Ahead of the Curve - An adviser's Guide to Open Banking

Brought to you by MoneySoft. How embracing Open Banking can create competitive advantage and innovation in an advice business.

In this special production

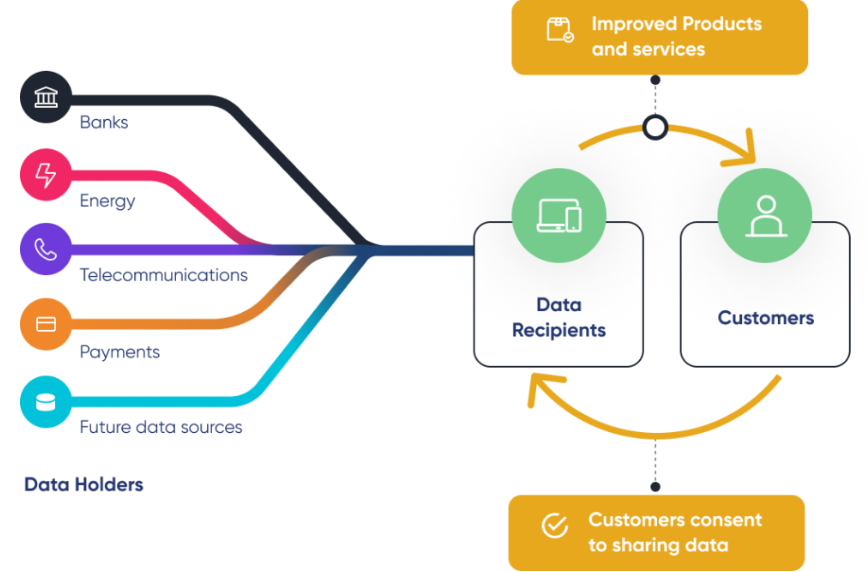

How does CDR and Open Banking work?

Data is shared from a Data Holder (such as a bank) to an Unrestricted ADR (i.e. Moneysoft) electronically and can only be accessed through a tested and approved App, web-based platform or system.

The approval and testing process by the ACCC is lengthy and requires strict IT protocols and privacy standards to be in force to ensure the environment the data is being transferred to within the Unrestricted ADR is private and secure.

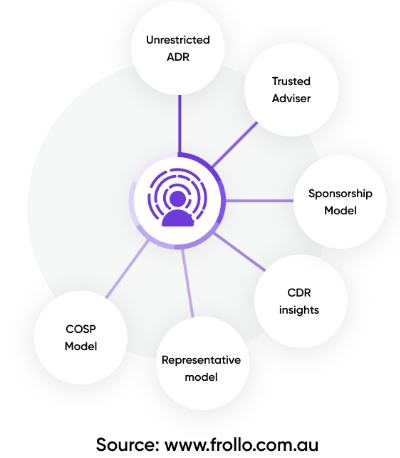

A Trusted Adviser can then gain access to that data via the Unrestricted ADR’s app or website.

The below diagram provides an overview of how this system and data sharing works:

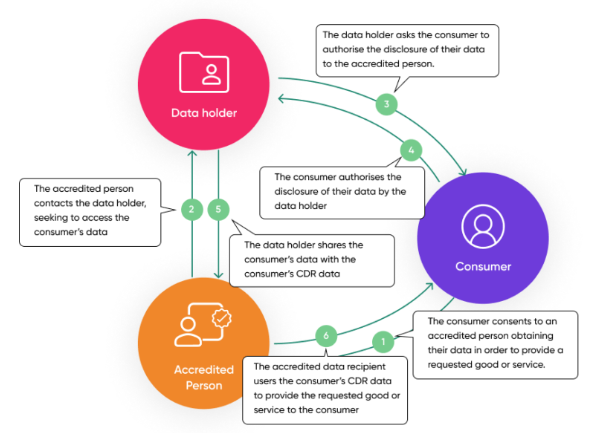

In summary, as outlined above, the step by step process involves:

- Giving Consent – a customer gives permission for a provider to access their personal and business data. Consent is granted via the provider’s website or app.

- Identity Check – the customer’s ID is verified by your existing provider via a One Time Password.

- Digital link – The website or app link to your existing provider’s website or app where the customer can confirm the data that they’d like to share. They’ll be able to manage the data they share.

