General Use: This document is for general use. Modification of content is prohibited unless you have Netwealth’s express prior written consent.

Most successful journeys start with a plan. A journey to digital maturity is no different, it needs a well-defined plan that is based on sound judgement and feedback. Using insights from Netwealth’s 2024 AdviceTech research, we provide some tips to help create a great plan.

Key takeaways:

• Understanding client needs and trends are an important input into your digital strategy.

• There are several tools, such as customer journey mapping, to identify client friction and improve their digital experiences.

• Prioritising technology projects by ease and business value will help ensure technology investments are impactful.

Digital transformation is critical for advice firms at a point in time where clients expect a seamless digital experience, and shareholders expect continued profitability and scale.

Because digital transformation affects so many parts of the business, having a clear strategy is critical. Without sufficient planning and alignment, a practice could end up wasting valuable resources and time.

Recently, Netwealth undertook substantial research into how firms are using AdviceTech in 2024. Out of this, we identified some firms as AdviceTech Stars because of their superior adoption of technology and business success.

In this article, we’ll take a closer look at the attributes needed to build a digital and IT strategy, based on Netwealth’s Digital Maturity Framework, a framework developed out of our proprietary 2024 AdviceTech research of 350 advice firms in Australia.

The Apple effect

One of the secrets to success for Apple is its customer-first attitude. Steve Jobs once said, “You’ve got to start with the customer experience and work back toward the technology, not the other way around.”

For advice firms, understanding client needs and spotting trends can deliver significant competitive advantage. Such trends could be the intergenerational wealth transfer, or that Gen Ys are the largest working segment, or that people are living longer.

AdviceTech Stars recognise this, and three-quarters (76 per cent) of their leaders spend time trying to understand the changing needs of their clients, whilst a further four in 10 collect feedback from clients regularly and use it to inform their digital strategy.

Keeping up with macro customer trends is important, but equally important is taking time to understand the nuances in how clients interact with the firm. This means gaining a thorough understanding of client motivations, attitudes, and points of frustration and using them to influence digital strategy.

Take, for example, Netwealth’s recent Advisable Australian research, which surveyed over 250 Australians aged 18 and above. It found that at least four in 10 of those considering advice expect a selection of digital experiences from their firm. These range from access to wealth management and self-service options, such as the ability to run reports, access to portfolio information, and ability to track goals via online portals or mobile apps.

And they want this on a digital platform that is intuitive to use. In addition, they expect streamlined processes when it comes to document signing and complicated financial procedures – something digitalisation can absolutely help with.

Customer journey mapping

One way to understand the client, their frustrations and joys, is to use a process called ‘customer journey mapping’, such as the one developed by Netwealth which can be downloaded on our website here.

For example, one firm who used this tool identified their inability to marry the original advice or Statement of Advice (SOA) with the ongoing communications and annual review process. They saw a disconnect between what was said right at the beginning of the advice journey and what was being communicated during the year and then at the annual review.

Using a customer journey map will help identify all the client touchpoints along their journey, and uncover areas where technology can aid and improve the experience.

Align digital strategy with business strategy

Stars understand the need for a digital strategy, and three-quarters (73 per cent) already have a technology roadmap or strategy.

They also recognise the need for a longer-term approach, with four in 10 Stars (43 per cent) having a strategy for at least the next two years or beyond, and almost half (49 per cent) saying they plan to invest more in technology in the coming year compared to the last. This translates to a spend of 10.7 per cent on technology by Stars as a percentage of their business revenue per annum.

When it comes to the strategy itself, most AdviceTech Stars align their digital and technology strategy with their business strategy. This seems obvious, but for some, it’s often easy to get sucked into the latest shiny new thing without properly thinking through whether it has a true business purpose.

Then, there are seven in 10 who are looking to improve client satisfaction, engagement, or enhance the quality of their advice. Also, just over half say they want to grow their client base through the use of technology.

Meanwhile, 65 per cent want to strengthen their IT security and protect client information and just over half want to improve their ability to manage compliance and governance.

And finally, six in 10 want to take advantage of emerging technologies like AI.

How to think about technology prioritisation

How does a firm prioritise business and technology imperatives when there are many? There are numerous prioritisation models, but firms might want to consider using a simple model like a prioritisation matrix.

Advice firms should then choose several IT projects that fit into Priority A (can be done easily) and B (will take longer but are worthwhile). A portfolio of IT projects allows them to gain quick wins while building out longer-term strategic business benefits.

