Introduction: The Real Risk Isn’t What You Think

While volatility has long been the standard risk measure used by funds management, research, and analytics professionals, the advice industry recognises that its relevance to actual client experience is often minimal – and in many cases, largely irrelevant. When we measure what’s easy rather than what’s meaningful, we risk missing the point entirely.

Clients don’t fear volatility. They fear losing money they can’t afford to lose. They fear outliving their savings. And most of all, they fear that the plan they’ve built – the one funding their lifestyle, retirement, or legacy -might not hold together when markets turn.

Let’s look at how we can re-define, communicate, and manage investment risk.

Volatility Is a Poor Substitute for Real-World Risk

Volatility is symmetrical. It treats upward surges the same as gut-wrenching losses. But clients don’t react to both equally. Most don’t worry when their portfolio grows rapidly – even if it’s “highly volatile.” What they can’t stomach is watching their balance fall sharply, even when the decline is technically “within expected bounds.”

Even over longer periods – like rolling 5-year (60-month) windows – volatility can remain elevated without necessarily producing poor outcomes. Markets may experience sharp but recoverable drawdowns, meaning short-term volatility doesn’t reliably predict long-term failure. Yet clients often react in the short term, not based on probability, but based on perception.

Advice Tip: Instead of focusing on volatility, shift the conversation to what kind of loss the client could tolerate before abandoning the plan. Use past drawdown events to frame expectations. And where volatility data is shared, always bring it back to lived experience: “If this happened, what would you do?”

Risk is the Probability of Not Achieving Client Goals

In advice, risk isn’t academic. It’s personal. It’s the chance that a retiree will outlive their money, that a 45-year-old won’t be able to exit work on their terms, or that a family won’t be able to leave the legacy they’ve worked for.

That means we need to shift our framing. From:

“How volatile is this portfolio?”

To:

“What’s the worst-case drawdown this client can emotionally and financially tolerate – and what’s the chance they fail to reach their goal?”

Advice Tip: Introduce drawdown-based guardrails: “As long as we stay above this red line, we’re on track.” It’s measurable and emotionally relevant.

Risk Profiling Needs a Refresh

Most advisers know that psychometric risk profiles are flawed. They capture an investor’s theoretical risk tolerance – but not their capacity to absorb loss, or their actual financial needs.

A better approach splits risk into three components:

• Risk Capacity: What can they afford to lose?

• Risk Need: What return do they need to achieve their objectives?

• Risk Tolerance: What drawdown can they tolerate without panicking?

Advice Tip: Use this triad in client conversations. It clarifies trade-offs and stops the “balanced-by-default” allocation trap.

Clients Understand Buckets or ‘Compartmentalising’ assets. Use Them.

One of the most powerful behavioural framing tools is bucketing – separating money into short-, medium-, and long-term “pots” with different objectives and risk tolerances.

Why it works:

• Emotional comfort (“I know my next 2 years are covered”)

• Strategic flexibility (“We don’t have to sell during a downturn”)

• Long-term compounding (“Growth assets can ride out volatility”)

Advice Tip: Bucketing isn’t about breaking portfolio theory. It’s about mapping strategy to time horizon in a way clients can see.

Drawdown Is the Risk Clients Feel Most

The most consistent client trigger point? Drawdowns. Behavioural research and experience show clients begin to disengage at remarkably consistent thresholds:

• 5%: Conservative retirees

• 10 – 15%: General retiree comfort zone

• 30%+: Often tolerable for younger investors (but still risky)

Advice Tip: Ask clients, “How much could your portfolio fall in 12 months before you’d feel something has gone wrong?” Then build portfolios to stay within that band.

