‘Alpha’ is a term which gets banded around a lot in our industry. Managers want to deliver alpha to clients, find investments which generate alpha and naturally can base the fees charged on investment products by their history of creating alpha for investors.

In its absolute simplest definition, alpha is just the return of some portfolio over its benchmark:

However, many don’t consider this a true reflection of manager outperformance – particularly by those who have an emphasis on factor investing. For now let’s just term this definition as ‘naïve alpha’.

Given that most advisers would hear the term alpha in relation to managed funds, let’s focus on that particular investment product: are there dangers with just paying attention to, or chasing, naïve alpha?

Past Performance is Not an Indicator etc.

It’s a well-known market behaviour that investors tend to chase performance – in spite of the ubiquitous ‘past performance is not an indicator of future performance’ label on all fund materials.

Human psychology tends to favour that which has been going up over something which has been losing money, its one of the fundamental building blocks for how ‘Momentum’ strategies consistently earn money by exploiting this phenomenon.

But for that behaviour to work and deliver long-term outcomes to clients, it assumes that performance will be persistent throughout time: managers who are delivering naïve alpha today must continue delivering that alpha tomorrow, and next year and so on.

Current analysis of the data suggests that naïve alpha is not persistent, and in fact may be mean reverting – the past performance of a manager has a negative relationship on their future performance when measured across a wide universe and multiple asset classes.

Mean Reverting Managers

Investors who’ve been in the market for a decade-plus have likely seen many managers go through periods of outperformance, and then flipped to periods of underperformance and back – appearing to fluctuate around that ‘zero’ line.

Rather than just say ‘we’ve seen it happen’ and move on, you can statistically show that this ‘alpha mean reversion’ exists.

To keep this discussion focussed, the data will be restricted to Aussie large cap managers.

Let’s start with some simple proxies for ‘momentum’ and ‘valuation’ (stablished in Asness, Moskowitz and Pederson (2013) for those who are interested in further reading):

• 1-year past performance is a good proxy for the ‘momentum’ of an asset; the higher the past performance, you would expect the higher the momentum

• 5-year past performance is a good proxy for the ‘valuation’ of an asset; if something has been performing highly for years, you would imagine it is getting expensive, therefore valuation will be high

But this was built for valuing individual assets, what’s this got to do with managed funds?

You can use these proxies for valuation and momentum to form a forecast for the next 1-year of returns – or in our case, the level of alpha – and then test this model throughout the history of a fund:

• If ‘momentum’ has a positive influence on the future alpha, then we can say that ‘naïve alpha’ has some short-term momentum drivers

• If ‘valuation’ has a negative influence on the next year of future alpha, we can say long term performance is mean reverting

Aussie Equities

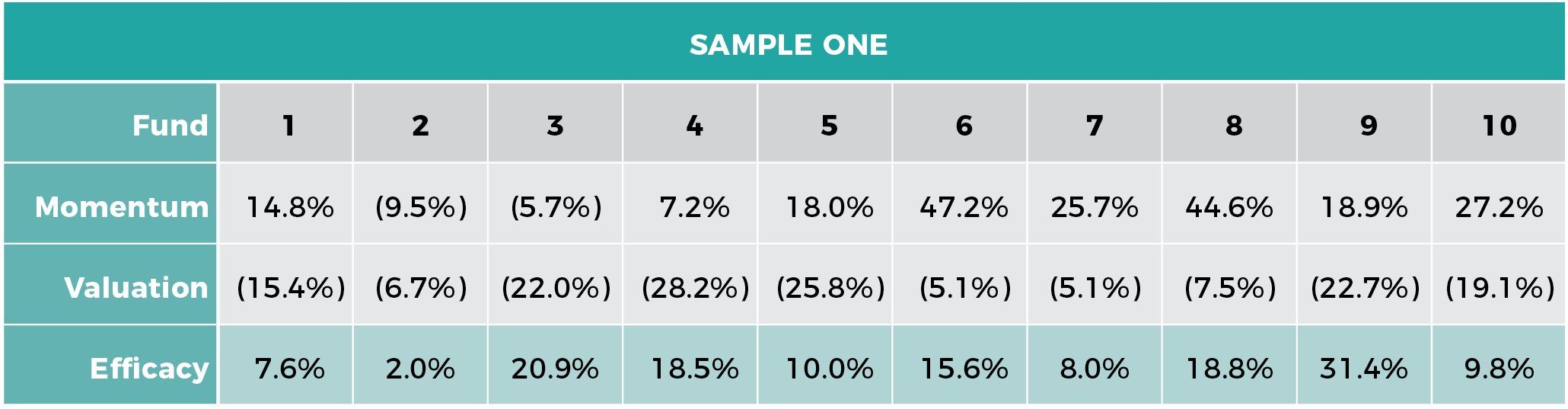

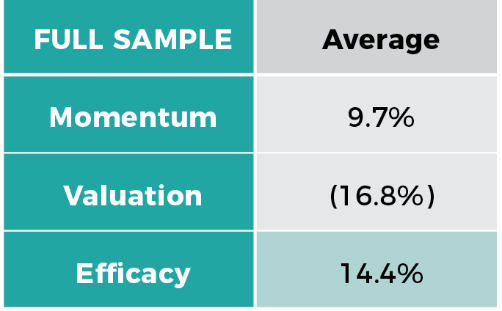

Below are two samples of managers (names anonymised) and the effect Momentum and Valuation have on their next 1-year alpha – the study then considers the average of these effects across the entire universe.

