Responsible Reflections

Brought to you by PIMCO. Adviser Insights from the World of ESG Investing

In this special production

Foreword:

This paper is a companion to the XY ESG Portfolio Series podcast, sponsored by PIMCO. We wish to thank the contributors to that podcast:

Introduction

Regardless of the criteria used – be it funds flow, media mentions, or the capacity to fundamentally reshape investment markets, product design, and financial advice – there is no hotter investment topic right now than Responsible Investing.

Once considered a fringe part of the market, catering for investors solely motivated by ‘saving the planet’, the field of Responsible Investing – encompassing approaches such as ESG integration, negative and positive screening, and impact investing – is now very much mainstream.

Furthermore, many experts believe the practices, disciplines and methodologies underpinning Responsible Investing will eventually become the norm, rendering the term redundant.

In the present, however, Australian Financial Advisers and their clients have much to ponder, faced with an ever-expanding array of investment products and solutions which offer both fundamental investment capabilities – such as alpha generation and risk reduction – and the opportunity to achieve positive social and environmental outcomes.

Whilst more and more advisers are building their skills and developing their offerings in this specialised space, many are still uncertain how best to incorporate Responsible Investing into their client conversations, their advice processes, their portfolio construction techniques, and their compliance obligations.

In this paper, we draw on the experiences and reflections of financial advisers who have placed Responsible Investing at the very core of their client proposition. These reflections – first captured in the PIMCO sponsored ‘ESG Portfolio Series’ podcasts – represent practical, enlightening, and actionable insights that can help advisers progress their Responsible Investing journey, no matter where on that journey they currently are.

Responsible Investing and ESG integration defined

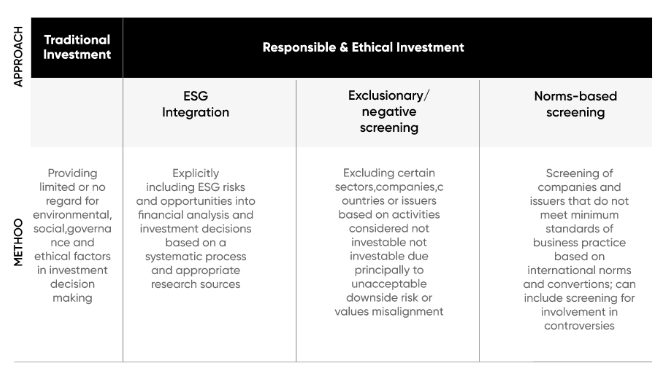

The field of Responsible Investing is characterised by a diversity of terminology, much of it used interchangeably.

For the purposes of this paper, we will align to the terminology and definitions used by the Responsible Investments Association of Australasia (RIAA).

According to the RIAA, Responsible Investing – also known as ethical or sustainable investing – is a holistic investment approach where environmental, social, corporate governance (ESG) and ethical issues are considered in addition to traditional financial metrics when making investment decisions.1

A key aspect of Responsible Investment processes is risk management, and the formalised and systematic consideration of ESG factors throughout the process of researching, analysing, selecting, and monitoring investments is known as ‘ESG integration’.

But the remit of Responsible Investing goes beyond just the consideration of individual investment opportunities:

“Responsible Investing requires funds to execute stewardship duties and to improve the performance of companies, thereby contributing to the stability and sustainability of the financial system more broadly.” 2

Importantly, Responsible Investing is used by the RIAA as an umbrella term, covering a spectrum of more specialised fields, as per Figure 1 below.

FIGURE 1: RIAAS RESPONSIBLE INVESTING SPECTRUM

Source: RIAA 3

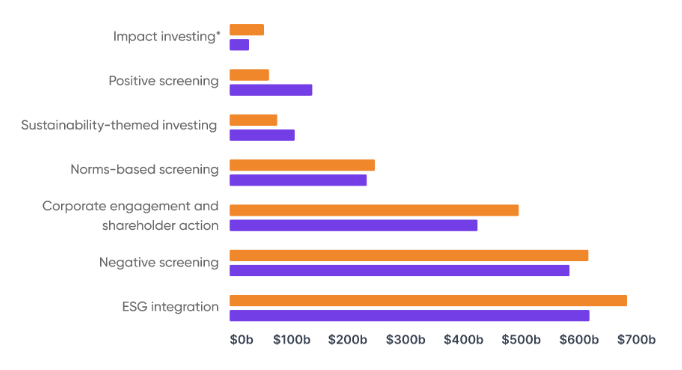

To the extent that – on an Assets Under Management (AUM) basis – ESG integration is by far the most common form of Responsible Investing approach currently employed in Australia, as shown in Figure 2 below, much of the discussion in this paper will be focused accordingly.

FIGURE 2: RELATIVE SIZE OF RESPONSIBLE INVESTMENT SECTORS AUSTRALIA (AUM)

2020 data for impact investing is combination of data from the Benchmarking Impact 2020 repact investment products released in 2020 collected via desktop research.

![]()

Source: RIAA 4

References

01 Responsible Investment Benchmark Report Australia 2021, Responsible Investment Association of Australasia

02 IBID.

03 IBID.

04 IBID.

Consumer interest is strong and growing

An extensive body of research points to the growing popularity of ESG investing.

RIAA5 research from 2019 found that 86% of Australians expect their super or other investments (excluding banking) to be invested responsibly and ethically. The same study found that two thirds (67%) of Australians who don’t currently invest in ethical companies, funds or superannuation funds would be most likely to consider doing so in the next 5 years.

