Directing the matrix

Brought to you by HUB24. Meeting the advice needs of high net worth clients

In this special production

Foreword

The number of high net worth (HNW) investors in Australia continues to grow, creating tremendous opportunities for financial advisers to provide services and support.

In this paper. we garner insights from leading advisers servicing Australia’s wealthiest individuals, families and businesses.

Go behind the scenes with advisers who have made it their mission to attract and retain HNW clients, and have built some incredibly successful businesses along the way.

Ensombl and HUB24 would like to thank the following contributors to this paper:

Introduction

We live in a world where demographic shifts and mega trends are taking shape in technology, geopolitics and the world economy. One of the largest opportunities emerging for financial advisers across Australia is the rise in the number of HNW investors.

In Australia, the HNW segment is sizeable and growing, and in 2023, is estimated by Investment Trends to comprise around 635,000 individuals, investing more than $2.98 trillion AUD in aggregate. Of the new entrants to the HNW segment, 66% are unadvised, representing a tremendous opportunity for financial advisers. The growth of the HNW segment can primarily be attributed to profits from direct shares and property investments1.

HNW investors have been widely researched and widely stereotyped. As noted above, they also represent a growing segment amongst the wider Australian population, oftentimes with complex financial advice needs that require professional advice. There are many myths about this segment and strategies to enter the market based on those myths may not be effective or successful.

The secret to success with HNW clients is determined less by your skill as an investment expert and more by your ability to connect HNW clients to the very best experts in any field. The leading advisers in this space act not as oracles who ‘know it all’ but as the directors of a matrix of providers and experts who all work together to support the needs of HNW clients.

Section One: Understanding HNW Investors

1.1 Who are HNW investors?

According to Capgemini’s 2023 World Wealth Report, there are around 21.7 million HNW investors globally (with net investable assets of at least $1 million USD). Of these investors, approximately 220,000 are classified as ultra-high net worth (UHNW) individuals (with net investable assets in excess of $30 million USD)2.

In Australia, the HNW segment in 2023 is estimated by Investment Trends to comprise around 635,000 individuals, investing more than $2.98 trillion AUD in aggregate.

Notwithstanding the widely accepted formal definition in Australia as being at least $1 million AUD net investable assets, many advisers specialising in this segment believe the threshold at which client needs become more complex – and a more bespoke service offering becomes more critical – is in reality much higher. Arguably, today the $1 million AUD in net investable assets is more akin to being affluent rather than HNW. For the purposes of this paper, we’ll use HNW to broadly encompass HNW and UHNW, unless otherwise specified.

Adviser Insights – True HNW

“In simple terms, high net worth clients are those who have enough wealth to have themselves sorted and their children sorted. These days it takes a lot more than a million dollars of investable assets to be in that position. To warrant taking them down a different investment journey to a normal retail client, you are probably talking more in terms of $10 million and above.” Stephen Furness

1.2 The changing face of HNW clients

As tempting as it is to think of HNW investors as one homogeneous group – that is stereotypically largely male, middle-aged, and professional – in reality, today’s HNW client is just as likely to be a female entrepreneur or a young IT whiz.

While various studies suggest the average age of a HNW investor is around 60, younger Australians are a growing part of the segment. Indeed, the under-40s are already estimated to make up 14% of Australia’s UHNW investors, with net assets exceeding $30 million USD.4

The rising economic power of female investors is also a standout trend around the world and is redefining the way firms are approaching this segment.

Global analysis reveals that females hold around 40% of all US wealth and a third of Australian wealth. But they are growing their wealth around 40% faster than males, and are expected to inherit 70% of global wealth over the next two generations. By 2030, females are projected to manage twothirds of all household wealth.5

Adviser Insights – How HNW clients acquire their wealth

“A lot of clients in this segment are self-made, entrepreneurs and business owners. Our youngest client is in his 30s. He ran a tech start-up and sold it to a big overseas company, so experienced a multi-million-dollar liquidity event.” Mark Nagle

“Our clients include people who have built fantastically successful businesses or professional and even sporting careers. The majority would absolutely be self-made.” Stephen Furness

The family office

One notable development in the UHNW sector is the family office. Long popular in the US, they have increasingly found their place in Australia over the last 20 years, and it is now common for advisers serving the UHNW segment to offer a Family Office service.

