Embrace New Era

Brought to you by Advice Intelligence. Machine learning, Automation, and Client experience, Explore the technology trends shaping the future of your financial advice business.

In this special production

Introduction

Goals planner, investment manager, psychologist, compliance manager and sales negotiator.

These are some of the responsibilities that financial planners in the modern advice landscape have taken on to effectively work with clients.

Combining this with an ever-moving regulatory landscape, along with advancements in technology, advisers are being thrust into a new era of financial planning, unlike one that we’ve ever seen before.

As a result of entering this new era, licensee and advisers are looking to leverage technology, to redefine their business models, and reassert their focus on client relationships; including the softer skills necessary to manage them in order to best demonstrate their advice value.

The legacy advice process of analogue technology, time-consuming administration, and manual paper-based plans, places great limitations on both adviser’s time and the practice’s ability to deliver timely, scalable, cost-effective, and efficient advice. This strain also impacts the adviser’s ability to conform to today’s client’s expectations and the role the financial adviser plays in their life.

Technology innovation is the key to optimising the current antiquated financial advice process, enabling businesses to remain relevant and competitive. Advances in tech are now transforming advice into a digital process and customer experience that clients can better understand, participate in, and engage with. It also encourages them to take more responsibility for any outcomes in accordance with the role they play in the management of their finances, and towards achieving their life goals.

The Business Case for Tech Innovation in Financial Advice

It is essential to clarify the difference between invention and innovation. Invention is a new idea, and innovation is the application and successful commercialisation.

This paper investigates the invention of new ideas that are now proven and applied innovations within the financial advice industry. It showcases how tech can improve the profitability and delivery of financial advice and create a more valuable client experience.

Fundamentally, tech innovation means introducing new technology into a business which:

01 Differentiates the business from its competitors;

02 Increases the perceived value to the consumer;

03 Improves or replaces business processes to increase efficiency and productivity; and

04 Supports the delivery of new and improved services, often to meet rapidly changing consumer demands or needs.

Innovative technology available today offers the ability to provide tailored, personalised and timely advice to clients in a far more efficient and cost-effective manner than previously thought possible.

From Challenge to Opportunity

The Financial Advice Industry has been required to adapt to a myriad of imposed regulatory and legislative changes through the Royal Commission, FoFA, Fee for Service guidelines, client best interest duty and minimum education requirements. In addition, it has been necessary to pivot to online advice delivery during COVID.

The challenges financial advice businesses face over the last few years have heavily impacted providing scalable, personalised, low-cost advice.

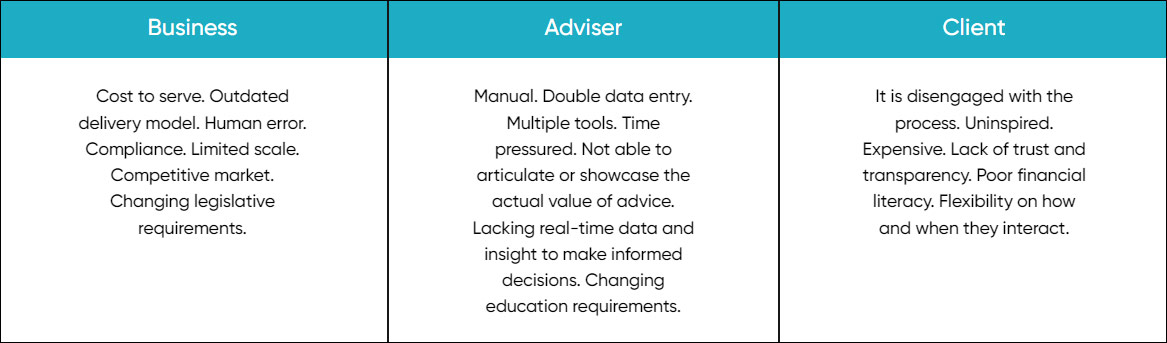

These challenges have been costly and evident on all levels:

“Innovation in tech has seen the shift from challenges to opportunities, paving the way for a better approach to providing financial advice.”

Introducing tech innovation can support a financial advice business to:

01 Improve Advice – benefiting through machine learning, real-time modelling and data and providing advisers with better tools & analytics for producing advice, strategies and product comparisons.