The extent to which Covid 19 catalysed investor sentiment into action was evident in research undertaken by Investment Trends6 in 2021, which found that 78 per cent of Australian investors are either currently adopting ESG investing principles or intending to do so (a finding consistent with US research which found interest in sustainable investing at 79% overall, and a staggering 99% amongst Millennial investors7).

The RIAA8 study found that consumers have similarly high expectations of their financial advisers, with 90% expecting their adviser to offer them responsible or ethical investment options, and 86% believing that it is important for their adviser to ask them about their interests and values in relation to their investments.

Little wonder then those Australian advisers are assigning increasing importance to Responsible Investing, with Investment Trends9 finding it doubled in importance through 2021, labelling it the fastest growing priority for advisers currently.

But has sentiment turned into action? It certainly has.

References

05 From Value to Riches 2020, Charting consumer expectations and demand for responsible investing in Australia, Responsible Investment Association of Australasia

06 Global trend towards ESG investing gathers pace, Tahn Sharpe, Professional Planner, May 2021.

07 Sustainable investing sentiment weathers economic uncertainty, Institute for Sustainable Investing, morganstanley.com, October 2021.

08 From Value to Riches 2020, Charting consumer expectations and demand for responsible investing in Australia, Responsible Investment Association of Australasia

09 ESG doubled in importance for advisers in 2021: Investment Trends, Tahn Sharpe, Professional Planner, December 2021.

Fund flows into ESG and other responsibly managed investments

In the US, research10 released in mid 2021 found the amount invested in listed ESG funds had increased elevenfold in just 5 years. The same study estimated that almost one in three dollars of total US assets under professional management were held in ESG funds.

Locally, data released by RIAA11 revealed that in 2020, Responsibly invested assets grew at 15 times the rate experienced by overall Australian professionally managed investments. Their Responsible Investment Benchmark Report 2021 Australia revealed that responsible investment assets under management (AUM) increased by $298 billion over 2020 to $1,281 billion – a 30 per cent increase, and a figure which represents 40 percent of the total market, up from 31% just a year earlier.

In comparison, the overall market grew by only 2 per cent during this time (from $3,135 billion to $3,199 billion).

In 2020, Responsible Investments made up 40 percent of the total market, up from 31 per cent in 2019.

This trend continued through 2021, with Morningstar data12 revealing flows into sustainable funds in the second quarter of 2021 (two-thirds of which went into active strategies) were the highest on record.

Demand drivers

Driving the explosion of interest – and action – in responsible investment is a powerful combination of evolving demographics, social trends, regulatory intervention and high-profile natural disasters and events which have shaped experiences and attitudes and raised our collective awareness of the concept of sustainability.

Awareness of climate change

The spectre of climate change is one that is hard to ignore, and hard to avoid, featuring extensively in our media and our political discourse (Coverage about COP 26 in Glasgow being a recent example). ‘Net Zero by 2050’ may be an empty slogan to some, but for many of the world’s governments and corporations, it is a North star, the journey to which will fundamentally reshape the world we live in, the way we live, and the products we consume.

You don’t have to be a politically attuned to be aware of this issue, nor an environmental activist to want to act.

In our own backyard we see the bleaching of the Great Barrier Reef and experience – with seemingly increasing regularity – droughts, floods and of course bushfires.

201913 research found that recent weather conditions in Australia had prompted 2 in 5 Australians to think about switching financial institutions (banks, super funds etc.) to one which invests ethically or responsibly. Undoubtedly the Black summer bushfires of 2019/20 – which brought the impacts of climate change and biodiversity loss to the forefront of Australia’s consciousness – have raised these consideration levels even further.

References

10 Fund numbers double in two years amid ESG boom, Richard Henderson, Australian Financial Review, July 2021.

11 Responsible Investment Benchmark Report Australia 2021, Responsible Investment Association of Australasia

12 Australia’s sustainable funds market is growing at a blistering pace, Christopher Franz, morningstar.com.au, August 2021.

13 From Value to Riches 2020, Charting consumer expectations and demand for responsible investing in Australia, Responsible Investment Association of Australasia

Adviser Reflection – ‘Clients have eyes wide open on these topics’

“My clients, like most people, have experience in being a ‘global citizen’. And they realize they don’t want to contribute to things like water scarcity, because they’ve travelled overseas and they don’t want to contribute to plastics in the oceans, because they’ve swum in beaches in Bali, that have been full of plastic. When you think about it from a real-life perspective, clients actually have eyes wide open on these topics. And they’re just struggling with how they connect what they see as problems for the planet with their money.” Karen McLeod.

Demographic shifts

High-level demographic analysis suggests that interest levels in ESG investing are higher amongst younger investors, females, and high net worth individuals.

But perhaps the most interesting and powerful demographic trend influencing the way we invest is the intergenerational wealth transfer which in Australia will see more than $3 trillion change hands over the next 20 years14.

Many of the beneficiaries of this transfer will be the Millennials – the eldest of which have already turned 40. Better educated and more environmentally conscious than their forebears, this generation understands better than most the need to improve the world our children are growing up in. And, according to one observer, ‘ESG investing will explode in the next decade with the incoming wealth being transferred from Baby Boomers to Millennials’15.

On the other side are those who will hand the wealth down, the Baby Boomers, who, having benefited from affordable real estate and more stable, predictable working lives, have accumulated enough wealth to be more than just comfortable. This generation has realised that the way they invest now will influence not only the wealth they transfer, but the world they leave behind. For them, ESG investing, with its capacity to outperform and create a more positive legacy, will be increasingly appealing.

