Intro

Advanced technology platforms, AI and big data are converging and are ready to transform the advice industry. Everything from portfolio construction to the advice process itself will be impacted. Understand the different ways advice firms can use AI in their practice today.

Key Points

• AI is set to impact the end-to-end advice process

• AI and adjacent technologies can support advisers when providing advice

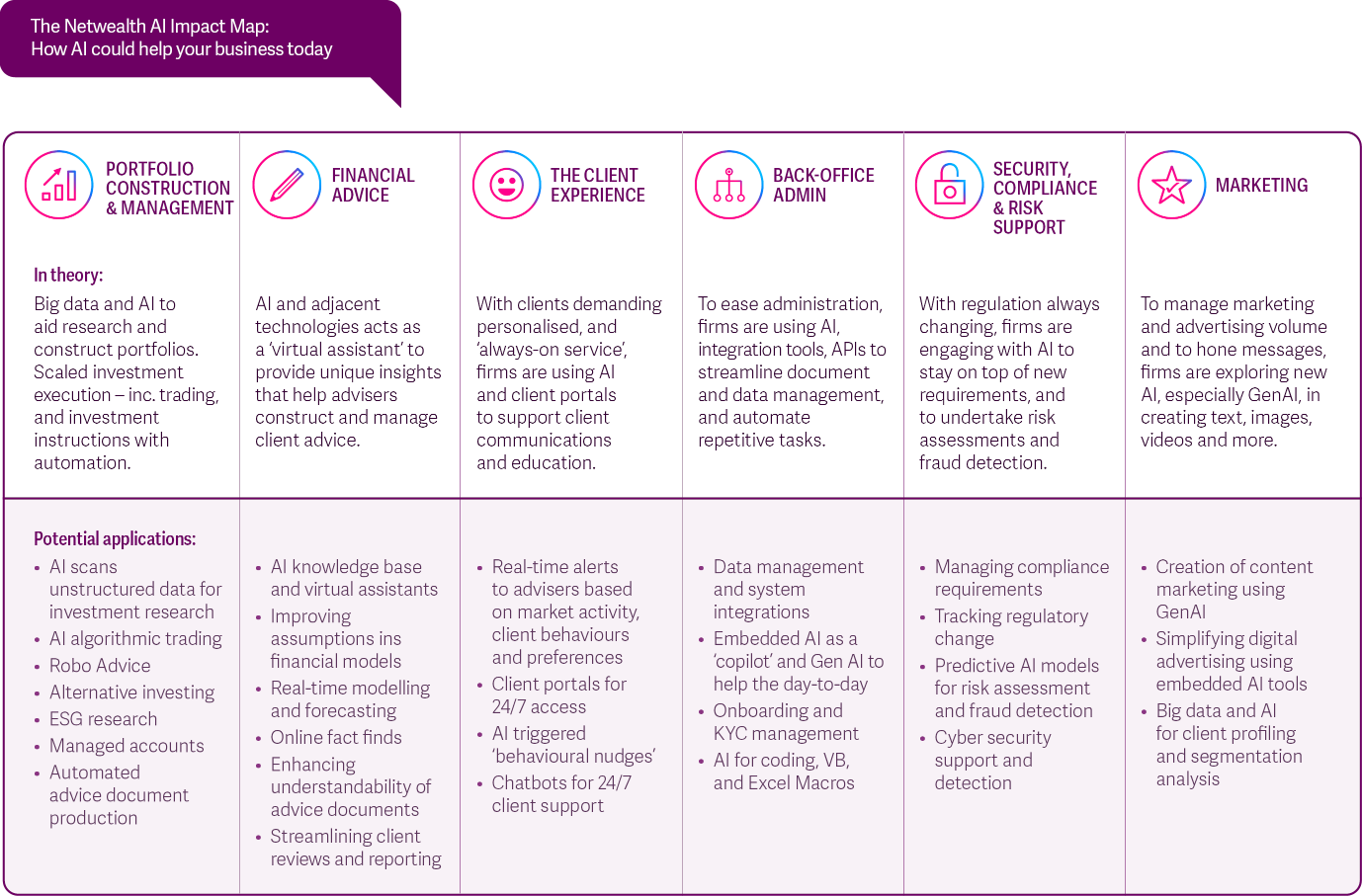

As we look ahead to the next five years, we see several key areas where artificial intelligence (AI) and adjacent technologies should have a real impact. Not surprisingly, these touch all parts of the advice process including portfolio construction and management, financial advice, the client experience, back-office administration, and compliance and risk support.

