Life Confidence

Brought to you by Zurich. Adviser insights to strengthen your risk advice proposition

In this special production

Foreword

This paper is based on adviser insights gained through a survey of the XY Adviser member base and a series of in-depth interviews. We wish to thank the following advisers for their participation and their willingness to share:

Introduction

If Mark Twain were asked about the market for life insurance, he may well declare that ‘reports of its death are greatly exaggerated’, and he’d have a point. While the sector has had more than its fair share of doomsayers over the last 3 years in particular, the fundamental need for life insurance – and the demand for life insurance advice – remains as strong as ever.

Of course, the market has undeniably seen powerful structural disruption, in the form of stricter professional development standards, remuneration capping, and group life opt-in requirements for under 25s.

While the demand for life insurance advice has held up, the accessibility of that advice has reduced dramatically, with adviser numbers having dropped by around one-third over the last three years, and the cost of providing advice increasing by roughly the same margin.

Interestingly, Zurich has found that the number of active risk writers has decreased at a less significant rate.

The most successful advisers are those who have the confidence to turn challenge into opportunity.

They know that the role of life insurance in protecting the wealth of consumers remains absolutely foundational to financial advice. Life insurance remains the base upon which all wealth accumulation is built (and without which, the best laid financial plans can be ruined).

Furthermore, they know that this mismatch between the demand for and supply of life insurance advice is a massive opportunity. An opportunity to bring consumers into the advice ecosystem for the first time. An opportunity to demonstrate the value of advice. An opportunity to create long-lasting relationships with more emotionally connected clients.

Part 1: The current landscape

1. The overall advice context in Australia

Notwithstanding concerted efforts by various stakeholders over recent years, the use of financial advisers by Australians remains stubbornly low. This despite multiple surveys finding high customer satisfaction levels experienced by advised clients and despite the obvious appetite Australians have for information about how to manage their money (most recently evidenced by the popularity of finfluencers – licensed and unlicensed).

1.1 Demand for advice is strong and growing

2020 research1 found that the demand for advice has doubled in the last five years, with 2.6 million surveyed non-advised Australians indicating an intention to seek help from a financial planner in the next two years, up from 1.3 million in 2015, and up from 2.1 million in 2019, demonstrating the extent to which Covid 19 has catalysed advice demand.

1.2 Advice clients are highly satisfied

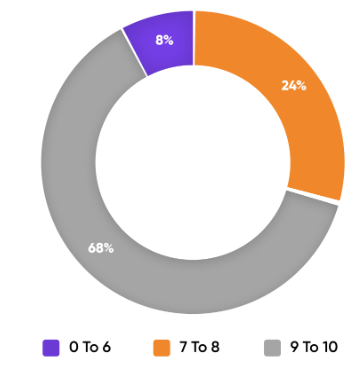

Advice clients satisfied with their adviser, with 94% scoring between a 7 and a 102

FIGURE 5: CLIENT SATISFACTION WITH THEIR FINANCIAL ADVISER

Client satisfaction with Financial Adviser Rating out of 10

Source: Zurich/AFA3

1.3 Use of advisers remains relatively low

A longstanding and frequently quoted rule of thumb suggests 1 in 5 Australian adults use, or had used, the services of a financial adviser, and indeed this was borne out by FPA research from 2020. As expected, their research4 found the majority of those clients were in their wealth accumulation phase (35-55 y.o).

1.4 Intent/action gap

When it comes to seeking financial advice, the figures above show there is a clear gap between intent and action. This gap was reinforced by ASIC5 research which showed that the proportion of Australians intending to seek advice – 40% – was almost twice as high as those who actually did/do. (ASIC found this intention/action gap to be notably higher amongst younger age groups).

1.5 Barrier to seeking advice

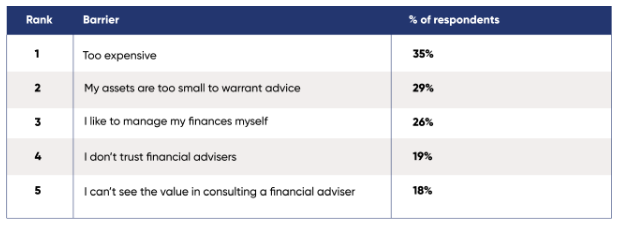

The most frequently identified barriers to seeking advice, according to ASIC, are (in ranked order)

TABLE 1: BARRIERS TO SEEKING FINANCIAL ADVICE

Source: ASIC6

References

01 www.professionalplanner.com.au/2020/09/advice-demand-doubles-in-5-years/

02 www.ifa.com.au/news/27145-client-experience-survey-the-findings-revealed

03 Pathways to Excellence, Zurich/AFA/Beddoes Institute Whitepaper.

04 FPA Money and Life Tracker, October 2020.

05 ‘Financial Advice: consumers really think’, ASIC Report 627, August 2019.

06 IBID.

The role of risk management within financial advice

2. The role of risk management within financial advice

There is little doubt that, when viewed from several perspectives, life insurance is a common and logical entry point to the world of advice.

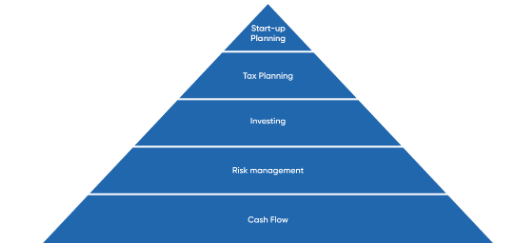

Most conceptual models of financial planning have protection, or life insurance, as one of the foundational elements – to be put in place before more advanced goals are tackled. This is intuitively sensible, as the ability to earn an income is central to the ability to build wealth. Conversely, the interruption of one’s ability to earn an income can bring even the best-laid wealth accumulation plans unstuck.