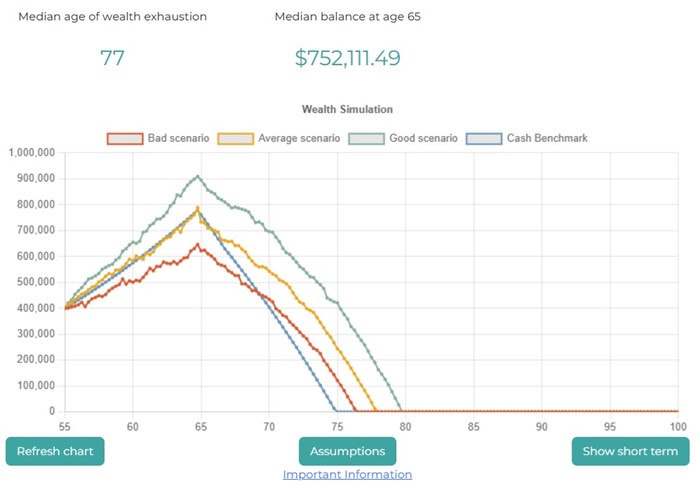

Simulation Snapshot: The Consequence of Inaction

• Age: 55

• Super balance: $400,000

• Salary: $180,000

• Retirement age: 65

• Risk profile: Balanced

Key point: Projected savings depletion by age 77, despite a ‘balanced’ label – showing longevity risk and inadequate growth allocation.

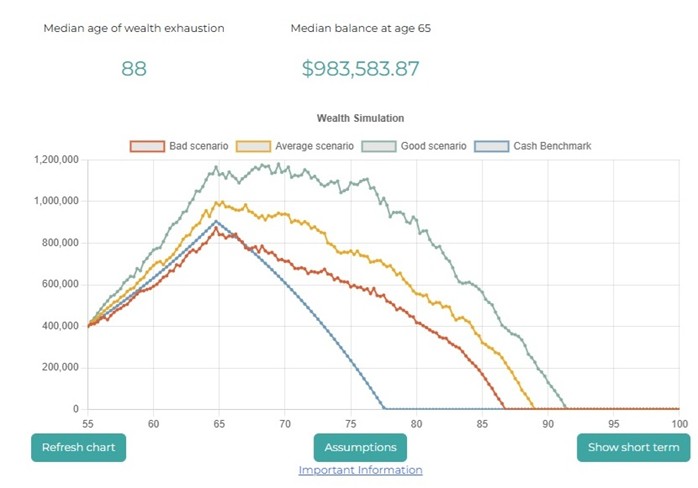

Same Client, Improved Strategy

Action taken: Modest portfolio reallocation and savings changes lift exhaustion age to 88 – a clear example of risk targeting improving outcomes

These simulations reinforce that “staying the course” only works when the course is set to realistic risk and return assumptions. It’s not about outperforming the market. It’s about not running out of money.

These simulations reinforce that “staying the course” only works when the course is set to realistic risk and return assumptions. It’s not about outperforming the market. It’s about not running out of money.

