchmark portfolios that advisers can use to allocate clients’ funds across different asset classes. Some advisers use the models provided by their licensee or by fund managers, while some choose to develop their own customised models.

In simple terms, what is being outsourced with a model portfolio is the detailed construction and day-to-day management of a portfolio. The adviser’s value add is mainly at the strategic asset allocation and risk profiling level – recommending a multi-asset portfolio to a client but then essentially outsourcing the management of that portfolio to the model manager.

Adviser Ratings reports on two categories of model portfolio – those comprising managed funds, and those comprising exchange-traded assets such as direct shares and ETFs.

Adviser Ratings data21 suggests both types have a prominent – but reducing – presence on adviser APLs.

The spectacular – and continuing – growth of managed accounts

Managed accounts on the other hand, have experienced spectacular growth over the last few years.

The three main types of managed accounts are Separately Managed Accounts (SMAs), Individually Managed Accounts (IMAs) and Managed Discretionary accounts (MDAs).

Separately Managed Accounts are classed as a financial product (and thus require a PDS), and are commonly found as a menu item on regulated platforms. The platform acts as the responsible entity, ensuring the investment manager adheres to the applicable investment mandate. The economics of SMAs are such that many operate on a model portfolio basis.

IMAs are highly customisable to individual investors, eschewing portfolio models in favour of an Investment Program built to reflect the investor’s specific needs, circumstances, and risk tolerances.

Managed Discretionary Accounts (MDAs) are described by ASIC as being both a ‘facility’ for making a financial investment and a Managed Investment Scheme.

Just like model portfolios, SMAs, and IMAs, MDAs are professionally managed single or multi-asset portfolios. Unlike other vehicles, however, the discretion to make and implement day-to-day portfolio decisions (including buying and selling stocks) rests with the manager, not the financial adviser. A special license is required to be an MDA provider.

Adviser Insights: MDAs offer flexibility and control

“What we like about the MDAs or individually managed accounts is the flexibility and control. We can still adopt a model portfolio approach, which is obviously very scalable, but we don’t have to push out changes to every client as would be the case with an SMA. And if a client needs to make a withdrawal, we can be specific about which holding to liquidate, whereas in an SMA that would need to taken out of all holdings on a pro-rata basis.” Andrew Height

Snapshot: the rise of managed accounts

1. A decade ago, 16% of Australian advisers were using managed accounts with their clients22

2. This had grown to 44% of advisers by 2020 and 53% by 202123

3. Advisers are now recommending them to 60% of their clients, up from 33% pre-pandemic24

4. 20% of client funds are now invested in managed accounts, up from 4% in 2015, and expected to grow to 25% by 2025, at which point it will exceed flows into direct shares and listed investment companies25

5. Funds in managed accounts grew by 22% over the 21/22 financial year, to $135 billion26

6. The number of managed account product launches in 2022 was double the rolling 5 year average27

The efficiency benefits of Managed Accounts are turbocharged with MDAs

The outsourcing of the discretion to make portfolio changes underpins a significant efficiency and compliance benefit, as an individual SOA or ROA is not required every time a transaction takes place on the portfolio.

Recent research by Investment Trends28 suggests the use of managed accounts was giving advisers 15.7 hours, or two days, back every week, in reduced client administration, compliance and communication. For MDAs, this included time saved in:

1. Production of SOAs/ROAs

2. Investment administration

3. Selecting/researching investments

4. Generating and collating reports for client reviews

5. Communicating portfolio changes to clients

6. Following up clients for approvals

7. Other compliance work

Using a simple example, it is easy to see how significant the efficiency benefit from MDAs can be over the course of a year, even for a small practice:

Consider a business with 4 advisers, each with 80 clients and 3 portfolio changes per client per annum. Under traditional approaches – including non-MDA model portfolios – 960 SOAs or ROAs will need to be generated each year. For some practices, these SOAs may need to be approved by the licensee.

There are clearly timeliness and workload implications of this approach. Indeed, one adviser suggested the elapsed time under this approach – from first recommending the change to actually implementing the transactions – could be anything from 3 to 4 weeks.

Under the MDA approach, changes to the investment portfolio are implemented without any SOA or ROA being required. Further, investors are not required to review and sign off recommendations, and implementation of portfolio changes – including the execution of all trades – is done by the MDA provider.

Only one SOA/ROA is required per client per year, confirming that the MDA service and associated investment program remain suitable for the client. In this example, we have gone from 960 SOA/ROAs per year to 320, a net saving of 640 per annum. The efficiency benefits and client experience benefits are clear.