References

14 Three trillion reasons Millennials are set to drive the clean money revolution, theguardian.com, March 2021.

15 ESG spike with largest intergenerational wealth transfer: deVere, Sarah Simpkins, investordaily.com.au, January 2020.

Adviser reflection – ESG investing is for all ages

“I don’t think ethical, or ESG or responsible investing is limited to younger demographics. I think their parents and their parents’ parents are definitely interested. My oldest ESG client is 75. They came in and said, ‘our son says we should use a low-cost index product, but we want to explore the options and get proper advice and compare the fees. And they came out with a ‘darker green portfolio because they wanted the social impact.” Nathan Fradley.

Companies sharpen their ESG focus

The mention of ESG issues on corporate earnings calls had skyrocketed since the start of 2020. PIMCO analysed more than 10,000 global companies and found that before 2018, less than 1% of Earnings Calls mentioned ESG. In 2019 that rose to 5% of earnings calls, and in May 2021, that rose again to 19% of earnings calls. 16

Our changing habits

Sometimes choosing the sustainable option is less about political idealism and more about our hip pockets, or increased choices.

Spurred on by their own need to achieve net-zero to satisfy different legislation across their global markets, the world’s largest car manufacturer – Volkswagen17 – have indicated they will go Electric Vehicle (EV) only from 2035, whilst Volvo aims to get there 5 years earlier 18.

Australians embraced hybrid vehicles – and the associated lower fuel costs – years ago. And with more than half of Australians now considering the purchase of an EV as their next car19, it is clear the future sales growth of electric vehicles in Australia will be driven more by bottom-up demand than top-down policy. Similarly, the opportunity to save on power bills has seen one in four Australian homes install solar energy sources, the highest uptake in the world, and the main reason that one quarter of all electricity in Australia is now generated from renewable sources20.

These changing behaviours not only lead to increased awareness of sustainability but they are also associated with an increasing array of investable opportunities that people can relate to.

References

16 Mentions of ‘ESG’ and sustainability are being made on thousands of corporate earnings calls, Debbie Carlson, marketwatch.com, July 2021.

17 Volkswagen will go all electric in Europe by 2035, US to follow shortly after, Sean Zymkowski, cnet.com, June 2021.

18 Volvo cars to be fully electric by 2030, Volvo Media Release, March 2021.

19 How lenders are responding to sustainable investments push, Aaron Bell, savings.com.au, August 2021.

20 IBID.

‘Adviser reflection Focus on economic sustainability’

“A lot of our clients are relatively mature, and this can come across as a radical change to some of them. And so, our sustainability narrative is that this is as much as about economic sustainability as saving the planet.” David Graham

Supply side drivers of growth

In addition to the strong demand for growth seen in recent years, it should be remembered that powerful supply drivers are at work too, some of which are underpinned by regulatory intervention.

APRA, for example, has highlighted the financial nature of climate change risks and strengthened its monitoring of climate change risk disclosures. Amongst the specific initiatives they have announced21 is their intention to update Prudential Practice Guide SPG530, designed to assist superannuation entities formulate and implement investment strategies which are inclusive of ESG factors. Consultation on this update will conclude during 2022.

Other notable recent developments include the updated Hutley Opinion on fiduciary duty, which suggests that Superannuation funds must divest from assets with a high degree of climate risk or face breaching their members’ best interests’ duties, and a surge in the number of asset owners and investment managers publicly making net-zero commitments22.

These supply side factors will undoubtedly increase community awareness of ESG issues and be matched by a proliferation of new choices for investors seeking to invest responsibly.

References

21 Consultation on Prudential Standard SPS 530 Investment Governance in Superannuation, apra.gov.au

22 Super trustees must diversify climate risk or divest: Noel Hutley, Australian Financial Review, April 2021.

Manager Reflections – exponential growth in green bond issuance

“The best barometer of interest that we look at as an active fixed income manager would be ESG labelled bond issuance. Total outstanding stock of ESG labelled bonds eclipsed $2 trillion in 2021, after breaking through $1 trillion in 2020. That trend is likely to continue into 2022. And it’s a good proxy for the demand in the marketplace” Grover Burthey.

ESG investing – a historical advice disconnect?

Given the clear and overwhelming demand for responsible investments that already exists, it may seem a little surprising that, in Australia, and around the world, there has been a historical disconnect between consumer demand for responsible investment options, and adviser offerings.

In a 2020 study of US financial advisers by Cerulli Associates, 58% of respondents said a lack of investor demand was a significant factor preventing their adoption of ESG strategies, and an additional 14% reported that it was a moderate factor23.

A 2021 survey of Australian advisers also uncovered a less than universal enthusiasm for ESG strategies24. Close to 40% of advisers surveyed indicated they had seen no increase in client demand for ESG investment options over the previous 3 to 5 years, while nearly a quarter said they didn’t expect to see an increase in client uptake over the coming 3-5 years. Around 80% of those surveyed said 10% of their clients or less were invested in ESG strategies.

Retail investor research conducted for Climate KIC Australia25 identified a perception that advisers were ‘generally misinformed about sustainable finance or were part of the problem in perpetuating myths about uncertainty related to green fund’.

Factors slowing adviser uptake

A number of factors can explain why, in some quarters at least, the incorporation of ESG investing into the advice proposition has been sluggish.

Firstly, it is likely that some advisers equate responsible investing with politics and environmental activism, and they may be reluctant to broach such sensitive and deeply personal topics with their clients.