In simple terms, a family office – sometimes known as a Private Office, is a family-owned and controlled structure that manages private wealth and other relevant family matters. The core purpose of a family office is to protect, grow, and transfer wealth across generations, and the range of functions performed by a family office will typically include investment management, accounting, management of legal affairs, property management, estate and succession planning, and philanthropy. (They can also manage non-financial tasks such as booking travel).

Managing a family office can be expensive, with various studies suggesting the annual running costs can be in excess of $1 million. For this reason, the threshold at which they become viable is estimated to be around $120 million.6

All but one of the advisers we interviewed for this paper had a Family Office arm to their practice.

Section Two: Their financial motivations and behaviours

2.1 Money motivations – The same but different

To some extent, the money motivations of HNW clients mirror those of many other investors – saving for retirement, the desire to make a social impact, preserving wealth, passing assets on to family members and leaving a legacy. However, the quantum of the amounts involved increases the number – and complexity – of solutions available.

Older HNW clients, such as Baby Boomers and beyond, have ridden a wave of enormous asset growth over their lives in both equity and housing markets. It is these clients who are at the very centre of the enormous intergenerational wealth transfer we will see over the next two decades.

According to Investment Trends’ 2023 High Net Worth Investor Report, they will be more focused on preserving wealth as opposed to chasing it, with key considerations being:

• estate planning, including the transfer of wealth to younger family members (55% of HNW investors who have unmet advice needs),

• asset protection, and

• optimising tax treatment.

The purpose of wealth

A differentiating characteristic of HNW investors is the importance they place on finding the purpose for their wealth and the associated decisions around charitable giving, succession planning and intergenerational wealth transfer.

At a more granular level, the purpose of wealth also drives investment strategy. The relative emphasis placed by the client on protecting wealth, growing wealth and enjoying wealth will determine the appropriate structures, strategies and asset allocations to meet the client’s needs.

2.2 How HNW clients behave as investors

The picture of HNW individuals as big stakes risk takers attracted to ‘exotic’ and complex investment opportunities is not borne out in reality. Indeed, various studies point to them being quite conservative and cautious, preferring more traditional domestic asset classes.

Adviser Insights – Complex situations don’t always need complex investment solutions

“Every HNW client wants to achieve a different goal, and the ways in which we achieve those goals don’t necessarily always require a complex or sophisticated investment solution. Recently, I had a client who wanted index funds and was quite happy with their capabilities and limitations.” John Kazakof

“Contrary to stereotypes, most HNW investors don’t look for complicated investments. If there is the opportunity to earn a modest, but steady return with little risk, they are quite likely to take it. After 2022, bond markets have had a reset, and for the first time in more than a decade, it’s becoming viable to build a portfolio around fixed interest.” Mark Nagle

In Australia, Investment Trends’ 2023 High Net Worth Investor Report found that the top 3 asset allocations among HNW and UHNW investors to be:

• Direct shares (33%)

• Property – residential & commercial (29%)

• Cash & term deposits (14%)

In contrast to a stereotypical picture of the HNW investor as a highly active and frequent trader always chasing the tiniest alpha, the majority tend to stick with a strategy and asset allocation even during the most challenging times.

Indeed, according to Investment Trends’ 2023 High Net Worth Investor Report, 37 per cent of HNW investors reported making substantial asset allocation changes to their portfolio in the year ended 30 June 2023—mirroring results in 2022, but down from 41 per cent in 2021 and 50 per cent in 2020. The same report found that those making more substantial shifts moved toward income generating strategies, such as term deposits, cash and fixed income.

Adviser Insights – Frequent portfolio transacting doesn’t equate to value

“We’ve taken on clients from other advisers who seem to believe the way to demonstrate value add is by frequently transacting on the client’s portfolio, but we don’t advocate that. In our experience, HNW clients don’t want lots of transactions or weird, exotic investments.” Stephen Furness

Of course, that is not to say that their circumstances don’t create an opportunity or an appetite for investments not easily accessible to retail investors. In the context of offering bespoke solutions to a diverse range of HNW clients, the advisers we interviewed had, at various times, connected their clients with direct (off-market) investment opportunities including wholesale syndicates and private equity.