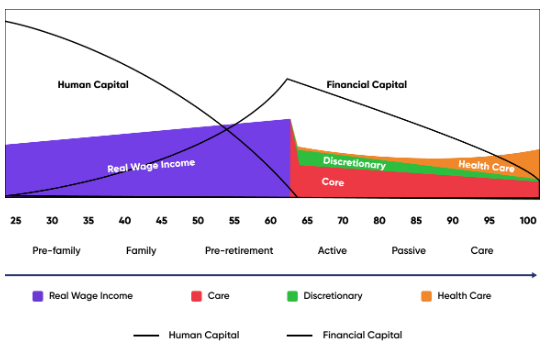

A scientific articulation of this relationship is shown in Figure 2 below, which uses the term ‘Human Capital’ to describe the future income generating capability of an individual over time. In retirement, financial capital is drawn down to fund core (everyday living) expenses, healthcare, and discretionary (travel, entertainment etc) expenditures.

FIGURE 2: FINANCIAL LIFE CYCLE IN REAL MONETARY TERMS

Source: Institute of Actuaries of Australia7

Taking this perspective, life insurance is a mechanism to replace the loss of Human Capital which occurs in the event of death, disablement, or critical illness.

A practical – and stark – example of the implications of a loss of human capital can be found in research8 which showed that around 20% of all mortgage foreclosures in Australia were due to a member of the household suffering an illness or accident. A simpler and more frequently used device to articulate the role of life insurance in financial planning is the pyramid, of which Figure 3 is a typical example. This is akin to Maslow’s hierarchy of needs, reflecting the base level needs that need to be satisfied to support achievement of goals – ‘actualisation’ further up the pyramid.

Figure 3: Financial Planning ‘Hierarchy of Needs’

One of the points to note here is that cash flow and life insurance are generally regarded as the ‘base needs’ to address, and in the context of life insurance advice, there is an important nexus between these two issues that we will explore later in this paper.

Adviser Reflection: Risk as a non-negotiable foundation for financial advice

Canberra Adviser Iain Jeffery has grown his holistic practice to the point where he is now able to specialise in risk, and for him, having appropriate life insurance in place is a non-negotiable if they are to work with that client on a more holistic basis.

“We don’t deal with people who aren’t appropriately insured. We say to them, look, we’re not going to take you on as a financial planning client for the simple fact that we can spend 10, 15 years of our time building something for you, and it can be broken in a heartbeat because of something out of our control. Having zero cover and working to build assets is just a pointless exercise for us.” Iain Jeffery.

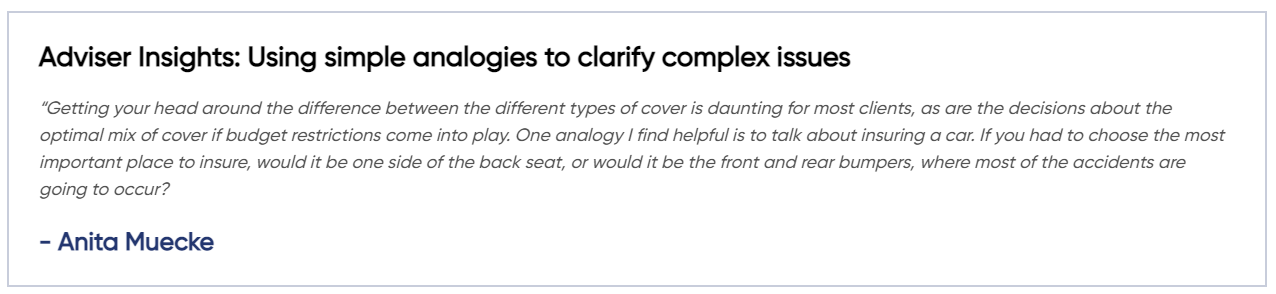

Adviser Reflection: Thinking outside the square in building a risk management strategy

“Life insurance is just one mechanism available to mitigate risk. Many clients have a fixed budget for insurance and so part of the advice process is to work with them on the best way to allocate that budget to the different cover types. You need to explore issues like sick leave, credit cards, whether they have nearby family and so on. Understanding that level of detail helps you adjust levers like benefit and waiting periods which can have a massive impact on premium. Coming up with the optimal risk management strategy does require some creative and strategic thinking.” Anita Muecke

2.1 FASEA and life insurance

The introduction of the FASEA code of ethics in 2019 created an increased responsibility to explore the totality of a client’s situation.

FPA’s Guidance on the Code suggests that acting with integrity, and in the best interests of a client, means “you will need to work out – and, if necessary, help the client to work out – what the client’s objectives, financial situation, needs, interests (including long-term interests), current circumstances and likely future circumstances are. To comply with the ethical duty, it will not be enough for you to limit your inquiries to the information provided by the client; you will need to inquire more widely into the client’s circumstances”9.

Their guidance further recommends not only understanding the client’s current insurance arrangements, but also any future trigger events such as health care and aged care needs, and the financial needs of any dependents.

Notwithstanding debates about whether this makes limited scope advice more challenging, there seems little doubt that an outcome of the Code’s introduction is increased adviser awareness of their client’s life insurance situation (regardless of whether they intend to provide advice in this area).