Here, ‘naïve alpha’ = return over the ASX 200.

For sake of clarity, the percentages for Momentum and Valuation are known as ‘coefficients’, which represent the relationship those two factors have to next year’s performance. For example, if Valuation reads –30%, the model is saying that for each 1% of Valuation, it will represent a drag of -0.30% on next year’s performance.

You might notice the row ‘efficacy’ here, known in statistics as R-Squared. Efficacy here represents how much variance of the next 1-year of returns that Momentum and Valuation alone explain in a model. Generally, in forecasting models, a number above ~7-10% is a strong relationship, particularly given this study is only using different windows of past performance as predictors.

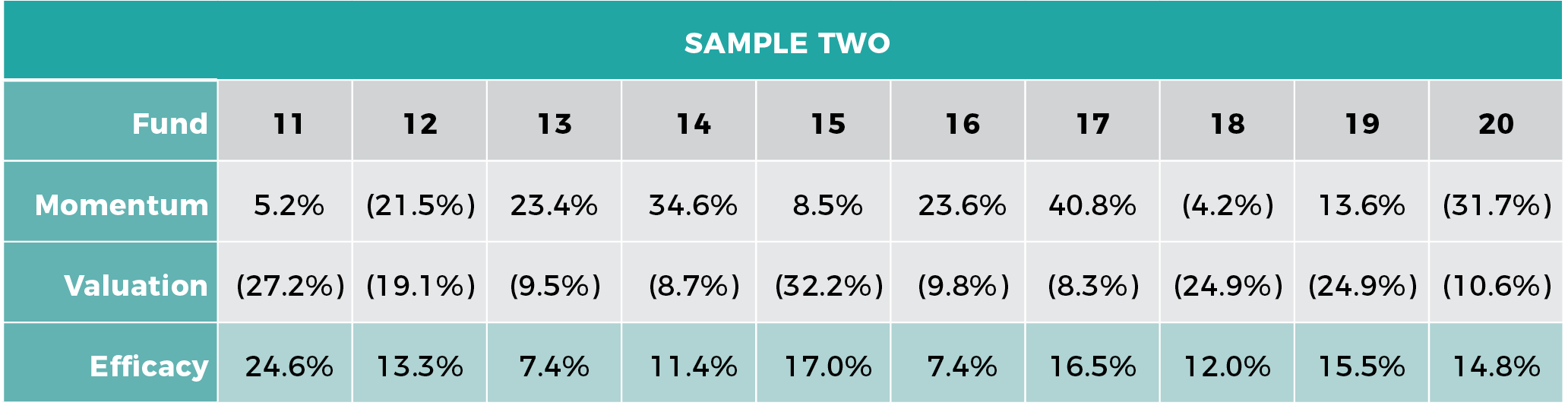

To show these results graphically:

You can see that indeed, all the funds in this sample have a negative relationship to valuation, and most have a positive relationship to momentum.

If you then average these findings out across the 100+ Aussie equity managers who fell within the testing universe, it produces the following results:

The strong negative relationship valuation has on future alpha is mathematical proof that ‘naïve alpha’ is mean reverting over the medium term. This effect can and has been confirmed across other asset classes, including fixed income.

What Does that Mean?

Intuitively, it doesn’t make sense for manager outperformance to mean revert over time – why would the skill and experience of an investment team fluctuate, rather than remain steady or even improve over time as they spent more time in markets developing their strategy?

Rather than management skill, the study suggests this is due to market factors. Most readers would be familiar with Value and Growth, but there is also Size, Quality and Momentum to consider.

