In this special production

About this paper

This paper has been prepared by Ensombl as a resource for financial advisers, with the permission and support of Vanguard Investments Australia.

We would like to thank the following adviser/expert contributors:

1. Introduction

One of the more notable trends within financial advice over the last decade – and the last five years in particular – has been the growing adviser usage of managed accounts.

Arguably the primary driver of this exceptional growth has been their potential to deliver operational efficiencies and superior client investment outcomes.

Another likely factor in this growth is the increasing role played by investment consultants within the retail advice sector, emblematic of a trend towards increased outsourcing of investment capabilities, by advisers eager to spend more time building client relationships, and less time monitoring markets and picking stocks.

The options available to advisers seeking to outsource aspects of their investment proposition continue to proliferate and benefit from ongoing innovation. With new solutions becoming available almost on a daily basis, both existing and potential users of managed accounts are almost overwhelmed by choice.

If we think in terms of a collective ‘investment outsourcing’ space, then it is one that is undoubtedly burgeoning, and this paper sets out to provide advisers with a framework for choice within this space.

Drawing on insights from advisers and investment consultants, its role is to provide advisers with a list of considerations and criteria that can link choices around products, platforms, and professional help, back to business fundamentals, including investment philosophy, target audience, practice size, and client value proposition.

2. Managed Accounts —Current market context

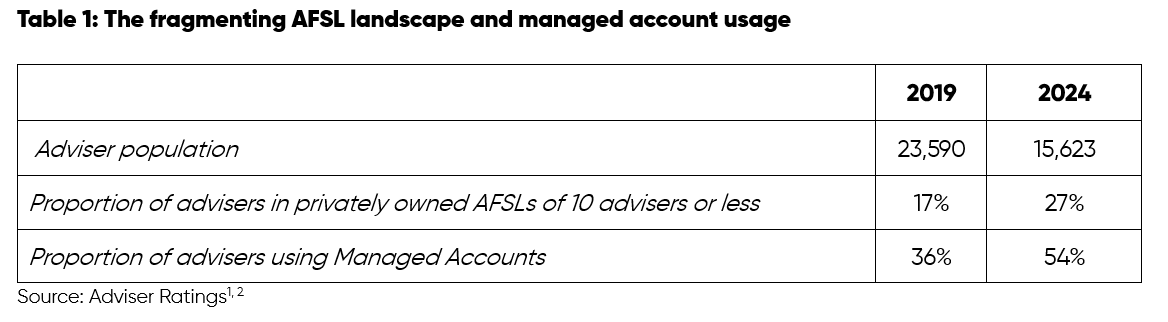

Data released by a number of sources, including the Institute for Managed Account Professionals (IMAP), and Adviser Ratings, has emphasised the extent to which managed accounts – and the associated outsourcing of investment capability – have become embedded in the Australian financial services ecosystem.

2.1 Fragmenting licensee landscape has driven outsourcing

A key driver of this evolution has undoubtedly been the gradual fragmentation of the licensee landscape. As advisers exited large, institutional licensees, they generally also left behind the support of well-resourced investment teams. At the same time, the gradual but significant exodus of advisers from the industry saw advisers dealing with larger client panels.

The combination of these two forces meant that advisers needed to source external support just to ‘stay on top of things’, let alone grow their business.

Managed accounts, with or without the support of external investment consultants, is seen as an affordable way to access both expertise and efficiency savings, and in this context, their growth should come as no surprise.

• 54% of Australian advisers report using managed accounts in 2024

– In 2019 this figure was 36% (= 50% growth)3

• Only 19% of advisers say they don’t or won’t use managed accounts4

• On 31 December 2023, total FUM across the various types of managed accounts was $194.85b5

2.4 The broader trend towards outsourcing investment capability

• According to Adviser Ratings, around three quarters of AFSLs and almost half of all advice practices actively use third party researchers and/or investment consultants10

• Less than 15% of advice practices have an internal research capability11

• It is estimated that more than 100 investment consultants now operate in the adviser market, increasingly acting as ‘gatekeepers’ to advisers and licensees12

Expert Insight – Smaller practices need external help

“As the licensee market has fragmented and the adviser population has shrunk, achieving scale has become a real issue. Advisers have realised that growing a practice with a more traditional approach to investments simply isn’t feasible, and puts all sorts of things at risk, including client outcomes and compliance. Advisers now have so many things competing for their time that even looking after a static client book can be challenging in itself without efficiencies. Managed accounts provide the opportunity to de-risk while achieving scale.” Mark Montaldi.

“The growth of managed accounts hasn’t been about a product solution, it’s come from a place of needing to solve a client problem and a business problem. The driver was the need to treat all clients more equitably, and to execute more quickly on their behalf to harness better returns.” Nino Ramunno.

“Advisers are still looking for an institutional grade research and investment capability that can be applied at a retail level, but now they have to look outside.” Neil Rogan.