Also, advisers only need to concern themselves with one Target Market Determination under the DDO regime, rather than one for every product in the portfolio.

Adviser Insights: Efficiency of MDAs allows a dynamic approach

“As a practice, our investment offering is a core part of our proposition. Back in 2013 or 2014 we were keen to implement dynamic asset allocation across some of our portfolios. We recognized that the only way we would be able to do that ourselves was to dedicate one day per month to take a reading of the market and then decide about how to act. To then apply that across the client base would take several days, assuming they all got back to you. And then there was the question of equity. Which clients do you contact first, the A’s of the Zs?

When you factor in the need for ROAs, it clearly wasn’t a very sustainable approach, which is why we started running our own portfolios through MDAs.

A big part of the rationale is obviously efficiency, we can make all the changes in every client’s portfolio once in the model, and push the button and it will all get done at once.” Alex Hont

There are other advantages from managed accounts too, including:

1. Scale and automation-related cost savings, including lower brokerage costs, which the managed account provider can pass back to the adviser, and thus the client

2. The economics of managed accounts make an active approach more viable, which can enhance returns and appeal to more engaged clients or those with higher risk tolerances

3. A more equitable approach for clients – as the adviser doesn’t have to decide which clients have the change implemented first – the change is made for all clients at the same time

4. Managed accounts can be highly customisable, with a great deal of flexibility in the type of underlying assets and the management style

5. Managed accounts are considered to be more transparent as investors can see their holdings live – compared to a traditional fund whereby an investor may only see the top weighted holdings of their units, usually reported quarterly

Expert investment management – enhancing the adviser value proposition

A common belief among some advisers is that outsourcing investment management somehow diminishes their own proposition and leads to a less personalised client experience. But, when done well, their own proposition can actually be enhanced by augmenting their strategic advice with expert full-time professional investment managers who have access to up-to-date research and leading-edge technology.

As well as the potential for superior investment outcomes, having expert investment managers, and their research, more accessible to clients can actually lead to a better service experience, and allows advisers to enhance their approach to ongoing client communication and education.

According to Adviser Ratings29, just under half of all advice practices have a formally documented investment philosophy. The outsourcing of investment management forces advisers to be clear about their investment philosophy, in order for them to select external experts and product providers.

This in turn enables them to create a clearer distinction between investments and their strategic advice when articulating their value proposition.

This is especially important in the context of the ‘fee conversation’. Tying one’s value add to investment performance is clearly fraught, and can lead to some awkward fee discussions when performance doesn’t live up to client expectations.

Adviser Insights: External experts align our actions with our Investment Philosophy

“Underpinning our investment philosophy is the belief that dynamic asset allocation leads to better investment outcomes, and we believe external expertise is critical to us being able to invest successfully in line with that philosophy.” Alex Hont

The client experience dividend

With the efficiency savings from outsourcing investment management clear – often via the use of managed accounts – the question becomes how are advisers using these savings?

Happily, Australian research has found 68% of managed account users say they now have more time to focus on client goals on education30.

Time freed up by outsourcing investment management can be used to support clients as their personal circumstances evolve. Helping clients manage their behavioural biases and stay on track during periods of stress is especially valuable, and indeed a number of studies31 have concluded that behavioural coaching can add 1-2% net annual return to a client, around twice that attributed to asset allocation, and 6 times that from portfolio rebalancing.

In addition to spending more time helping clients with specific decisions at any given time, advisers can also invest more time in educating clients (individually and as a group), improving their understanding of the financial principles and practicalities of growing wealth. This can be especially valuable in intergenerational wealth transfer scenarios, where many clients value the opportunity to impart knowledge and a sense of financial responsibility to their children, helping set them up for a more secure future.

Other dividends that can accrue to wealth practices who outsource investment management include:

1. Communication support from a dedicated investment manager enables advisers to provide clients with more timely, more transparent, higher quality communication, helping instil confidence and build trust

2. Structures and processes put in place by the outsourced investment manager help ensure Clients receive a more consistent level of service, and a more consistent experience in terms of the implementation of their agreed investment strategy

3. Generally being more accessible to clients

4. The marketing benefits that flow from presenting a more professional investment proposition, more tailored to your chosen target market. This includes the ability to promote your offering, and the credentials of your extended investment ‘team’ on your website and in email campaigns.

