Grandparents and parents have an intrinsic drive to aspire for a better life for their children, regardless of their own childhood. Recent studies show 86% of parents believe it is either extremely or very important to have a good education to be able to thrive in life, demonstrating an overwhelming vote in favour of the power of education.

Education is also now seen as more than just the journey through infancy, primary and high school; it’s now a never-ending journey, even beyond university, with 77% of Australian parents and 74% of students agreeing lifelong learning will be essential for future-proofing careers. There is no need to look far for proof of this; consider your own ongoing education requirements as a financial adviser.

While most families are reasonably satisfied with their children’s education, there are still lingering thoughts that they could do better. This is an emotional topic for many parents with thoughts like:

- Will my child be bullied?

- How many children are in each class?

- Will my child be listened to?

- Are the facilities up to scratch?

The emotional burden these fears place on parents to ensure their child has the best chance in life is massive, and this is all before cost has come into the equation.

These costs can be overwhelming, with three in four Australian parents facing financial difficulties caused by the cost of education. To ensure their children receive a quality education, many parents have made sacrifices such as not buying things for themselves, forgoing family holidays or working more than they wanted in order to pay for their children’s education.

Challenges being faced with the rising cost of education

The biggest issue we find is most people don’t plan for their child’s education. Often, they want to do it but don’t know where to start. Recent research shows only 49% of parents are actively preparing for this in an intentional manner, meaning a staggering 51% aren’t prepared at all and don’t know where to begin!

Advisers will see this often with clients with future education needs for a child; a standard question when in the fact-finding phase or even when working out insurances levels, but how many times do we also see a structured savings plan or intentional investment which is earmarked specifically for education costs? Not many, even though it’s so important to those clients in this demographic.

Of course, a top-notch private school education is something many clients would love to be able to provide for their child, and while many are willing to make sacrifices to do this, often, they don’t know how this would affect their day-to-day financial life, let alone the long-term impact.

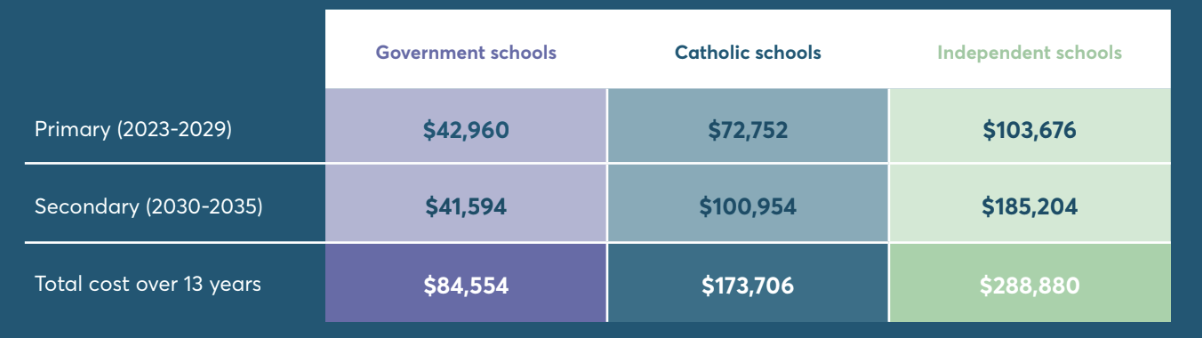

Education costs can be significant and can have a big impact on all household budgets, regardless of school sector. As seen in the table below, the average national cost of a government school currently sits at over $84,000 for the 13 years through primary and secondary levels, with catholic schools over $170,000 and independent schools coming in at over $280,000.

Average cost over 13 years of schooling starting in 2023 by school type.

A common misconception among parents is that government-funded public schooling is free; however, as seen above, there is still a large cost associated with children attending these schools over 13 years. It’s important to note that ancillary costs such as uniforms, stationery, excursions, and iPads or laptops contribute in excess of 45% to the total cost of education regardless of school sector.

The ongoing challenge will also be that these costs, along with everything else, will only increase over time, especially in the current high inflation climate. Well-organised parents will often already have things in place for their child, putting aside money on a regular basis into an account, or have saved money that was given to the child as gifts etc. If they are astute, they may have an Education Bond in place; however, in our experience, this only occurs if their own parents had something similar in place for them, likely having been set up by an adviser.

Paul Mann of of True Direction Financial believes:

“This provides a unique opportunity for advisers to guide parents through a major lifestage, ensuring they can afford these education costs and structuring it in the best way possible to maximise every dollar.

Advisers always talk to clients about their dreams and aspirations but should always consider education aspirations when working with clients, including parents, grandparents, and partners within blended families.

With less than half of parents having a plan in place for education needs and the reliance on family members and relatives to pitch in with school costs , this presents a great opportunity for advisers to further enhance the relationship with their clients.”

Most parents know they must do something but don’t know where to begin, and without a plan will probably end up paying the fees out of their mortgage or putting it on the credit card. Even if they do want their child to go to a more expensive school, they won’t have researched the costs in detail or put thought into a good long-term structure for this.

Advisers can add a huge amount of value to their client’s position here by mapping out a long-term vision, ensuring they know all the associated costs they face over the long term, and then recommending a systemized long-term savings plan. By regularly adding into a tax-effective structure, the child’s future educational needs are looked after, and all the parent’s stress will disappear!

Obviously, the sooner they start, the better, even if their child is quite young and they don’t know what type of school system they want to put their child into yet. Beginning a plan as early as possible will provide clients with many more options down the track, and even if the funds are not used during primary or secondary schooling, they can then be used for university or beyond.

For clients with a young child, or planning a family, or even grandparents, this type of conversation is a must-have early in the engagement process, and the value you will be able to add to your client’s lives, and the child’s lives, is immeasurable.

This article was written based on the recently released ‘The cost of schooling in Australia’ report developed by Futurity Investment Group in partnership with McCrindle. This report details the importance of education and the financial impact of providing a quality education.

You can access the total Cost of Schooling in Australia report here.

In an ever-changing world of new opportunities and increasing challenges, education is the key to unlocking opportunities to find out how Futurity can help you, and your client’s on their educational journeys here.