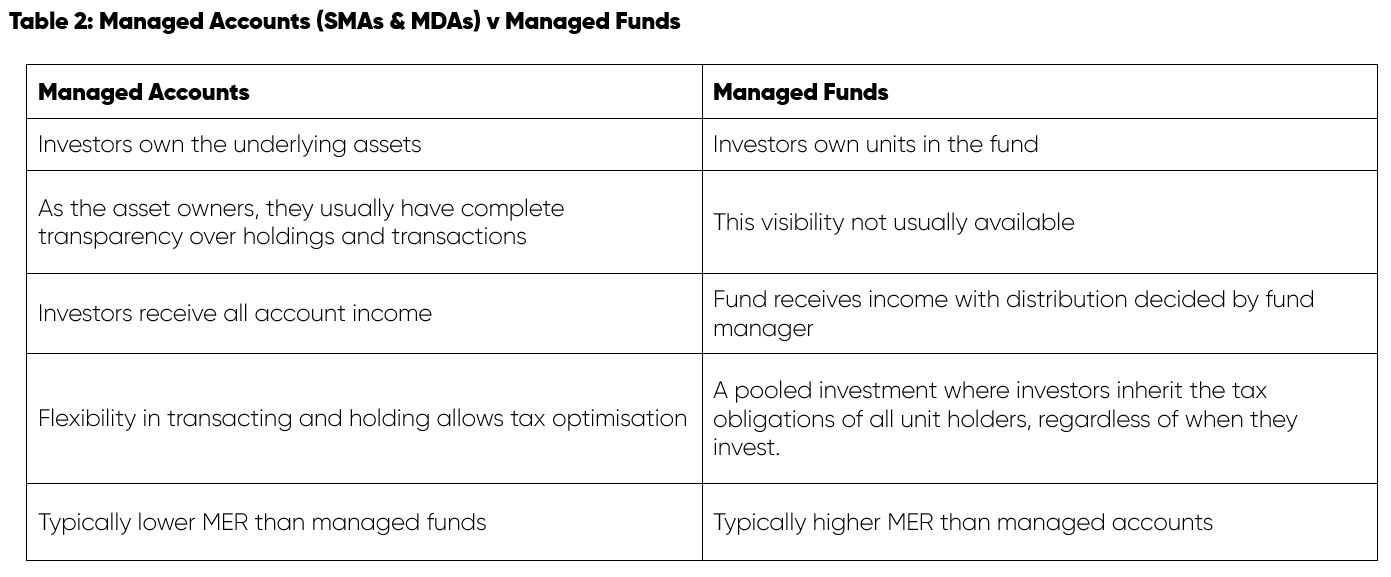

3.0 Decision point: Managed accounts or managed funds?

There can be many reasons to go down the managed account path, some client focused, and others adviser focused. Table 2 shows some of the key differences between managed accounts and managed funds, the previous mainstay of a multi-asset portfolio.

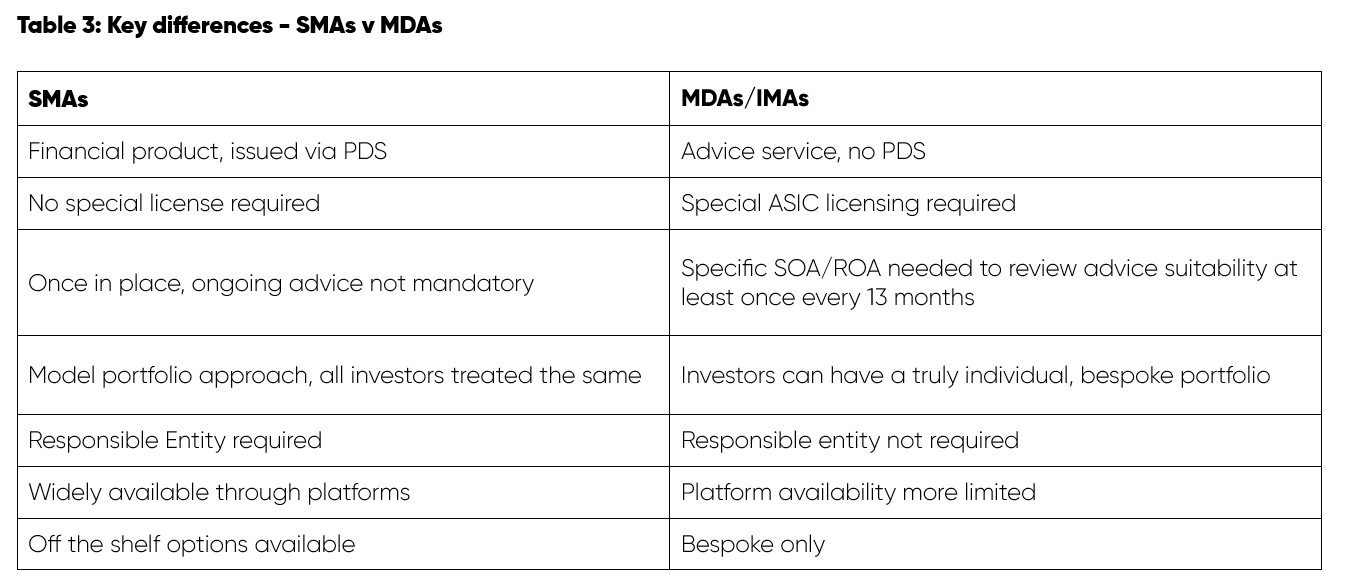

3.1 Decision point: SMA or MDA/IMA?

SMAs are the fastest growing type of managed account, currently representing 56% of total managed account FUM, with MDAs representing around 31%13. On a usage basis the preference for SMAs is more pronounced, with experts estimating 80% of advisers are using SMAs in preference to MDAs and Individually Managed Accounts (IMAs)14.

While MDAs and SMAs offer some common benefits (explained below), they are actually very different in their legal structure, operation, and financial dynamics.

While SMAs are a financial product, issued via a PDS, MDAs (and IMAs) are a financial service, and providers are required to have a special accreditation. They are a personal investment account where the investor signs a contractual agreement to give the MDA providers the authority to buy and sell investments in accordance with an agreed strategy. Their discretionary nature lies with the fact that the MDA manager can make portfolio changes without needing the authority of the investor, which gives an efficiency benefit similar to SMAs.

Expert Insights – MDAs have more limited appeal

“The feedback we get from advisers around MDAs is that the extra layers of cost and complexity limit their appeal. Unless you want to go through the effort of getting an AFSL variation, delivering an MDA via one of the major platforms would necessitate partnering with a licensed MDA provider, which is another layer of stakeholders, cost, and work.” Nino Ramunno.

“MDAs came on the scene for advisers emphasising full control over assets, and investment decision making, on behalf of their clients. However many advisers we have spoken to feel they are overly complex for their business needs often associated with very complex -off platform – assets and scenarios not required for Retail clients.” Mark Montaldi.

4.0 SMA growth drivers

Much is made of the efficiency benefits delivered by SMAs, and these certainly can be substantial.

Because portfolio level transactions (including rebalancing) can be made without the need for Statements or Records of Advice (SOA/ROA), many experts have estimated the efficiency savings can be anything from 13 – 17 hours per week, and this is often the headline advantage promoted by SMA advocates. But this is far from the only benefit, with SMAs delivering a range of positive outcomes to both clients and advisers.

4.1 A day and a half to reinvest in your practice

At a time when the cost to provide advice continues to rise – while consumer willingness and ability to pay for advice remains low – efficiency is seen as the key to making advice more affordable and accessible. In this context, the efficiency savings that SMAs can deliver hold heightened appeal.

