Introduction

Australia faces a persistent challenge in the realm of housing affordability, with soaring prices and limited accessibility. Amidst this backdrop, various private sector solutions have emerged as a potential catalyst for transformative change. This article is the first of a series of two analysing these solutions, and exploring the investable opportunities advisers can make available to their clients.

According to AHURI, “home ownership rates for people aged 30 have fallen from a high of 65 per cent among those born in the late 1950s to around 45 per cent among those born in the 1980s. This development reflects a range of social, demographic, and economic influences. Coinciding with the decline in housing affordability, successive cohorts of Australians have entered home ownership at lower rates at any given age”.1

While rental relief is a much-needed solution for many Australians, home ownership remains the primary aspiration for many, given its criticality in retirement. As documented in Treasury’s Retirement Income Review – Final Report, the home is the most important component of voluntary savings. It improves retirement outcomes by reducing ongoing housing costs and acts as a store of wealth that may be drawn upon to help fund retirement.2

Advised clients may be seeing this situation play out with their own children. Fewer younger Australians are becoming first homebuyers: the average age of buying a first home increased from 26 years in the late 1960s to 31 years in the mid 2010s.3

Falling rates of home ownership are a concern

Falling rates of home ownership among pre-retirement Australians is of great concern, and if not reversed, will significantly impact retirement outcomes for many. Declining home ownership rates will force retirees to increase their reliance on the Age Pension and other welfare measures to support increased housing costs during their non-working years. Treasury’s 2023 Intergenerational Report is alert to this, noting that changing home ownership trends and rising mortgage indebtedness are a fiscal risk to Age Pension spending in the future, and will impact superannuation draw down rates.4

Given the central role home ownership plays in retirement, it is important that private market investment solutions focus on delivering expanded access to home ownership, not just increased rental stock options. While renting remains a critical step towards ownership, fostering renting as a long-term, entrenched housing solution has negative long-term impacts on wealth creation and retirement.

Evolving the mortgage with private capital

Falling rates of homeownership demonstrate, in part, that the traditional home ownership financing solution – a mortgage – is no longer sufficient at stepping middle-income Australians into home ownership. In the same way that private credit has opened funding pathways for businesses, private capital has the potential to evolve the traditional mortgage.

By bringing in private capital, to sit alongside a traditional deposit and mortgage, we can not only increase access to home ownership, but deliver to private market capital a compelling financial return with socially responsible characteristics. This approach, commonly termed ‘shared equity’ is a step-change from the traditional approach to property investment – the landlord/tenant model – but has compelling return drivers that many investors may see as superior.

The landlord model under review

Private capital (including via directly held and SMSF vehicles) has been the biggest supporter of residential property investment, having long bought into the return narrative of the landlord model. Clients within the advised wealth sector, have bought into this narrative too, and with good reason – favourable tax settings and a low cost of leverage have encouraged Australians in droves to become landlords. However, there is a growing body of evidence that indicates this model may not be as optimal as it once was, in maximising returns.

Analysis of residential property yields indicates that gross yield (rent) on houses in Australia, over the period 2010-2013, averaged 3.5%, according to SQM Research.5 However, there are substantial running costs which need to be considered to arrive at a net yield. Analysis by Stockspot, building on RBA data sources, puts running costs (including council rates, repairs, depreciation, body corporate fees, water, and insurance costs) at 2.6% p.a.6 On this basis net yields barely approach 1%.

Capital growth, not rental yield, is the key return driver in residential property