2.2 Life insurance as an entry point to financial advice

There are a number of factors that make life insurance a common, and logical, entry point to the world of financial advice.

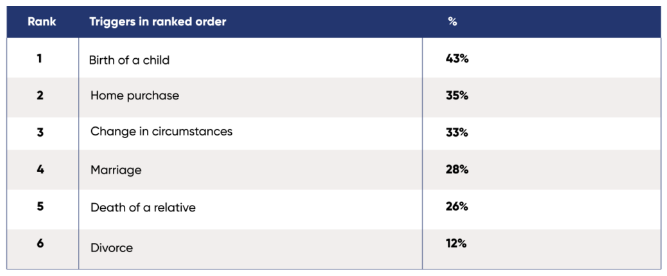

Firstly, the triggers which drive demand for life insurance are often chronological, and occur earlier in life, giving advisers an opportunity to engage clients earlier in the financial lifestage and creating the potential for a longer, and more mutually profitable, relationship.

TABLE 2: Triggers driving life insurance purchase

Source: Deloitte10

Secondly, many of the major hurdles to consumers seeking advice, discussed earlier in this paper, either don’t apply or are less significant in the context of life insurance.

The affordability hurdle becomes less relevant when clients can choose to pay for their advice via commissions.

The belief that they don’t have enough assets to warrant advice becomes less relevant, as does the lack of clarity over the role and value of the financial adviser (it is largely clear what value the adviser will provide in these circumstances).

References

07 ‘A holistic framework for lifecycle financial planning’, Corrigan, J., & Matterson, W., Presentation to Institute of Actuaries of Australia Financial Services Forum, May 2010.

08 ‘Risk Nexus, Understanding income protection gaps: awareness, behaviour, choices’, Zurich Insurance and Smith School of Enterprise and Environment, Oxford University, 2016.

09 ‘Helping you understand the FASEA Code of Ethics’, Financial Planning Association of Australia, April 2019.

10 ‘Life Insurance consumer purchase behaviour, Tailoring consumer engagement in today’s middle market’, Deloitte, September 2015.

The Opportunity

3. The Opportunity

At a macro level, the disruption experienced across the advice and life insurance sectors has created a substantial mismatch between demand and supply, which represents an opportunity.

3.1 Life insurance demand remains buoyant

The headline stories around recent trends in life insurance sales don’t tell the true story. Certainly, the number of lives insured, summed across cover and channel types, has decreased by 10% over the last year and by 23% over the last two years11. A confluence of recent factors has made it hard to get a true read on the forces at play, with most evidence from around the world suggesting:

- Covid 19 has increased demand levels for life insurance; but

- Job losses have affected people’s ability to afford cover.

In Australia we have seen coverage impacted by the PYS and PMIF legislation, and the reduction in distribution capacity as adviser numbers continue to fall.

If we dig deeper and examine fundamentals, the need and demand for life insurance remains extremely strong.

The extent of the need is neatly summed up in the size of the underinsurance gap, which has been measured in several different ways.

Rice Warner’s 2015 review of life underinsurance suggested the gap between life cover held and cover required to maintain current living standards was $2.2 trillion for death cover, $7.9 trillion for TPD and $589 billion for income protection.

Median life cover was only 37 per cent of the income replacement level – the level required to replace the expected net income of the insured and maintain current living standards until the insured would have reached age 65.

A more recent review by global consulting group NMG used a different methodology, instead basing their analysis on the gap between actual cover held and the levels of cover the community expected should be held.

One of the more surprising elements of that research was that the levels of cover consumers felt were adequate for the needs were relatively high, as the table below shows.

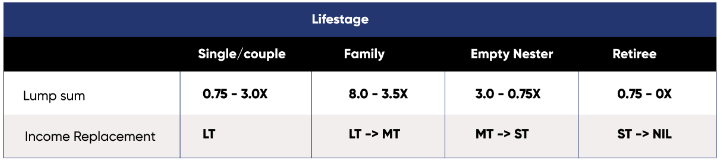

TABLE 3: Community expectations on cover by lifestage

Source: NMG14

Note: Lump sum is multiple of primary earner annual income; Income Replacement is either short, medium, or long term (LT).

At an overall level, NMG found the cover adequacy gap relative to community expectations was close to 50% for those aged 35 and over who only relied on group cover. In other words, people in those age cohorts generally had only half the cover the community expected they should have. (This was not true for advised clients).

Thankfully, many people are aware of these gaps, and this awareness – combined with the frequency of the trigger events explained above – helps drive continued strong proactive consumer demand for life insurance.

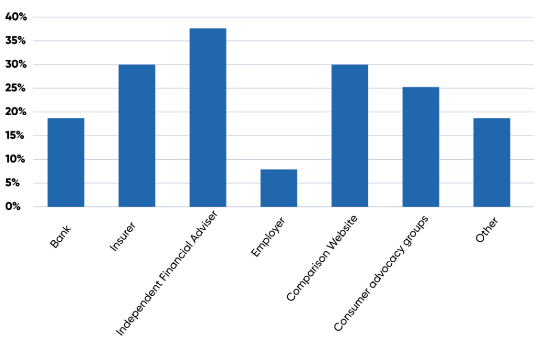

Furthermore, as demonstrated by Zurich/Oxford University research15, when Australian consumers are seeking life insurance, their number one preferred and trusted source of help with that insurance is a financial adviser (ahead of insurers, their employer, online comparison sites and even consumer advocacy groups).

