For most Advisers, a recommended portfolio is not held for a few months or years. Instead, they are intended to be held over a 5-10+year time horizon.

In such an environment, asset allocation is arguably the most valuable tool to both generate return and manage risk. This is intuitive – a 30-year old executive is unlikely to hold a portfolio comprised entirely of bonds, and a 70-year old retiree would be ill-advised to have their entire portfolio in volatile equity exposures.

It is well understood by leading Advisers that asset allocation is the main driver of returns over the long term. Therefore, many financial advisers share a common approach: they strategically construct diversified portfolios tailored to their clients’ goals. Advisers allocate assets based on client long-term expected risk and return profiles, known as a Strategic Asset Allocation (SAA) approach. These portfolios are periodically adjusted to re-align with this long-term asset allocation, or to align with changing client circumstances or objectives.

This SAA approach to portfolio diversification is likely to generate solid returns over the long term, as it still focuses on asset allocation as the primary tool for managing risk. Each asset class has a broad risk and return profile, and when operating over multi-year time horizons, the interplay between these profiles is key to a superior outcome. But are there ways to generate even better outcomes through a more actively managed asset allocation approach?

The Benefits of Being Dynamic

Dynamic Asset Allocation (DAA), involves actively managing the asset allocation of a portfolio based on top-down/broad asset views of markets. This might involve tilting a portfolio away from equities to bonds, or being underweight real estate in favour of cash – based on a deviation from some long-term fair value, enhanced macro risks, or a structural factor which changes the investing landscape in the short-term (such as a higher inflationary or rate rising regime).

Advisers use this approach by allocating between different factors within asset classes (such as Value vs Growth in equities) to be part of the DAA process, even though you might not classify them as rotating ‘asset classes’ specifically, it is actually an asset allocation decision.

DAA tends to look over a 1-3 year time horizon and adjust a portfolio to cater for the near-term risks and opportunities of a market. This does not mean that DAA completely ignores SAA, which tends to be a 10+ year view – rather, it can be viewed as an enhancement to safely steer a portfolio through market cycles.

Indulge the analogy of a sailboat on its way from Sydney to San Francisco.

SAA says roughly when and where the boat will arrive, and if it will make the journey at all. DAA is what helps the captain avoid one area which has a storm brewing, avoid the sharp rocks which are likely to be there at a certain point in the tide – it’s SAA which is ultimately guiding the journey, DAA just helps you get there without a leaky hull and a bad case of sea sickness.

It is also important to note that DAA does not involve trying to ‘time’ market decisions – it is based on a 1-3 year time horizon, not 3 months. Top advisers often implement it using a dollar cost averaging strategy over a number of months as they are not trying to time the perfect entry point. It is very difficult to implement timed entry and exit points in assets, hence using a dynamic approach is far more practical.

What goes into DAA?

Like most portfolio management techniques, the implementation of DAA spans a spectrum from intuition and simple strategies, to complex mathematical and factor frameworks.

In general, there are a few key tenets to DAA that advisors can consider:

- Valuation: are equities at an extreme P/E + are bond yields at 1%.Is property yielding you less than a corporate bond etc?

- Macro: are central banks aggressively tightening rates? Are governments injecting stimulus into the economy? Has a war made investors flock to gold?

- Economic Fundamentals: are we likely heading for a recession or is growth slowing? Is inflation rapidly accelerating/decelerating?

- Correlations: are rates going up?, Does the portfolio happen to be exposed to multiple ‘diversified’ investments which all happen to be interest rate sensitive?

You can of course extend these inputs further. For example, a robust DAA process might consider forward-looking return forecasts for different assets or even factors.