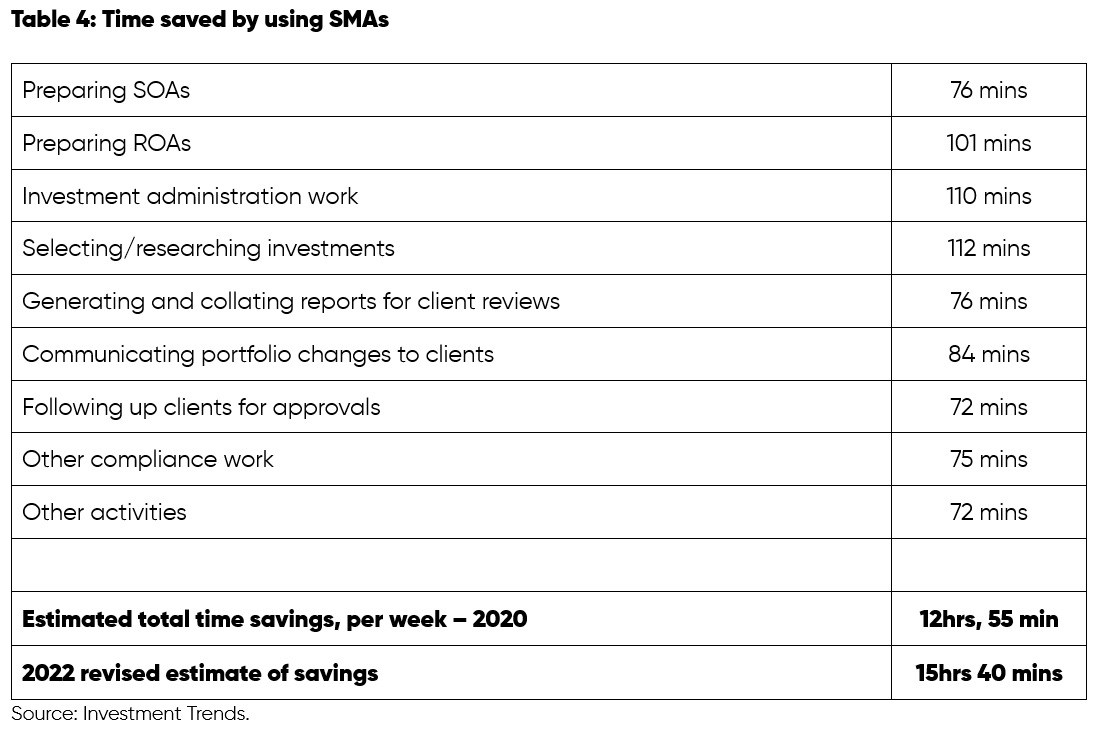

Research by Investment Trends in 202015 studied these time savings in more detail, estimating a total time saving of around 13 hours per week – an estimate they upgraded in 2022 to 15.7 hours16. The breakdown of this saving is shown in Table 4 below.

Adviser Insights – The efficiencies are real and substantial

“There are many benefits from using managed accounts. I like to think in terms of productivity. We are just at the start of our managed accounts journey. Our practice is working towards a four-day working week, where we are able to achieve 100% of the output in 80% of the time. To do that takes more than the odd process tweak here, or some automation there, it takes a real step change, which is why we have gone down the managed accounts path.” Anthony McInnes.

“In simple terms it’s a more efficient way of investing, portfolio changes are made automatically for you. Aside from the speed it cuts a lot of paperwork; there’s no need to do an ROA for every client for every portfolio change. From a client’s perspective there’s none of the toing and froing, they don’t have to spend time reading, thinking about, or responding to something you’ve sent, so it’s efficient for them too.” Martin Jakovics.

“Previously, issuing hundreds of ROAs (Records of Advice) each quarter for portfolio rebalances was a routine but time-consuming task. With this process streamlined, we now have significantly more time to engage directly with clients, opening up greater opportunities for delivering tailored, strategic advice. This shift is transformative for us.” Nazar Pochynok.

4.2 Enabling small practices to access investment expertise and infrastructure

According to Adviser Ratings17, of the 6163 advice practices operating at the start of 2024:

• 60.4% comprised 1 adviser

• 33.8% comprised 2-5 advisers.

This means over 94% of all advice practices comprise 5 advisers or less.

Practices of this size generally lack the scale to support in house investment management, which requires time, skill, and dedicated resources to facilitate tasks such as:

• Research

• Strategic asset allocation

• Asset selection

• Transacting and rebalancing

• Ongoing monitoring

• Reporting

• Compliance, and

• Client communication.

Using SMAs can be a simple and cost-effective way of accessing all that expertise and support, either as a ‘bundle’ – in the case of fully off-the-shelf SMAs – or on a more selective basis in the case of tailored (or ‘private label’) SMAs.

This flexibility means even those advisers who pride themselves on their own investment expertise, and for whom investment management is central to their client proposition, can leverage SMAs in a way that gives this proposition more scalability, without ceding total control.

Expert Insights – Outsourcing to relieve pressure and access expertise

“We recognise we’re not investment experts as such. There are hundreds, even thousands of options out there, it can be hard to keep on top. As we’ve got busier, and the markets have got more unpredictable, we’ve found we had less time and bandwidth to review all these options.” Martin Jakovics.

“The client now benefits from not only the adviser’s guidance but also the specialised expertise of fund managers regarding investment solutions, risk management, and access to markets.” Julien Renard.

“I don’t really want to spend my time facing out to 100 or more different fund managers, it’s not an efficient use of my time. I’m more than happy to leave that to the asset consultant.” Anthony McIness.

“We get advisers who recognise that probably the risk and the process and the information that they need to be able to pick stocks now has changed and they’re not equipped to do it. So they want someone to look after that for them. And then you get those who would have always wanted to delegate the whole thing anyway.” Neil Rogan.

4.3 Risk management

In a 2022 study by Praemium18, 64% of advisers using managed accounts reported improved risk control of client portfolios. Implementing SMAs can deliver powerful risk management benefits to a practice, and indeed in many cases risk management considerations will be a bigger driver of uptake than efficiency benefits (although in fact both are intertwined).

At a high level, these benefits could be summarised as:

• Minimising delay in implementing portfolio changes allows the upside gain or downside protection to be more fully captured (see below for more details about timing risk)

• Changes are made for all clients at the same time, meaning they are treated equally and fairly, a far better outcome – from a client best interest perspective – than implementing individually, potentially at materially different execution prices

• Access to professional investment management mitigates the risk of making uninformed decisions, ongoing monitoring allows more responsiveness in volatile times, and a robust governance and reporting framework delivers stronger compliance

• The transparency around underlying holdings and transactions mitigates risks of clients being uninformed and allows them to raise concerns more quickly

• Accessing institutional grade research and portfolio management can also help mitigate greenwashing risks.

Adviser Insights – SMAs enable more dynamic risk management

“Without managed accounts, the time and effort in making portfolio changes can be a barrier, perhaps dissuading you from being as active as you perhaps should be when markets are moving, and that in itself is a risk. You can be more dynamic as you don’t need to rely on the availability of the clients to be able to execute on a theme.” Anthony McInnes.