Figure 4: Most trusted sources of life insurance help (Australia)

Source: Zurich/Oxford University15

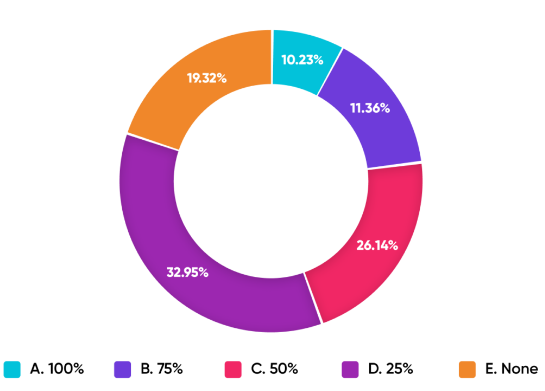

Unsurprisingly, a significant number of clients are proactively approaching financial advisers to discuss life insurance, as borne out by 2022 research16 by XY. Nearly half the advisers responding to this survey said that 50% or more of their risk recommendations resulted from a proactive client request.

Figure 5: % of risk recommendations where client proactively requested cover changed

Source: XY 16

3.2 But there are advice access issues

The contraction of adviser numbers has been well documented , with the current 17,000 registered advisers representing a decrease of more than a third compared to three years ago.

The combination of commission capping, and new educational requirements has seen a disproportionate impact on those advisers recommending purely risk, and so whilst the overall adviser population may be down 40%, the population of risk specialists has decreased by closer to half, with Investment Trends data from 2019 suggesting the proportion of advisers specialising in risk had dropped from 34% to 15%.

(This downward trend may well have bottomed out, with a 14.1 % of respondents to an XY survey classing themselves as risk specialists).

Zurich has found that over the past three years the number of advisers who have written an insurance policy has decreased at a far less significant rate.

References

11 https://home.kpmg/au/en/home/insights/2021/10/life-insurance-insights.html

12 https://www.swissre.com/institute/research/topics-and-risk-dialogues/health-and-longevity/covid-19-life-insurance.html

13 https://www.professionalplanner.com.au/2019/09/guided-by-evidence-risk-advices-single-canberra-message/

14 ‘Australian Life Insurance Market Research Report, NMG Consulting, July 2020.

15 ‘Risk Nexus, Understanding income protection gaps: awareness, behaviour, choices’, Zurich Insurance and Smith School of Enterprise and Environment, Oxford University, 2016.

16 XY Adviser life insurance survey, 2022.

17 https://www.afr.com/companies/financial-services/wealth-adviser-exodus-opens-door-to-fraudsters-20220310-p5a3fj

18 https://www.professionalplanner.com.au/2019/11/advisers-flee-risk-advice-in-droves/

19 XY Adviser Life Insurance Survey, 2022.

Part 2 – Building Life Confidence

Leveraging opportunity takes confidence

There are a number of different ways advisers can leverage the clear opportunity that exists for life insurance advice.

One is to strengthen your offering within your existing holistic advice offering, an exciting opportunity to bring your advice to a much wider audience.

The second is to go full ‘hyperniche’ and choose to specialise in this space, leveraging that speciality to create efficiencies, referral sources and develop new sources of revenue by offering related services such as claims advocacy or estate planning.

Notwithstanding that life insurance is a technically demanding area, the main driver of your ability to successfully leverage this opportunity will be confidence:

- Confidence in your skills

- Confidence in the offerings; and

- Confidence in your business model and processes.

4. Soft skills differentiate the best advisers from the rest

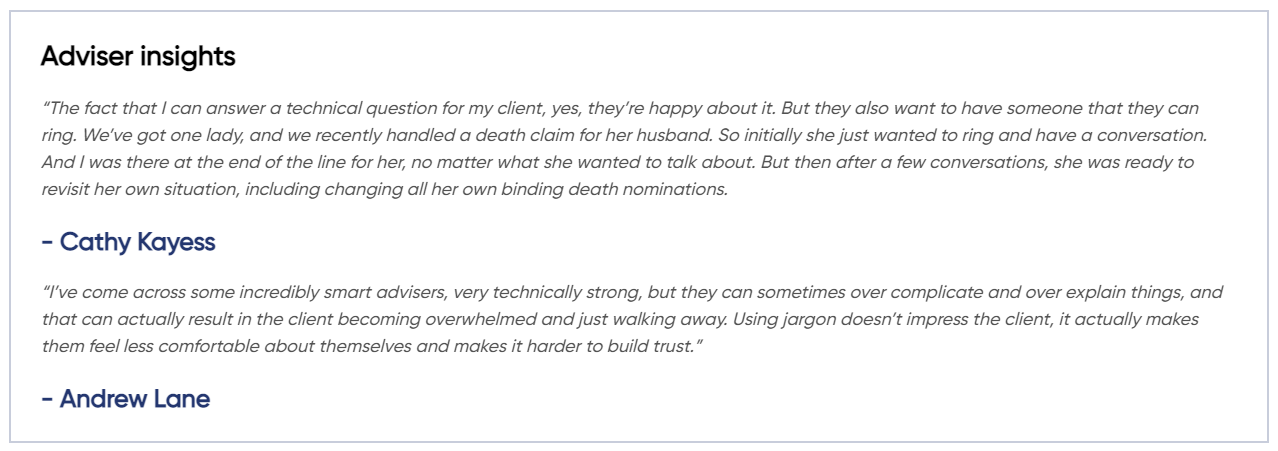

In most successful adviser/client relationships, the role played by the adviser is that of mentor, coach, and even counsellor. A study of Australian advisers in 2020 found that, on average, advisers spend 45% of their time talking with their clients about non-financial personal issues.