As part of Netwealth’s 2023 AdviceTech Report, Humans and Machines, we have developed an AI Impact Map to help advice firms navigate the changes and understand the different uses for AI in the short and medium term, in this article we consider a few of these.

New technologies are making life easier for those responsible for the research-heavy, time-consuming task of building and managing portfolios.

Advice firms are turning to big data and AI solutions to help research and construct portfolios, and use platforms, alternative exchanges, managed accounts, automated RoAs, and non-custodial asset administration services to help scale investment execution.

Source: Netwealth 2023 AdviceTech Report – Humans and Machines

AI and investment research

Today’s traditional research tools are getting stretched with the introduction of new asset classes and an increasing demand by clients for more personalised and niche investment options – such as responsible investments (52% of advised clients hold today1), private markets and alternatives (on average around 20% of a client’s portfolio is held in non-custodial assets1).

New AI capabilities can assist investment research by not only analysing real-time market data, such as price movements, trade volumes, and liquidity levels, but financial news articles and analyst reviews, social media data, and company reports.

AI and adjacent technologies can support advisers when providing advice.

The hope of AdviceTech and especially AI, will be to address the often-time-consuming activities related to providing advice.

AI as knowledge base and ‘virtual assistant’

Some advice firms are using AI to make the most of all their large data sets to help guide their advisers. According to OpenAIs case study on their website, Morgan Stanley has trained OpenAI’s ChatGPT its research on over 2000 companies, as well as procedure documents, and product cards.2 This means when one of its advisers asks the AI chatbot a question, can answer simple questions like how a client can setup a Morgan Stanley online account, or what is the in-house view on Alphabet. It can also answer market questions such as who the top 5 competitors to IBM are.

Jeff McMillan, responsible for Morgan Stanley’s big data and AI efforts, said: “You essentially have the knowledge of the most knowledgeable person in wealth management instantly. Think of it as having our Chief Investment Strategist, Chief Global Economist, Global Equities Strategist, and every other analyst around the globe on call for every advisor, every day.3”

AI for financial modelling

A financial model is comprised of two parts – assumptions and projections. Assumptions are made on things like the client’s risk profile, asset valuations and projections, life expectancy, timings of inheritance, and on expenditure and savings. Typically, these assumptions are based on feedback from the client, historical data, and the experience of the adviser.

To improve the accuracy of data collected from clients, almost half of advice firms (46%) use online self-service tools to capture client (or prospect) information, including their risk profile. A further 36% plan to adopt these tools in the next 24 months.