- Sharing Data between providers – data is transferred to the prospective provider in a machine-relatable format.

- Using the Provider’s service – Customers will be able to use accredited provider’s service with their data being shared.

How is this different from the current data sharing method of Screen Scraping?

The CDR is designed to provide more secure transfer of data between consumers, data holders and recipients, as well as provide the consumer with more control and management over the data they do share.

In the current data environment which uses screen scraping to share data, customers must share their password with providers. They have no ability to view, manage or withdraw consent. There is no visibility into third parties receiving this data. Customers do not have control over the length of time they consent to data being shared, and have no rights to delete data. Data recipients are not subject to regulatory requirements or minimum standards.

“The CDR process is not as easy as screen scraping, which is the data collection method that we use now. But it does provide a lot of comfort and security, knowing that it’s Government regulated, and there’s lots of rules and regulations around what data can be used and for what purpose”. – Jon Shaw.

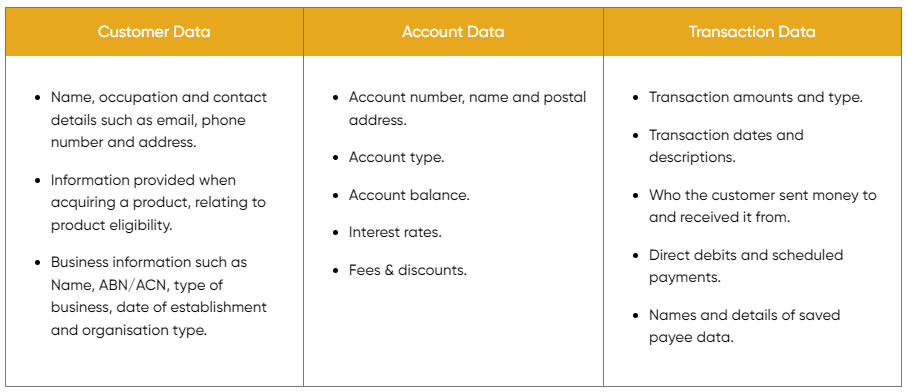

What Data is shared within CDR?

The data that is shared via CDR and Open Banking includes raw and derived data.

1. Raw Data

Raw Data in data management terms, is information as gathered at the source before it has been further processed, cleaned or analysed. Under CDR, a data holder could provide another business access to the following raw data:

2. Derived Data

CDR data isn’t just limited to the data directly received from Data Holders. It also includes any data derived from CDR data and any information extrapolated from that.

And this is where Open Banking has the potential to create significant innovation.

Derived data is created by transforming existing raw data points to create new insights that aren’t readily obvious from observing the original data. These insights can be created from observations, experiments, and simulations when raw data is cross-referenced against different data sets and advanced statistical analysis is completed on that combined material.

A good example of this derived data is an automation that triggers a ‘yes or no’ insight, which uses CDR data to get an answer to progress to the next step of a customer interaction.

For example, XY Company, Accredited Data Recipient receives raw consumer CDR data and analyses it against an algorithm for the purposes of determining whether they are credit-worthy against its unsecured personal loan scorecard. The end answer of ‘yes or no’ that XY Company will use to determine if the applicant meets its requirements to be offered a loan is considered derived data.

It isn’t the raw transactional data itself, but is an answer to a question that becomes new data. Any subsequent processes based on the ‘yes or no’ are also considered derived data.

This is an important point because it highlights the automation potential for innovation, and is a key benefit of CDR for any business in creating more efficient services, products and offerings.

For advice businesses, derived data could flow into automated triggers that would prompt a review of real-time suitability which would prompt an Adviser to recommend to their client strategy changes and product recommendations etc.

Data derived from CDR data is treated like CDR data and needs to comply with all the CDR Rules.

Consumer Data Requires Consumer Consent (Ongoing)

The CDR is designed to support businesses to create competitive advantages and drive the innovation of products and services. But the CDR is also designed to give consumers ownership over one of their most powerful assets: information about themselves. It hinges on consumers consenting to share this data with a Data Recipient for a specific purpose.

“When a customer consents to hand their data over to an organisation, like Moneysoft, for example, we will only collect the data that we need to provide the Moneysoft service, we cannot access all of your data, in the way Facebook does today, that is not how the CDR works. It really has to be very strictly and tightly controlled, in terms of using that data only for the specified purpose. There are a lot of controls around this, which is a very good thing in terms of giving people confidence about the safety of the regime.” – Jon Shaw.