This is particularly true of life insurance, where the very nature of the product involves discussions around health, family members and other emotionally charged issues.

These conversations, which draw heavily on adviser soft skills, help build relationships which move beyond client satisfaction to true client connection.

4.1 Client connection trumps client satisfaction

When it comes to predicting consumer behaviour and business success, a growing body of research suggests that traditional metrics – such as customer satisfaction – are far less powerful and predictive than the emotional connection between customers and businesses.

One such study, reported in the Harvard Business Review, found that emotionally engaged customers are:

- At least three times more likely to recommend your product or service

- Three times more likely to purchase again

- Less likely to shop around (44% say they rarely or never shop around)

- Much less price sensitive

Unsurprisingly, such clients are also more valuable to your practice over the longer term, with the same study finding that fully connected clients are up to 52% more valuable than those who are merely ‘highly satisfied’.

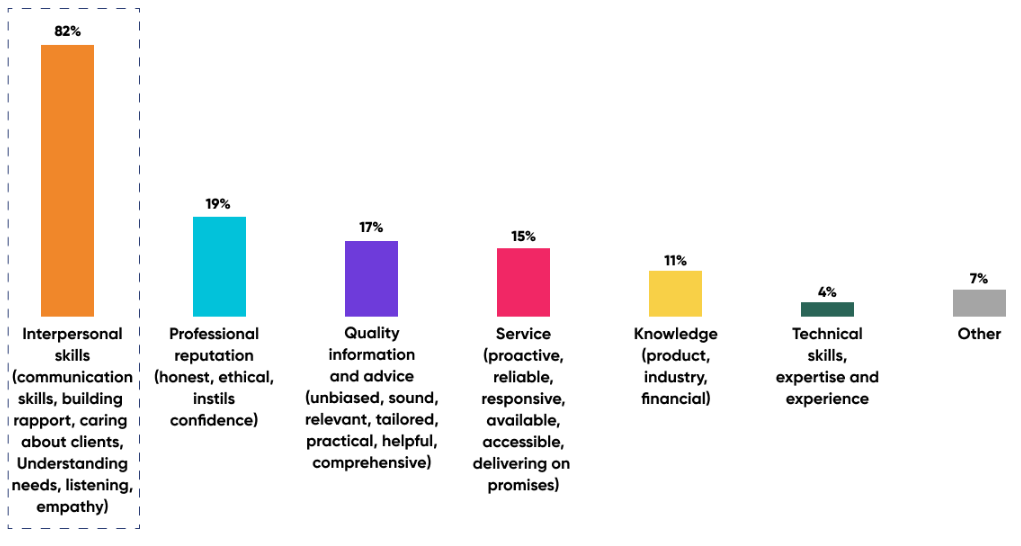

4.2 Clients value soft skills more highly than technical skills

Despite the plethora of advice practice websites emphasising their qualifications, technical strength, and breadth of offering, clients are actually seeking something else in an advice relationship.

Various studies, including the one shown below, have found that clients value soft skills – such as listening, communication, interpersonal skills, and creative thinking, more than they value technical skills.

FIGURE 6: WHAT ADVISER QUALITIES ARE MOST IMPORTANT TO CLIENTS?

Source: Zurich/AFA22

4.3 Advisers also agree soft skills are important

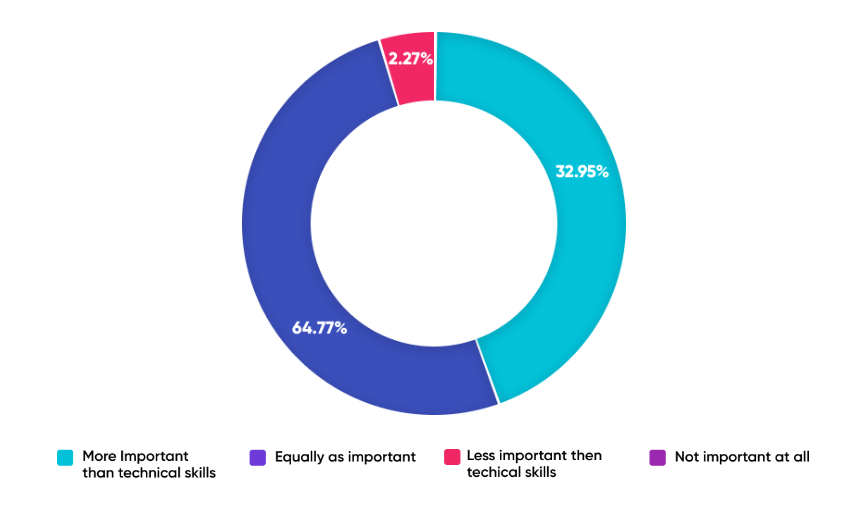

The 2022 survey of XY advisers , previously referred to, found a third of advisers agreed that soft skills were more important, and close to two thirds felt they were equally as important. (Only 2% felt technical skills were more important).