“It’s a lot easier to move non-performers out”. Martin Jackovics.

4.4 The risk of delays in execution

A powerful benefit of SMAs is the ability to make portfolio changes – in response to market conditions – in real time, for all investors at once, a benefit enabled by the regulatory and technology framework SMAs operate within. This is underscored by various studies that have quantified the substantial cost of the delays associated with the traditional approach of issuing ROAs and gaining client authority every time there was a rebalance.

Research by HUB2419, for example, found that a delay of just one week in implementing a change would see 42% of the benefit (in performance) gone. Over a 6-week period, 60% would disappear. A similar study by Philo Capital20 found that 50% of the benefit otherwise accruing to immediate implementation was lost in just 4 weeks, and 80% was lost if implementation was delayed by 3 months.

Adviser Insights – Executing quickly and fairly for all clients at the same time

“In the past we had to write an ROA for every client for every change. If your last name started with ‘Z’ you’d be getting notified two weeks after everyone else. Now you’ve got the managers making the same change for every client at the same time, whether they are worth $100 million or $25,000. You can now sleep at night knowing every client is looked after the same.” Julien Renard.

“I think Covid really proved the importance of being able to handle volatility efficiently.” Martin Jakovics.

Expert Insight – Using experts helps filter out the noise

“There’s a lot of noise out there. You can get a million different views on Nvidia just by googling. And that’s just one stock. So how do you synthesise all that information? It’s near impossible.” Neil Rogan

4.5 In summary – Top adviser reasons for using managed accounts

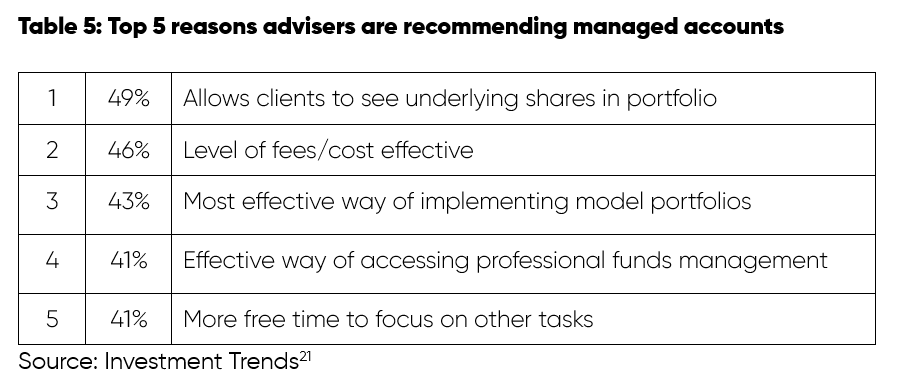

The 2020 summary by Investment Trends – shown below – of the top reasons advisers recommended managed accounts are likely just as applicable today.

5.0 Client-focused drivers

While it is easy to attribute the growth of managed accounts to a range of inwardly focused drivers, it is arguably the end clients who are ultimately benefiting the most. This is not just through the enhanced tax flexibility and the potential for better investment outcomes (for the reasons discussed above), but through a deeper engagement with their adviser.

Advice relies on trust and relationships, and the efficiency dividend delivered by SMAs can be reinvested in more client facing time.

2022 Research commissioned for Praemium22 found that 89% of advisers using managed accounts said they had more time to spend with clients. That same study also found:

• 67% reported better client engagement

• 43% of advisers said they could focus more on client and lifestyle goals, and

• 33% said they could focus on better educating their clients.

Furthermore, advisers using managed accounts for 3 years or more were:

• 19% more likely to have client reviews lasting 60 minutes or more

• 64% more likely to cover off 20+ items in those reviews

• 57% more likely to formally seek client feedback, and

• 73% more likely to contact their best clients more than 10 times per year.

Adviser Insight – Our clients’ time is precious too

“I’m no longer needing to send clients 4 documents a year for them to check numbers, review, and sign, and occasionally have meetings about. So if we can give our clients more time back, that’s definitely a benefit for them.” Anthony McInnes.

5.1 Enhanced tax flexibility helps lift returns

Because investors directly own the underlying assets in an SMA, as opposed to being in a pooled arrangement (e.g., a managed fund), tax events can be controlled at a more individual level. Managed fund redemptions and manager changes may result in a CGT burden, which is passed back to all fund investors equally, regardless of tenure. This is especially the case if the managed fund has not elected into Attribution Managed Investment Trust, also known as the AMIT regime.

For SMAs.- In the case of a manager change, rather than liquidating the entire holdings in a fund, SMA investors only need to trade securities where there is a difference between the new and old model portfolios, potentially reducing the amount of realised capital gain/losses that may be generated.

Additionally, SMAs allow investors to be more tactical in the way trades are executed. For example, where a change in a model portfolio may cause capital gains to be crystallised, investors may be able to offset the gain by also selling a security that has unrealised capital losses. In a managed fund, investors have no ability to tactically trade to minimise the impact of capital gains.

Adviser Insight – Crucial tax planning data at a glance

“SMAs present a robust strategy for effective tax planning. By positioning an SMA as the core of a diversified portfolio, with satellite investments in other unlisted assets, investors gain a sophisticated level of control. The transparent structure of an SMA allows for real-time visibility into the portfolio’s composition, enabling informed decisions regarding asset sales and the associated tax implications—without the need for external consultation. This seamless integration of tax efficiency and investment strategy underscores the value of SMAs in a well-constructed financial plan.” Nazar Pochynok.

5.2 SMAs allow practices to elevate their digital experience

Consumers now have very high expectations around digital experience, judging financial services providers the same as they would judge a fashion or technology brand.

Accenture research23 from 2021 found that 42% of investors rated technology offerings as an important criteria when selecting an adviser.

For advice practices, offering SMAs via a platform is a way to quickly elevate the digital experience provided to their clients, combining the contemporary, mobile-friendly UX and 24/7 accessibility of most leading platforms, with the inherent transparency of SMAs.

Expert Insights – Leveraging best practice communications

“One of the things we are really excited about is the collateral that we’ll be able to get from the asset consultant, that talks to the underlying investments. We can then white label these and send to clients.” Anthony McInnes.

“Market commentary isn’t everyone’s passion, which is why we leverage insights from our asset consultants to provide expert analysis with ease.” Julien Renard.