Adviser Insights – Diversification looks different for HNW clients

“Typically, the main objective for these clients is capital preservation over the very long term, and that takes you down a different path. They tend to be asset-class agnostic, and because many of them have their wealth tied up in a large family business, the diversification task is not about equities and fixed interest, it’s about diversifying their wealth away from that business, which might be in transport, or manufacturing, or retail, for example.” Nat Daley

2.3 The desire for control

Having largely self-made their wealth through building and running highly successful businesses, HNW clients can be characterised as intelligent, driven individuals who are accustomed to being in control. This desire for control often carries across to their behaviour as investors, and while not necessarily wanting to get hands-on buying and selling assets, they certainly expect to be involved in making decisions about opportunities and even identifying opportunities themselves.

Adviser Insights – HNW investors are accustomed to control

“We deal with a lot of highly successful professionals, who are accustomed to controlling every aspect of their lives. They usually aren’t going to hand over that control in the short term, if at all.” Brett Roberts

This desire for control helps explain the enduring appeal – among some HNW clients – of the do it yourself approach, although research has identified a growing proportion of HNW investors seeking to engage a financial adviser to get a second opinion on their ideas.

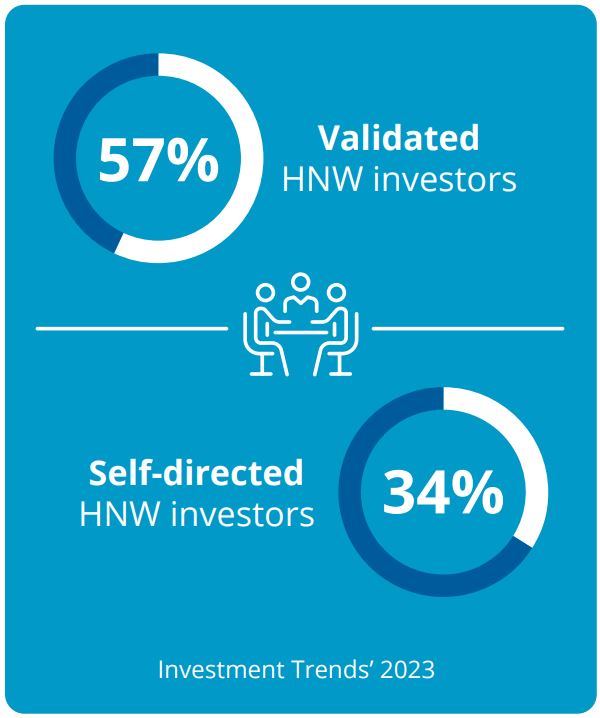

According to Investment Trends, between late 2019 and late 2020, the percentage of HNW investors seeking to ‘validate’ their ideas with a financial adviser rose from 40% to 56%. Over the same period, there was a corresponding fall in selfdirected HNWs, from 49% to 34%.7

Interestingly, according to Investment Trends’ 2023 report, the percent of validators (57%) and selfdirected HNW investors (34%) remains consistent with the 2020 levels—despite changes in the global and Australian market environments.

Section Three: Advice and service needs

3.1 Solving complex needs

Without exception, the advisers interviewed for this paper agreed that the core basis on which their HNW clients had engaged them – and their ongoing advice needs – was to solve complexity.

Accumulating large amounts of wealth is almost always associated with complexity, particularly in areas such as business structure, cash flow, tax and debt management and family dynamics. While investment management is undoubtedly a core service required by HNW clients, it is likely to be simply one of many utilised in solving their problems. Centring the benefits around investment management to HNW investors is likely to dilute rather than strengthen the advice proposition in the eyes of these clients.

Adviser Insights – Investment advice is a commodity, solving complexity isn’t

“With wealth comes complexity, and what sets us apart is how we use strategy and structures to manage this complexity. Once you pitch yourself as an investment adviser, you have made yourself a commodity who can be easily replaced. If you ask my clients what they value about our advice, investment returns are unlikely to figure in the top 10.” Brett Roberts

Adviser Insights – It’s not about the money

“When you are talking about HNW clients, the challenge is not generally a financial one, it is an emotional one. They have built considerable wealth through a high-powered career or through owning a successful business. For years they were usually the smartest, most powerful person in the room. In retirement—that all stops. That’s why we pivoted to a lifestyle planning approach. Even for HNW clients, it is not about achieving investment outcomes, it’s about achieving lifestyle outcomes.” Mark Nagle

Adviser Insights – Stewarding HNW clients to success in the next phase of their lives