FIGURE 7: HOW ADVISERS RATE IMPORTANCE OF SOFT SKILLS V TECHNICAL SKILLS

Source: XY23

4.4 How to build these soft skills

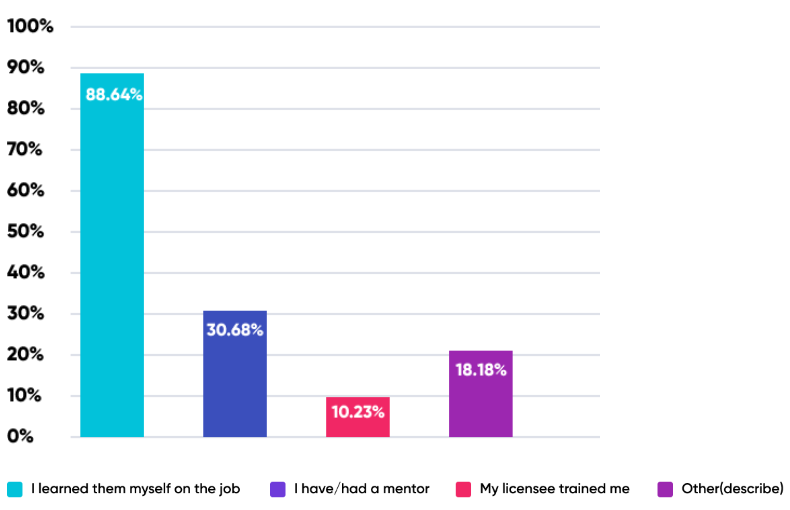

Whilst soft skills are typically developed ‘on the job’ and are honed with experience, many advisers highlight the importance of mentors and peer communities, as well as the dedicated courses training programs available.

FIGURE 8: HOW ADVISERS DEVELOP THEIR SOFT SKILLS

Source: XY24

4.5 Technical competence builds confidence

Notwithstanding the overwhelming importance of soft skills – a point applicable to all types of advice – a consistent theme emerging from the adviser research was that risk is not an area to just ‘dabble in’.

Life insurance is technically demanding, with complexity to be found in areas such as

- At least three times more likely to recommend your product or service

- Three times more likely to purchase again

- Less likely to shop around (44% say they rarely or never shop around)

- Much less price sensitive

XY research25 shows that while overall confidence levels amongst active risk writers were quite high, the areas where the advisers exhibited less confidence included field underwriting and discussing underwriting outcomes – including loadings and exclusions – with clients.

Regardless of whether you aim to specialise in risk, or it is just one component of your overall advice offering, building technical strength is therefore crucial.

Fortunately, many life insurance providers, including Zurich, offer resources through various channels to help advisers to build this strength, including BDM support, comprehensive face to face and virtual educational programs and PD Day presentations.

4.6 The confidence to negotiate with underwriters

Another common trait of the advisers interviewed for this paper was their confidence – borne out of knowledge and experience – to negotiate with underwriters in the event they come back with a decline, loading or exclusion.

Rather than accepting underwriting decisions at face value, they have the confidence and ability to negotiate with the underwriter for a better outcome on behalf of their client. Note, we aren’t talking about haggling or blind refusal to accept a non-standard outcome, we are talking about professional, courteous negotiation that comes from a place of being informed, knowledgeable and experienced in how different risk factors are judged by insurers and reinsurers.

References

20 XY Adviser Survey, August 2020.

21 https://hbr.org/2015/11/the-new-science-of-customer-emotions?autocomplete=true

22 ‘The Trusted Adviser, honouring the client at every turn’, AFA/Zurich/Beddoes Institute Whitepaper, May 2013.

23 XY Adviser Life Insurance survey, 2022.

24 IBID.

25 IBID.

Confidence in your business model and processes

5. Confidence in your business model and processes

The commission caps that apply to life insurance make a focus on efficiency especially critical to business model viability. For life insurance advice to be truly sustainable over the long term, efficiency can’t come at the expense of the customer experience.

Efficiency in a life insurance advice context comes more from the competence and confidence that allows you to:

- Set realistic expectations with clients

- Minimise surprises; and

- Minimise rework and wasted time.