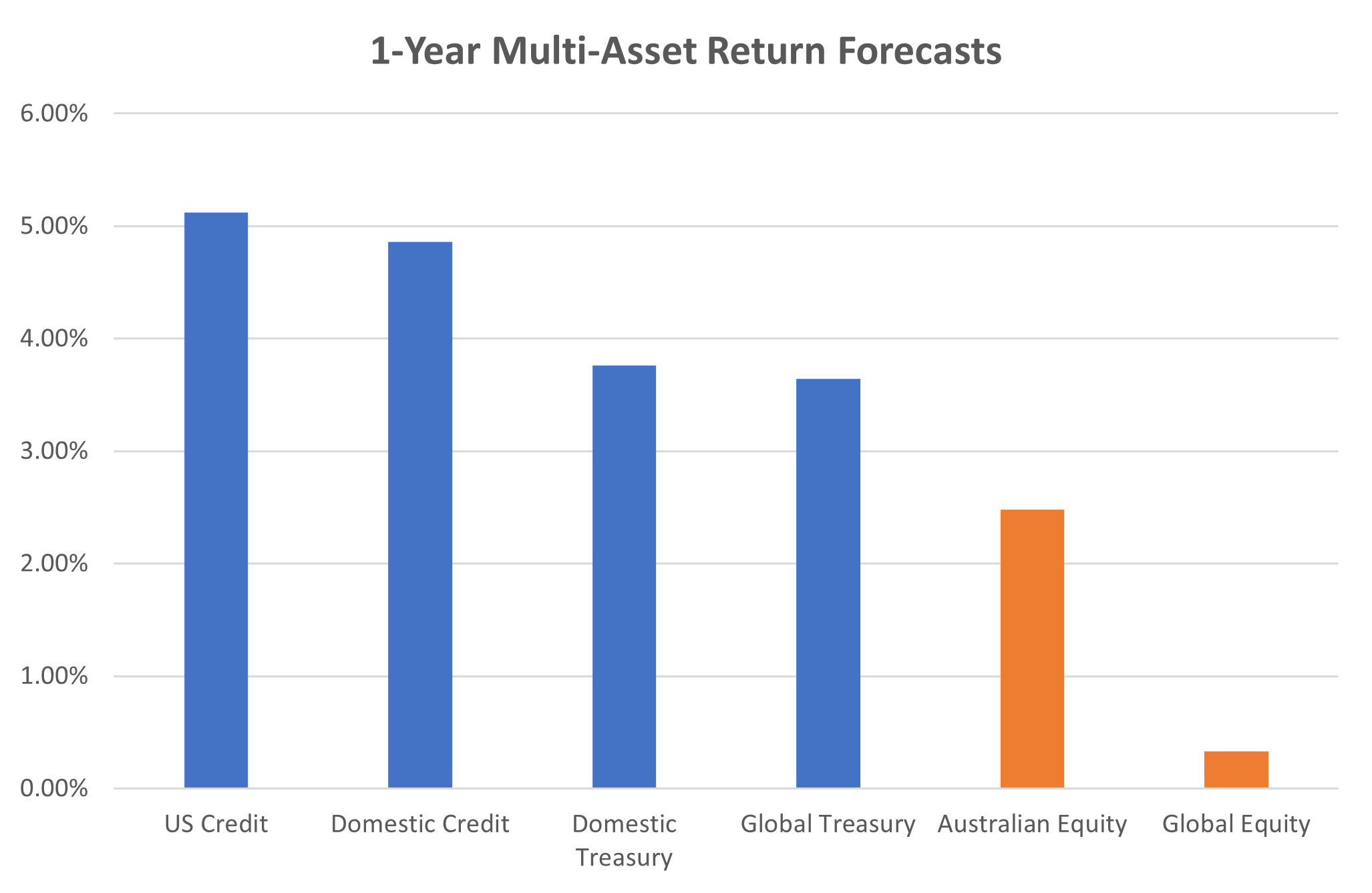

When looking at the chart below, a DAA process might use the higher expected return over credit and government bonds to tilt away from equities:

