Pricing of advice is a subject that is frequently on the minds of financial advisers and a hot topic in the XY community forum. And rightfully so, given its importance to the sustainability of advice businesses.

With the final report from the Quality of Advice Review (QOAR) due to be handed down in less than six weeks, 2023 will no doubt see many Advisers revisiting processes, reviewing cost to serve and re-evaluating advice and service pricing.

Cost to serve plays a fundamental role in a business’s profitability and should function as a basis for determining advice and service fees. CEO of DASH Technology Group, Andrew Whelan, observes that “When an adviser is able to accurately articulate their cost to serve, they are able to price their advice in a way which ensures their business is sustainable.”

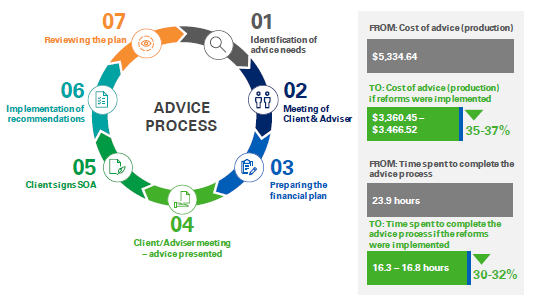

Recent research by KPMG¹, commissioned by the Financial Services Council, has found that the average cost of providing financial advice (approximately $5,335) is greater than the average fee charged to consumers (approximately $3,660) for the advice.

Further, they found that the successful adoption of the FSC proposed advice reforms could result in between 37%-39% cost savings and save advisers a third of the time they currently spend in the advice process.

Source: Cost Profile of Australia’s Financial Advice Industry Research Paper. KPMG 2021

In the QOAR proposal paper, Michelle Levy stated that she believed changes should be made to the regulatory framework applying to financial advice to improve the accessibility and affordability of financial advice and that the changes need to be substantial if financial advice is going to be widely accessible and truly affordable. While the outcomes of QOAR are yet to be known, it should be expected that some of the pressures faced by Advisers under the current framework will be eased.

This represents a ripe occasion for Advisers to revisit their current advice and ongoing service processes and not only capitalise on the changes but also use this as an opportunity to further streamline and create efficiencies within their business.

While it might seem fun and exciting to get lost in ideas and innovations, it is important to make sure you have built the right foundations.

Andrew goes on to state, “after seeing thousands of advisers attempt to implement different practices in different ways, we’ve developed an innovation implementation framework (IIF).”

“The IIF suggests that advisers should first, work on scrutinising their existing business processes to pinpoint areas of inefficiency and duplication. By identifying and reducing staff time in repetitive tasks that rarely add client value, practices can free up the resources required to invest in big-ticket items that will start to move the needles.

How to approach process improvement

While there is no shortage of theories and methodologies that can be applied when approaching process and continuous improvement, there are two popular theories that might be worthwhile considering if you choose to undertake a review of your business processes –

1. The Pareto Principle

The Pareto Principle focuses on the observation of the imbalance between causes and consequences or inputs and outputs.

More commonly known as the 80/20 rule, it is the theory that typically, 80% of outcomes come from 20% of inputs.

This concept was developed based on the works of Italian economist Vilfredo Pareto, who originally observed that 80% of the land in Italy was owned by 20% of the population. Pareto extended his research to a number of other countries with similar findings, and this phenomenon has continued to be observed across a wide range of datasets since.

An example of when this that has been noted in businesses is where 80% of revenue is being generated from 20% of clients.

Some ways to apply The Pareto Principle when approaching process improvement include:

- Identifying the clients which are most profitable (i.e. the 20% of clients delivering 80% of revenue) and tailoring client acquisition strategies and service offerings to target this segment.

- Identifying which inefficiencies, if solved, are going to provide the greatest outcomes. An important factor to be considered here is the frequency of the task/process, i.e. finding a five-minute efficiency on a task that is completed 100 times in a year outweighs a 30-minute efficiency on a task that is only completed ten times a year.

The Pareto Principle effectively involves prioritising efforts to achieve maximum results for the said effort.

2. The Law of Marginal Gains

As performance director of the British Cycling team, Sir David Brailsford applied ‘The Law of Marginal Gains’ to take the team from one gold medal and no winners of the Tour de France in over 100 years, to winning 60% of gold medals at the 2008 Olympics, setting nine Olympic records and seven world records at the 2012 Olympics and captured multiple Tour de France victories, all within the space of 10 years. And the successes continued.

His idea was that ‘if you broke down everything you could think of that goes into riding a bike, then improve it by 1%, you will get a significant increase when you put them all together.’²

This concept also forms the basis of the book by James Clear, ‘Atomic Habits’ and how the compounding of getting 1% better each day achieves significant results.

Some ways to apply The Law of Marginal Gains when approaching process improvement include:

- Process – Similar to the British Cycling team, breaking down and identifying 1% improvements in any and all areas across your existing advice and service processes.

- Continuous Improvement – Adopting a continuous improvement mindset and dedication to making small improvements on a regular basis.

The Law of Marginal Gains effectively involves making any and all changes that compound to achieve significant results.

Whichever way you decide to tackle reviewing your business processes, maintaining a growth mindset when approaching process development helps with facing and overcoming challenges through iteration and pivoting when required.

Once the foundations have been built and efficient and effective processes have been developed, technology can then be leveraged to further enhance operation efficiency and deliver an engaging and quality customer experience.

“These steps are key to achieving cost efficiency, and subsequently a cost to serve that allows for feasible advice pricing for clients and sustainable, profitable businesses for advisers,” Andrew Whelan states.

Reach out to the team at DASH for more information on diagnosing your cost to serve, creating efficiencies in the advice process and how you can leverage technology to streamline and enhance your customer experience.

¹Cost Profile of Australia’s Financial Advice Industry’ Research Paper, KPMG 2021

²Matt Slater, “Olympics Cycling: Marginal Gains Underpin Team GB dominance”, BBC