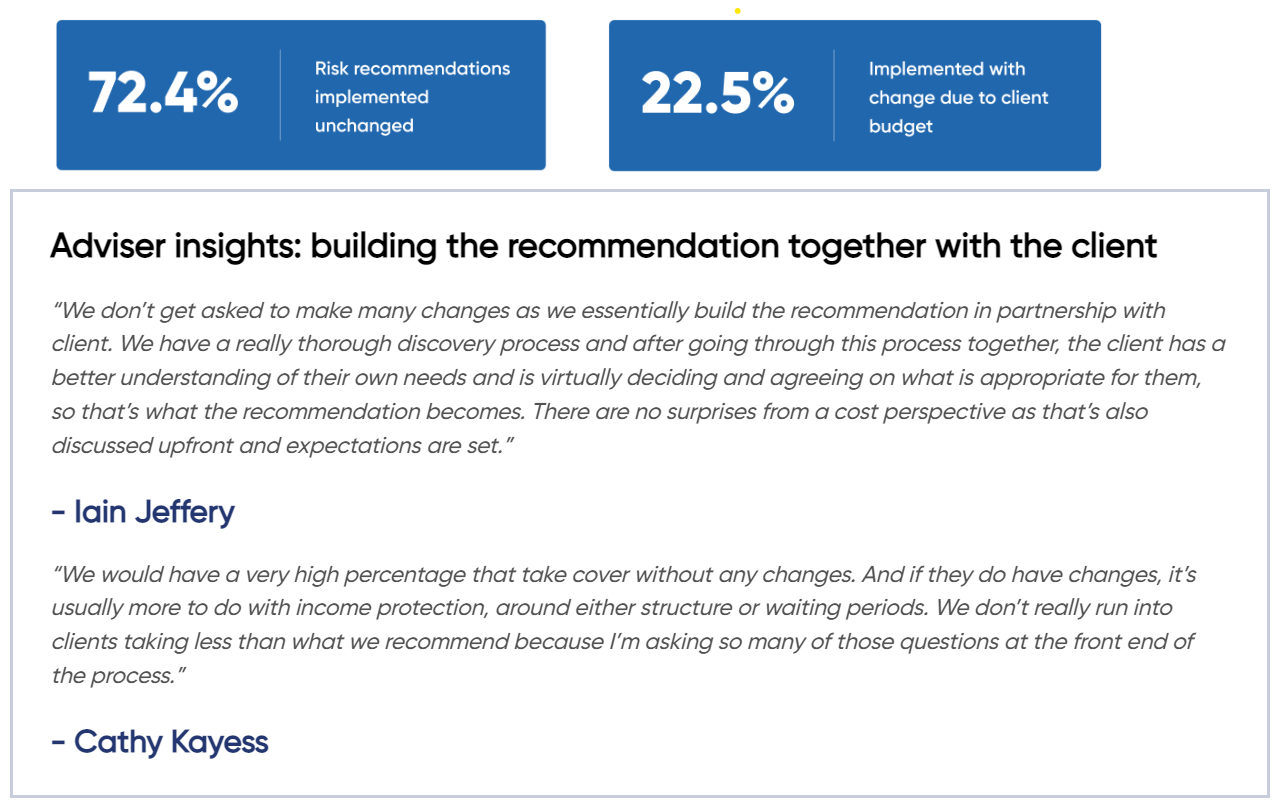

Success in these areas manifests itself as more clients accepting your advice recommendations unchanged, as identified in the XY adviser study26, which found that 72.4% of risk recommendations were implemented without change, and a further 22.5% were accepted with some modification, mainly for budgetary reasons.

The experts we interviewed for this paper were universal in their belief that best practice risk advice processes incorporated the following elements:

- Field underwriting

- The use of pre-assessments

- Risk researcher software

5.1 Field underwriting and pre-assessments

In simple terms, field underwriting is gathering enough information about the life insured to be able to determine their insurability before they actually apply for cover.

This generally means understanding, whether there are elements of their health, occupation, family history, or other circumstances which could impact the willingness of an insurer to offer cover on standard terms.

Successful field underwriting therefore relies on an understanding of the client’s circumstances and the underwriting approach of the insurer, bridged by a base level of understanding of medical terminology and medical conditions.

Having this understanding enables you to make a judgement of your client’s insurability before they even apply, which can help you narrow down your selection of suitable insurers (to those you believe are more likely to give you cover, on the best terms, perhaps because they specialise in particular occupations, or underwrite some health conditions – e.g., mental health or diabetes – more generously than others).

Knowing which health conditions are likely to attract a loading or exclusion is also important, as it will help you set client expectations from the outset. Understanding how loadings and exclusions work, and in the circumstances in which their removal can be requested, is also important.

Pre-assessments go hand in hand with field underwriting and involve getting an indicative sense of how a client is likely to be underwritten by an insurer. This can allow you to narrow down your choice of insurers as well as indicate those aspects of your client’s situation which may require more clarification and information gathering. Pre-assessments can therefore improve your efficiency as well as manage your client expectations.

Each life insurer tends to approach pre-assessments differently, in terms of their process, their responsiveness, and their accuracy. Pre-assessments do not represent ironclad offers of cover, nor definitive rejections. But they can help identify possible ‘speed bumps’ in the process of getting your client covered.

Essential to a smooth process is honesty and openness on the part of your client, and this means your pre-assessment information gathering needs to be rigorous. You don’t want the fact that your client drinks 10 beers every night to only come out when they actually apply for cover – there should be no surprises. In this sense the level of detail sought by insurers in their personal statements and – where applicable – their supplementary questionnaires, is a good benchmark.

5.2 Risk researcher software

Put simply, the sheer volume and complexity of life insurance products makes the modest cost of a subscription to risk research software an investment that will pay immediate dividends. As well as the obvious efficiency savings in product comparisons across multiple criteria (including premium rates), there are often other useful resources to be found within them, including data on claims rates and statistics around the likelihood of suffering various health conditions.

References

26 IBID.

Confidence in your offerings

6. Confidence in your offerings

Having confidence – belief – in your offering is a vital foundation of success. In the context of life insurance advice, this means having confidence in the inherent value of both the advice you are providing and the product solutions you recommend as part of that advice.

6.1 Know your products

Whilst the life insurance sector has seen much consolidation, there has been no shortage of new entrants eager to take their place. This means the sector remains ultra-competitive and there is a proliferation of new products. The 2021 IDII changes, in response to APRA’s intervention, mean that advisers also need to know their way around legacy contracts as well as contemporary product offerings, and the differences between them (another area where risk research software can prove invaluable).