02 Scale Advice – streamlining & digitising the advice process to enable advisers to reach and secure broader client demographics (eg: mass market).

03 Improve productivity & efficiency – the ability to provide advice to clients as a live, frictionless and digital experience, whilst at the same time increasing transparency & engagement.

04 Reduce Cost to Serve – increasing profitability through the automation of manual processes, saving time in administration & compliance to become more cost-effective, whilst reducing the need to add employees.

05 Simplify Compliance – Providing a single source of truth for data, reducing human biases & error, with central record management, inbuilt automated compliance management and simplified auditing.

06 Build the value of their brand – creating a better client experience and advice process to improve employee and client satisfaction.

Businesses that fail to innovate run the risk of:

01 losing market share to competitors with a better client experience

02 losing relevance in meeting client’s need

03 reduced productivity & efficiency

04 inability to scale services or offering

05 reduced profitability

Application of a Hybrid Advice Model

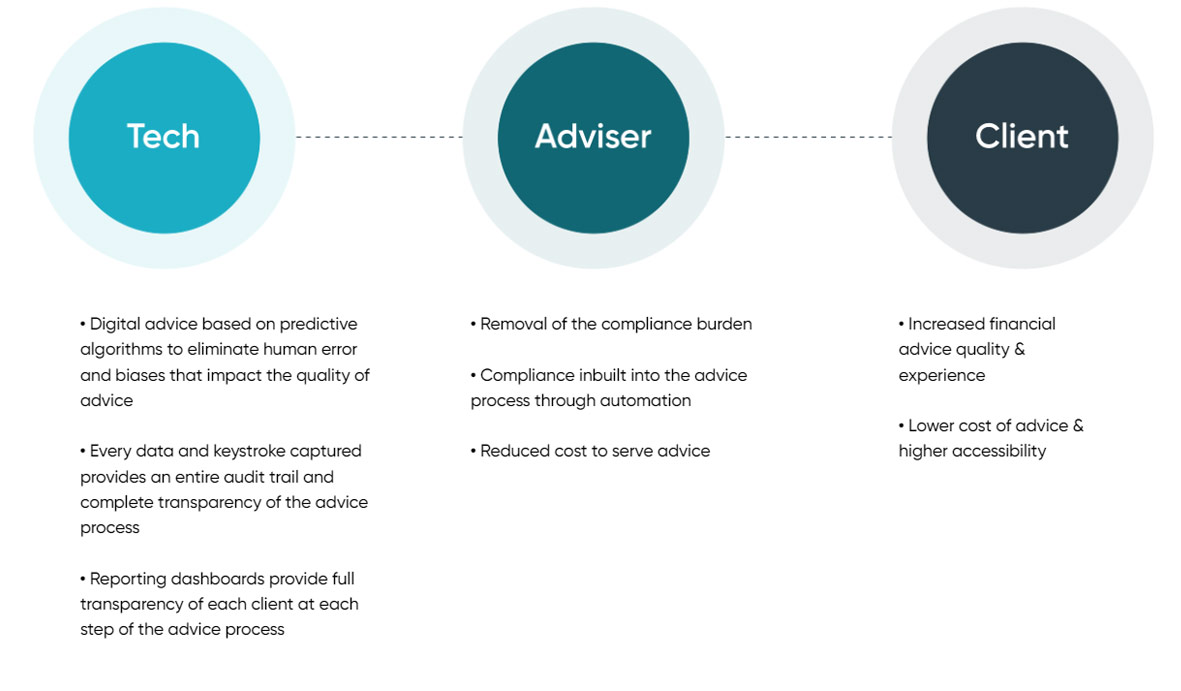

You can think of Hybrid Advice as the best of both worlds. Tech is integrated to replace previously manual, time-consuming tasks, whilst providing deeper and higher quality data, analytics and insight.