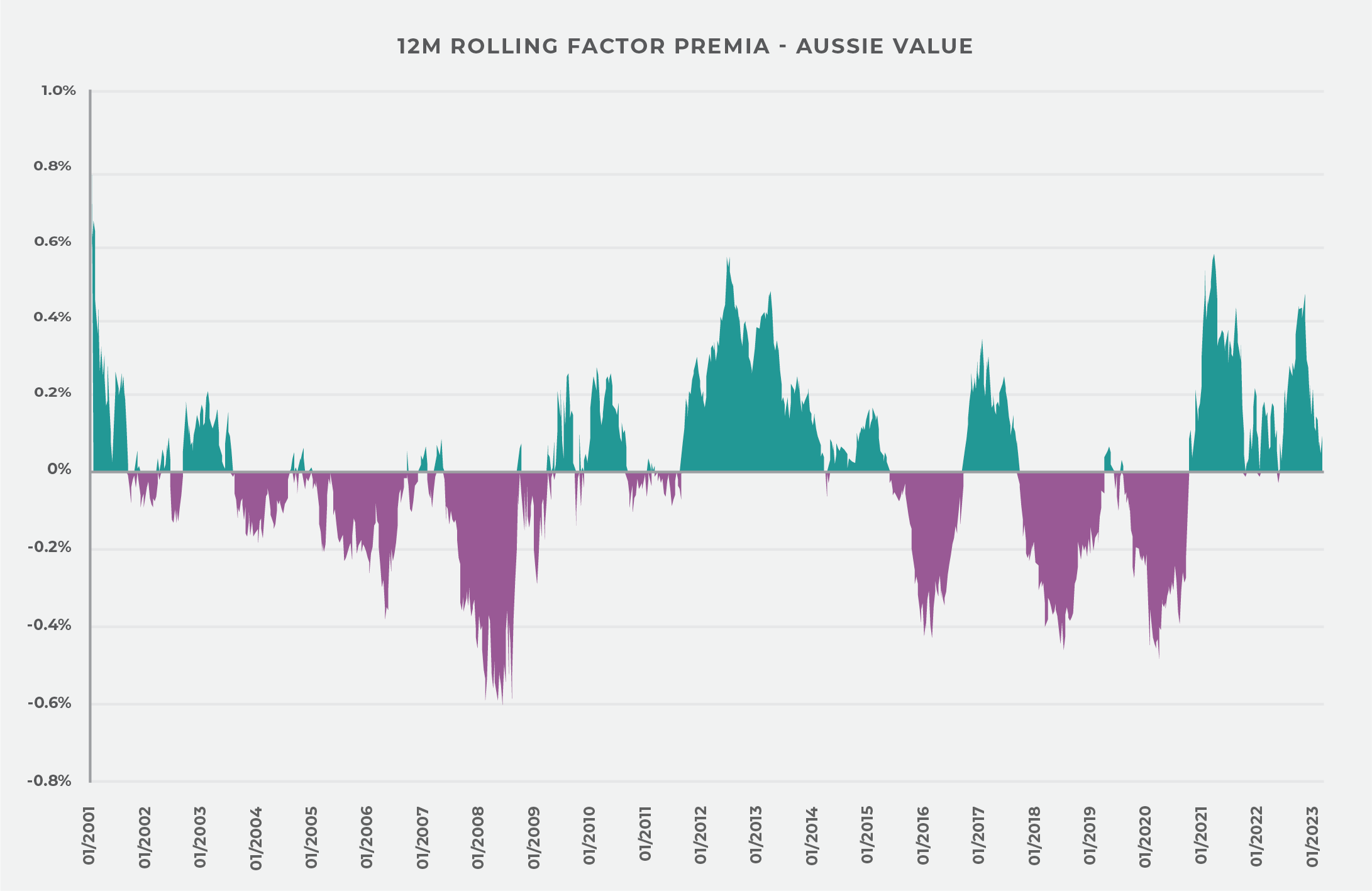

Unlike some undefinable level of investor skill, factors very much do cycle, you can even graph it:

This chart quite clearly shows that the Value factor in Aussie markets tends to cycle, with the peak to trough often taking at least two years – something which lines up with Momentum being positive (the factor is moving in one direction), and Valuation being negative (the factor is cycling back).

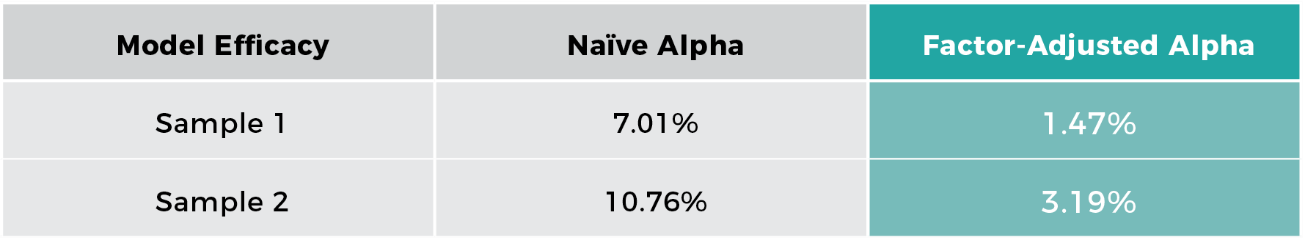

You can also mathematically demonstrate this by measuring ‘factor-adjusted alpha’ rather than ‘naïve alpha’.

Let’s take two new random samples from Aussie Equities to prove this. With the exact same forecast model for factor-adjusted alpha, using only past returns, here are the comparisons of results for two identical samples of managers:

Factor adjusted alpha takes the performance of the manager over a certain factor, plus the market, to penalize any out/underperformance based on the driving market factor behind their returns.

The dramatic reduction in model efficacy when switching from Naïve Alpha to Factor-Adjusted Alpha shows that the market factors influencing manager returns is what has the highest mean reverting qualities, as opposed to looking at the manager ‘skill’ in isolation.

A takeaway from these findings is not necessarily that active management adds no value, far from it. What this does show is that investors need to be aware of the nuances of manager performance, recognise what market style or factor has helped generate that performance, and above all exercise extreme caution in basing an investment decision purely on the back of strong historical performance or weakness.

This article is based on a recently released whitepaper by Innova Asset Management, Factors, Funds and Performance Chasing. You can download a full copy of this whitepaper here.