Secondly, the availability of ESG options in the past has been relatively limited. For some advisers, including David Graham, this lack of options across different asset classes and risk profiles meant that – until recently – he wasn’t able to construct fully sustainable portfolios for his clients.

References

23 Advisers are missing the boat on ESG: Cerulli, Jeff Benjamin, investmentnews.com, April 2021.

24 Survey of Australian Financial Advisers conducted by Marketing Pulse, August 2021.

25 Unlocking Australia’s Sustainable Finance Potential, Edwards, M., Kelly, S., Klettner, A., Brown, P., University of Technology Sydney, 2019.

Adviser Reflections – ESG options now available across all asset classes

“10 years ago, it was difficult to find ethical solutions that suited our clients in fixed interest and property. Equity based solutions were available. But what we’ve seen over the last, let’s say 10 years is ethically screened solutions become available across all the asset classes” Michelle Brisbane.

“A year or so ago, we could finally put hand on heart and say, we can build a properly diversified portfolio across most asset classes with sufficient management, diversification and style to replace the more traditional options we were using up to that point” David Graham.

The lack of consistency in jargon used, and a lack of transparency in data and reporting of investments labelled as ‘green’ or ‘ethical’ may also have deterred some advisers.

But undoubtedly the biggest barrier to adviser uptake – and the one based on the biggest misconception – is that responsible investments come at the cost of lower returns.

Busting the performance myth

Despite the scepticism and remembering that ESG investing is predicated on the consideration of financial – as well as ethical – metrics, the data suggests that responsible investing does not come at the cost of returns. On the contrary, across the responsible investing spectrum, and across different markets and asset classes, responsible investments either match or outperform traditional investments on a risk adjusted basis.

Respected financial ratings and analytics firm Moody’s wrote on February 23, 2021, that, ‘Environmental, social and governance (ESG) themed investments have become one of the best performing investment categories in recent years, paving the way for continued growth of this strategy.’26

A comparison of traditional equity indices and socially responsible investment indices reinforces this point.

The MSCI KLD 400, which was founded as the Domini Social Index, was established in 1990 and consists of 400 companies that meet rigorous standards for environmental excellence and social responsibility. Over the past 30 years, it has tracked performance of these companies against the S&P 500. As can be seen below, the social index has consistently outperformed traditional stocks for the past 25 years. And this gap continues to grow.

FIGURE 3: US INDEX COMPARISONS MSCI KLD 400 V S&P 500

Source: Bloomberg 27

This outperformance has continued, with the KLD index growing 31.6% during 2021, compared to the S&P’s 26.9% annual return28.

References

26 ESG investing is a star. Women are why, Joan Michaelson, forbes.com, March 2021.

27 ‘Does impact investing equate to lower returns?’, mycnote.com, April 2020.

28 MSCI KLD 400 Social Index (USD) Fact Sheet, msci.com

Companies with poor ESG records pay a performance penalty

Another way of looking at the performance equation is from a risk management perspective. To the extent that companies who don’t exhibit good ESG behaviours are more at risk of falling consumer demand, reputational damage, or even financial penalties, is there a corresponding performance penalty paid by these companies?

One study estimated the performance drag for companies who strongly violate ESG norms to be a market underperformance of around 3.5% per annum29.

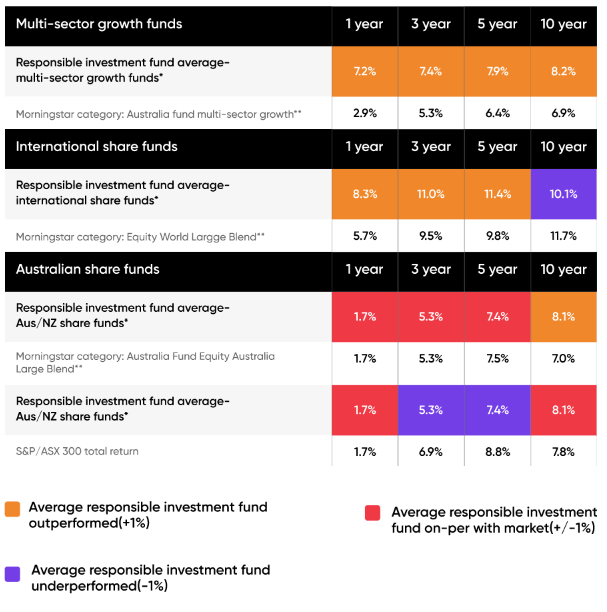

In Australia, 10 years performance data released by the RIAA30 shows responsible investment funds matched or outperformed ‘mainstream’ funds across most time frames and asset classes.

FIGURE 4: PERFORMANCE COMPARISON RESPONSIBLE V MAINSTREAM INVESTMENT FUNDS

Note: Average performance of responsible investment ends was determined using the asset-weighted returns (net of fees) reported by survey respondents over one, three, five and ten-year time horizons and compared to the mainstream fund performance from morningstar DirectTM.

- Data provided by survey respondents

- Data provided by Morningstar direct

Source: RIAA

References

29 Researchers find that ESG investing may benefit consultants more than investors, Simon Moore, forbes.com, April 2021.

30 Responsible Investment Benchmark Report Australia 2021, Responsible Investment Association of Australasia

Adviser reflections: ESG investments add alpha and reduce risk

“So it’s about diversification, and we have all those regular conversations, but there’s an added level where we take into account the client’s values and making sure their portfolio’s aligned with those things. We say definitely, we are not about sacrificing returns. We actually try and outperform as much as we possibly can. And we’re in the business of finance and making money for our clients.” Michelle Brisbane

“Looking at it from a financial analysis point of view, it all makes sense, it’s all financially logical. The circular economy for example is all about reuse, which is about efficiency, and efficiency improves the bottom line.” Claudia Mah.