Consumers can control the consent that they provide to any data collector, providers must provide a dashboard by which consumers can see to whom they have provided consent, who they are sharing that data with and the ability to control that data flow.

This data flow is consumer driven and opt-in with mandatory opt-in every 12 months. Data can be switched off externally at any time. If consent is revoked then the data held by the ADR must be de-identified or deleted.

With the background to what CDR and Open Banking is, how it works and what is involved in accreditation the second half of this report focuses on how Advisers can use this information in their client service offering.

Why Now is the Time to Embrace Open Banking

To date, the biggest challenge for financial services organisations in CDR has been a lack of clarity around what it takes to make the most of the reform.

For a business to embrace CDR, it requires the acknowledgement that the future of data holding and sharing is going to move from a silo approach toward an eco-system and open style data sharing.

Any organisation that embraces this move now can add more value and be more competitive by innovating with data-driven insights to create better product and service offerings.

CDR and Open Banking Benefits

Consumer Benefits

The main benefits of CDR for consumers are:

- Consistent Consent Process across industries for the sharing of data.

- Greater control of data with the ability to provide, manage and withdraw consent.

- Limits on how long data can be shared with a 12-month opt-in.

- Full transparency around which parties are receiving their data.

- No requirement to share passwords.

- The ability to request unsharing, deletion and de-identification of data.

- Peace of mind of the security and proper management of their data due to accreditation requirements for data holders and recipients.

- Over time the ability to easily share data across industries (i.e. banking, insurance, retail, energy, super etc).

The main benefits are designed around reducing friction in experiences with different service and product providers either directly through quicker outcomes, or indirectly through reduced costs.

As businesses adopt CDR and use automation to refine their services and products, consumers will benefit from better services, tailored to their specific situation and needs.

In application this can translate into being able to more easily sign up for a new account, credit or debit card, application for loans, and using budgeting tools more efficiently and in real time, as well as the ability to switch from one bank or provider to another more easily.

From an Advice perspective, for clients it could include efficient onboarding and sharing data to auto-complete fact find documents, and financial information at reviews. Managing cashflow real-time. Sharing banking and investing data to enable their Adviser to provide specific, personalised and tailored advice to product solutions based on real time data.

For ADR and Other Authorised Recipients

The main benefits of CDR for Accredited and Other Recipients are:

- Data is updated in near real-time.

- Organisations that receive CDR data can use this data to provide smoother experiences to their customers across a range of touchpoints.

- Through automation, effort is reduced and scalability of processes increased.

- Data Recipients benefit from higher quality inputs, increased streamlining of existing processes and enablement of entirely new services.

- Data Recipients can provide smarter experiences to their customers through innovation in analytics. Enhances their analytical capabilities and the ability to learn from data.

- Data Recipients benefit from truly actionable datasets, ability to personalise offerings and improved predictive modelling capabilities.

“I believe there are three main benefits: Increased confidence around sharing information through the transparency of CDR, the reliability and trust of the information that is shared, and then over time, the richness and breadth of the data available.” – Jon Shaw.

For Approved Deposit Recipients there are also some disadvantages:

- Time, cost and effort are required to be accredited as an ADR.

- Ongoing security, process and audit requirements.

- Barriers to entry for accreditation.

- Changing customer experience guidelines.

- More complex client consent process.

How does CDR apply to the Innovation of Advice and Client Service Offerings?

Simply becoming accredited under CDR will not improve an organisation’s competitive advantage. Instead, the CDR drives organisations to build end-to-end customer journeys that solve real problems in real-time.

While the data is valuable, it’s actually what can be done with open banking data that is of greatest value to Advisers and their clients. Innovation will occur through partnerships between Advisers and Tech organisations that have built automation using the raw and derived data that open banking provides.

For Advisers who are Authorised as a Trusted Adviser under a sponsorship with an Accredited Data Recipient, the main benefit of CDR will be in the form of partnering with tech providers who can support them to use raw and derived data to:

- Better understand their clients’ needs, wants and habits through their behaviours

- Enhance the client experience through personalisation

- Innovate on new service offerings

- Provide more timely client service

- Meet shifting client demands

- Optimise processes and reduce costs of providing service

- Streamline compliance management

How does CDR apply to the Innovation of Advice and Client Service Offerings?

