Delivering Cost-Effective advice with an Entrepreneurial Mindset

Brought to you by HUB24. How advice entrpreneurs are delivering cost-effective advice to more Australians

In this special production

Introduction

Over the last few years, we’ve seen unprecedented change across the financial advice industry and while licensees are innovating and adapting, we’re also seeing a new breed of ‘advice entrepreneurs’ – advisers who are empowered by solving challenges that drive better client outcomes and business efficiencies.

This paper brings together HUB24 Limited and XY Adviser Pty Ltd (ACN 45 606 168 781) (XY Adviser), the professional network for financial advisers, to discuss the advice entrepreneur and the ways they are innovating within their business.

We speak to advisers across the industry to find out what they are doing differently and how they are creating positive change to make advice more efficient, more client centric and more accessible.

The Evolving Advice Landscape

Recent Industry Challenges

Over the last few years, the Australian financial advice landscape has experienced an unprecedented pace of change.

Since 2015, there has been a steady migration of advisers from large, institutionally owned practices to self-licensed or small-to-medium practices. This rate of migration accelerated rapidly in the wake of the Hayne Royal Commission as the banks exited advice altogether, ending the domination of the ‘Big Six’.

To illustrate, 39% of all advisers practising in 2018 were licensed to an AFSL with more than 500 advisers. By the end of 2020, this figure had shrunk to just 27%.1 Also by 2020, 61% of AFSLs were in the category of 1–10 advisers, with around 20% of all advisers licensed by an entity of that size.2

The regulatory framework for financial advice also continues to evolve rapidly. Advisers have had to contend with a continual slew of new regulations including Design and Distribution Obligations (DDO), breach reporting, and fee disclosures and permissions, to name a few. Meanwhile, the new professional development requirements have proved challenging for many, while increasing the cost burden for most.

In response to these challenges, and regulator-enforced remuneration changes, advisers have been leaving the industry in droves. In just a few years, the advice profession has shrunk from well over 25,000 advisers to just under 20,000, and this number is expected to drop even further.3

But despite the challenges facing the industry, a new breed of advice innovators are finding many reasons to be optimistic.

01 ASIC financial advice register, 31 December 2020.

02 AR Data, Adviser Musical Chairs Report, Q4 2020.

03 Rainmaker Information, Financial Adviser Report, 2021.

New Dynamics Setting the Stage

Australia’s financial advice industry has plenty to be optimistic about. Most of all, it’s important to remember that the demand for advice remains strong – and is even increasing.

According to 2020 research by Investment Trends, around 2.6 million non-advised Australians said they intend to seek help from a financial adviser in the next two years. This was a substantial increase over the 2.1 million Australians with that intention in 2019, and a doubling of the 1.3 million identified in 2015.4

Similarly, the pool of Australians who actively invest – and who represent a strong pipeline of advice demand – is growing faster than ever.

It’s estimated that around 46% of Australians now hold investments5 other than their primary residence or superannuation, with 6.6 million Australians owning listed investments. Of those, more than 1.25 million are described as ‘active’ online investors, and over 400,000 made their first sharemarket trade in 2020.6 There are also just over 600,000 SMSFs currently registered with the ATO.7

Much of this growth is being driven by younger investors. According to Canstar research, around 42% of Gen Z Australians (aged 18 to 25) and 44% of Millennials (aged 26 to 40) invested in the sharemarket for the first time during 2020.8

At the same time, the mindset of many advisers is changing. Advisers that were previously part of groups that were risk averse or lacked investment in new technologies are enjoying newfound freedoms. Without the burden of legacy systems, they’re able to think outside the square to build contemporary business models that are agile and responsive to consumer needs.

04 T Sharpe, ‘Advice demand doubles in 5 years’, Professional Planner, 17 September 2020.

05 ASX, Australian Investor Study 2020.

06 A Vickovich, ‘First-time traders hit 400,000 during pandemic’, Australian Financial Review, 11 March 2021.

07 Australian Tax Office, Self-Managed Super Fund Quarterly Statistical Report, December 2021.

08 A Vickovich, ‘Why more than 40pc of Millennials and Gen Z bought shares in 2020’, Australian Financial Review, 22 December 2020.