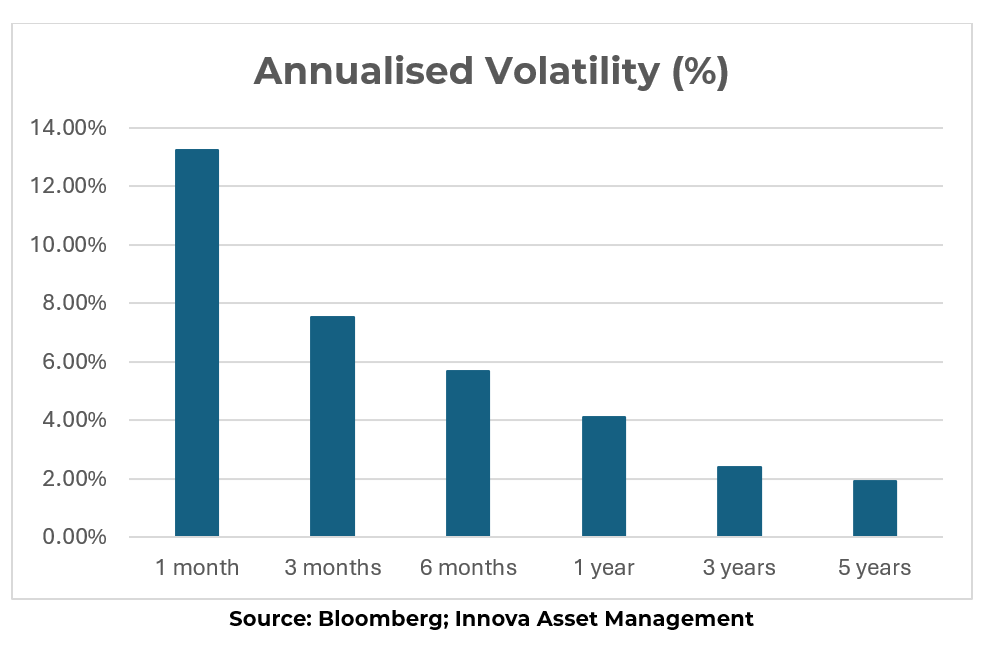

Volatility Shrinks with Time – But Clients Don’t Feel That

Advisers know this instinctively: the longer the horizon, the less impact short-term volatility has. But clients often don’t see the distinction.

The ASX200 has historically shown annualised volatility of ~15% on a monthly time horizon. Yet when measured over rolling 10-year windows, this figure drops to under 6%. Short-term movements are noisy and emotional. Long-term trends are far more stable – and more relevant to retirement success.

Volatility Over Time – Perception vs Reality

Key point: Annualised volatility of the ASX200 decreases as the investment horizon extends – from ~13% over one-month intervals to under 2% over 5-year time periods.

Risk Targeted Investing uses this reality to reframe client conversations. Instead of focusing on what might happen this year, we ask: what are the chances you’ll meet your goal over the next 30 years – and what kind of path are you willing to stick with to get there?

Conclusion: Better Risk Framing = Better Advice

Great advice isn’t about predicting the future. It’s about preparing clients to stay invested through whatever the future holds.

By redefining risk around real-world outcomes – not just standard deviation – advisers can build more robust, resilient portfolios that clients understand and trust. Volatility might be easy to measure. But confidence is what delivers results.

Want to see how Risk Targeted Investing could apply to your practice? Reach out to Innova for tools, training, and client-ready visuals to help shift the conversation from fear to focus.

Reference

1 Refer to appendix for details of simple strategy changes.

This information has been prepared by Innova Asset Management Pty Ltd

(Innova), ABN 99 141 597 104, Corporate Authorised Representative of Innova Investment Management Pty Ltd (CAR

402207), AFSL 509578 for provision to Australian financial services (AFS) licensees and their representatives, and for

other persons who are wholesale clients under section 761G of the Corporations Act.

All investment involves risks, including possible delays in repayments

and loss of income and principal invested. Any discussion of risks contained in this document with respect to any type

of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks

involved. Past performance information provided in this document is not indicative of future results and the

illustrations are not intended to project or predict future investment returns.

The performance reporting in this document is a representation only.

Innova has used a calculation methodology to simulate the performance of the relevant Investment Program since

commencement, net of all fees and commissions at the fund/security level, and gross of other fees and commissions.

Simulated performance does not reflect the performance of any specific account. Each account will have its own unique

performance history, due to factors including varied methods of implementation, fee and tax structures. Therefore,

simulated performance may vary significantly compared to that of any specific account. The out of sample backtested

performance data has been simulated by Innova and is for illustrative purposed only, and is not representative of any

investment or product. Results based on simulated performance results have certain inherent limitations as these

results do not represent actual trading. No representation is being made that any account will or is likely to achieve

profits or losses similar to those being shown.

Although non-Fund specific information has been prepared from sources

believed to be reliable, we offer no guarantees as to its accuracy or completeness. Any performance figures are not

promises of future performance and are not guaranteed. Opinions expressed are valid at the date this document was

published and may change. All dollars are Australian dollars unless otherwise specified.