It’s no secret the bond market has been volatile this year, as rising rates and inflation have led to large sell-offs. But with higher yields across maturities, the case is now stronger for investing in bonds.

How did we get here?

Two years ago, as we dealt with the uncertainties of Covid-19, the world was awash with cheap credit and unprecedented levels of quantitative easing and fiscal stimulus. The fear was not about inflation but instead about whether or not the global economy could survive the pandemic.

Particularly at the start, we saw bond prices soar, and yields fall to unprecedented levels. As the chart below shows, the yield on the US 10-year bond bottomed at below 0.40%. (As a quick refresher, bond prices move inversely to yields.) Over that period, institutional investors were desperate for safe havens while retail equity traders were investing in now-infamous meme stocks.

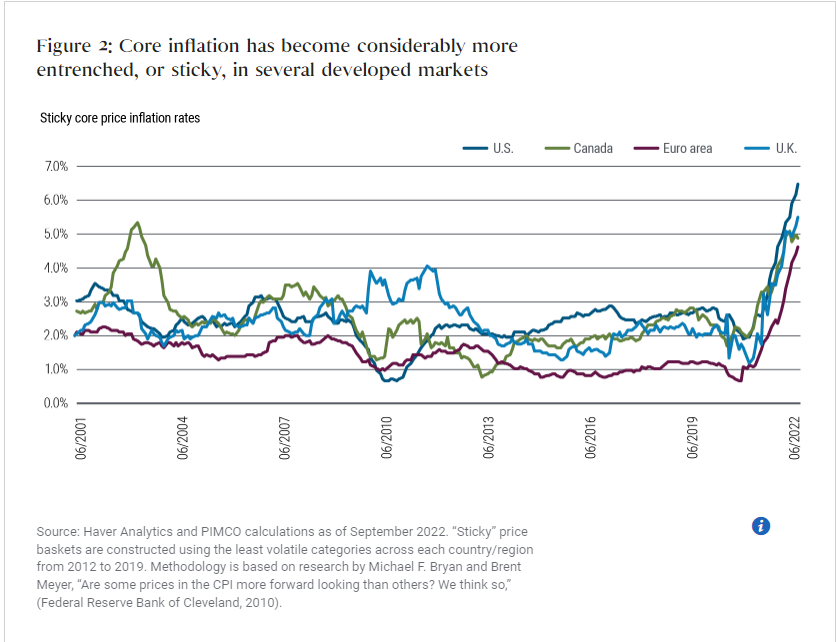

Today the world is a significantly different place; what we thought was transitory, mostly supply chain-related inflation has turned out to be much more persistent. Global interest rates are rising rapidly, the Dollar Index is soaring, and investors are desperately seeking inflation hedges.

The current environment

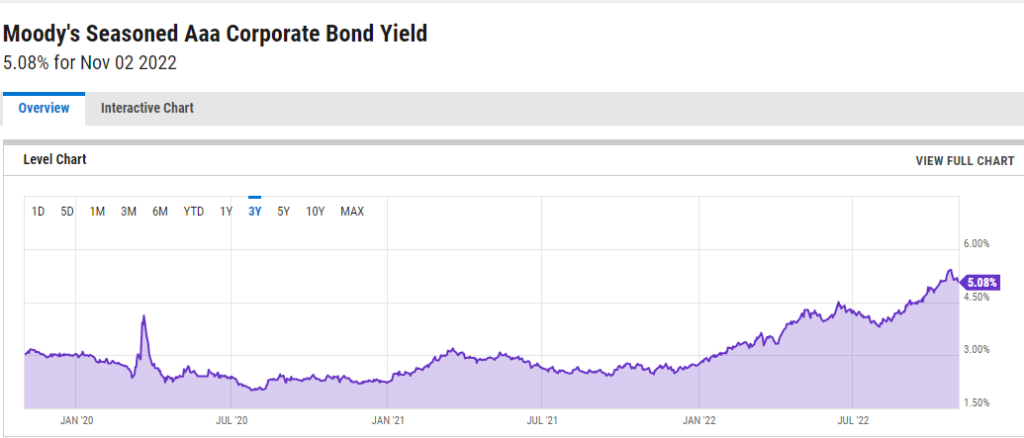

Contrary to common perception, yields on offer in the bond market have improved significantly, with those on 10-year government bonds around 4% and the high-quality corporate credit market closer to 5.50%. The Moody’s Seasoned Aaa Corporate Yield Index is sitting north of 5%.

The two most prevalent topics in markets right now are inflation and rising interest rates. Between July and September, annual price growth in Australia rose to a 32-year high of 7.3%,6 and market analyst forecasts for the cash rate continue to rise. It’s striking to think that it was only last year that the RBA was suggesting rate rises were highly unlikely before 2024.

PIMCO, one of the world’s leading fixed income managers, believes that after many years of accommodative monetary and fiscal policy, recent and future increases in central bank rates, targeting inflation overshoots, will pressure economic growth outcomes and increase the probability of recession in developed markets.

The role of bonds in client portfolios

Over the past few years, with bond yields at record lows, the acronym TINA (there is no alternative) described the rationale for moving clients up the risk curve. Today it is a little different.