“Advisers can spend a lot of time tailoring communications to clients. It’s taxing and it can be difficult to get out in a timely fashion. Managed Accounts enable a comprehensive suite of supporting Comms – advisers typically choose the items they want from a menu, so they aren’t getting material they won’t utilise. There’s economic data, there’s an investment market outlook, there’s material tailored to the end investor and so on. It saves advisers having to do that themselves, which is priceless to them.” Mark Montaldi.

“We do all communications on any change, which advisers can then just forward to the client. There is a lot of detail around what we’ve done within the portfolios and how that impacts the client.” Nino Ramunno.

“Running your own models during periods of extreme volatility, which seem to be happening more frequently, can be challenging in terms of the workload and the messaging to clients, and I think managed accounts makes that a lot easier.” Martin Jakovics.

5.3 The question of cost

Expert Insights – Fee savings with managed accounts

“The sophistication embedded in the portfolio construction process delivers exceptional cost efficiency. Achieving a well-diversified portfolio at a mere 20 to 30 basis points represents a significant evolution in our industry, empowering investors to optimise returns while minimising expenses .” Nazar Pochynok.

“There’s a broad view of things under best interest that they’ll look at and fees is obviously an important outcome for clients. As a result, many managed account transitions are fee neutral or cheaper than the current portfolios that they’re already delivering to clients. So what we try to do is, in line with the investment philosophy, ensure that there’s a fee budget, so we can get the right portfolio outcomes for the adviser to deliver to the clients. .” Mark Montaldi.

“In many cases these are blended portfolios and it’s so not unusual for the cost to be sub 100 basis points, which is considerably lower than a traditional managed fund.” Neil Rogan.

6.0 The evolving advice proposition — From stockpicking to mentoring & coaching

One of the foundational success drivers for an advice practice is having a clear value proposition. Historically, the fear of losing control and ceding what many advisers believed to be their core value add – managing a client’s money for maximum returns – was one of the main barriers to outsourcing elements of their investment management.

But this perspective has changed, and continues to change, with the majority of advisers now recognising that their real value-add is around behavioural coaching, mentoring, and educating – helping their clients articulate their personal values, turning those into investable goals, and helping the client avoid emotionally charged decision making.

• A Vanguard study24 to quantify ‘adviser alpha’ estimated the value-add from behavioural coaching was as much as 200 basis points per year.

Furthermore, there has been a growing recognition that investing money is hard, and is not something advisers can do – well – on a part-time basis:

• Balancing the needs to see clients, stay compliant, keep up to date with product and legislative changes, and meet ones professional development requirements, leaves advisers little time to watch the markets

• Yet only 14% of practices have their own research capability

• Being a part-time investment expert leads is likely to lead to sub-optimal client outcomes

• Having your value proposition tied to investment performance can become problematic when performance is poor.

Expert Insights – Being clear in your advice value proposition

“I was worried that I would lose some of my personal expertise by not being as hands on, but I tend to use managed accounts in conjunction with other satellite investments, so I still retain some control.” Martin Jakovics.

“Positioning oneself as an investment expert necessitates a robust and transparent value proposition. Managed accounts, while beneficial, may prompt clients to scrutinise the distinct value and expertise you offer when fund selection is available to clients and the market more broadly.” Nazar Pochynok.

“We pride ourselves on providing bespoke, strategic financial advice that reflects our extensive expertise. Our approach transcends the mere pursuit of alpha generation from portfolios; instead, we advocate for a Core and Satellite strategy. In this framework, Exchange-Traded Funds (ETFs) serve as the cornerstone of our core investment strategy, ensuring a robust and well-rounded foundation for our clients .” Julien Renard.

“We don’t see ourselves as stockpickers, I’m not going to tell you to buy BHP over Rio. We fall more on the passive side of the debate, but we think we add real value at the higher level, in terms of asset allocations, which the science says is a major driver of outcomes, and in terms of translating client risk profiles into those allocations.” Anthony McInnes.

“I think it comes down to value proposition. There are some advisers who are really great with investment decisions, and they might have been doing it well for a while and they are worried they might lose control. There’s nothing wrong with that. We increasingly see them going down the path of tailored SMAs, where they work with the asset consultant on the design of the portfolio, and they are actively involved in the investment committee and voting on all investment decisions.” Mark Montaldi.

According to the SPDR ETFs/Investment Trends 2022 Managed Accounts Report25, when asked about how their value proposition has changed as a result of using managed accounts:

• 43% of advisers said it allowed them to focus more on client financial and lifestyle goals,

• 33% said they could now focus on educating clients as a financial coach or mentor, and

• 24% said it helped them distance their value proposition from investment returns.

7.0 The rise of the investment/asset consultant in retail advice

In tandem with the growth of managed accounts, the evolution of advice propositions (from investment guru to holistic financial coach) has also driven the growth of investment consultants, to the point where they are now seen to be playing a gatekeeping role between fund managers and advisers.

• The 2022 Adviser Ratings Landscape Report found that 45% of practices were actively using third party researchers and/or investment consultants, a figure which has likely to have grown in line with the increased usage of managed accounts.

• There are now estimated to be more than 100 investment consultants active in the retail space, particularly in the tailored/private label SMA and MDA markets.

Expert Insights – Using investment consultants sharpens your focus and story

“I think it’s possible that when you use an asset consultant you actually have more control because you have more dedicated thinking around investments. It can focus your investment philosophy a lot more, so rather than reinvesting the wheel each time you have a new client, there is a far more considered approach.” Anthony McInnes.

“Prior to using managed accounts, advisers were probably sourcing different investment solutions from different areas, which can be hard to blend into a cohesive story to relay to clients.” Mark Montaldi.

7.1 Products and services offered by investment consultants

Investment consultants are able to offer a comprehensive menu of investment related services, helping retail advice practices with

• Setting investment philosophy

• Strategic asset allocation

• Portfolio construction

– Rebalancing

• Modelling

• Research

-Market

-Fund managers

• Ongoing monitoring and reporting

• Investment committees

• Governance

• Communication support

– Research notes

– Collateral

7.2 Managed accounts make these services affordable and accessible

While many investment consultants can offer their services from a menu, they are more typically accessed on a bundled basis via managed accounts, particularly off-the-shelf and tailored/bespoke SMAs. Bundling allows the services to be provided at scale, making them more cost effective.

The HNW client myth

Contrary to the belief that SMA structures are only suited to sophisticated, HNW, high balance clients, the efficiency savings SMAs make possible are arguably more important when servicing low balance clients.