Hybrid Advice Technology can be used to create a new model that integrates traditional financial advice into streamlined process as follows:

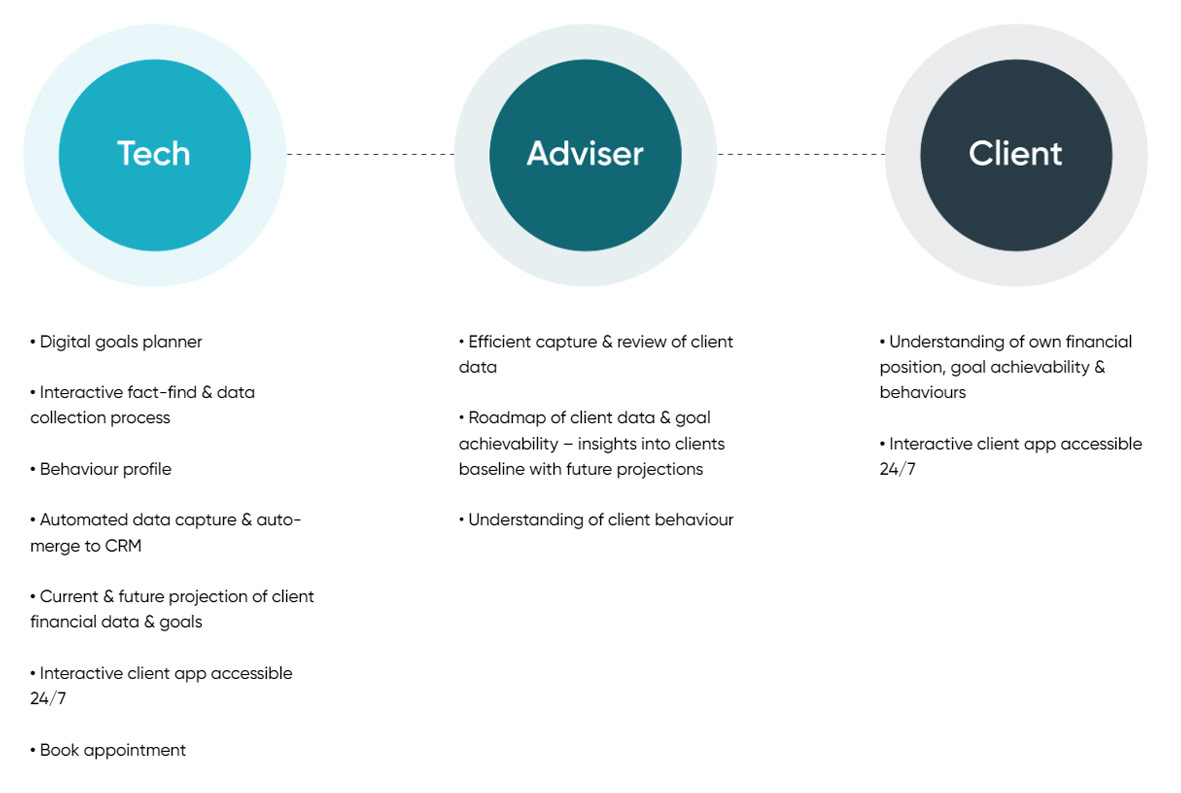

1. Interactive Discovery

A digitally-driven, client on-boarding and fact-finding process.