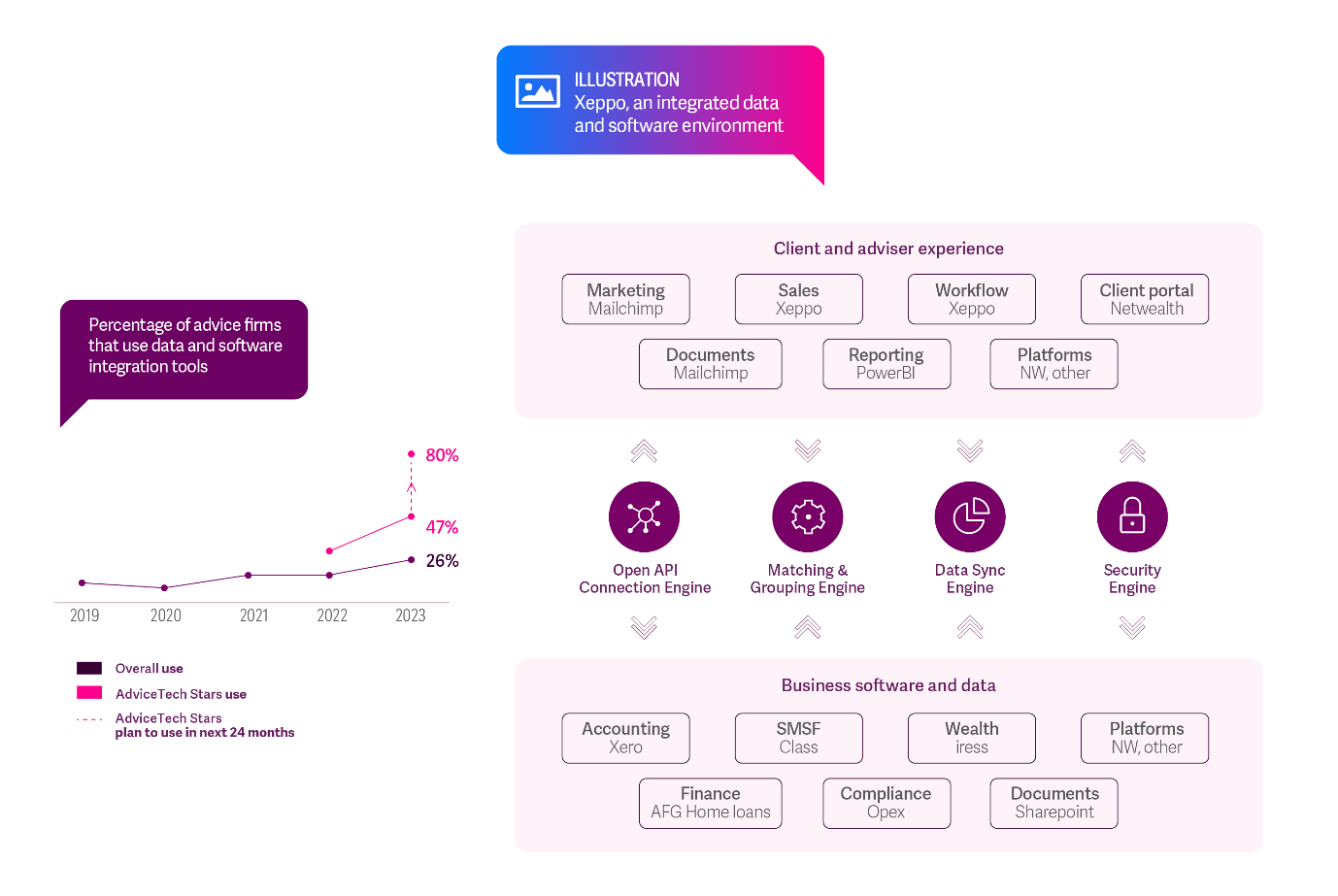

With tools like Netwealth and Xeppo, open-banking and API capabilities, you can collect bank account and transaction information, asset holdings, property values and business information from different sources and systems to provide a more accurate picture of a client when preparing advice.

Some organisations are also using AI to help make assumptions and projections more accurate and useful. AI can draw on information such as a client’s spending habits or debt, and compare that to other similar clients, who are perhaps older. By making this comparison, you might be able to better forecast their long-term expenditure, life expectancy etc.

Source: Netwealth 2023 AdviceTech Report – Humans and Machines

Refining advice documents with AI

Advice documents are a critical tool in communicating the advice options and strategy to clients, but can often be complicated with legal and compliance necessity. Some advice firms are looking at how Generative AI tools, such as ChatGPT, may help to refine advice documents into a more relatable document, with improved grammar and even diagrams, whilst still maintaining their legal rigour.

Alert! As a word of warning, remember to never upload client details or personally identifiable information (PII) to any public AI system, like ChatGPT.

Clients expect a human-digital (or machine) interaction with your firm that varies over the client lifecycle.

The nature of the relationship will often be dependent upon how established the relationship is, and the message being communicated, and AI can help guide you.

Proactive advice with alerts

AI and machine learning systems are being developed to produce operational and advice alerts to advisers so they can service clients more proactively. For example, alerts like margin calls, or low-cash balances, or if a term deposit is about to expire can be displayed in the adviser’s platform. AI has the potential to come up with insurance or portfolio adjustment suggestions. It could also provide behavioural-event notifications, for example, when a person changes jobs (identified through a new employee on their contribution details), or an inheritance alert (based on a lump sum bank transaction), or identify if a child has just started school (based on first time tuition fees). Behavioural analytics can also reveal things like which clients prefer to access information over their mobile device, or the frequency of contact they desire.

