In planning for a client’s retirement, advisers face a different set of considerations than accumulation phase. This includes a change in what best interest means, but also sequencing risk, inflation risk, investment risk and longevity risk. In the ALPD session on “Building Certainty into a Retirement Offering”, many of the questions that came up in the online chat, and in the room afterwards, related to planning for longevity. We look to address that here, and dive into a few of the other curly questions advisers raised on the day.

Q. What age should we be projecting out to for clients in modelling?

A. The standard life expectancy figures from the Australian Life Tables are based on the population as a whole – but just by virtue of the fact someone is wealthy enough to be able to obtain financial advice, and healthy enough to be considering their retirement income options, an individual’s life expectancy is likely to be significantly longer than the average.

Research by the Actuaries Institute in 2019 showed, for instance, a couple of average health, aged 65 (male) and 62 (female), need a plan that lasts until he is 100 in order to be 80% sure their financial plan meets their potential lifespan. That is 16 years longer than if an adviser used the simple look-up table for a 65-year-old male.

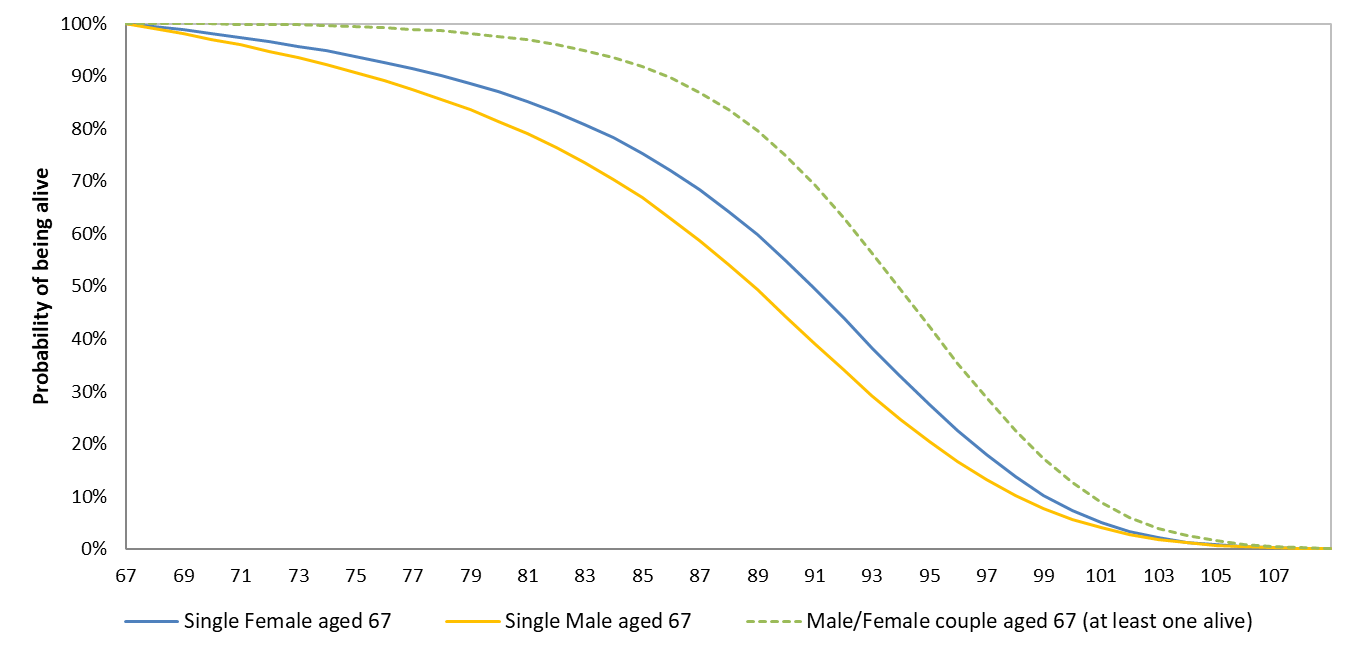

New research initiated by Allianz Retire+ in conjunction with Accurium also addresses the challenge of how long to project out to in retirement income modelling. Melanie Dunn from Accurium says, for healthy clients, instead of using average population life expectancy, an appropriate starting point for the retirement planning horizon may be to use the top quartile of life expectancy, or “the 25% age”.

A general rule of thumb for identifying the 25% age for a person around retirement age is to add three years to life expectancy (calculated allowing for mortality improvements) for couples, five years for a single female, and six years for a single male.

