Beyond the Mortgage: Rethinking last Century’s financing structure to Solve the Housing Crisis

Introduction

Australia has a proud history of innovation, with world-changing inventions like Wi-Fi, Cochlear implants, Google Maps, and Black Box flight recorders all brought to life by tenacious Australians who reimagined problems to create solutions.

Australia has been a fertile ground too, for notable financial market innovations, including:

| • | The Australian stock exchange (ASX), which has been at the forefront of market innovations, including electronic trading platforms, clearing and settlement systems, and advanced market surveillance technologies. |

| • | The superannuation system, creating one of the largest pools of retirement savings in the world. |

| • | And within the property sector, Australia was a pioneer in developing and adopting Mortgage-Backed Securities. |

With it increasingly being the case that individuals and families on a median income are unable to afford a median priced property in major capital cities, can the innovators of Australia develop a new financing model to address the housing crisis? Have debt driven instruments, like mortgages, as standalone tools, come to the end of their useful life?

In this article we’ll look at the factors that have shaped the home buying process over the last century and examine if Shared Equity could also be the next financial innovation that could enable more of the next generation to buy a home.

A Brief History of Housing Affordability | Policy Drivers & the Evolution of Financial Products

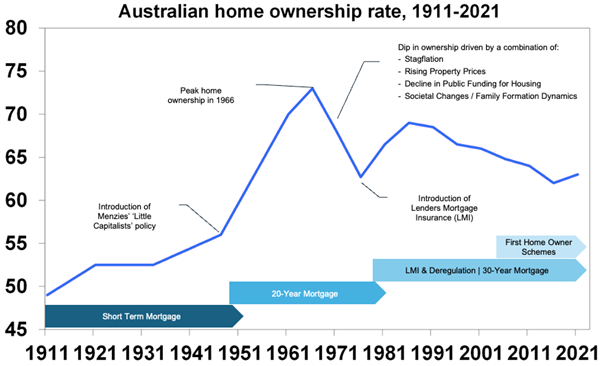

Housing affordability in Australia has evolved significantly over the past century, reflecting broader economic trends, government policies, and demographic changes. Financial products too have evolved to meet the changing needs of Australian society, and to enable the majority of the population to own a home.

Early 20th Century: Post-Federation Era

In the early 1900s, housing affordability in Australia was relatively high. During this period, the government implemented policies to support home ownership, including land grants and low-interest loans. The expansion of suburban areas was encouraged, and affordable housing was largely achieved through these initiatives.

In the post war era, under the Menzies policy of creating ‘little Capitalists’, the push for home ownership led to the expansion of the mortgage market.

1950s-1970s: Economic Boom and Government Intervention

The post-war economic boom led to substantial growth in Australia’s housing market. The 1950s and 1960s were characterised by widespread suburban development and increasing home ownership rates. The government played a significant role through policies such as the introduction of the Commonwealth-State Housing Agreement.

During the 1970s, the focus on affordable housing continued with the introduction of policies to promote home ownership among lower-income groups.

The post-World War II era also saw substantial changes in the mortgage market, driven by economic expansion and increased home ownership. During this period, we saw:

1. Introduction of Long-Term Mortgages: The length of mortgage terms began to extend, with 20-year terms becoming more common. This change made home ownership more accessible by reducing monthly repayments, although interest rates remained high.

2. Deregulation Movements: The 1970s introduced a more deregulated financial environment, laying the groundwork for future innovations. During this period, the traditional mortgage market began to experience increased competition and more diverse offerings.

1980s-1990s: Market Liberalisation and Rising Costs

Economic reforms during the1980s and 1990s included deregulation of the financial sector and the introduction of policies favoring private home ownership over public housing.

In the 1980s, housing affordability began to deteriorate as property prices outpaced wage growth, making it increasingly difficult for first-time buyers to enter the market.

The 1980s were also marked by significant financial deregulation, which reshaped the mortgage market:

1. Interest Rate Deregulation: Deregulation allowed rates to be determined by market forces, increasing competition among lenders, and leading to a wider range of mortgage products.

2. Rise of Variable Rate Mortgages: With deregulation, variable rate mortgages became more popular. These loans had interest rates that could fluctuate with market conditions, offering initially lower rates but with the risk of increases over time.

3. Increased Lender Competition: The entry of non-bank financial institutions into the mortgage market increased competition, providing more choices and potentially better rates for borrowers.

4. Lenders Mortgage Insurance (LMI): LMI began to gain prominence in the 1980s as a way to address the growing need for lower deposit requirements and to mitigate the risk associated with higher loan-to-value ratios (LVRs).

The 1990s saw further innovations and changes in the mortgage market:

1. Mortgage-Backed Securities (MBS): The introduction of mortgage-backed securities allowed lenders to bundle and sell mortgages as investment products. This helped to distribute risk and provided additional liquidity to the mortgage market, facilitating increased lending.

2. Introduction of Offset Accounts and Redraw Facilities: These features provided more flexibility for borrowers. Offset accounts, where the balance of a savings account reduces the mortgage principle on which interest is calculated, and redraw facilities, which allow borrowers to access extra payments made on their mortgage, became popular.

3. Expansion of LMI Providers and Regulatory Developments: Several insurance companies entered the market, providing various LMI products to cater to the increasing demand for lower deposit home loans. As the LMI market grew, regulatory bodies, began to focus more on oversight and consumer protection.

2000s-Present: Escalating Prices and Policy Responses

The last 20+ years have seen an escalation in housing prices, driven by a range of factors. Housing affordability became a major issue, with median house prices in capital cities soaring to levels beyond the reach of many Australians.