Source: Innova Asset Management 2023

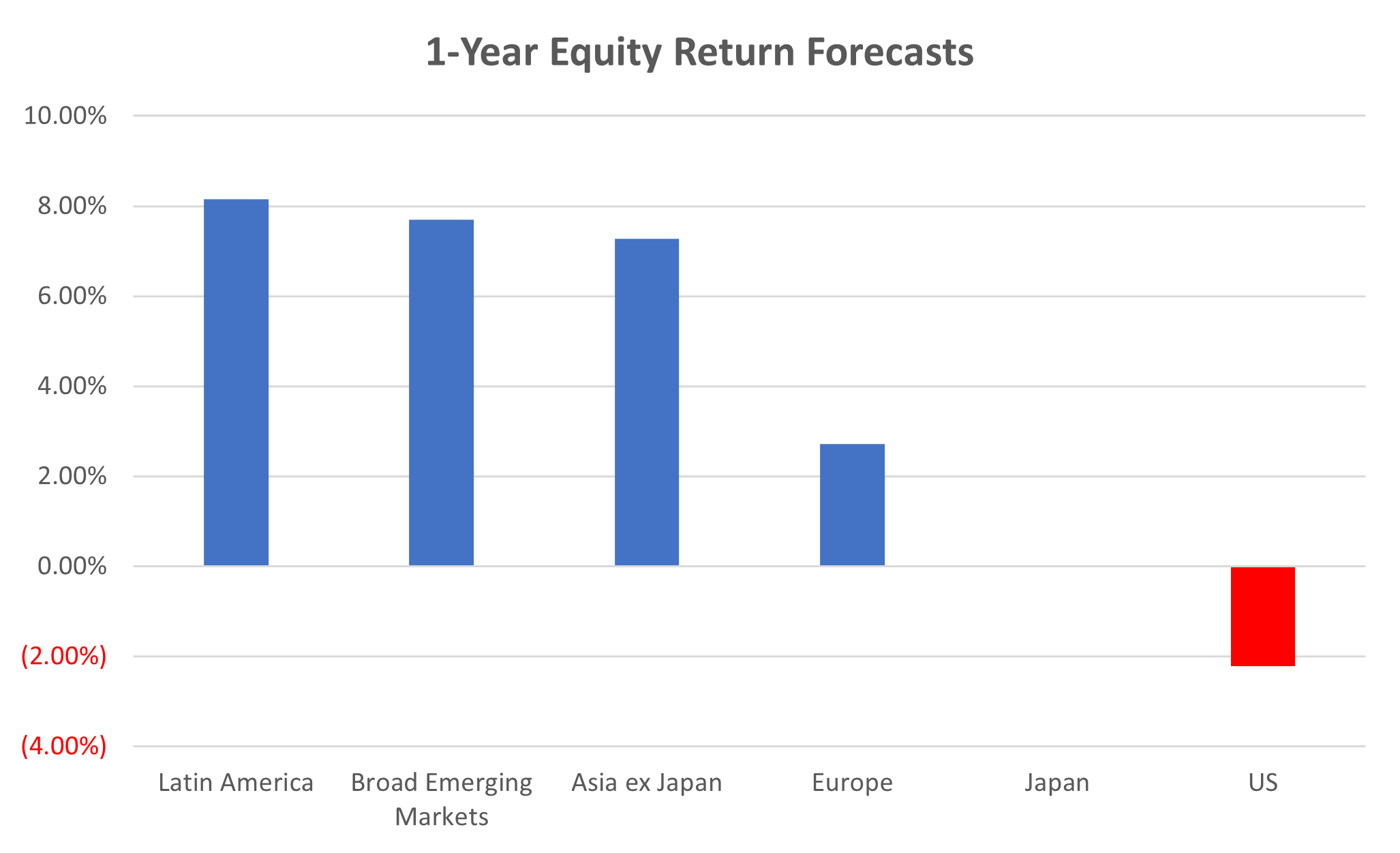

Or even within risk assets, a DAA process might tilt the portfolio away from developed market equities and into Emerging Markets (often its own separate asset class bucket) based on forecasts like the ones below:

Source: Innova Asset Management 2023

The key takeaway is that there are many intuitive and actionable inputs which can help inform a DAA process for a portfolio.

Case Study – Balanced Client Portfolio

As a case study, let’s relate implementing DAA to the context of a Balanced portfolio for a pension client.

Suffice to say, those maintaining a 65/351 static allocation throughout 2022 saw some of the worst client outcomes in recent investing memory. Professional fund managers should have known better than to simply play out a collapse in any asset with interest-rate sensitivity. Particularly when clients have sequencing risk and may very well need to access their funds during this period of market downturn.