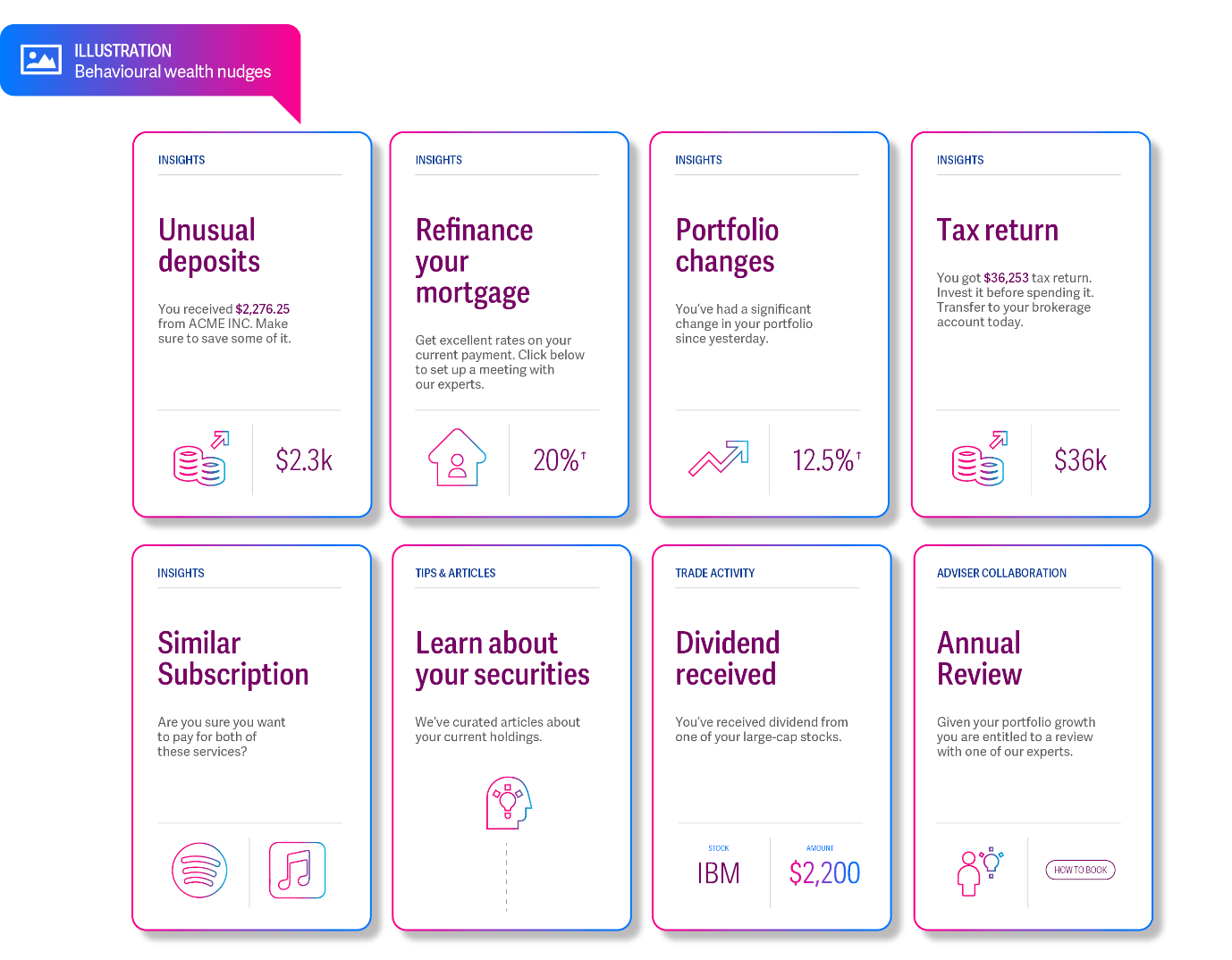

Behavioural nudges

With AI and big data sets, alerts can be directed to the client portal encouraging clients to behave in a certain way, such as saving more. Some people call this a ‘behavioural nudge’!

Clients could get spending alerts to help budgeting and reduce debt, such as an alert when they overspend, loan rates change, they use a new merchant (to prevent cyber fraud), or it might recommend a foreign currency account when overseas. They might even get alerts to improve financial literacy, like educational material sent during market volatility (which can also help manage client expectations and reduce the influx of phone calls and emails that may occur).