“I think clients really understand impact investing to be having your cake and eating it too. So, it’s having the beautiful returns we would expect for the clients that we deal with, who are all looking for market returns or better. And then there is the additionality of creating positive and measurably articulated change through what they’re invested in.” Karen McLeod.

“There is a pure belief, from my perspective that my darkest green portfolio outperforms any other portfolio I’ve seen so far. And besides, If I said to you, you can get X% on your bond portfolio, or you can get X% on your bond portfolio AND provide a house for 450 homeless women to get back on their feet, what are you going to choose?” Nathan Fradley.

“Looking at it from a risk management perspective, we believe returns from sustainably invested funds will be better risk-adjusted returns because the industries which are not part of our portfolio just don’t have a future. And if it’s not sustainable, it’s unsustainable.” David Graham.

Responsible Investing is about more than just climate

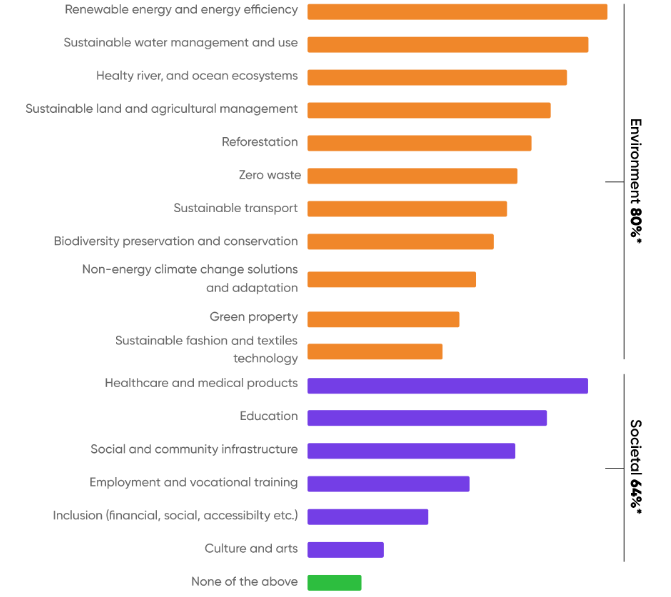

A common misconception is that socially responsible investments are focused on just a handful of issues like climate change or renewable energy. In reality, it is possible to find investment opportunities linked to all 17 of the UN’s 17 SDGs, which encompass everything from social housing to education, clean drinking water to sustainable fishing, gender equality to the food access and quality.

Research by the RIAA31, shown in Figure 5 below, reveals Australian investors are interested in a variety of causes.

FIGURE 5: ISSUES OF IMPORTANCE TO CONSUMERS WHEN INVESTING

Source: RIAA

References

31 From Value to Riches 2020, Charting consumer expectations and demand for responsible investing in Australia, Responsible Investment Association of Australasia

Manager Reflection: A balanced approach to ESG

“When it comes to ESG, it’s important to be balanced. And as important as efforts related to climate and the environment obviously are, there are certainly other areas that are important to PIMCO in the marketplace with regards to the social impact we can have. We focus quite a bit on human capital management – including staffing, worker treatment and worker rights. When assessing a given business or assets or government, we focus on health and safety and wellness, particularly in areas such as nutrition, food and pharmaceuticals, as well as a variety of other similar topics. It’s about asking – are tangible goods being sourced and distributed in a reasonable manner? Is access to those products equitable? Are they a healthy construct for the consumer? And to the extent that claims have been made, are they viable and reconcilable?” Grover Burthey

Ways to invest responsibly

Retail investors are faced with an ever-growing array of ways to invest responsibly, ranging from direct investments in equities, ‘green property’ and fixed interest securities to managed funds across all asset classes.

Superannuation funds have been at the forefront of offering sustainable options, and according to Rainmaker research, in 2021 there were over 170 ESG investment options offered across the market32.

Managed fund options in this space vary greatly in terms of the underlying approach. Some are narrowly focused on particular issues – for example climate or renewable energy. Others are more thematically based or aligned to particular UN Sustainable Development Goals (SDGs).

Managers and individual funds also vary in the approach to engagement.

More passive managers and products will largely be managed in a non-interventionist fashion, relying on straightforward techniques such as excluding firms from industries such as alcohol/tobacco, fossil fuels, gambling, and firearms, or proactively seeking out companies and industries exhibiting more ESG friendly behaviours.

But for some specialist managers, this hands-off approach is sub-optimal and misses the opportunity to engage with companies across many industries and help them fundamentally reshape their businesses to be more resilient and more sustainable, and ultimately more profitable. This is particularly relevant for those companies and industries that are in a state of ‘transition’ to a low emissions future. For example, negatively screening a fossil fuel company simply starves them of capital but does not help them transition towards net zero. Actively engaging with the management of that company could help them make that transition faster and more sustainably.

This active engagement approach delineates those managers who are not only ensuring their client’s investment is being more impactful but are likely achieving superior risk adjusted returns compared to other options.

Manager Reflection – Beyond exclusions

“Now for some, ESG primarily – or even solely – means exclusions. And that means taking parts of the market and saying, I’m not going to invest in those. And if you take out large parts of the market from an opportunity set, then you miss out on potential opportunities that may come up in those areas over some period of time, especially when we think about those companies and industries that are doing a good job of transitioning. Similarly, you may end up with more concentration in other parts of the market, because you’ve reduced your opportunity set, and that can have an impact on returns.” Grover Burthey.