Adviser Insights: Communications support and content

“We engage our external experts on an annual basis. As well as sitting on out investment committee and providing investment insights that drive tour portfolio construction, they also give us amazing communications support and content we can share with our clients. That includes a weekly email, monthly, quarterly and annual updates as well as updates on any major market developments. There is also a range of research and reporting packs, meaning we are always super informed about how our portfolios – and markets generally – are tracking.” Daniel Rake

Similarly, advisers are able to invest more time in broadening their client offerings, for example by:

1. Building a multi-family offering, including inheritance and estate planning advice, and

2. Strengthening their ESG proposition

An estimated 45% of advised HNW investors already share their adviser with other family members and the more family members using an adviser, the more willing HNWs are to pay for advice32. Developing an advice proposition that offers value to both current clients and their children can help mitigate the risk of losing clients in the future, and capture the opportunity that the rapidly growing intergenerational transfer of wealth presents.

Summary

The full or partial outsourcing of the investment management value chain – sometimes called the Outsourced Chief Investment Office (CIO) – is a growing trend around the world, among both institutional investors and small to medium wealth practices.

For advisers, outsourcing investment expertise allows them to deliver improved investment outcomes while simultaneously freeing them up to spend more time engaging with their clients. Done properly, this outsourcing can actually augment the strength of the adviser’s investment proposition and improve the client experience. This in turn, can make individual advice practices, and indeed financial advice overall, more futureproof against competitive and existential threats.

In Australia, advisers are increasingly turning to Managed Accounts to drive operational efficiencies and as a way of accessing external investment expertise in a sustainable way.

It is hard not to be inspired by the resolute and unwavering focus financial advisers have on delivering for their clients.

At Mason Stevens, our business has been built on partnering with advisers around Australia, and so we see every day the difference they are making in their clients’ lives, helping them plot a path to their financial goals while navigating the many hurdles life can present.

But while most advised clients are incredibly satisfied, they, like all consumers, are becoming more demanding, constantly seeking better value and more convenience, and advisers are increasingly being required to do more with less. Technology, as enabler of both efficiency and an improved client experience, is unsurprisingly taking centre stage within the advice landscape.

Technology is also enabling those advisers for whom investment management is at the core of their offering to differentiate and futureproof their practices, which is why we wanted to bring this paper to life. By sharing the experiences of some of Australia’s most innovative advisers, we hope to provide all advisers with valuable insights and ideas that can be put to use in their own practices.

For our part, we believe by providing advisers with our award winning platform technology and truly universal investment offering, we can empower them to optimise portfolio outcomes for their clients, with confidence.

About Mason Stevens

Mason Stevens is a leading wealth platform provider with a unique focus on driving investor portfolio outcomes. More than just an administration platform, our innovative technology paired with experienced investment specialist support empowers financial advisers to deliver on their clients’ investment objectives. Our platform technology and investment solutions are supported by exceptional client services and a philosophy of ‘your models, your way’.

Established in 2010, the firm is led by some of Australia’s most experienced finance and investment professionals. The company has over 80 staff nationally with offices in Sydney and Melbourne.

References

01 https://www.xyadviser.com/financial-advice-reimagined/

02 https://www.fidelity.com.au/insights/investment-articles/the-value-of-advice/

05 https://smartasset.com/financial-adviser/human-advisors-vs-robo-advisors

08 https://www.investmentnews.com/the-great-wealth-transfer-is-coming-putting-advisers-at-risk-63303

09 https://www.ifa.com.au/news/32268-why-advisers-fear-intergenerational-wealth-transfers

10 IBID.

11 https://www.im.natixis.com/resources/2020-financial-professionals-survey-executive-overview

13 https://www.ft.com/content/fe5706bc-840d-4e99-a8dd-bb98bc0fa6b5

14 IBID.

15 https://www.investmentmagazine.com.au/2019/11/more-investors-mull-outsourcing-cio/

17 https://www.thinkadvisor.com/2022/09/21/more-rias-outsourcing-investment-management-survey/

18 https://www.thinkadvisor.com/2021/02/04/landscape-change-for-investment-outsourcing/

19 https://www.ifa.com.au/news/27218-more-advisers-seeking-outsourcing-of-investment-selection

20 https://www.ardata.com.au/wp-content/uploads/2022/05/AFALandscape2022-AB_R2.pdf

21 IBID

22 https://www.professionalplanner.com.au/2022/03/most-advisers-now-using-managed-accounts-research/

23 IBID.

24 IBID.

25 IBID.

26 https://www.professionalplanner.com.au/2022/09/managed-accounts-grow-another-22-during-fy22

29 https://www.ardata.com.au/wp-content/uploads/2022/05/AFALandscape2022-AB_R2.pdf

31 https://www.xyadviser.com/financial-advice-reimagined/behavioural-advice-alpha/