Source: Netwealth 2023 AdviceTech Report – Humans and Machines

Big data, AI and client analysis

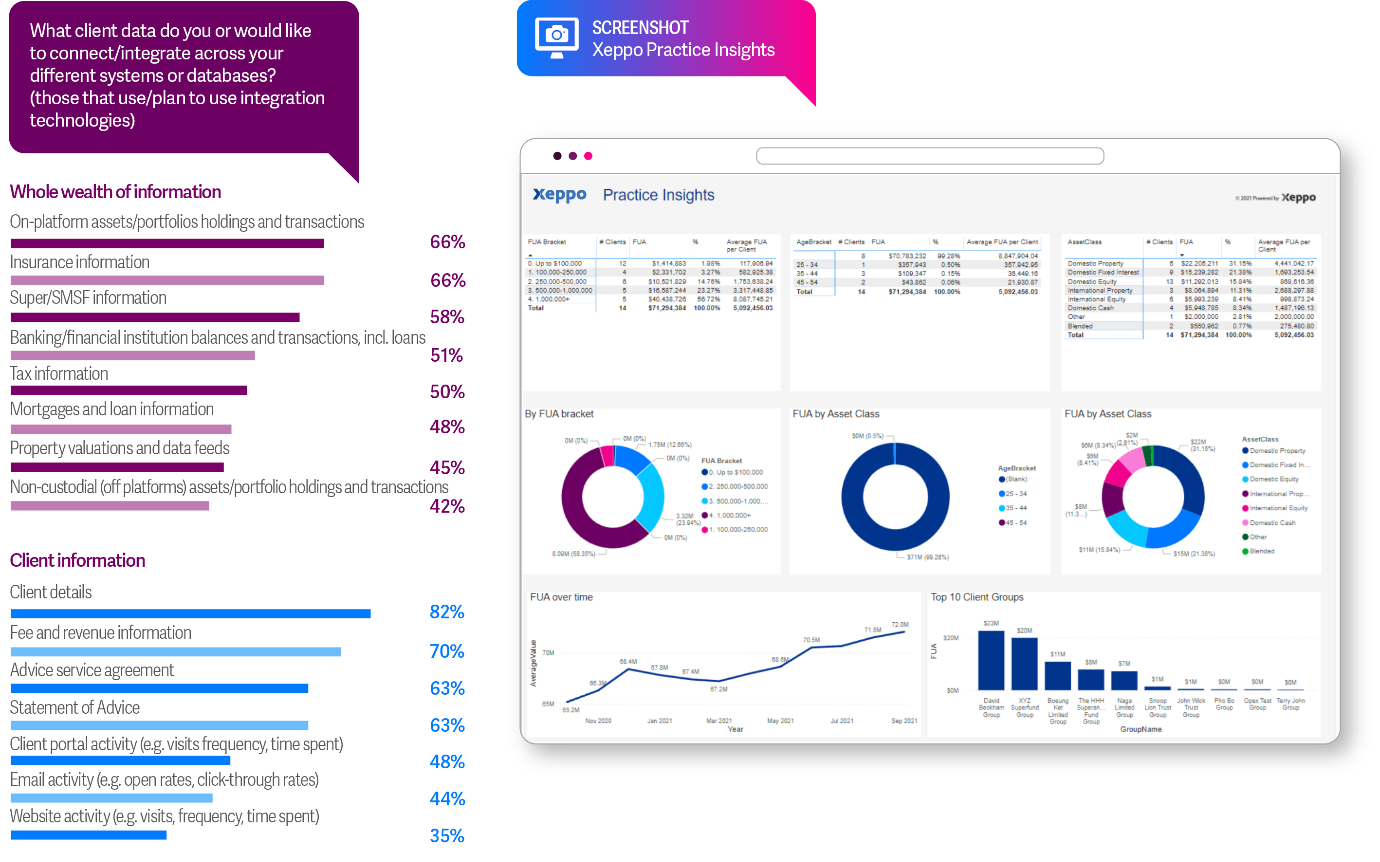

AI tools can help financial advice firms better research and understand their market. AI tools can analyse customer data and preferences, or factors such as client behaviours, sentiment and decision making. This information can inform marketing strategies for finding new clients, tweaking pricing, or reducing client churn.

Advice firms can then leverage these tools to segment prospects and clients into different groups beyond traditional metrics like demographics and net worth and look at behaviours such as email open rates, website visitation, and client portal usage. These tools can also help advice firms understand client attrition issues, with AI predictive tools helping to identify clients at high risk of leaving or prospects who are more engaged with, for example, their website or newsletter.

Source: Netwealth 2023 AdviceTech Report – Humans and Machines

Download the 2023 Netwealth AdviceTech Report – Humans and Machines, for a more detailed analysis at www.netwealth.com.au/advicetech.

1. 2023 Netwealth Advisable Australian survey

2. Morgan Stanley testing OpenAI-powered chatbot for its financial advisors (cnbc.com)

3. https://openai.com/customer-stories/morgan-stanley

Disclaimer: This article has been prepared by Netwealth Investments Limited (Netwealth), ABN 85 090 569 109. It contains factual information and general financial product advice only. While all care has been taken in the preparation of this information (using sources believed to be reliable and accurate), no person, including Netwealth, or any other member of the Netwealth group of companies, accepts responsibility for any loss suffered by any person arising from reliance on this information. Any person considering a financial product from Netwealth should obtain the relevant disclosure document at www.netwealth.com.au.