Adviser Reflections – Client conversations

“I think the focus should be on the fact that everyone cares about something. So having a list of topics that they can care about, and then paying attention to the conversation cues prior to that point. What have they talked about with regards to their diet, exercise, their routine or hobbies, their location, have they got family, particularly grandchildren, what do they do for a job, what they have previously done for a job?” Nathan Fradley

“There will certainly be ways you can really ask some meaningful questions based on their background. For example, have they lived overseas or travelled? What are their hobbies? They might enjoy gardening, for example, and they might know, that they’ve certainly seen less native bees in their garden, or they might be interested in, the impact on native wildlife because of large scale development and land clearing. So, there’ll be ways you can tailor conversations to clients, depending on who they are, and what’s important to them. I think our knack as an adviser is knowing our clients.” Karen McLeod.

“As part of the initial client meeting, we do a fairly comprehensive ethical profile with them. So, we will have a discussion about the sort of things that they want to either avoid or support, with their investment money.” Michelle Brisbane.

Bonds. Green Bonds.

Many people equate investment markets purely and simply with equity markets. But in fact, fixed interest markets are larger, with PIMCO estimating the size of global fixed interest markets to be around $106 trillion USD, compared to the $95 trillion in global stock markets33.

And one of the fastest growing parts of the bond market is Green Bonds (and their close relatives Social Bonds and Sustainability Linked Bonds). World-wide issuance of Green and Social Bonds reached half a trillion dollars during 2021, a figure expected to grow to $1 trillion annually by 202334.

Unlike traditional fixed interest instruments, Green Bonds are issued to raise funds specifically for projects that have positive environmental impacts. The majority of Green Bonds issued are ‘Use of Proceeds’ Bonds, where proceeds are earmarked for specific projects35. Best practice issuers of such bonds will be extremely transparent in the setting of targets, the allocation of proceeds, and the reporting of progress towards defined goals.

Social bonds work in a similar way but are used to fund projects with social, rather than environmental goals.

A newer alternative to Green Bonds is the Sustainability Linked bond. These bonds do not have their proceeds set aside for any specific project. Instead, they penalise the issuer by requiring higher interest payments to investors if the issuer fails to meet pre-defined sustainability targets, such as reducing carbon emissions. Some experts believe such bonds can be more powerful in funding the transition to a low carbon economy.

Green and social bonds in Australia

Although Green and Social Bonds first originated in Europe, Australia now has a buoyant and growing market for such instruments. Although largely issued by state governments, there is also a nascent corporate green bond market. Developer Lend Lease for example, raised $800m in just 5 months during 2021 through 2 oversubscribed Green Bonds36. Proceeds were earmarked for a number of ‘green building’ projects, with benefits ranging from the lowering of carbon emissions, to reducing the environmental impact of materials and the delivery of health and wellbeing benefits.

State governments are currently issuing bonds to fund everything from light rail projects and cycleways to solar farms and social housing. In terms of Federal Government issuance, the Australian Financial Review recently reported that issuances by the National Housing and Finance Corporation were regularly oversubscribed two to three times37.

References

32 Australia’s ESG Superannuation Funds, rainmaker.com.au, April 2021.

33 Introduction to Sustainable Investing, presentation prepared by PIMCO, October 2021.

34 2021 Green forecast updated to half a trillion – latest H1 figures signal new surge in global green, social & sustainability investment, Liam Jones, climatebonds.net, August 2021.

35 Explaining green bonds, climatebonds.net

36 Lendlease Media Release, lendlease.com/au, March 2021.

37 NHFIC bonds snapped up by investors, Michael Bleby, Australian Financial Review, October 2021.

The challenges in looking under the hood

There are two major challenges investors face when ‘looking under the hood’ to assess the merits of individual ESG investments.

The first is a widespread lack of transparency in relevant data about investments made and outcomes achieved.

The second is a lack of consistency in methodologies, reporting and ratings. Some estimates suggest there are around 600 different ESG approaches being used today38.

Some methodologies to rate companies on against ESG criteria can be counterintuitive. In one high profile example39, Mcdonalds Corporation was given an improved ESG rating when the ratings agency dropped carbon emissions as an assessment criterion and determined that climate change neither posed a risk nor offered opportunities to the company’s bottom line. In other words, they assessed the risk the company faced from the world, not the risk the world faced from the company!

While progress has been made in this area, with initiatives such as the Task Force on Climate-Related Financial Disclosures (TCFD) and the Partnership for Carbon Accounting Financials (PCAF), the hitherto lack of harmonisation and standardisation has created the opportunity for some companies and funds to claim green credentials on tenuous grounds. (Should a fund that merely excludes alcohol, tobacco, firearms, and gambling be entitled to call itself ethical? Is that what investors would expect?).

Greenwashing

The potential for funds to overstate the extent to which they are environmentally friendly, sustainable, or ethical is referred to in the market as ‘greenwashing’.

In Australia, the RIAA estimates only 25% of the investment managers who say they invest responsibly can actually prove their credentials40.

There is growing global unease about the risks of greenwashing of financial products, and international regulators have established a Sustainable Finance Task Force that covers greenwashing and other investor protection concerns. ASIC is participating in this task force, and in July 2021 they announced their intentions to conduct a review of environmentally focused investment funds in Australia41

Added to the underlying challenge of assessing diverse and complex instruments and there is little wonder that individual investors need advice in this area.