Emerging Client Trends

Central to entrepreneurial success is the ability to understand and listen to the market. This makes it possible to anticipate and take advantage of opportunities based on emerging trends.

Among the many disruptive forces shaping the financial landscape in recent times has been the proliferation of app-based trading platforms. These often feature gamification, fractionalisation and offer affordable pricing.

Australian-born trading platform Stake, which allows zero-fee brokerage access to US shares, has amassed well over 300,000 customers since launching in 20179. Zip Pay and Afterpay backed platform Superhero signed its 100,000th customer in July 2021 after just 11 months in operation.10

At the same time, we’ve seen rapid growth in financial and investing ‘tips’ on social media. The ‘finfluencer’ phenomenon is playing out on social media channels where some videos using hashtags like #stocktok and #crypto have garnered millions – or even billions – of views. Younger consumers are attracted to finfluencers because of how they explain complex financial concepts in simple, engaging ways.

A third trend skewed towards younger investors is the growing demand for investments that have a positive environmental or social impact. According to 2020 research by the Responsible Investments Association of Australia (RIAA), 80% of Australians want to choose environmentally friendly investments, while 64% believe societal issues are a key consideration for how their money is invested. The same survey found that 9 in 10 Australians believe it’s important that their financial adviser provides responsible or ethical options.11

The financial outlook for Millennials and Generation Z is bright. As the most educated generations in history, many younger adults are now in highly paid professional roles. They’re also on the cusp of benefitting from the largest intergenerational wealth transfer in history, which will see an estimated $3.5 trillion handed down to them over the next two decades.12

Even so, these generations have been ignored by many established advice practices, while being pigeonholed as not needing, or unwilling to pay for, financial advice. However, advisers who are listening to the advice needs of younger Australians are positioning their businesses for a sustainable future.

09 J Derwin, ‘The investor boom has tripled Stake’s users in 12 months’, Business Insider, 22 February 2021..

10 ‘Superhero rockets to 100,000 customers in less than a year,’ Australian Fintech, 11 August 2021.

11 RIAA, From Value to Riches, 2020

12 M Brimble et al, Intergenerational Wealth Transfer: The Opportunity of Gen X & Y in Australia, Griffith University, 2017.

The Roadmap to Innovation

Innovation in advice isn’t new. Over the years we’ve seen a variety of innovative changes taking shape across different elements of the advice value chain.

Much of this innovation has focused on driving down costs using technology, client segmentation and outsourcing. We’ve seen practices step up their client engagement game too, with online fact finds, videos, podcasts, mobile apps and social media becoming common features of the advice landscape.

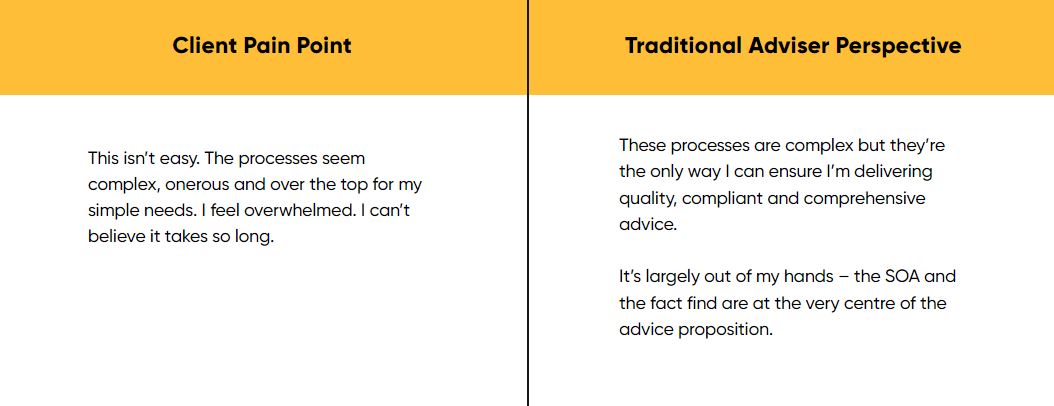

But as worthy as these types of innovations are, they may have been driven from a licensee perspective. They’ve also focused primarily on removing pain points for advice practices, rather than for advice clients.

Many of these innovations have been developed within a framework that keeps the SOA and its compliance requirements at the centre like some fixed, immovable object. Rather than getting to the root of the problem, the industry has been tinkering at the edges to try and make weighty advice documents less off-putting. But the answer doesn’t lie in simply adding some pictures and colour to an SOA.