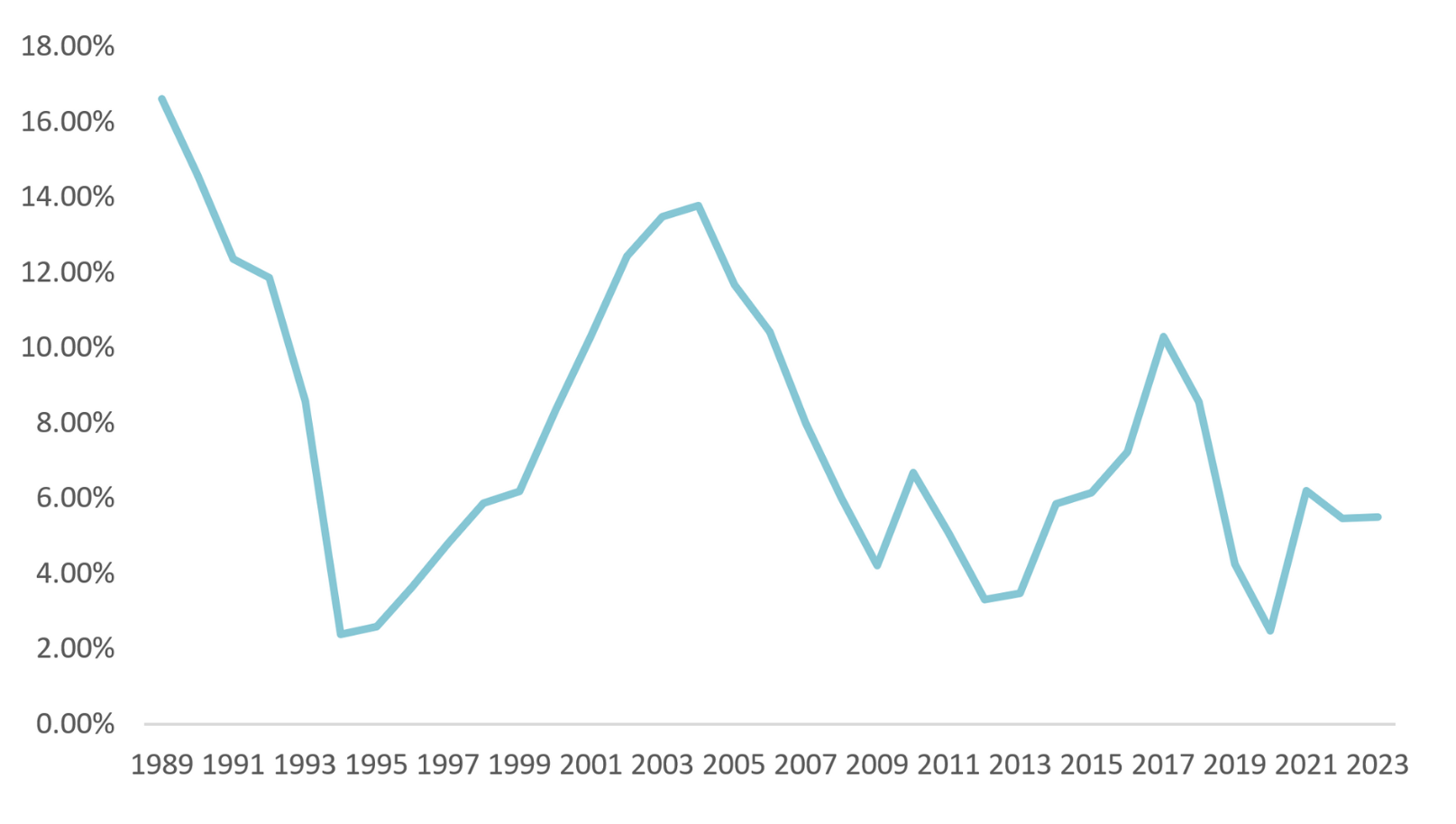

Ongoing yield compression and even negative yields in residential real estate has been tolerated by Australian investors due to favourable tax settings (negative gearing) and the remarkably strong capital growth characteristics that have persisted in capital cities in Australia for over 25 years. This is best demonstrated by analysis of Australian capital city house prices (Figure 1), which have not experienced a negative 5Y rolling return since at least 1989.7

Investable solutions to the housing crisis which are driven by growth not yield

Rather than fighting the macroeconomic thematics at play in the Australian residential property market, one investment fund that has leant into the capital growth story is HOPE Housing. HOPE offers a unique co-investment solution for essential workers to purchase homes near their workplaces. Its innovative product allows equity investments up to 50% of a home’s value, supplementing the homeowner’s deposit and mortgage.