Indeed according to the 2024 SPDR ETFs/Investment Trends Managed Accounts study, around 40% of existing managed accounts advisers believe it’s appropriate to hold the majority of assets in a managed account for clients with balances less than $100k, up from 33% the previous year26.

Adviser Insight – SMAs make sense for lower value clients

“Lower value portfolios are perfect for managed accounts because they’re much easier to manage in that way, and with some platforms there’s no additional fee for going down that path.” Martin Jakovics.

8.0 Decision point: Choosing an SMA structure (off-the-shelf v tailored)

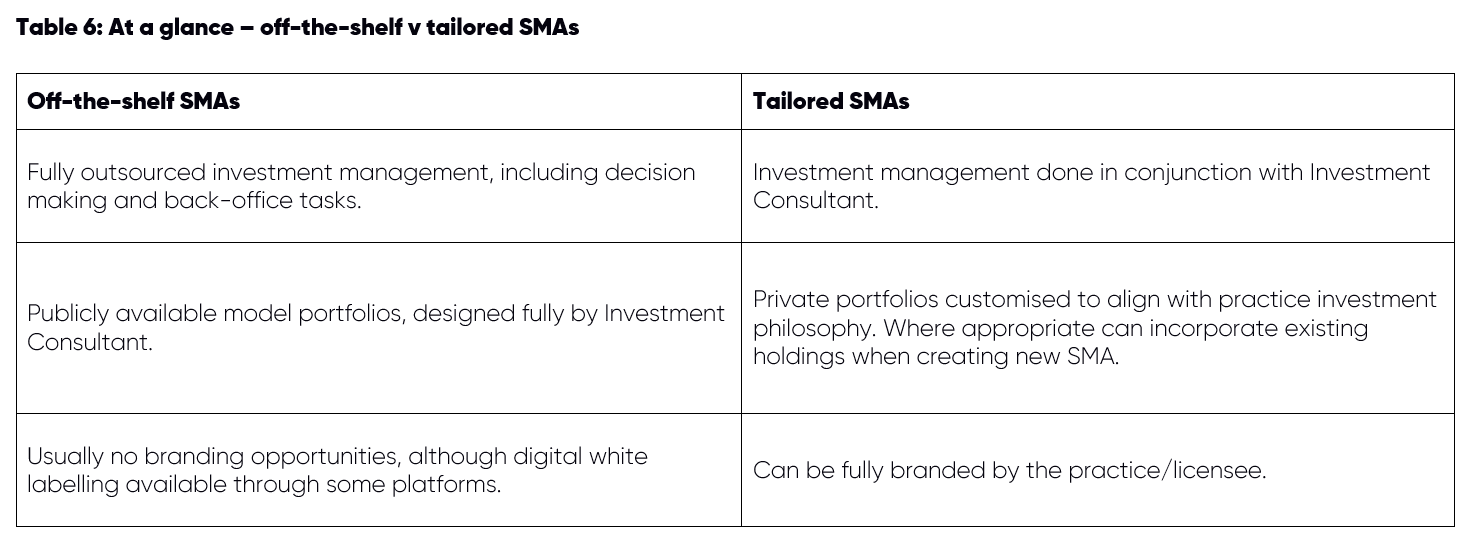

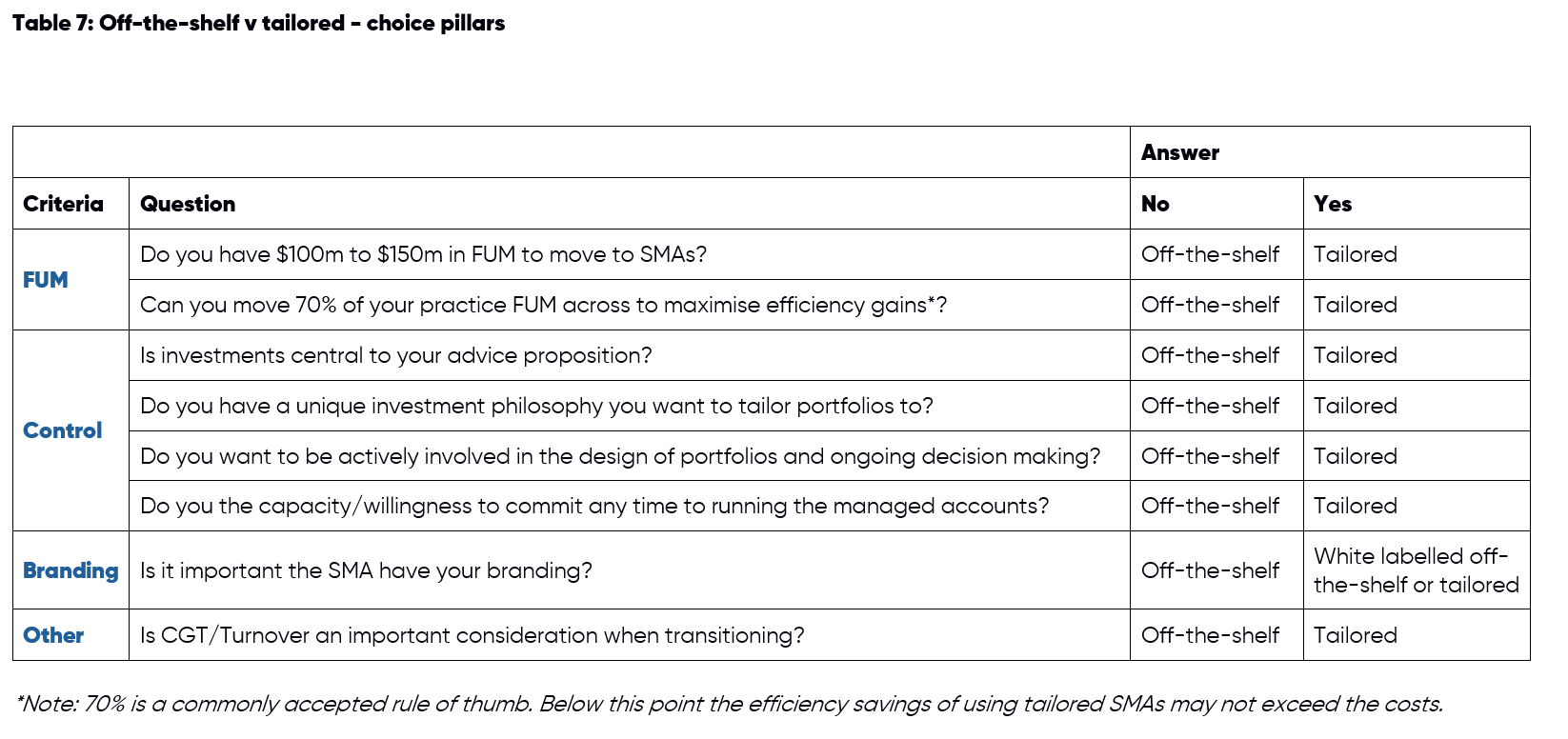

For those looking to implement SMAs within their practice, a key decision is whether to use an off-the shelf (public menu) solution, or a tailored (private menu) solution.