Enter the new breed of advice entrepreneur. What makes these advisers different is that they’re empowered by their newfound thinking and an appetite for taking calculated risks. Because they’re starting with a blank sheet of paper, they can identify the real pain points of their clients and engineer solutions that will solve them.

For these advice entrepreneurs, their ‘north star’ is the client, not the SOA. This enables them to apply a design-thinking approach within their business. This inspires innovation and new ways of looking at how to deliver advice in a process and format that matches the needs and preferences of their clients.

HUB24 and XY Adviser, the professional network for financial advisers, spoke to a range of entrepreneurial advisers across the industry to find out what they are doing differently – how they are innovating within their business to make advice more client centric and more accessible.

Advice Entrepreneurship in Action

To understand the tangible benefits of shifting focus from the SOA to the client, let’s consider how perspectives differ across several key facets of advice – namely, the structure, process, price and language of advice.

We’ll also look at how some advice entrepreneurs are finding innovative ways to overcome typical hurdles in these areas.

Structure

Modular Advice: Giving Clients What They Want

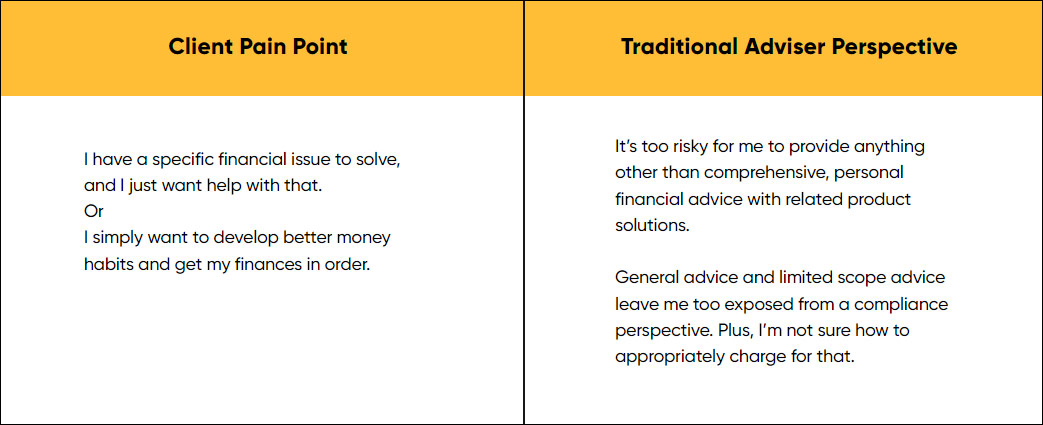

The demand for modular or limited advice is strong. Whether it’s for younger clients with fewer complex problems to solve, or DIY investors who need guidance or specialist help from time to time, there’s a large and growing group of clients who would happily pay for expert help, if they could only access it in a modular form. This is a client pain point.

Despite ASIC virtually pleading with advisers to offer more options for clients seeking personal guidance on one or two topics, most established practices seem reluctant to go down this path13. There are likely two reasons for this:

- They believe anything other than comprehensive personal financial advice exposes them to an increased risk of non-compliance (a view exacerbated by a perceived lack of consistency between RG 244 and Standard 6 of the Code of Ethics)

- They haven’t found a way to appropriately price such an offering

Fortunately, however, we’re seeing newer advice businesses take a much more market-driven approach, offering clients the opportunity to access expert advice on specific topics. These topics can often be explored in discrete modules with their own challenges and solutions, such as:

- Debt management

- Cashflow management and budgeting

- Insurance

- Superannuation

- Home buying (saving and borrowing)

- Investing

One advice business that offers advice in this way is Finnacle (Finnacle Solutions Pty Ltd ABN 47 621 162 67

Case Study: Market Listening

Prashant Nagarajan and his business partner had a singular vision when starting their business, Finnacle, which was to make advice affordable and accessible to young Australians.

Every aspect of the business has been designed to accommodate this vision. Before they even opened their doors to clients (or ‘members’ as they call them), the Finnacle team had conducted three months’ of extensive market research – using paid surveys and client focus groups – to listen to what this target market wanted. This ‘proof of concept’ stage proved crucial in the creation of a sustainable offering for an under-served market.