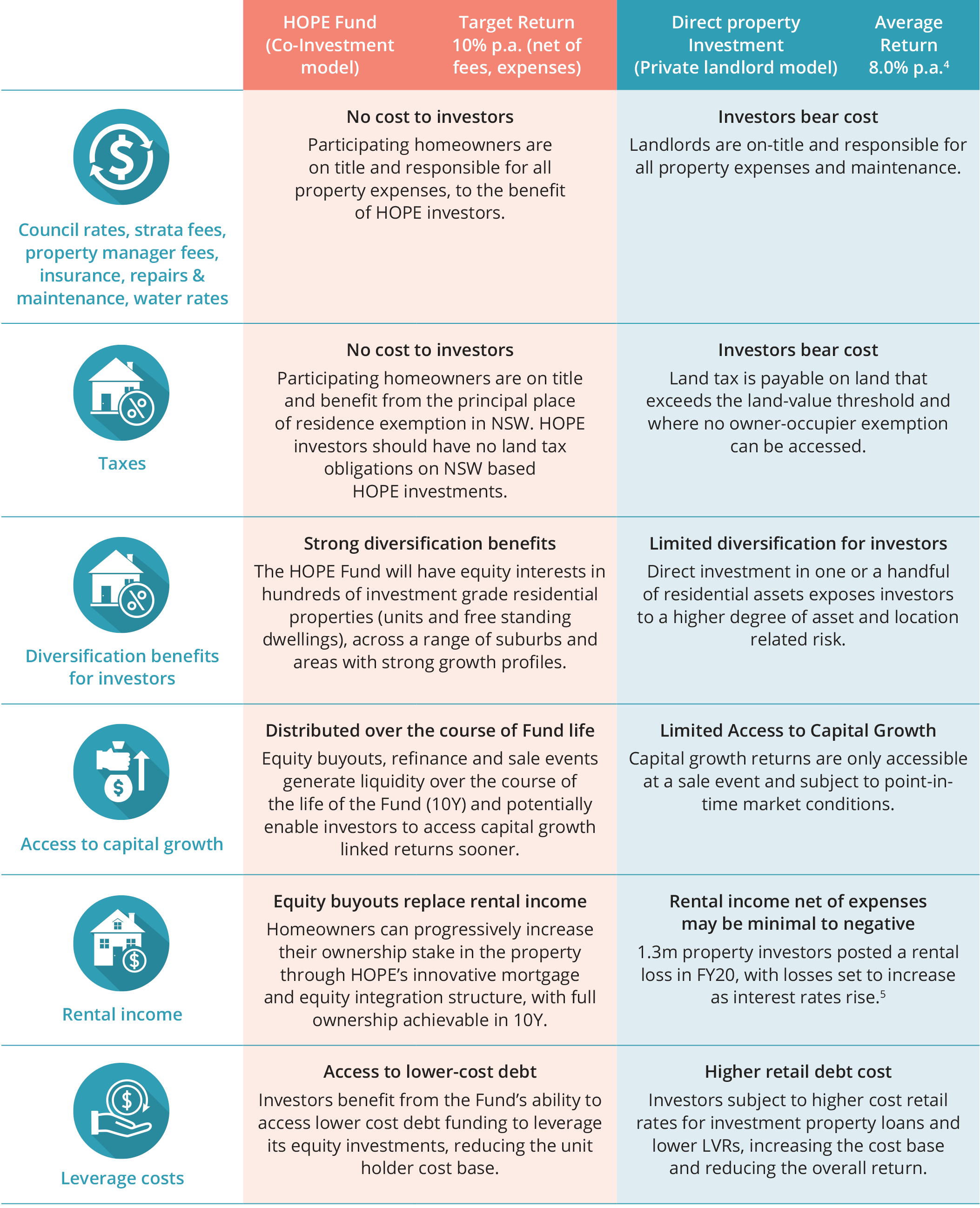

Additionally, it provides investors with access to the residential real estate market at scale, allowing them to share in property appreciation based on their equity stake in a diverse residential property portfolio, without all the hassles of the landlord model. A comparison of the HOPE model to the traditional landlord model is encapsulated in Figure 2.

The market evolution of co-investment funds, now enables those investors who have a strong affinity for property but have experienced sub optimal net returns or who are looking to be part of the home ownership solution, whilst generating attractive returns.

Visit our website to learn more about how HOPE Housing is creating new pathways for residential property investment.

REFERENCES

1 https://www.ahuri.edu.au/research/final-reports/404

2 https://treasury.gov.au/publication/p2020-100554

3 https://www.ahuri.edu.au/analysis/news/first-home-buyers-face-severe-financial-hurdles-smarter-government-interventions-can-help

4 https://treasury.gov.au/publication/2023-intergenerational-report

5 https://sqmresearch.com.au/property-rental-yield.php?t=1&avg=1

6 https://blog.stockspot.com.au/rent-or-buy-we-do-the-sums/

7 The data shown covers Sydney, Melbourne, Brisbane, Adelaide, Perth, and Hobart. Data exists back to the 1960s for major capital cities like Sydney and Melbourne, however for consistency the earliest date for all cities (1989) has been used here.

DISCLAIMER

The information in this article was finalised in April 2024. This article has been prepared by HOPE Housing Fund Management Limited (HOPE) ACN 629 589 939 (Investment Manager/Manager/Company/HOPE/HOPE Housing) for general information purposes only, without taking into account your personal objectives, financial situation or needs. Before acting on this general information, you must consider its appropriateness having regard to your own objectives, financial situation and needs. The information provided is not intended to replace or serve as a substitute for any accounting, tax or other professional advice, consultation or service and nothing in this article shall be construed as a solicitation to buy or sell any financial product, or to engage in or refrain from engaging in any transaction. The Investment Manager is a corporate authorised representative (number 001289514) of SILC Fiduciary Solutions Pty Ltd ACN 638 984 602 (AFS licence number 522145). The authority of the Investment Manager is limited to general advice and deal by arranging services to wholesale clients relating to the Fund in Australia only.

Past performance should not be taken as an indication or guarantee of future performance and no representation or warranty, express or implied, is made regarding future performance. Economic conditions may change.

The analysis provided in this article is based on information obtained from sources believed to be reliable but HOPE does not make any representation or warranty that it is accurate, complete or up to date. HOPE accepts no obligation to correct or update the information or opinions in it. Any opinions expressed in this article are subject to change without notice. No member of HOPE accepts any liability whatsoever for any direct, indirect, consequential, or other loss arising from any use of such information.