2022 demonstrated that the traditional ‘hedge’ against equity market weakness – an allocation to fixed-rate Government bonds – carried with it meaningful risk and susceptibility to rising interest rates. So, bonds, equities and listed property all fell at the same time.

What if an adviser or manager had implemented a simple, easy to execute DAA framework like the one below?

- Taking a one-to-3-year view, rotate clients slightly out of equities, towards fixed income and cash

- Within equities, tilt towards less interest rate-sensitive allocations, such as Value

- Within fixed income, tilt towards less interest rate-sensitive allocations, such as floating rate corporate bonds

Towards the end of 2021 these were logical things to consider in client portfolios. Assets were pricing in the chance of inflation and rate rises at 0%, as equity valuations were on the expensive side, and Government bonds were yielding less than 1% (so offered no inflation premium).

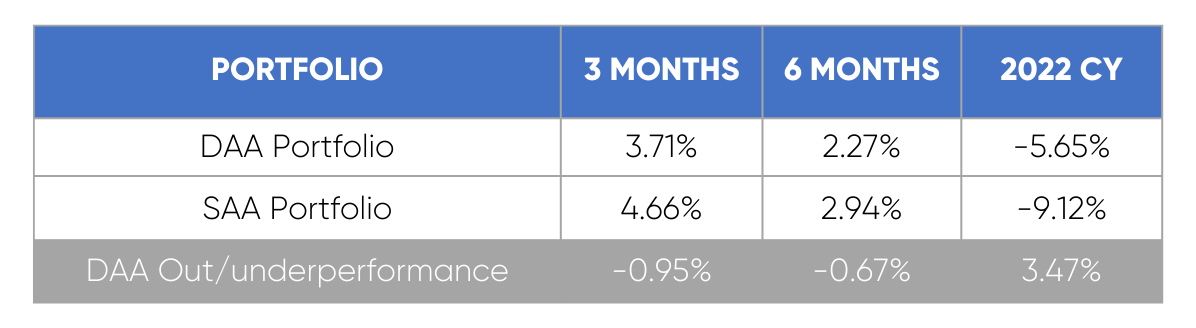

We show the performance and attribution of such an example portfolio below in 2022, compared to a benchmark-standard multi-asset SAA for a Balanced fund2.

By implementing a simple, intuitive DAA framework, a client would have had a materially better outcome over the year – over 3.4% for the 2022 calendar year – clients got protection right when they needed it the most:

Source: Bloomberg and Innova Asset Management (as at 31 December 2022)

Source: Bloomberg and Innova Asset Management (as at 31 December 2022)