The result is an online-only practice through which members can access personal advice on demand in a progressive, modular fashion.

Members subscribe to either an Essentials package for $199 per month, or the Advanced package for $299 per month, according to the number of financial goals they’re looking to address. Over the course of a year, members will access modules progressively, with each module broken down into steps including situational diagnosis, plans of action and implementation. Each module has its own needs analysis, allowing targeted solutions to be delivered across a broad range of typical client situations. As an example, saving for a home deposit is one module, with a later module devoted to applying for a first mortgage.

Recognising the ceiling on what their target clients were willing and able to pay for advice, Finnacle set about building a model that could support that level of pricing. Limiting face-to-face engagement strictly to Zoom calls has substantially minimised overheads, and their just-in-time approach to administrative resourcing (a concept borrowed from the motor vehicle industry) sees them outsource administrative work to a team of virtual assistants. This allows support to be dialled up or down – and paid for – according to need.

What differentiates the model further is its focus on step-by-step financial management.

“Rather than the entire advice relationship being centred on one upfront discovery and SOA process, Finnacle members effectively tackle their issues one step at a time, which helps them learn, helps them build confidence and helps them build trust in the value of advice,” said Nagarajan.

Finnacle is already reaping the rewards of their approach, with the team tracking currently towards 75–100% revenue growth year on year.

Word of mouth has been a driving force behind this growth. For every active member of the program, they average three referrals a year. Of those three, an average of two a year convert to paying members themselves.

According to Nagarajan, his licensee has also been extremely supportive, recognising the compliance rigour inherent in the individual steps in each module.

“From their perspective, the underlying principles of quality, compliant advice are all there, it’s just old wine in a new bottle”.

13 T Sharpe, ‘ASIC wants to know what’s holding up ‘bite-sized’ advice’, Professional Planner, 14 October 2020.

Process

Innovation in Compliance

If any aspects of the advice value chain are ripe for a rethink, they are risk management and compliance.

Since the 2014 FOFA reforms, advisers have seen an exponential increase in legislation, regulation and compliance requirements – and associated costs. To illustrate, advisers and licensees are now subject to approximately 28 different laws, codes of practice and regulatory guides.

This burden has increased further since the introduction of new laws in the wake of the Hayne Royal Commission, driving the cost of advice up by 28% between 2019 and 2021. 14

The rising cost of compliance is arguably the biggest single sustainability challenge facing the advice profession, with every increase making advice more expensive to provide and putting it further out of the reach of everyday Australians.

But it’s not just the cost of compliance that’s problematic for the clients and potential clients of advisers.

The processes, documentation and language of compliance are, for most clients, impenetrable and although their purpose is to protect consumers, they often only succeed in building a barrier to the client’s engagement with, and understanding of, advice. This, in turn, makes them less willing to pay for advice.

Innovation we’ve seen in this area has typically followed two paths:

- A technological path (RegTech), focused on efficiency-led cost savings

- A structural or process-led path whereby the adviser reimagines the role of compliance in the advice offering and develops new methods for achieving their compliance objective

Case Study: Reimagining Advice Processes

An alternative path to innovation in compliance is to focus more on the client, rather than the SOA.

A recent industry panel discussion concluded that SOAs have become “big, alienating and defensive documents that are more likely to increase the anxiety of consumers who are accessing advice for the first time”.15

According to Tim Henry of Aspire Planning (Aspire Financial & Retirement Planning PTY LTD ABN 63 123 748 603), a process whereby the SOA is put forward as the embodiment of the advice proposition is problematic on two levels:

- SOAs are generally hard to understand

- They don’t reflect how clients see advice

Henry believes clients see advice as the ‘co-creation of strategies designed to solve particular problems’ rather than simply ‘recommending and implementing’ solutions.

For this reason, he has redesigned his own processes around a document he calls the Strategy and Options paper. This paper documents the ‘co-creation journey’ with the client, during which the client has been actively involved in choosing from the options presented to them.

While Henry still produces an SOA – as dictated by regulatory requirements – he doesn’t make this the central focus. Instead, he directs most of the client’s attention onto the Strategy and Options paper, which he presents 2-3 weeks prior to a ‘Recommend and Implement’ meeting. The SOA is thus relegated to the status of necessary compliance documentation, rather than being the centrepiece of his advice.