Off-the-shelf solutions are the most cost effective and are essentially model portfolios, fully managed by the investment consultant (with the support of a Responsible Entity, usually a platform). Once a practice has selected a provider and individual model portfolio solutions, they can essentially outsource total control of ‘managing the money’, while the adviser can focus on matching individual clients to portfolios (based on their risk profile, circumstances, and objectives).

At the other end of the spectrum are tailored SMAs, based around portfolios built specifically in partnership between a practice/licensee and the platform and investment consultant providing the SMA.

Tailored SMAs allow practices to have a lot more control over how a portfolio is constructed and managed. Typically practices implementing tailored SMAs will run their own investment committee (including investment consultant/provider representatives), in contrast to off-the-shelf SMAs, where the committees are fully run by the SMA provider.

Tailored SMAs obviously allow practices to exert far more influence and control over their design, construction, ongoing management, and branding, however this naturally comes at a higher cost, meaning the level of FUM needed to support a tailored solution is much higher than an off-the-shelf alternative.

Adviser Insight – Tailored SMAs as guardrails

“From our perspective Separately Managed Accounts (SMAs) are increasingly favored by licensees for their ability to establish clear boundaries around advisers’ activities and risk profiling. This approach ensures that portfolios adhere precisely to their intended parameters, enhancing both transparency and alignment with stated objectives.” Nazar Pochynok.

Expert Insights – Tailored SMAs bring your investment philosophy to life

“We work well with those groups who actually want to have tailored portfolios and want our help in bringing their investment philosophy to life.” Mark Montaldi.

“A previous barrier to entry was the assumption that you had to adopt the investment philosophy of the asset consultant, but with tailored SMAs that’s not the case, they can be used to bring your own philosophy to life.” Nino Ramunno.

The $100m question – The economics of tailored SMAs.

As little as 2-3 years ago, a typical rule of thumb for the level of FUM needed to support a tailored SMA approach was around $300 – $350m.

However, ongoing technological innovation has seen this amount come down considerably, and most experts suggest it is now possible to support a tailored solution with FUM of around $100 – $150m.

Expert Insight – $100m to make tailored SMAs viable

“Previously to go down the path of tailored managed accounts, you needed to be able to invest $350 million over a two-year period. Now, thanks to the platform technology, that has come down to about $100 million. And for a lot of solo-adviser practices, $100 million over 18-24 months is absolutely doable.” Nino Ramunno.

Expert Insight – 70%, the threshold at which tailored SMAs can make sense

“Having the majority of your clients in an SMA allows you to reap more of the benefits. Using it for less than 2/3 or 70% of your business means that you will still have to commit a large amount of time to the existing way of running your back office, effectively burdening you with a large legacy component to your practice and parallel processes. Things like communication and investment changes will be proactive with managed accounts vs reactive for your legacy clients. This can be complicated and confusing for staff.” Ian Boater.

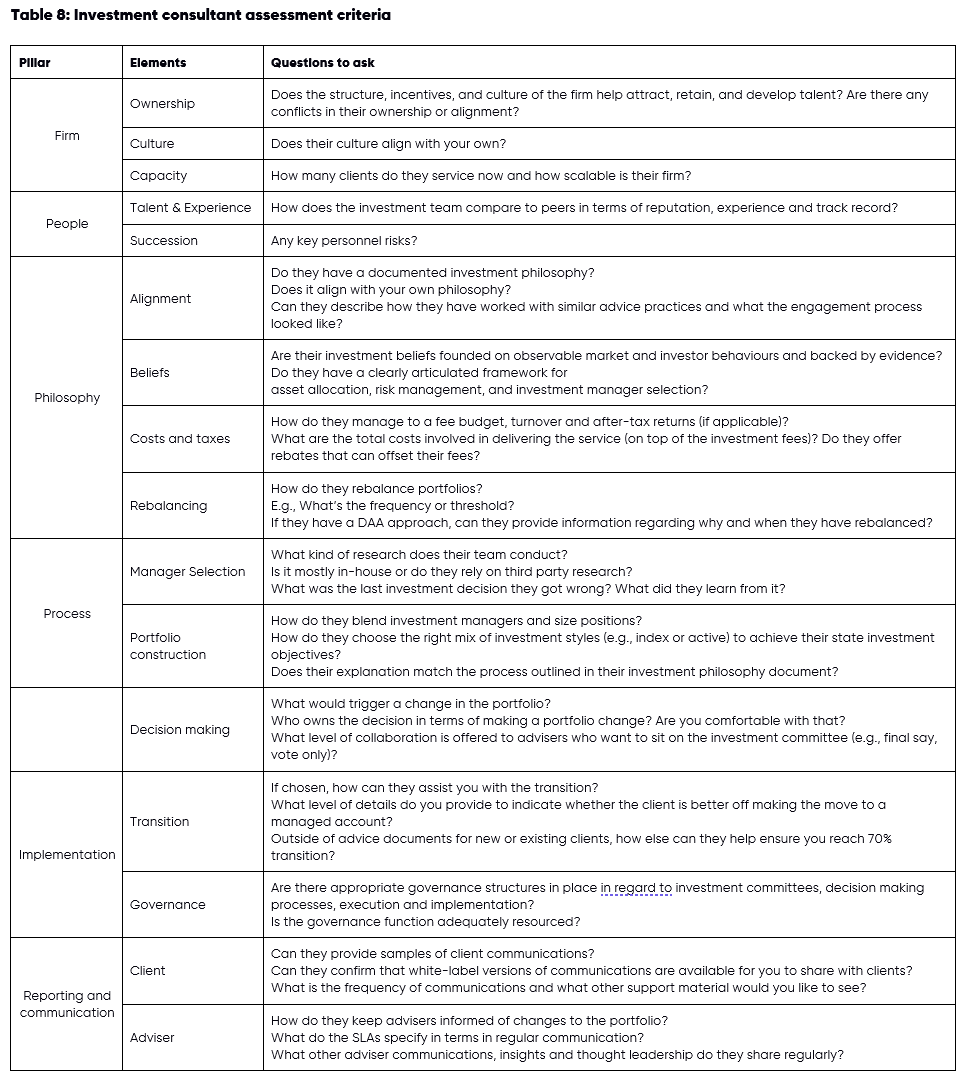

9.0 Decision point: Choosing an investment consultant/SMA provider

The choice of investment consultant to partner with on an SMA solution is a complex one, with many considerations and dimensions.