In a world where traditionally safe assets like the US 10-year government bond were effectively offering a negative return (after taxes and even the benign inflation of the time), it made sense to pay more for the chance of greater returns in riskier sectors or asset classes. By way of example, using the Discounted Cashflow Model and applying a risk-free rate close to zero for valuing equities, the value of future cashflows was enormous. However, pricing in a rate of 4% today, without even adjusting for equity risk premium or margin-of-safety assumptions, the value falls substantially. As equity markets adjust to higher risk-free rate assumptions and recessionary/inflationary fears continue to increase, investors finally have options outside of TINA.

One of these is bonds. Although short-term price movements may be volatile, barring default, investors can expect to make up any short-term mark-to-market losses when the principal is returned at maturity. In addition to this, historically during periods when the equity market has fallen, bonds have not suffered the same results.

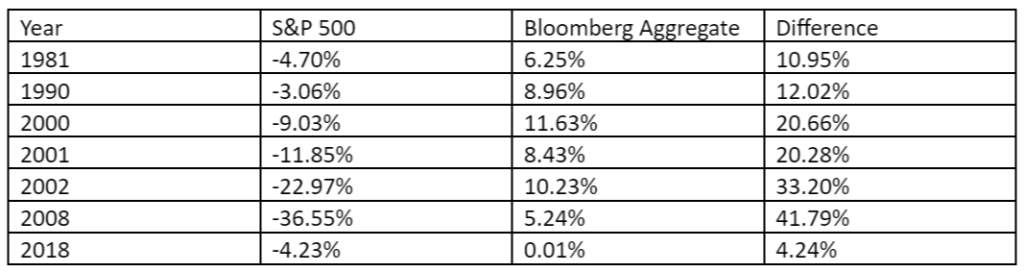

Looking at past years’ performance of the Bloomberg Aggregate US Bond Index vs the S&P 500, you can see how holding a portfolio of bonds would have enabled investors to reduce portfolio volatility during periods of equity market distress. The table below shows relative performance in the years since 1980 when equity markets were negative:

The chart below, courtesy of PIMCO, further highlights the cushioning effect that a diversified portfolio of high-quality bonds can have on an investor’s portfolio. We saw the biggest performance differential during the GFC when the Australian equity market fell 49.3% while Australian bonds delivered a positive return of 16.4%.

Although bonds have not provided equity diversification over the past 12 months, with government bond yields now significantly higher, there is more room for bonds to again play that traditional diversifying role in a portfolio. If the global economy slows or moves into recession, this would be particularly valuable.

When asked about the outlook for bonds and what investors/advisers can expect, Rob Mead, PIMCO’s head of Australia and co-head of Asia-Pacific portfolio management, said: “In preparing their portfolios for a more subdued growth outlook, including the potential for recession, investors should be thinking about moving back to structural targets, whether that be 70-30 or 60-40 in terms of risk versus defensive asset splits. What’s more, with bond yields where they are, the hurdle rate for investing in riskier assets is much higher, especially when you consider that investors can now lock in yields of 6% or more from higher-quality fixed income assets.”

The combination of higher bond yields and potential slowing economic growth means that we are looking at more favourable bond market dynamics than we’ve seen over the past few years.

For advisers looking for further insight into how best to use fixed income and bonds for their clients, particularly those needing reliable yield from their portfolios, the PIMCO insights page is a great research tool.

NOTES

Performance results for certain charts and graphs may be limited by date ranges specified on those charts and graphs; different time periods may produce different results. Charts are provided for illustrative purposes and are not indicative of the past or future performance of any PIMCO product.

The time period referenced throughout the presentation as pre-COVID-19 refers to the period leading up to Q1 2020. Post-COVID-19 refers to a forward-looking time period following market volatility in Q1 2020 and early Q2 2020.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fees, and/or other costs. In addition, references to future results should not be construed as an estimate or promise of results that a client portfolio may achieve.

There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of downturn in the market. No representation is being made that any account, product, or strategy will or is likely to achieve profits, losses, or results similar to those shown.

The material contains statements of opinion and belief. Any views expressed herein are those of PIMCO as of the date indicated, are based on information available to PIMCO as of such date, and are subject to change, without notice, based on market and other conditions. No representation is made or assurance given that such views are correct. PIMCO has no duty or obligation to update the information contained herein.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

There can be no guarantee that the trends above will continue. Statements concerning financial market trends are based on current market conditions, which will fluctuate.

The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. You should consult your tax or legal advisor regarding such matters. Please contact your account manager for further information.

Optimized and optimal portfolios described may not be suitable for all investors and each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Past performance is not a guarantee or a reliable indicator of future results.

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Inflation-linked bonds (ILBs) issued by a government are fixed income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Treasury Inflation-Protected Securities (TIPS) are ILBs issued by the U.S. government. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be appropriate for all investors. The value of real estate and portfolios that invest in real estate may fluctuate due to: losses from casualty or condemnation, changes in local and general economic conditions, supply and demand, interest rates, property tax rates, regulatory limitations on rents, zoning laws, and operating expenses. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee, there is no assurance that private guarantors will meet their obligations. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Private credit and equity strategies involve a high degree of risk and prospective investors are advised that these strategies are appropriate only for persons of adequate financial means who have no need for liquidity with respect to their investment and who can bear the economic risk, including the possible complete loss, of their investment. Management risk is the risk that the investment techniques and risk analyses applied by PIMCO will not produce the desired results, and that certain policies or developments may affect the investment techniques available to PIMCO in connection with managing the strategy.