Henry sees two benefits in his approach:

- The client is better able to understand the advice and they feel they’ve played a more active role in its direction, which means their consent is genuinely more informed

- Clients want to pay for action, not the production of a 100-page document. Defining the advice proposition in terms of providing a framework for ideas and concepts prior to recommendations and steps for implementation represents a more tangible outcome in the eyes of the client, which translates into a greater willingness to pay fees

“The new process has significantly improved the quality of our annual client meetings, and hence our compliance,” Henry said. “The main reason for this is that the structured modules ensure we consistently discuss relevant areas of the client’s circumstances.

Like Finnacle, Aspire Planning also offers advice on a modular basis. This approach has the additional compliance benefit of making it easier to map individual modules to the sole-purpose test.

“The process of ascertaining what fee amount is deductible from the client’s superannuation is thus much easier and more transparent”, says Henry.

The results of this approach speak for themselves. Aspire has doubled its number of new clients in the last year, most of whom have been referrals from existing clients.

Another benefit of the modular approach has been a significant increase in existing clients requesting additional advice. “Most existing clients held super and insurance with us; however, we are getting a big uptake on estate planning and investment options,” Henry said. “Our estate planning revenue is up 250%, and next year we will have more revenue in estate planning than insurance.”

“We have also written significantly more investment advice with existing clients using their personal money – like investment bonds for kids and grandkids or commencing an investment for themselves. These were things that we were previously missing out on, which we’re attaching to our existing service.”

13 Financial Services Council, Affordable and Accessible Advice green paper, 2021.

14 J Goh, ‘SOAs are alienating clients’, Money Management, 31 March 2021.

Price

Understanding Your Business and Your Clients

The focus on advice practice financials has intensified in recent years as increasing compliance costs, the ceasing of grandfathered remuneration and continuing consumer concerns around advice fees have created a margin squeeze. This has left some practices on the brink.

But despite the challenges of the current environment, many innovative practices are thriving, largely because they’ve achieved a more sustainable match between their cost to serve and the way they price their offering.

To truly understand the cost of serving their clients, advisers need to meticulously break down the advice process into granular steps. This includes measuring the time taken to perform each step and the cost of the resource allocated to it. Armed with this information, advisers then have several levers they can pull, including:

- Changing the resource allocation (for example, by automating a process, allocating it to a junior team member or outsourcing)

- Changing the process (for example, by simplifying steps or removing them altogether)Adjusting the price of their offering

- The individual circumstances of the business will determine which course of action is most appropriate. For instance, newer businesses are more likely to have greater flexibility around changing their external pricing than established businesses. Similarly, smaller practices may find process changes easier to implement

To price advice services appropriately, the adviser also needs to clearly understand the client segment they’re targeting. Advice clients vary widely across many attributes, including their circumstances, financial objectives, engagement preferences and level of sophistication, which means a one-size-fits-all approach to pricing is unlikely to be the best option.

In fact, research into Australian advice practices has shown that those with an effective client segmentation model are, on average, 148% more profitable than their non-segmenting peers.16

For a new advice business, tightly defining a target audience makes market research and testing more meaningful. It also enables offerings to be developed that are more focused, more tailored to the specific needs of those segments and more suitably priced.

For an existing practice, understanding client economics at a segmented level also informs how the business can strike the optimal balance between resources, fees and services. In turn, this can help to prioritise and target innovation efforts.

Tailoring engagement activities to match the preferences of different segments can also help take client relationships to the next level. Segmentation delivers further benefits in acquisition, retention, and communications too, including:

- The scale benefits of conducting these activities at the segment level

- The ability to focus on clients who are more financially viable, or to reallocate resources away from over-serviced scenarios

- Improved ROI on marketing activities through more targeted communications tailored to the decision drivers and channel preferences of target segments

Case Study: The Diverse Needs and Expectations of High-Net-Wealth (HNW) Clients

The HNW segment is an increasingly attractive target for financial advisers, and one which can be both intellectually and financially rewarding. It’s also big, with Investment Trends estimating in 2021 that the HNW advice market comprises around 485,000 individuals who invest more than $2 trillion AUD.17

While the definition of HNW differs depending on who you talk to, one certainty is that this cohort is far from homogeneous. HNW clients vary greatly in terms of their behaviours, motivations and financial sophistication. In fact, the only universal truth for this segment may be that a ‘one size fits all’ approach is doomed to fail.