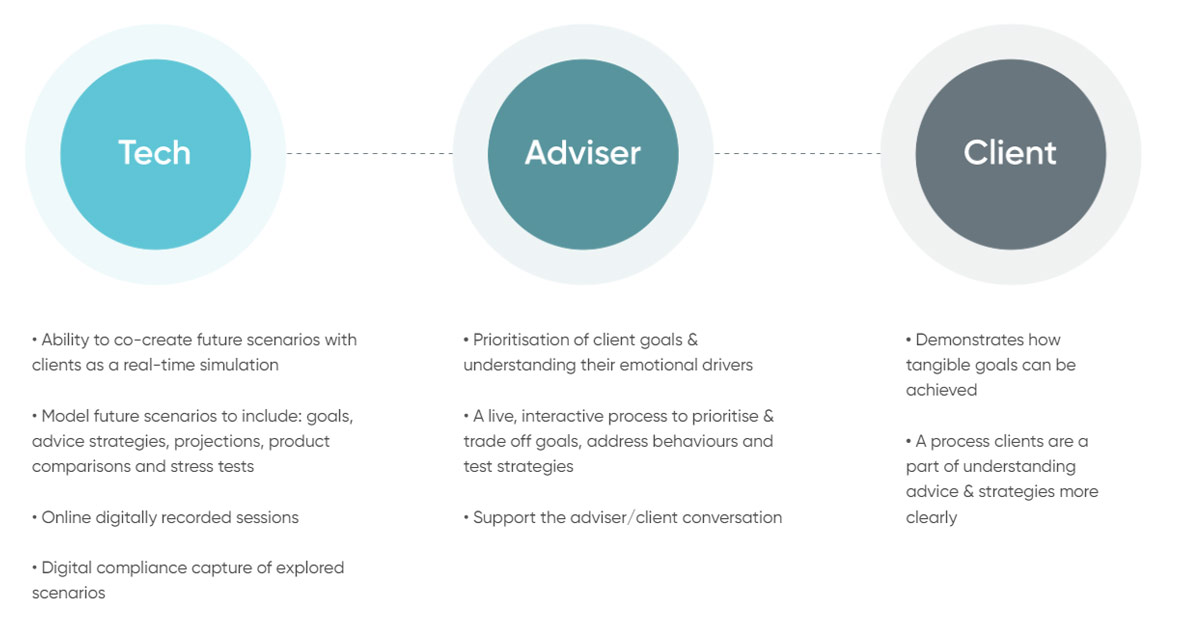

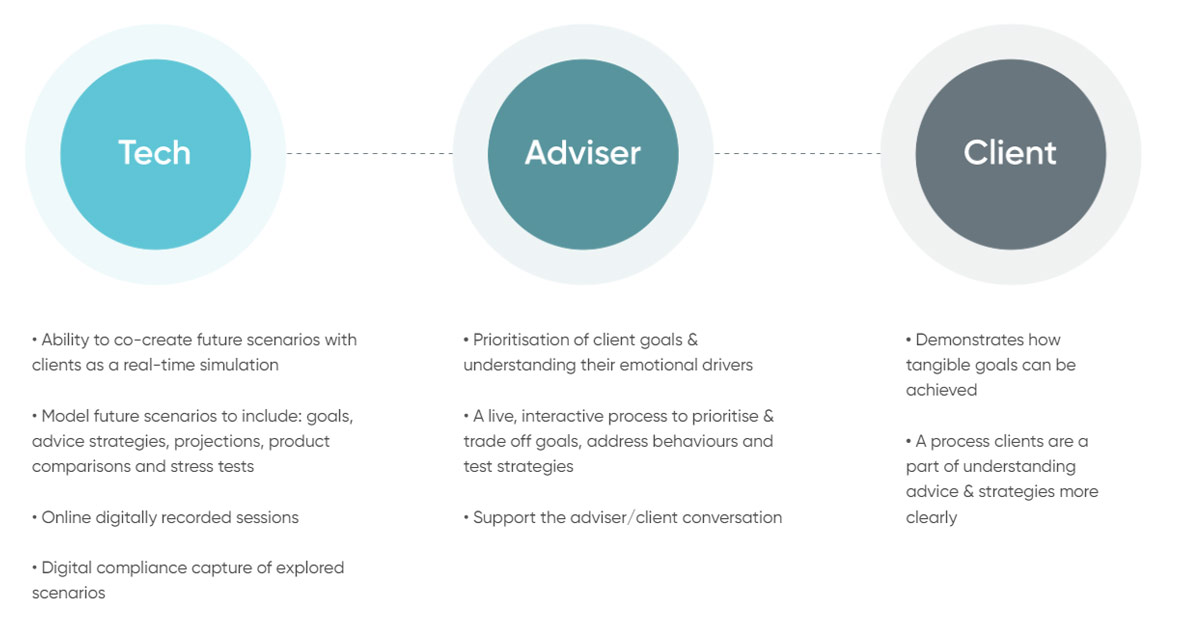

2. Explore Possibilities

An interactive, co-created digital advice process, showcasing the steps involved and promoting client ownership of advice.

3. Financial Plan Creation & Delivery

High-quality, data-driven strategic & compliant financial advice delivered via an interactive approach to support understanding and clients’ best interest.