In response to the growing affordability crisis, various policies have been introduced. The Australian government implemented measures such as the First Home Owner Grant (with no LMI requirement and stamp duty concessions), as well as State and Federal Shared Equity programs.

The 2000s were characterised by rapid growth and increasing challenges in the mortgage market:

1. Continued Innovation in Mortgage Products: The market saw the introduction of various innovative mortgage products, including hybrid loans that combined features of fixed and variable rates.

2. Digital Platforms and Fintech: The rise of digital platforms and fintech solutions streamlined the mortgage application process, with online lenders, comparison tools, and digital mortgage brokers becoming more prevalent.

3. Regulatory Reforms: In response to concerns about financial stability and consumer protection, regulatory reforms were introduced to improve transparency and oversight in lending.

4. Rising Property Prices drive LMI uptake and innovation: With property values rising rapidly, more borrowers sought to secure loans with lower deposits, making LMI an essential component of the mortgage market. During this period, LMI providers began to offer more innovative products features such as varying premium structures, coverage options, and more flexible terms.

While these market innovations have historically supported a home ownership rate across cohorts of ~70%, with a sustained dip below this 70% level, it is becoming increasingly apparent that they have run their course. So where to from here?

Shared Equity: the next frontier in enabling home ownership

One promising solution is Shared Equity schemes, an innovative financial arrangement designed to make home ownership more accessible, particularly for first-time buyers and low-to-moderate income households.

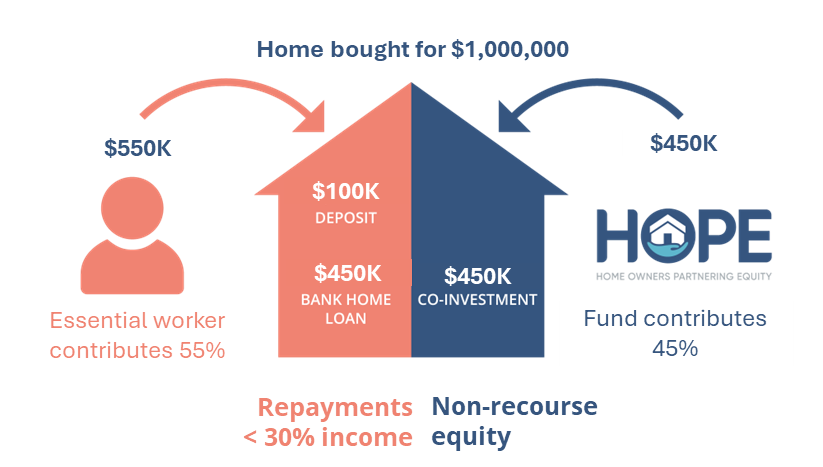

These schemes allow a buyer to purchase a property with a smaller mortgage by sharing the equity with a partner, typically a government agency or private organisation. The partner contributes a portion of the property’s purchase price in exchange for an equity stake.

By reducing the mortgage required, shared equity schemes make home ownership more attainable for individuals who may otherwise struggle to service an increasingly larger mortgage.

While few of the government run Shared Equity schemes have moved beyond the pilot phase, this market innovation, in the hands of the private sector has the potential to continue to open access to home ownership in Australia.

One organisation that is leading the charge in delivering this exciting innovation to the Australian market is HOPE Housing. HOPE Housing offers a unique co-investment solution for essential workers to purchase homes near their workplaces. Its innovative product allows equity investments up to 50% of a home’s value, supplementing the homeowner’s deposit and mortgage.

Additionally, the HOPE Housing model provides investors with access to the residential real estate market at scale, allowing them to share in property appreciation based on their equity stake in a diverse residential property portfolio, without all the hassles of the landlord model.

The market evolution of co-investment funds, now enables those investors who have a strong affinity for property but have experienced sub optimal net returns or who are looking to be part of the home ownership solution, whilst generating attractive returns.

Visit our website to learn more about how HOPE Housing is creating new pathways for residential property investment.

REFERENCES

1. Source: ABS Censuses, Bernard Salt/The Demographics Group, AMP, HOPE Housing analysis

2 Excludes costs like stamp duty, LMI and conveyancing fees, which are paid by the homeowner

DISCLAIMER

The information in this article was finalised in September 2024. This article has been prepared by HOPE Housing Fund Management Limited (HOPE) ACN 629 589 939 (Investment Manager/Manager/Company/HOPE/HOPE Housing) for general information purposes only, without taking into account your personal objectives, financial situation or needs. Before acting on this general information, you must consider its appropriateness having regard to your own objectives, financial situation and needs. The information provided is not intended to replace or serve as a substitute for any accounting, tax or other professional advice, consultation or service and nothing in this article shall be construed as a solicitation to buy or sell any financial product, or to engage in or refrain from engaging in any transaction. The Investment Manager is a corporate authorised representative (number 001289514) of SILC Fiduciary Solutions Pty Ltd ACN 638 984 602 (AFS licence number 522145). The authority of the Investment Manager is limited to general advice and deal by arranging services to wholesale clients relating to the Fund in Australia only.

Past performance should not be taken as an indication or guarantee of future performance and no representation or warranty, express or implied, is made regarding future performance. Economic conditions may change.

The analysis provided in this article is based on information obtained from sources believed to be reliable but HOPE does not make any representation or warranty that it is accurate, complete or up to date. HOPE accepts no obligation to correct or update the information or opinions in it. Any opinions expressed in this article are subject to change without notice. No member of HOPE accepts any liability whatsoever for any direct, indirect, consequential, or other loss arising from any use of such information