As Brendon Vade, of HNW specialists Lorica Partners, (Lorica Partners PTY Limited ABN 26 082 828 948) puts it, “Relying on stereotypes about this group can be dangerous. The notion that they are all financially sophisticated is just plain wrong. So too is the assumption that they all want to be educated about detailed financial issues.”

One reason for the attractiveness of this segment is that they have a larger capacity to pay fees, although Vade notes that the type of arrangement that best suits their circumstances will vary, from a flat fee retainer, through to a percentage of assets or a mix of both.

Rather than adopting a one-size-fits-all approach, Lorica Partners effectively subsegments HNW clients according to their money beliefs and behaviours. Using a model developed by American private wealth guru Russ Alan Prince, Vade classifies each of his clients into one of nine money personalities. The value of this approach is that it allows him to tailor his engagement and communication approach to suit their needs.

“The three types we see most of are the ‘family stewards,’ ‘phobics’ and the ‘independents’,” Vade says.

“The family stewards are primarily focused on making sure their wealth positively affects future generations. The ‘phobics’ are those who feel burdened by making financial decisions. With them the threshold for trust is high and so it takes a while, but after you reach that threshold, they trust you implicitly, and it generally becomes a very deep relationship. The ‘independents’ see money as an enabler, and they don’t want to feel boxed in by documented goals.”

According to Vade, HNW clients also vary greatly in their desire to be hands on or hands off. However, he notes that one characteristic most HNW clients seem to share is that once the adviser has gained the client’s trust, the client looks to them to be the financial facilitator, or project manager, at the centre of all finance-related matters. This involves working in partnership with the client’s lawyer, accountant, banker, mortgage broker and other specialists.

It’s for this reason that Vade believes advisers in this space need to be equipped to have very fluent conversations on matters such as estate planning and accounting, and even philanthropy.

“They don’t want you to just blindly outsource these areas, they expect you to play a role,” he says. “For example, we get quite involved with the estate planning discovery process and then we sit in on meetings between the client and lawyer.”

“Legacy is another issue that’s more important for these clients than others. Many of them, especially the older clients, are investing not for themselves, but for their children and future generations, which gives them a much longer investment horizon, and is why many of them have portfolios that would be considered too aggressive for everyday retiree clients.”

16 ‘Five key drivers of practice profitability’, Money Management, 19 June 2017.

17 ‘The rise of high-net-worth advice validators’, IFA, 12 April 2021.

Language

Cutting Through the Jargon

In recent years, ‘finfluencers’ have found a wide audience on social media channels such as TikTok, YouTube, Facebook and Instagram where they offer a wide range of finance and investment tips. As they grow in popularity, ASIC is now focussing on the discussion of financial products and services online.

The popularity of videos and other posts on these topics is indeed phenomenal. As of April 2022, for instance, the hashtag #FinTok has attracted around 1 billion video views on Tiktok globally, while #stocktok has over 2 billion, #cryptocurrency over 5 billion and #crypto over 14 billion.

Closer to home, Sydney-based finfluencer Queenie Tan’s posts have gained her more than 36,000 followers on Instagram. Her TikTok videos explaining Australian tax rules for cryptocurrency capital gains and offering tips for first home buyers have each been viewed more than 400,000 times, and both last less than a minute.

Notwithstanding issues around legality, younger consumers are attracted to finfluencers because they use this group’s preferred social channels. And because finfluencers are generally young themselves, they talk the same easy-to-understand language and can break down complex topics into bite-sized chunks that are both digestible and relatable.

While many advisers think of Millennials and Gen Zeros as the clients of the future, these cohorts clearly have a desire to improve their financial knowledge now, so they can put the foundations in place to build a secure future.

And there’s a lesson here for all advisers.

Case Study: The Power of Social Communities

Recognising the appetite of younger clients for financial education, and the power of online communities, Adele Martin of Firefly Wealth (Firefly Wealth Pty Ltd, ABN 30 818 437 055) has built an offering built around education and general advice only called My Money Buddy. Where clients need personal advice, she refers them on.