“Our clients were highly successful before they ever came to see us. Our role isn’t to make them more successful, it’s to steward their success and their wealth, to help them transition to the next phase of their lives.” Stephen Furness

3.2 Family dynamics can add to this complexity

As society and cultural norms evolve, so too are family and household structures changing

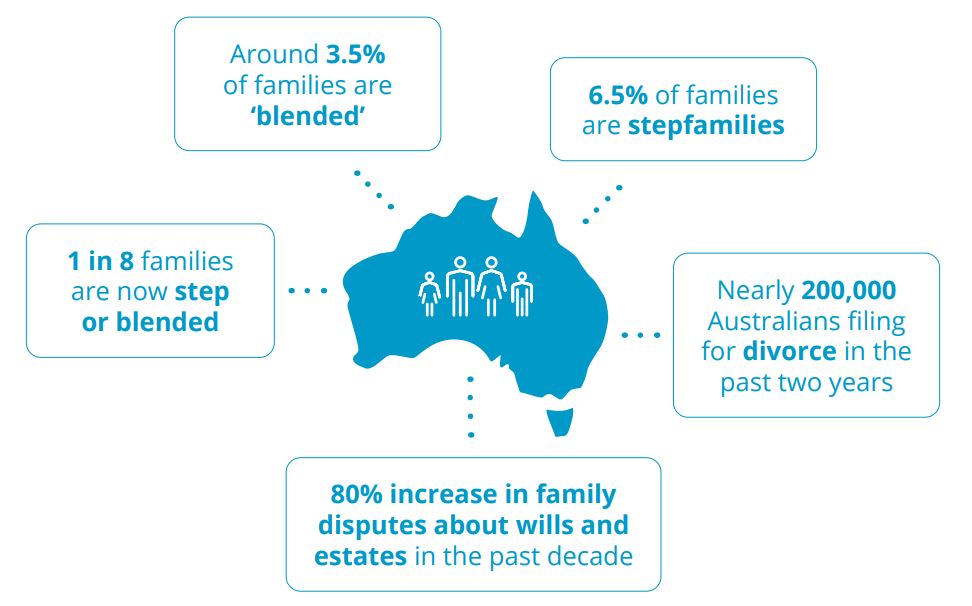

According to 2021 Census data, around 3.5% of families are ‘blended’, meaning families with two or more children, at least one of whom is the natural or adopted child of both partners, and at least one other child is the stepchild of one of them. A further 6.5% of families are stepfamilies, where there is at least one resident stepchild but no child who is the natural or adopted child of both partners. Collectively that means around one in eight families are now step or blended, an increase of around 20% since the 2016 Census.

Divorce rates are also on the rise, with nearly 200,000 Australians filing for divorce in the past two years, the highest number in more than a decade.9

This evolving complexity makes the likelihood of costly, wealth-destroying family disputes more likely, with one expert believing it to be the main driver of an 80% increase in family disputes about wills and estates in the past decade.10

Needless to say, for HNW clients, the amounts at stake are much higher. Wealth transfer for these clients can often involve the transfer of not only significant financial assets but also business ownership stakes; hence an important role of advice in this segment is to protect wealth and smooth the path for its transfer in the face of potentially challenging family dynamics.

Case Study – Liability Driven Investing (LDI) advice approach and HNW intergenerational wealth transfer

MGD Wealth is a wealth practice based in Brisbane. Founded more than 40 years ago, they have evolved from a practice focusing on superannuation, savings and life insurance into a sophisticated multi-disciplinary business capable of serving HNW clients on either a retail or wholesale basis. MGD have long had a focus on

exceptional governance, a focus which equipped them well to move into the HNW space.

Uniting the four core business units – tax, personal insurance, SMSFs, and wealth management – is the underlying advice philosophy of LDI, a form of goals-based advice. According to Stephen Furness, Director of Wealth, goals-based advice is very appropriate for HNW clients, but it is just ‘done a little differently.

“Our advice methodology is about purposebased investing. It’s about helping clients make better decisions with their balance sheets, which means taking the macro view and asking, ‘what’s the purpose of this capital?’ To answer that question, you need to ask, ‘what is the purpose of this family, what are the shared values around which the future is based?’. At its simplest level, LDI revolves around capital pools and buckets. It works for all clients but obviously there are

nuances with HNW clients as the pools are so much bigger.