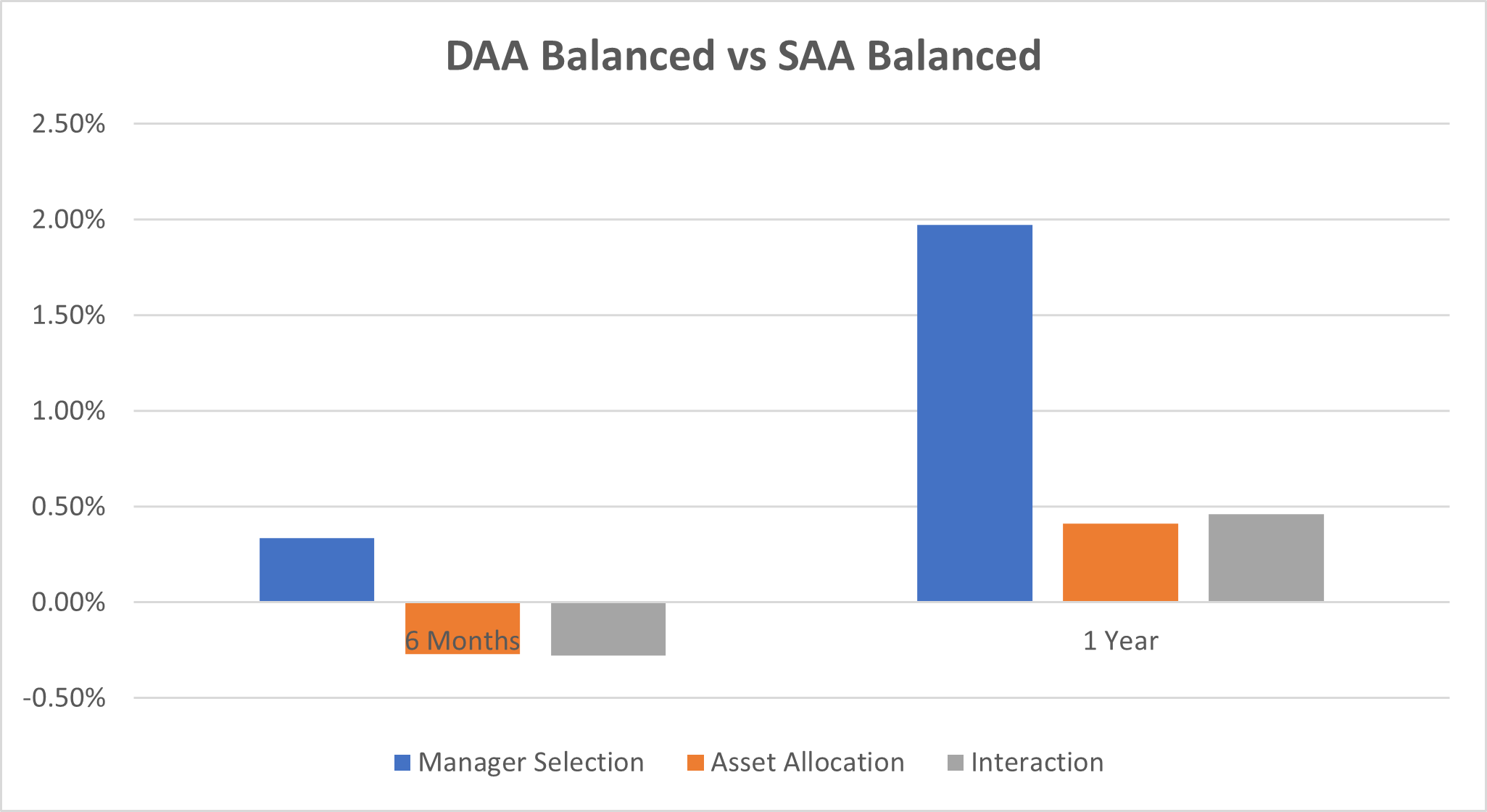

We’ve broken this performance down into attribution (compared to the SAA portfolio) to show where value has been accreted:

Source: Bloomberg, Innova Asset Management (as at 31 December 2022)

[Remember, this is not your typical manager selection, this is allocating to specific factor-exposures within the same asset class, rather than necessarily choosing Global Manager A over Global Manager B based on their 3 year track record. The rotation to floating rate bonds within fixed income, and to value equities within the equities allocation has come out as ‘Manager Selection’, but it is more accurately considered a DAA decision as discussed above.]

In the example we used above, a DAA approach led to a better return outcome with less drawdown. This might not always be the case, but it is an important tool for managing risk, particularly when the outlook is uncertain.

Try DAA Today

Top advisers employ DAA to enhance portfolio returns, better navigate risk and produce a better client outcome over the long run.

When markets are particularly volatile as we have seen in recent years, DAA is an essential tool in ensuring a smooth return profile for clients, a key pillar of active management which ensures an evidence-based approach to investing rather than chasing trends or risky market moves. However, it is important that the DAA process be robust and sensible. To simply tilt client portfolios based on ‘gut-feel’, recent performance or recent news stories can lead to short-term performance chasing, and NOT a sensible, robust framework for implementing DAA.

For any investor, having a long-term view of their portfolio allocation, with some nimbleness and dynamism to account for the ebbs and flows of market cycles, is a worthy use of focus and time.

You can learn more about Innova Asset Management’s dynamic approach to asset allocation here.

1. 65% ‘growth’ assets such as equities and listed property, 35% ‘defensive’ assets such as cash and fixed income

2. Balanced fund benchmark consists of: 10% Cash, 12.5% AusBond Composite, 12.5% Barclays Global Aggregate, 10% listed property, 27.5% ASX200, 27.5% MSCI AC World (50% hedged)