As Nathan Fradley put it, this is a field that calls not just for active management, but for ‘active advice’.

38 ‘Are universal sustainability standards and ESG reporting the key to net zero?’, Felicia Jackson, forbes.com, October 2021.

39 The ESG Mirage, bloomberg.com, December 2021.

40 Pressure mounts on funds to come clean about being green, John Collett, Sydney Morning Herald, October 2021.

41 ASIC to review ESG funds for greenwashing, Tara McCabe, mozo.com.au, July 2021.

Adviser reflection: navigating the nuances of greenwashing

“Clients need help navigating the nuances of the ethical investment world and greenwashing. They need to know what they’re going into is genuine. They need an adviser for that, and that’s where we can create a lot of value. I also think it’s the rise of the active manager again, because, while there’s some great index products out there in this space, there are also some really poor ones, that represent themselves as much, much more than they are. With active managers, it’s not just about it’s not just about their holdings anymore. It’s about their engagement.” Nathan Fradley.

ESG research in Australia

The last two years has seen a surge of activity from research houses seeking to differentiate themselves on the basis of their ESG rating methodologies.

Morningstar research formally integrated ESG into its analysis of shares, funds, and managers. Following their purchase of Sustainalytics they also launched a new rating for managers, the ESG Commitment level, which sits alongside its existing classifications.

Lonsec integrated its ESG biometric scores into its main fund rating model and entered a partnership with ESG research provider Sustainable Platforms. Zenith launched a Responsible Investment Classification to sit alongside its traditional ratings.

Of course, with no consensus on definitions and the subsequently wide variety of (proprietary) approaches taken, the proliferation of ESG research doesn’t necessarily make it easier for advisers to assess any given fund against their clients’ ESG preferences.

Questions to ask of an ESG manager

Advisers and investors seeking the confidence of a true to label’ ESG manager can look for a number of attributes.

How committed to ESG and responsible investing is the manager? Are they just testing the green wave to see how long it continues? Do they have only one or two ‘sustainable’ funds, or is their entire offering based on ESG principles?

Do they have ESG subject-matter experts dedicated to engagement, stewardship, and responsible investing? If so, are their backgrounds and education steeped in corporate sustainability, environmental data science and social advocacy experience?

What is their own approach to ESG, in terms of diversity and inclusion, working conditions, and emissions reductions?

Are they signatories to the various global Principles and Guidelines around sustainable investing, or members of groups such as the Investor Group on Climate Change (IGCC) or the TCFD?

What firms do they invest in, and do they actively engage with those firms?

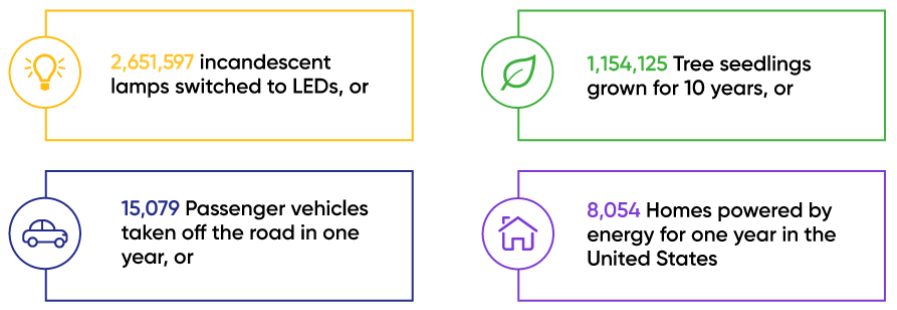

How transparent are they, and how well are they able to link investment activity with environmental/social outcomes? And can they quantify those outcomes it in a way that is easily understood?

For example, in 2020, PIMCOs Climate Bond Strategy held green and sustainable bonds linked to projects that helped avoid almost 70,000 tons of carbon dioxide equivalent emissions. In Figure 6 below, this has been expressed in a more tangible way.

FIGURE 6: AVOIDED EMISSIONS PIMCO CLIMATE BOND STRATEGY

69,798 TCO2E(TONS OF CARBON DIOXIDE EQUIVALENT) IS SIMILAR TO:

Source: PIMCO 42

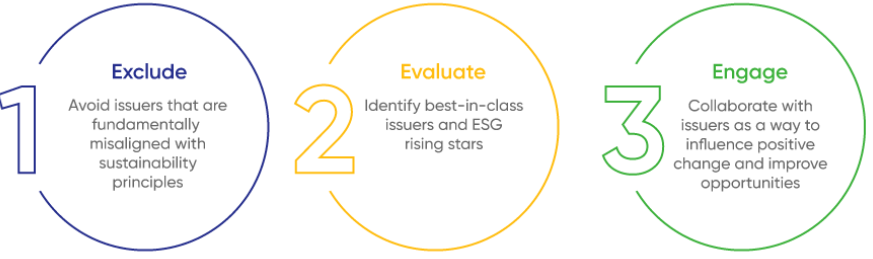

One of the most important things to look for is whether they have a rigorous model for assessing individual investment opportunities.

An example of such a model is that used by PIMCO, one of the world’s leading active ESG Fixed Interest Managers.

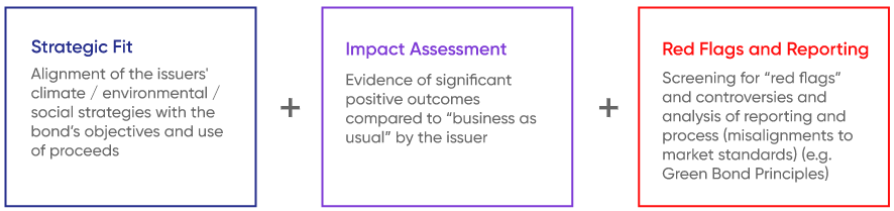

FIGURE 7 BELOW DETAILS PIMCO’S 3 STEP ESG INVESTMENT PROCESS.