4. Track & Optimise

Keep clients on track and accountable to their goals, proactive support to respond to changes in circumstances and behaviours.

5. Managing Compliance

Provide a streamlined, robust compliance process that protects the adviser business and the client in the advice journey.

Debunking The Myths About Tech in Financial Advice

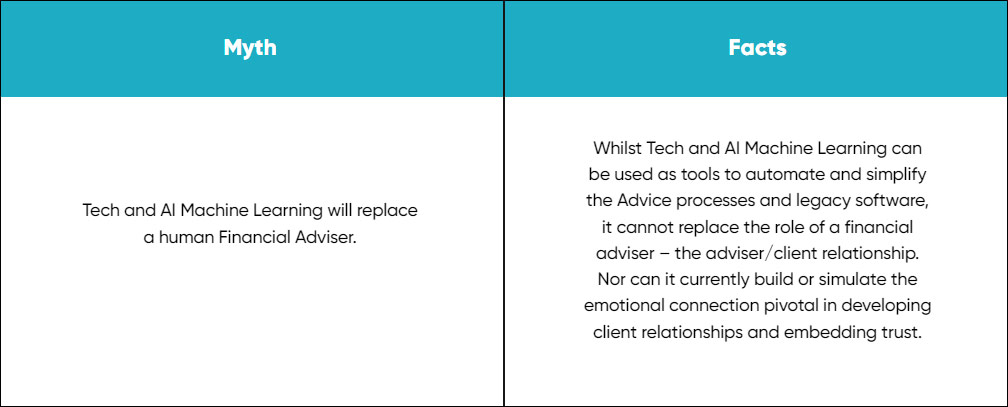

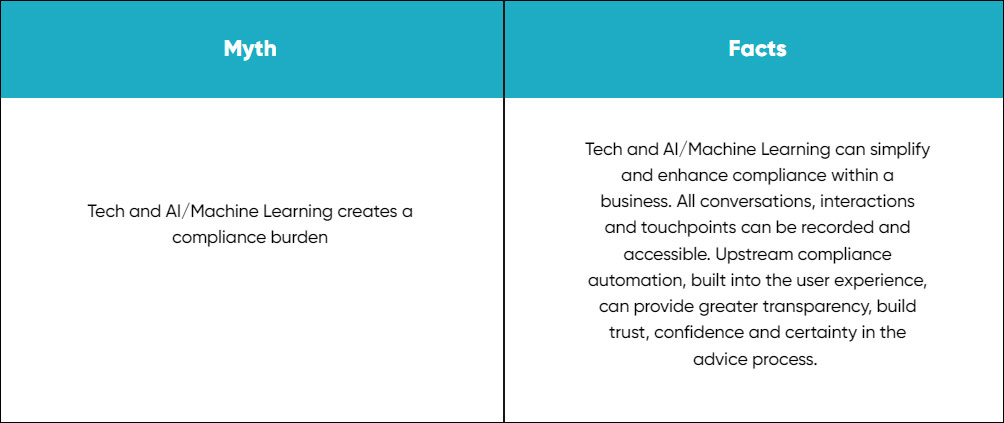

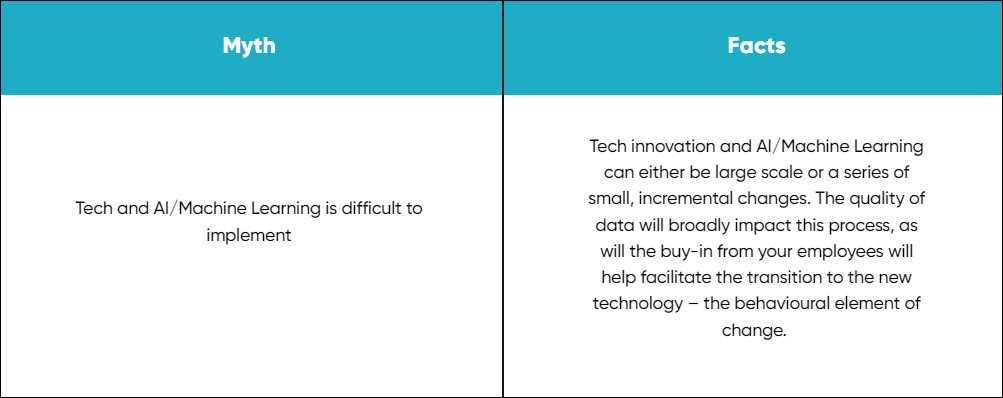

With change, there often comes resistance and even fear. Suppose we are to learn from Y2K or Robo Advice examples, and the hype of how these two events impacted the financial advice industry. In that case, let’s address the same propensity for change in integrating Tech Innovation into financial advice.