Along with the arguably central decision pillar of consultant’s investment philosophy – and the extent to which the SMA will be managed in line with your own – other critical decision pillars include the firm, its people, processes, implementation/transition support, and reporting and communication.

The details within these pillars are summarised below:

Expert Insight – Do your due diligence when choosing an investment consultant

“If you are choosing an asset consultant, my advice is to meet them and do a detailed due diligence. Ask them hard questions. Get them to review your existing model portfolios and to tell you their thoughts and whether they would make any changes. That will give you a more meaningful sense of their capabilities and processes than what it says in their brochure.” Nino Ramunno.

9.1 The foundational importance of an investment philosophy

A documented investment philosophy is a roadmap for how advisers manage their client’s money, and as such is a foundational component of the advice value proposition. It should reflect not only the core investment beliefs and principles of the practice, but also the nature of the client base. The ability of an investment consultant to align to and implement a practice’s investment philosophy is obviously a key criterion against which to assess potential outsourcing partners. For those practices with undocumented, more informal investment philosophies, investment consultants can provide support in the development and articulation of a more considered philosophy.

Expert Insights – Helping advisers articulate the philosophy in their heads

“I think a big part of how we help is bringing thoughts out of the advisers’ minds and putting them down on paper. We’ll ask to have a look at their philosophy, but we also look at their portfolios and analyse the way they are investing from a technical perspective. We can then work with them to fill in the blanks and help them formalise their investment philosophy.” Nino Ramunno.

“We use off-the-shelf SMAs only. We’ve got an investment philosophy which we wrote ourselves, but use the asset consultant to help us massage it a bit. It was a really useful process to go through, as it helped us get more clarity about how we wanted to move forward as a business in terms of investing.” Martin Jakovics.

Expert Insight – Tailored SMAs work with purely passive philosophies

“We’ve got some clients who require a low-cost solution for their accumulator client segment, which may involve a purely passive investment approach. Our fee will reduce but we still run quarterly investment committee meetings and monitor the portfolios.” Mark Montaldi

Adviser Insights – Investment philosophies help identify the right clients

“As a sophisticated advisory firm, we have a commitment to a unified investment philosophy. Consequently, there are instances where we must respectfully decline engagements with prospective clients whose objectives do not align with our strategic approach.” Julien Renard.

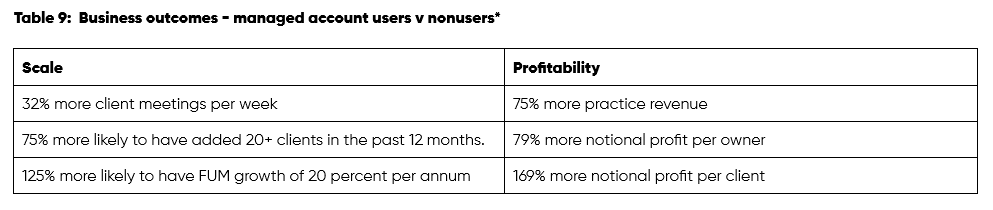

10. Scale and profitability dividends.

The undoubted efficiency benefits of managed accounts remove a scalability barrier to practices looking to grow. Those practices reliant on more traditional, labour-intensive methods of managing client investments will find their ability to grow is hampered unless they increase their resourcing – which can be an expensive, time-consuming, and risky exercise.

Managed accounts allow investment expertise to be quickly and easily deployed, in a way that is eminently scalable, meaning practices don’t need to compromise on service quality, or compliance.

As research from Praemium confirms27, firms that have been using managed accounts for 3 years or more have grown faster and are more profitable than those firms not using managed accounts.

Adviser Insight – SMAs can boost future sale value

“SMAs enhance the quality of record-keeping, ensuring that, in the event of a practice sale, the incoming team will have access to a detailed overview of client investment strategies, and funds under management, and will be able to monitor fees and overall compliance. This meticulous approach can potentially increase the practice’s sale value.” Nazar Pochynok.

11. Conclusion

The adoption of managed accounts has proved to be an enduring and transformational trend in the financial advice sector, driven by the need for operational efficiency, enhanced client outcomes, and the evolving licensee landscape.

Managed accounts offer a scalable solution that allows advisers to focus on building client relationships and providing strategic advice, rather than being bogged down by the complexities of investment management.

As the market continues to fragment towards small, self-licensed practices, the need for external support, such as investment consultants, has become more pronounced.

This shift not only alleviates the burden on advisers but also ensures that clients receive timely, consistent, and well-informed investment decisions. Moreover, the flexibility and efficiency offered by managed accounts, particularly SMAs, enables advisers to deliver tailored solutions that align with their clients’ needs and their own investment philosophies. As technology and market dynamics continue to evolve, managed accounts are poised to remain a vital tool for advisers seeking to grow their practices while maintaining high standards of client care and compliance.

Ultimately, the rise of managed accounts reflects a broader transformation in the advice industry, where the focus is increasingly on delivering value through personalised, scalable, and efficient investment solutions.

References

1. https://www.ifa.com.au/news/33945-managed-accounts-on-the-rise-among-advisers

2. https://www.adviserratings.com.au/news/2024-australian-financial-advice-landscape-report/

3. https://www.ifa.com.au/news/33945-managed-accounts-on-the-rise-among-advisers

4. https://www.professionalplanner.com.au/2024/03/managed-accounts-take-up-plateaus-but-assets-surge/

6. IBID

7. https://www.professionalplanner.com.au/2024/03/managed-accounts-take-up-plateaus-but-assets-surge/

10. https://www.ardata.com.au/wp-content/uploads/2022/05/AFALandscape2022-AB_R2.pdf

11. IBID

12. https://www.adviserratings.com.au/news/2024-australian-financial-advice-landscape-report/

13. https://www.ifa.com.au/news/33979-managed-accounts-fum-up-20-over-prior-6-months

14. https://www.professionalplanner.com.au/2024/03/managed-accounts-take-up-plateaus-but-assets-surge/

16. https://www.adviservoice.com.au/2023/03/cpd-managed-accounts-hit-their-stride/

17. https://www.adviserratings.com.au/news/2024-australian-financial-advice-landscape-report/