Source: PIMCO 43

This process combines ESG-focused portfolio construction with active engagement and transparent reporting.

Central to this process is PIMCO’s own proprietary Green, Social and SDG Bond Scoring System shown in Figure 8.

FIGURE 8: PIMCO’S GREEN, SOCIAL AND SDG BOND SCORING SYSTEM

Source: PIMCO 44

PIMCO is also a highly active ESG fixed interest manager, and during 2020 engaged with over 1500 corporate bond issuers across many sectors, on topics including greenhouse gas emissions, human labour rights, product safety, governance, land use, and conduct and culture.

References

42 Bonds for change, ESG Investing Report, PIMCO, 2021.

43 Introduction to Sustainable Investing, presentation prepared by PIMCO, October 2021.

44 IBID.

ASIC guidance on ESG and advice processes

Putting aside the matter of approved product lists, there are a number of practical considerations for Advisers looking to build or enhance their ESG offerings to clients. From a regulatory perspective, guidance from ASIC is neutral. RG 175 suggests:

“Advice providers must form their own view about how far s961B requires inquiries to be made into their client’s attitudes to environmental, social or ethical considerations. Advice providers may need to ascertain where environmental, social or ethical considerations are important to the client, and if they are, conduct inquiries about them.”

Although not definitive, the RIAA45 suggests that, in order to satisfy their legal duty, advisers should ask clients a comprehensive set of questions, including determining whether there are any sectors the client may not be comfortable investing in. (A possible guide to the future may be seen in the EU proposal to mandate a requirement for advisers to proactively seek out the sustainability preferences of clients.)

Client fact finds which don’t currently touch on sustainability preferences could be easily amended.

45 Financial Adviser Guide to Responsible Investment, Responsible Investment Association Australasia, responsibleinvestment.org

Adviser reflections – best interests and financial stewardship

“I suppose when we think about FASEA and our best interest duty, where does that code of ethics lead us? I would argue that it means we need to think of ourselves as stewards of our clients’ capital, in how we allocate that. And so, it’s no longer really appropriate to say that they haven’t asked about it. We need to position the portfolio to make sure that proactively, we’ve proactively prevented any downside risk.” Karen McLeod.

“Back in 2019, when a 25-year-old sued a major superannuation fund for the lack of climate disclosure, that drove a lot of this change in institutional level, because it woke people up to climate as a material risk. It’s a material risk to members of super funds, who have got 30-year retirement horizons. And therefore, it’s a material risk to financial advisers who are working with clients who have 30-year retirement horizons.”

Other useful adviser resources

Ratings platforms – and the variances between them – are another issue which we have touched on already.

In addition to the mainstream rating systems already mentioned, a highly valuable resource which advisers can freely benefit from is the research done by the Ethical Advisers Co-operative, who have developed a leaf rating system for comparing sustainable products46.

Advisers should also consider standalone, bespoke ESG research platforms such as ETHOS from the US, or Perth-based Sustainable Platform.

A variety of useful resources, including fact sheets, research reports, and an Adviser Guide, can be found on the website of the RIAA.

Their Financial Adviser Guide to Responsible Investment seeks to demystify responsible and ethical investing by breaking down the key components of responsible investing to help advisers better understand the demand in the market and how they can consider their clients’ values, along with details of 4 practical steps to getting started.

The guide also includes a host of other resources to help grow an adviser’s knowledge of responsible investment and help them meet their obligations when considering clients’ broader, long-term interests.

Adviser reflections – RIAA

“RIAA are a great organisation. You should check out their website if this is a space you want to start learning about. They do annual reports on the market itself, and what’s happening there. They’ve got a screening tool, they engage with funds to improve, and they hold conferences and educational sessions. They also manage the certification of ethical advisers. So, if you want to push into this space, consider joining them. The bigger their member base, the more value they can create.” Nathan Fradley.

46 Ethical Fund Ratings, ethicaladviserscoop.org

In summary

01 As a consequence of increased awareness, the looming intergenerational wealth transfer, and the ageing of Millennials, advisers will encounter more demand for ESG options.

02 ESG investing is no longer a niche category, with funds flow into sustainable funds outstripping flows into traditional investments in recent years.

03 The ubiquity of ESG investing reflects not only increasingly powerful social and regulatory factors, but also the superior investment returns achieved by funds managed sustainably.

04 Rather than being a homogenous, one size fits all framework, Responsible Investing is an umbrella under which sits a spectrum of different methodologies reflecting the different objectives and preferences of investors.

05 Advisers should identify whether there are any gaps between increasing demand for Responsible offerings by their clients, and their ability to make them available for client consideration.

06 Regulatory guidance around Responsible Investing advice is likely to evolve, as it has in other corporate sectors, and advisers should keep abreast of any changes.

In summary, an increasing desire to make a positive impact on the planet is being seen across governments, businesses, and individuals. This is being reflected in both the increasing incorporation of ESG principles into day-to-day business management, and in the growing popularity of ESG investment options. As this momentum continues to grow, financial advisers have an ideal opportunity to engage with both new and existing clients, to facilitate outcomes which can meet both ethical and financial objectives and adding a new dimension to the value of their advice.