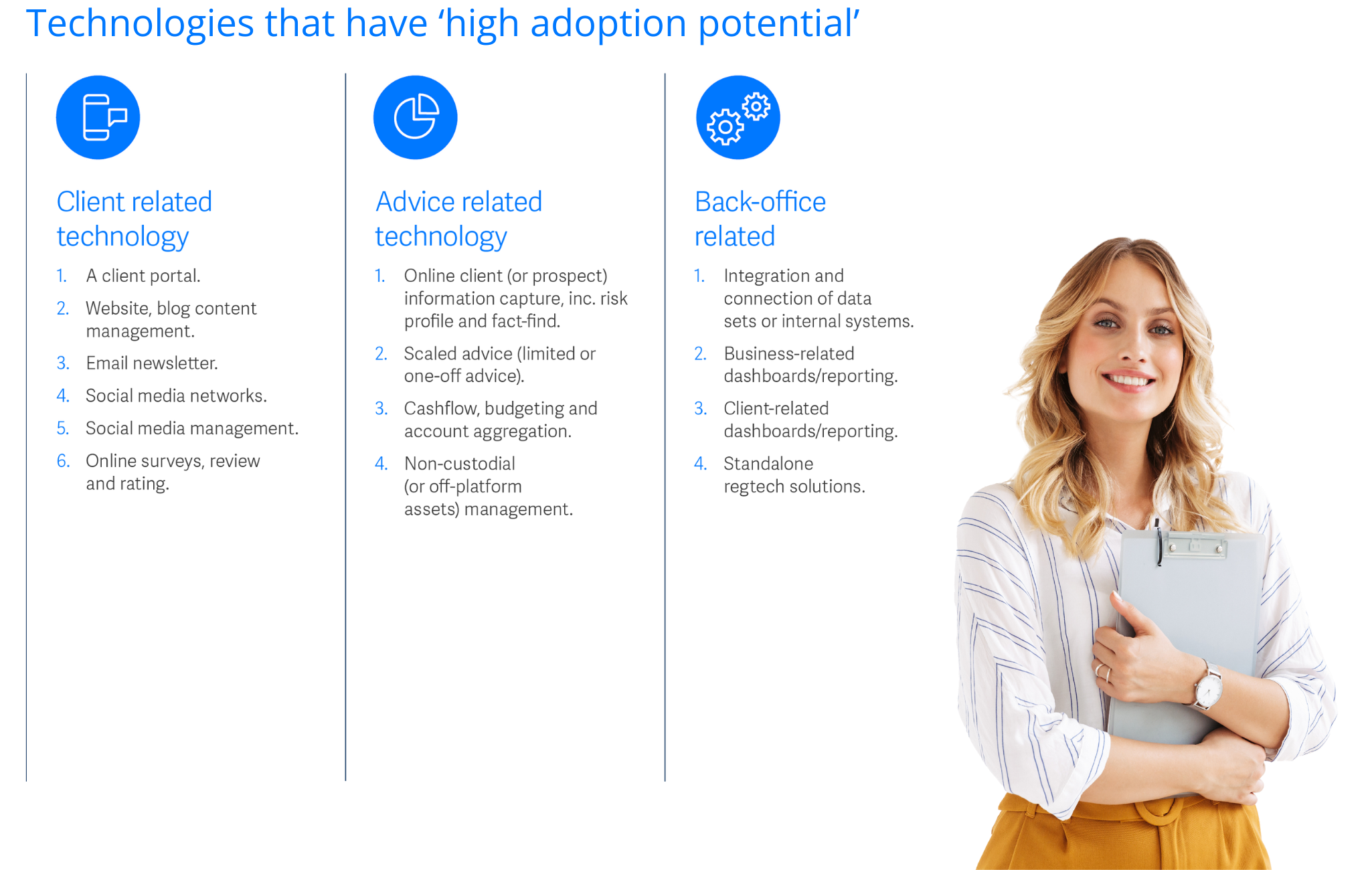

Netwealth has another great tool that firms can use to learn about new technologies and prioritise them, called the Technology Adoption Framework. Through our AdviceTech research, we have identified how mature a technology is, ranging from niche to mass adoption. Of particular interest are technologies that fall into the high adoption potential group. These are technologies are on the up and are worth having a look at.

There are 14 technologies that fall into this high adoption potential group, and they can be organised into three buckets: those that are client related (such as a client portal for client engagement), those that provide advice-related benefits (such as technology to manage non-custodial or off-platform assets), and those that offer back-office efficiency benefits (such as integration tools).

Having a strategy is essential to building the digital capabilities clients and shareholders increasingly expect from their advice firms. That way, firms can avoid falling for the latest shiny object and instead ensure they pick technologies which will make the most difference to clients, and that will have the biggest impact on the firm.

Having a strategy is essential to building the digital capabilities clients and shareholders increasingly expect from their advice firms. That way, firms can avoid falling for the latest shiny object and instead ensure they pick technologies which will make the most difference to clients, and that will have the biggest impact on the firm.