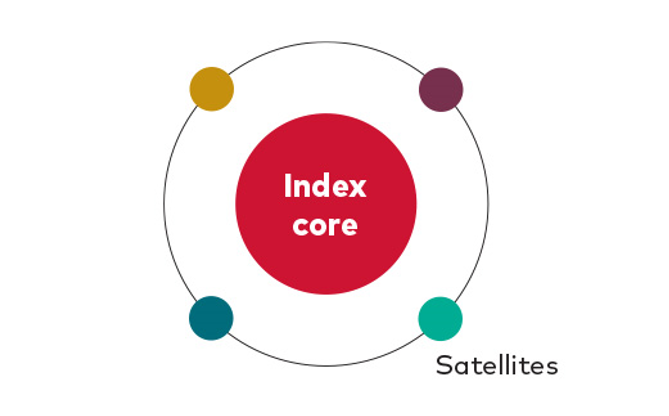

As the name suggests, a core-satellite portfolio consists of a core where most of your clients’ investments are allocated. Around the core are various satellite investments that serve specific investment needs.

For many investors, the purpose of the portfolio core is to provide broad exposure to investment markets. For this reason, it’s typically made up of low-cost, highly diversified index funds.

The satellites provide scope to invest in select assets to support your client’s investment strategy. These could be riskier investments with the potential for higher returns than the index, or they could aim to target specific sectors, regions, or investment themes.

Combining the power of passive and the advantage of active

The old active-passive debate implied that portfolio construction is a binary choice. Today the main portfolio construction question is no longer about active or passive, but instead how they can best be combined to achieve the right investment outcomes.

Core-satellite portfolio construction provides an excellent framework for combining these two investment approaches.

Core-satellite combines the power of passive and the advantage of active

Notes: Use active funds as satellites for potential to outperform or to provide tilts. Typically active funds are used as satellites for sector or style specific tilts; however index funds may also be suitable.

One major benefit of core-satellite is that it offers a common-sense investment approach, allowing investors to maintain disciplined control of their portfolio using ETFs and funds as the primary building blocks for their portfolio.

Core-satellite recognises that long-term investment success depends on securing the right balance of assets rather than timing markets or picking winners.

Market timing and security selection may provide some short-term gains at times. However, over the long term, research shows that asset allocation is the primary driver of portfolio return variation1.

Core-satellite brings greater discipline and stability to an investment portfolio by:

• Reducing reliance on ‘picking winners’ or chasing returns.

• Providing greater portfolio diversification.

• Potentially improving after-tax returns by taking maximum advantage of capital gains discounts.

• Reducing overall fund management and transaction costs.

Importantly, for advisers, core-satellite provides a replicable process for creating high-quality, risk-managed portfolios while delivering a consistent client experience.

Implementing a core-satellite portfolio

The principles of core-satellite can be easily integrated into a traditional investment portfolio implementation process.

The following three steps can help you get started.

1. Determine your client’s risk profile and asset allocation

Risk profile analysis remains the first step in core-satellite portfolio construction. Your client’s goals, personal situation, preferences, and risk tolerance all need to be considered. Their risk profile then needs to be matched to an appropriate broad asset allocation across shares, property, fixed interest, cash, and other assets.

2. Decide how much of the portfolio to allocate to the core and satellites

Within each asset class, decisions need to be made around the proportion of ‘core’ to be allocated to indexing and the proportion to active management or direct shares.

This can be dependent on the level of risk compared with the market an investor is prepared to take on, and the level of tax efficiency an investor desires.

The mix of index and active chosen may vary from sector to sector. In some asset classes where the indexing case is particularly strong—for example fixed interest—it may be appropriate to have 100% indexed.

3. Select your investment managers

Finally, you need to decide on an index manager for the ‘core’ (not all index managers are the same), as well as the number of active manager ‘satellites’ to complement the core. Ideally, managers selected should correlate differently to the index core. In some sectors you may require only one or two managers, while in other sectors you may require more.

Build a trusted, values-based relationship with your clients

Your investment philosophy is central to articulating conviction in your investment approach and earning your clients’ trust.

A good investment philosophy encourages clients to take a disciplined, long-term view of their wealth by focusing on the aspects of investing that are within their control.

Core-satellite fits perfectly with this approach. It emphasises the importance of asset allocation, diversification, cost management, and time in the market—all of which can be controlled with a well-structured investment portfolio.

Using diversified index funds as the core of a portfolio means you can deliver broad, low-cost market exposure with an asset allocation that matches your client’s objectives and risk preferences.

Your client’s portfolio should be built for long-term investment success. The core-satellite approach recognises that the most important investment decision you can make is how you allocate your investments across different types of assets.

Once you have your plan in place, the best thing you can do is stay the course.

Get more from your core with Vanguard. More information on core-satellite portfolio construction is available here.

Reference

1. Vanguard research: Vanguard’s approach to construction Australia’s Diversified Portfolios, 2024.

Important Information

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer and the Operator of Vanguard Personal Investor. We have not taken yours or your clients’ objectives, financial situation or needs into account when this article so it may not be applicable to the particular situation you are considering. You should consider yours and your clients’ objectives, financial situation or needs, and the Product Disclosure Statement (“PDS”) and the IDPS Guide (“the Guide”) for Vanguard products, before making any investment decision or recommendation. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained at vanguard.com.au free of charge and include a description of who the financial product is appropriate for. You should refer to the TMD of the relevant Vanguard product before making any investment decision or recommendation. You can access our disclosure documents at vanguard.com.au or by calling 1300 655 205. This article was prepared in good faith, and we accept no liability for any errors or omissions.

Any investment is subject to investment and other known and unknown risks, some of which are beyond the control of Vanguard Investments Australia Ltd (VIA), including possible delays in repayment and loss of income and principal invested. Please see the risks section of the PDS for the relevant VIA product for further details. No Vanguard company, nor their directors or officers give any guarantee as to the performance or rate of return of any Vanguard product, amount or timing of distributions, capital growth or taxation consequences of investing in the relevant product