6.2 Be confident about claims rates

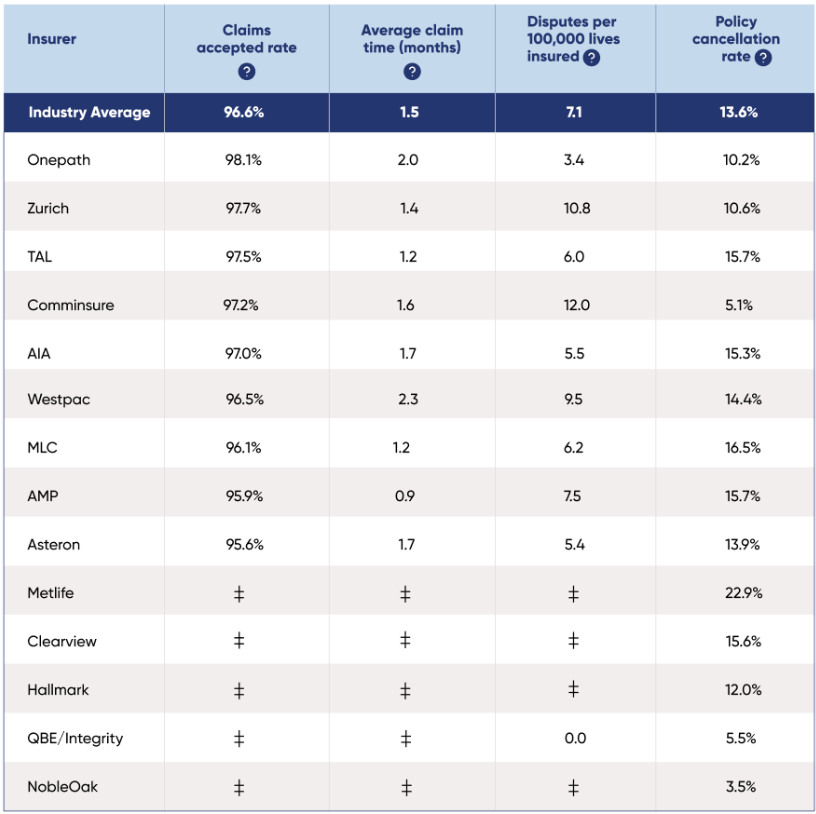

Claim time is the absolute moment of truth for life insurance and life insurance advice. It is the time when life insurers honour the promise made by the adviser.

Notwithstanding minor variations from time to time, advisers can be confident that the vast majority of retail insurers pay claims at a very high rate, and that advised policies have a much higher rate of claims success than unadvised.

APRA and ASIC (through their Money Smart site) issue regular updates on claims rates that demonstrate the differences between products, channels, and insurers.

Aside from being a useful resource to compare insurers, they can also instil extra confidence in clients that their cover will be there when it matters most (a major value -add of life insurance advice). Table 4 below is an example of this data, showing death claims on retail advised policies. By way of comparison, the average acceptance rate for direct life policies over the same period is 91.5%, compared to the 96.6% average for retail policies and 87.4% for directly written accidental death policies.

TABLE 4: Illustrative claims rates for retail advised death cover

Source: ASIC27

6.3 Opportunities for related offerings

The nature of life insurance, and its position within the financial planning pyramid, described above, opens up a wide range of opportunities in related offerings, creating new sources of revenue.

Budgeting and cash flow

Sharing the base of the pyramid with risk management is cash flow management, and there is a natural nexus between life insurance and cash flow management. Not only are they both important for younger clients – at the beginning of their wealth accumulation journey – but they are also interdependent on one another, with the affordability of cover over the longer term being crucial, and indeed something that advisers are obliged to demonstrate and document.

Claims advocacy

Beyond the assistance of existing clients at claim time (which most advisers see as a vital and highly satisfying part of their role) the articulation of Claims Advocacy as a specific, standalone component of the advice offering opens up the opportunity to (a) provide such a service to new clients, and (b) charge fees for such a service.

Happily, we are starting to see the emergence of Claims Advocacy firms from within the financial advice profession, with a growing number of financial advisers incorporating Claims Advocacy into their service offering, some even going so far as to establish standalone businesses.

Estate planning

Estate planning has a strong relationship to life insurance, which is why many risk specialists also incorporate this service into their practice offerings (either directly or via referral).

It is worth remembering that not all aspects of estate planning require the involvement of a legal professional. Furthermore, whilst only qualified legal professionals may be able to execute certain documents, financial advisers are generally far better qualified to help clients make the actual decisions that are being codified in those documents. This is because the financial adviser generally has a far more holistic understanding of the client’s family and financial situation, and also because most lawyers are not qualified nor experienced to deal with the vast range of estate planning issues that planners often see within their clients’ affairs. One example might be the navigation of superannuation death benefits post the 2017 reforms , particularly with SMSFs with pension and accumulation balances. Other areas where many lawyers lack experience and expertise include Centrelink, aged care, and taxation issues arising on death.

Keyman, business succession and SME clients

Life insurance is often used by business clients in business succession arrangements for partnerships, SMEs, and family businesses. This can be lucrative area to become involved in, as the sums insured are generally higher and business clients are generally more willing and able to pay fees for the advice.

Referral partnerships

A further opportunity for those advisers who decide to strengthen their risk credentials is to partner with those advisers who choose to outsource life insurance advice.

References

27 https://moneysmart.gov.au/how-life-insurance-works/life-insurance-claims-comparison-tool

28 Law Companion Ruling 2017/3, ato.gov.au. accessed October 2020.

Top 6 resources for building your Life confidence

7. Top 6 resources for building your Life confidence

We asked our panel of experts for their top 6 tips and tricks for those advisers looking to build their ‘Life Confidence’ and become more active in the risk advice space. Here’s what they came up with:

01 Learn how to field underwrite and use pre-assessments

02 Don’t accept underwriting decisions at face value

03 Use risk research software

04 Tap into peer networks such as XY Adviser, or risk specific groups on LinkedIn and Facebook, or the many podcasts dedicated to life insurance advice

05 Sharpen your skills by making use of the training programs offered by insurers (e.g., Zurich _Zone)

06 Access claims statistics from APRA and insurers, understand them and use them