Technology that interfaces with Open Banking will support Advisers to become more efficient in the management of data and provision of their client service.

By using technology that integrates with open banking, Advisers can innovate their customer experience journeys by streamlining client onboarding, review and service processes. The potential to create less cumbersome and time consuming interactions for clients through the automation and pre-population of accurate data collection and analysis.

Automating the population of a fact find for a client is one example, but further than this, automation through open banking would allow for the constant updating of that information in real-time. Another example is the pre–population of data in product comparison tools and strategy projection software on a continuous and live basis.

This could help to drive efficiencies of scale, reduce human error within advice processes and compliance requirements.

Innovation through Real-Time Data, Real-Time Advice.

One of the key benefits of CDR is the provision of real-time data.

Technology that integrates with Open Banking to use this real-time data has the potential to provide an Adviser with incredible insight into a client’s financial situation in real-time, which would facilitate better decision making and outcomes for clients.

Real-time derived data can support the innovation of client communication, strategy recommendations and advice delivery. Instead of being limited to the static observations of direct raw data, derived data brings raw data to life creating new data points, new scenarios and models.

Real-time raw and derived data will drive new technology that will allow Advisers to respond in real-time to the changing financial circumstances of their clients. Real-time data insights will allow Advisers to tailor their offering to individuals based on the raw and derived data they receive.

If an Adviser is using technology that embraces the transparency, and insights that CDR can provide, they will be able to use this data to create more efficient business processes and client interactions.

Access to data in real-time will enable Advisers to have more meaningful advice conversations based on real-time financial and behavioural information. As information is constantly pre-populated in real-time, Advisers could provide advice that is more timely and suitable by monitoring their clients’ finances on an ongoing basis.

With automation alerts, triggers can flag when a client’s financial circumstances change, or when they can afford a new investment or property, or have enough funds to be able to invest in their recommended portfolio.

Over time as the industries that use CDR open to wealth management, insurance and superannuation, this will increase the level of data and advice opportunities that can be generated from the data-driven insights.

Next Steps

- There are a number of steps that an Adviser can take to prepare themselves and their business for CDR including:

- Familiarise yourself with the CDR and Open Banking system.

- Start investigating Unrestricted ADR providers willing to offer sponsorship as a Trusted Adviser.

- Consider innovation. Identify the processes and procedures in your onboarding, communication and advice process that could benefit from data-driven insights.

- Review ADR providers that are offering innovative solutions to enhance the ability for you to access data in real-time.

- Look to partner with ADR providers that will support you to innovate your client service offering and advice model.

- As a Trusted Adviser data recipient you will be required to operate a CDR data environment that complies with the Rules. This means having effectively designed security controls implemented in the business to protect the integrity of data, privacy of clients and safe storage, use and application of data.

- Review your IT systems to ensure they meet minimum security requirements to prove they are able to protect CDR data from misuse, loss, and unauthorised access and use.

Summary

There is a wide range of opportunities for the financial services industry to successfully implement and further develop open banking.

The consensus among industry leaders is that first movers will have a real competitive advantage and by offering a superior user experience this will put pressure on the rest of the industry to invest in catching up. This is likely to see the evolution of a more innovative financial services landscape for advisers and drive better client engagement.

Preparing now is essential for those Advisers who want to stay ahead of the curve and embrace this world of real-time data. Real-time data can translate into real-time conversations and advice solutions. Businesses that choose to innovate their products and services through CDR may benefit from the increased transparency, cost saving in data entry, streamlined process, compliance management, as well as the competitive advantage provided by being able to provide real-time advice and product solutions for clients.

References

1. Moneysoft Webinar: Are you ready to embrace Open Banking

2. https://www.cdr.gov.au/

3. https://www.cdr.gov.au/what-is-cdr

4. https://www.cdr.gov.au/rollout

5. https://www.cdr.gov.au/resources

6. https://www.cdr.gov.au/find-a-provider?providerType=Data%2520Recipient

7. https://treasury.gov.au/consultation/c2021-182135

8. https://www.cdr.gov.au/find-a-provider?providerType=Data%2520Holder

9. https://www.minterellison.com/articles/expanding-the-consumer-data-right