There are many misconceptions about the role of tech and machine learning in financial advice. Let’s address some of them here:

Its efficiency lies in computing and analysing vast amounts of data at significant speeds, and removing human error attributed to human biases inputted into the system.

01 AI/Machine Learning’s strength is in the insight & data it provides.

02 AI/Machine Learning supports automation.

03 AI/Machine Learning creates efficiencies.

04 AI/Machine Learning strengthens the IQ component supporting advice.

Innovation can be costly in terms of time and money to implement. But being left behind in a quickly changing environment can be even more expensive.

An investment in tech is an investment into future proofing your business by automating and improving processes, creating more transparency of the advice process and enhancing record-keeping and compliance functionality. The value-added to the client experience can also prove to be invaluable.

01 AI/Machine Learning saves time in admin & processes.

02 AI/Machine Learning can improve business efficiency.

03 AI/Machine Learning can reduce the cost to serve a client.

04 AI/Machine Learning can Improve Client Experience.

05 AI/Machine Learning can improve compliance audit trails.

06 AI/Machine Learning offers scalability.

01 AI/Machine Learning can provide quality assurance.

02 AI/Machine Learning can enhance reporting.

03 AI/Machine Learning can automate opt-in & ongoing services.

04 AI/Machine Learning can provide a central log of all interactions.

05 AI/Machine Learning can improve the transparency of the entire advice process with every interaction recorded, dated & time-stamped.

A business can start initially by automating essential, time-consuming processes and procedures like offering clients a digital option instead of a paper fact-find or building remote meetings automatically into workflows. These steps can be taken toward improving the client experience, whilst reducing overheads and freeing up time for further implementation.

Finding the Right Tech Partner

The success of any tech in a business and advice process lies in the implementation and change of human behaviour. Tech needs to be intuitive, but it also goes hand-in-hand with clear communication, training and guidance involving employees and clients, encouraging human adoption.

Implementing the right technology into a business requires assessing the company and the adviser’s time and willingness to invest and adapt to new ways of doing business.

The common barriers to implementing tech are:

01 Quality and safety of data

Sourcing accurate client data can be complex; in addition, cyber security, privacy measures, client identification issues require high levels of data security and governance measures.

02 Integration of systems

Utilising multiple processes and platforms can be difficult and inefficient to update and automate. Many companies have created an ecosystem of platforms, tools, spreadsheets, software and systems that integrate into an inefficient and time-consuming end-to-end advice process.

03 Employee buy-in of systems

Culture will often drive whether tech is effectively implemented in a business.

04 Client buy-in of systems

Communication is key to supporting clients to a new way of doing business. Moving them to a digital approach is less problematic as many clients use technology in much of their day-to-day interactions.

Implementing Tech into your advice business requires the right combination of design and function to support business efficiency, client data and streamlining your client experience.

Old tech has shown that by focusing on just one of these elements, such as back-office efficiency, can reduce the impact on the client experience.

The tech partner selected needs to understand the world of financial advice. The complexities of modelling, algorithms and financial data subject matter, and the need to have a robust set of advice and compliance rules. An overlay of ethics and governance must also be present.

The key components that should be considered with a tech provider include:

01 Financial advice subject matter expertise

02 Client experience

03 Modern SaaS platform architecture

04 Data Security & Privacy

05 Industry Compliance & Governance

06 Implementation & Ongoing Support

07 Professional Services – API & data integrations

Before engaging with a tech partner, it is essential that both parties have a clear understanding of the vision, objectives and desired end-to-end client experience.

Understanding the business needs, employee needs, client needs, time frame and resources required, are all factors that support the selection criteria of an appropriate tech partner to complement your advice process.