For example, an estimate of the 25% age for a single female aged 67 is their life expectancy of 23 years plus five, so age 95. Where a healthy single female aged 67 is seeking financial advice, an adviser could look to assess strategies over a retirement planning horizon to at least age 95 to allow for longevity risk.

Likelihood of an Australian aged 67 being alive at each future age in retirement1

Q. Is the modelling for lifetime income streams based on a pooled investment for the longevity effect?

A. New age lifetime income streams are approaching longevity risk and lifetime income guarantees in new and innovative ways that can differ from each other quite significantly.

Traditional lifetime income streams pool longevity risk by redistributing money that would otherwise be paid as bequests to provide additional income to surviving retirees in the pool, i.e. individuals who pass away before their life expectancy leave behind reserves that get used to fund the income of those who live past life expectancy.

Some pooled investment-linked products and pensions supplement their investment performance and/or provide investment choice (with corresponding investment risk) similar to an account-based pension (ABP), but with survival credits (redistributed amounts retained after the death of members of the pool to survivors) to provide some level of income for life. In this case, the income is generally not guaranteed. Pooled investment-linked products and pensions such as these do not bear the cost of capital to back investment or mortality guarantees, but investors must be prepared to accept the risks. Product issuers may add some guarantees – of investments, mortality experience or income payments – where they believe that there is investor appetite to pay for those guarantees.

The latest new age retirement income products unbundle longevity risk from the investment portfolio and provide market exposure through the chosen portfolio or index, and offer downside protection. This style of innovative guaranteed lifetime income stream uses an insurer to match asset and liability durations to meet lifetime income needs, alongside providing flexibility for the client to retain access to their underlying capital if they change their mind or pass away. The cost to provide the guaranteed income with flexible access to capital using this method, i.e. the premium for that insurance, can be disclosed in a clear and transparent way.

Q. If the guaranteed lifetime incomes stream is held on platform how is the purchase price / Centrelink assessment exemption calculated?

A. Some lifetime income products appear on a platform but are technically still separate and not integrated into the platform’s ABP, so have separate purchase and reporting processes.

Where the guaranteed lifetime income product is fully integrated into a platform/fund’s ABP as an investment option, allocating the capital to the investment option and the reporting on it is fully integrated and wrapped up in the fund reporting, whether in accumulation or pension phase. Importantly, there is still a separate identification of the investment amount used to commence the guaranteed lifetime income when that amount becomes assessable, meaning it is counted separately and easily identifiable as the purchase price for social security purposes means testing (and any associated exemption). Then the amount making up the remainder of the ABP is treated in the usual way, that is, as a deemed asset.

Q. “Enough to live on” and “comfortable retirement” are so subjective – how do you provide certainty and assurance around this without controlling the client’s spending?

A. A guaranteed lifetime income stream can provide a base line level of regular income (which can be fixed or increasing in line with up-side market performance), that a client can rely upon, on top of other investment, ABP or Age Pension income that they are receiving. If we assume, given the current cost of living, that the Age Pension is not going to be “enough to live on”, nor provide for “a comfortable retirement”, then having an additional amount invested, with downside protection, to provide guaranteed income for life can be an important source of retirement spending security and comfort, even as other investments are run down. The regular income can be guaranteed to never decrease, and the rate can be known and planned for well in advance of retirement.

Learn about how our next-gen retirement income solution, AGILE, can build certainty into a retirement offering – visit the website at AGILE Overview | Flexible Retirement Investments | Allianz Retire+ (allianzretireplus.com.au)

This material is issued by Allianz Australia Life Insurance Limited, ABN 27 076 033 782, AFSL 296559. (Allianz Retire+). Allianz Retire+ is a registered business name of Allianz Australia Life Insurance Limited. This information is current as at 6 December 2023 unless otherwise specified. This information has been prepared specifically for authorised financial advisers in Australia, and is not intended for retail investors. No person should rely on the content of this material or act on the basis of anything stated in this material. Allianz Retire+ and its related entities, agents or employees do not accept any liability for any loss arising whether directly or indirectly from any use of this material. PIMCO provides investment management and other support services to Allianz Retire+ but is not responsible for the performance of any Allianz Retire+ product, or any other product or service promoted or supplied by Allianz. Use of the POWERED BY PIMCO trade mark, or any other use of the PIMCO name, is not a recommendation of any particular security, strategy or investment product.