Described by the Australian Financial Review as “the F45 equivalent for financial advice, charting a middle course between the DIY and the premium route of one-on-one”18, My Money Buddy is a subscription-based program of tools, support, and community.

This approach has proven especially popular with younger Australians.

“While many people talk about the younger generations as the clients of the future, what we are seeing is a significant and widespread appetite for education on financial matters right now,” Martin says.

Delivered live online (with recordings available on demand), the My Money Buddy program comprises six modules delivered over a six-week period:

- Defining goals and success

- Savings systems and spending plan design

- Superannuation

- Pros and cons of shares and property

- Debt

- Money psychology and money habits

Among the practical tools Martin offers through the program are a series of negotiation scripts, which her clients can use to negotiate everything from a salary increase (one of her most popular) to a cheaper power bill.

The community of program participants is also central to its success. Within a closed Facebook group, members share their goals and success stories. So powerful are her negotiation scripts and savings tips that most members usually achieve significant savings in a short period of time.

“This gives them the enthusiasm and momentum to keep going and many go on to seek one on one advice”, says Martin.

Martin also offers an online personal money coaching program as well as a free podcast with its own community: The Savings Squad.

Using the Kajabi e-learning platform, Martin finds that online and video-based resources are not only more convenient and more aligned to the way younger clients want to engage, but they also bring significant efficiency savings, allowing her to sustainably offer her services at an affordable price. Her My Money Buddy program, for example, costs participants as little as $1,500.

“My programs are getting a younger generation ‘advice ready’, allowing them to gain confidence and trust in the process and outcomes of expert help,” says Martin. “This improves the client onboarding experience as clients can set their own goals, create a budget, and learn about concepts such as risk profiling at a time convenient to them. Instead of an adviser explaining everything over and over, a concept like this could be used in a traditional advice business to save advisers time and give younger clients the experience they’re after.”

Martin says she’s been signing between one and four clients a week to the program – even while on maternity leave and during COVID lockdowns, and with very little marketing. And while $1,500 per participant is well below the $5,000 to $7,000 she would charge clients for comprehensive advice; her overheads are far reduced for things like administration and paraplanning.

“At its scaled model, this is profitable,” she said.

Not only does the My Money Buddy program support clients in their early stages of the advice process, it has also had benefited Martin herself after the industry challenges of recent years.

“I think what’s it done more than anything is let me breathe and enjoy advice again,” Martin said.

18 ‘How the virus inspired the F45 of financial advice’, Australian Financial Review, 9 April 2020.

Where to From Here?

Innovation isn’t new but the way these advice entrepreneurs look at common challenges provides fresh perspectives on the way they do business. By shifting their focus to the client and approaching key facets of advice in innovative ways, they are making their business more efficient while driving better client outcomes.

At HUB24, we believe in the value of advice and are committed to innovation that creates better outcomes for the industry. By leveraging data and technology, and collaborating with industry participants, we are helping to solve key advice challenges and make advice accessible to more Australians.

Disclaimer – Important Information

This document has been issued jointly by HUB24 Custodial Services Ltd (ABN 94 073 633 664, AFSL 239 122 (HUB24) and XY Adviser Pty Ltd (ACN 45 606 168 781) (XY Adviser) and is current at the date of issue. HUB24 is the operator of HUB24 Invest (an investor directed portfolio service), promoter and service provider of HUB24 Super which is a regulated superannuation fund. The trustee and issuer of interests in HUB24 Super is HTFS Nominees Pty Limited (ABN 78 000 880 553, AFSL 232500, RSE L0003216).

XY Adviser operates a professional network for financial advisers.

The information in this document is intended to be general information only and not financial product advice. The views expressed in this document by persons who are not representatives of either HUB24 or XY Adviser are their own, and do not necessarily represent HUB24 of XY Adviser’s views. Neither HUB24 nor XY Adviser:

- Have validated or verified the views expressed in this paper.

- Makes any representation as to the completeness or reliability of the material in this paper.

- Accepts any liability for loss attributable to use of this paper, including liability for any statements which are incorrect or misleading.

Readers should not rely on the information in this paper and should undertake their own investigations and use their own commercial judgment. This document must not be copied or reproduced without the prior written consent of HUB24. © HUB24