The Fintech space offers a variety of solutions, some solve one part of the advice process, whilst others provide a full end-to-end platform solution, so any search for a potential tech partner must begin with a clear understanding of what their tech delivers today, including their future tech roadmap.

If you have limited resources, you could start with incremental steps to implement depending on what you think are the most significant needs or problems that you’re trying to solve within your business and prioritise them into short term and long term.

We’ve compiled a list of 20 questions to research and consider when selecting a tech partner or solution to support your advice process:

☑ Does the tech solve key problem statements within your business?

☑ Does the tech complement or complicate your financial planning process?

☑ Which parts of the advice process will the tech need to automate?

☑ Which parts of the advice process will the tech simplify?

☑ Which challenges within the advice process will be solved?

☑ Will the tech enhance your client experience?

☑ What is the adviser and administrative experience of the tech?

☑ What are the critical efficiency and process gains this tech offers?

☑ What are the key benefits of this tech to the adviser support staff?

☑ What are the key benefits of this tech to the client?

☑ What is the investment required for this tech?

☑ What is the time and cost-benefit that this tech will provide?

☑ Will this tech integrate with other software, systems or data providers?

☑ Can this tech be white-labelled?

☑ What resources are required to implement and manage this tech?

☑ Who will need to be involved in making this a success?

☑ What features can be launched immediately, and what can you build on later?

☑ What solutions are offered for tracking and managing client goals and objectives?

☑ How does the tech manage compliance and data collection?

☑ What kind of support does the tech provider offer in integration, customisation, and ongoing tech maintenance?

About Advice Intelligence

At a.i., our reason for being is to support financial advisers to deliver inspiring, empowering wealth management experiences.

Why? Because we believe that financial wellbeing is one of the most powerful things that any Australian can experience.

With the guidance of a trusted adviser, people can better understand their financial position, make informed decisions, see new possibilities, and ultimately achieve their goals.

A.i. provides financial advisers with a new world of digital & goals-based advice tools within our integrated CRM platform. We are proud to be leading the industry with a new hybrid advice model, making financial advice more accessible, efficient and sustainable.

With a.i. Taking care of your day-to-day, imagine the extra time you could invest in your client relationships – and the new things that become possible!

Watch this video to learn more or visit www.adviceintelligence.com

Book a Demo to see the tech in action.

Research references as part of this work:

01 Henderson, Jacqui. (2022). Finance Technology Trends For FY22: Tech-Savvy Financial Planning Practices

https://www.adviceintelligence.com/finance-technology-trends-2022

02 Henderson, Jacqui. (2022). The Value of Advice Beyond an SOA

https://www.adviceintelligence.com/blog/value-of-financial-advice-beyond-an-soa

03 Henderson, Jacqui. (2022). Financial Planning Automation

https://www.adviceintelligence.com/financial-planning-automation

04 Henderson, Jacqui. (2020). Goals Based Advice Whitepaper

https://www.adviceintelligence.com/goals-based-advice-whitepaper

05 Fidelity International (Australia) Limited, (2020) The Value of Financial Advice

06 ASIC Regulatory Guide 255: (August 2016) Providing digital financial product advice to retail clients

07 The Capco Institute Journal of Financial Transformation, Alternative Models: #49 (April 2019) Designing digital experiences in wealth (P22-30)

08 Capco Institute. The Hybrid Advice Model. The European View.

09 Deloittte. (2017) The Next Frontier. The future of automated financial advice in the UK.

10 Axell. Human Touch in a New Digital World. (July 2020) The future of financial advice distribution in a time of rapid worldwide transformation.

11 Altus Consulting in consultation with Ignition UK (June 2021) Reimagining financial advice. How digital capabilities are enhancing not replacing the financial adviser.

12 Financial Planning Association of Australia Ltd: Mapping Fintech to The Financial Planning Process: (2017) Why fintech is not a threat

13 Forbes, Akula, Vasudeva (July 2020) Three ways AI can Protect Revenue and Bring Costs Down during Challenging Times.

14 XY Adviser Podcast: Tech Trend Series #5. (November 2021) The evolution of technology and what the future may hold.