The LDI advice philosophy makes the intergenerational wealth conversation essential, right from the start. A lot of HNW clients are looking at their balance sheets and deciding it makes sense to disburse some of these funds sooner rather than later. We see many decide to help their children pay off mortgages now rather than 20 years down the track. You also need to put in place mechanisms to protect their wealth in case their children’s relationships break down.” MGD

Adviser Insights – Clients take an intergenerational approach

“People are living longer, and these days it wouldn’t be unusual for inheritors to be in their sixties or older. By that stage in their lives, they are likely to be well set up already, meaning the inheritance is less valuable. For this reason, we are seeing more HNW clients planning ‘living inheritances’. They are gifting to their children and grandchildren during their lifetime. Common examples we see include paying school fees for their grandchildren, putting money into the mortgage offset accounts of their children and grandchildren, helping with house deposits and clearing HECS debts.” Mark Nagle

“On one level, the underlying issues for which the wealthy seek advice are the same as everyone else: get me out of debt, help me save for something, help me manage my cashflow, etc. But the quantum and complexity are obviously amplified 100 times, especially around family. Clients have come to us with some incredibly messy situations. Helping untangle them has undoubtedly brought marriages and families closer.” Nat Daley

3.3 The ecosystem of experts needed to solve the needs of HNW clients

To the extent they have more complex needs, HNW clients require specialist expertise amongst a broader range of disciplines than the average client. Examples include (but are not limited to):

• Tailored portfolio construction and management services

• ESG investments

• Access to bespoke, alternative, and non-retail investment opportunities including private equity, infrastructure, private credit, and hedge funds

• Consolidated reporting, offering clients a complete view of wealth

• Structured giving expertise • Estate planning, insurance and asset protection advice

• Business succession planning

• Private banking and commercial finance

• Trustee services

• Tax planning

• Cash flow planning

• Debt management

Importantly, HNW clients aren’t looking for an adviser to ‘hand them off’ to other experts, nor do they expect their adviser to ‘know it all’. Rather, they look to their adviser to be the connector or facilitator, coordinating access to specialists with deep expertise in their own field.

Serving this segment of the market means the adviser needs to be the director at the centre of an ecosystem of highly specialised experts (including, but not limited to, lawyers, accountants, finance brokers, philanthropy advisers, fund managers, psychologists, wellness experts, travel agents and tax experts).

Case Study – PwC buyout leads to thecreation of Arrive Wealth Management

Arrive Wealth Management was founded in 2002, as a result of a partner buyout of PwC’s Australian financial services business. Those strong links to accounting and tax expertise remain and underpin a highly successful practice which specialises in the strategies and structures necessary to meet the complex needs of HNW

clients.

Critically, the team at Arrive see their role as problem solvers and a key link in facilitating access to a network of leading experts in their field.

“A lot of our clients are business owners and successful professionals with families. They come to us with complex problems that need the right structures and strategies to help preserve their wealth for the future. Wealth always comes with complexity, not just in managing the money but also in managing the family.

In many of our initial conversations with clients, they aren’t sure what advice they need. But once they meet with us, they soon realise there is a real depth to our knowledge, and a breadth to our skill set, that they know will be of great benefit to them.

Structuring alone can deliver a great deal of value, so it’s vitally important. Clients place a lot of value on the fact that our team are qualified as Chartered Accountants and recognise the skill set and the underlying ethics we offer.

Clients pay us to spot the issues and to have partnerships with the best of the best in every discipline, including tax, legal, estate planning, commercial property leases, accounting, and commercial finance. They don’t expect us to know everything, but they do count on us to know who to connect them to. We provide them with access to a network of trustworthy professionals that would be hard for them to replicate themselves.” Brett Roberts and John Kazakof – Arrive

3.4 Do they require more time to serve?

Unsurprisingly, HNW clients often (but not always) require more time to serve. According to Capgemini Research Institute, 86% want personalised offerings and 91% of them say service quality (rather than expertise or investment returns) is the most important criterion when selecting a financial adviser.11

Whilst they don’t necessarily require more ongoing attention, when they need help from their adviser, they expect responsive service. This has cost and resourcing implications for advice businesses, as it means creating enough capacity to be able to respond as soon as needed—to situations that can be complex.

Adviser Insights

“They don’t need me all the time, but when they need me, they need me immediately. That means I need to build, and they need to pay for, capacity” John Kazakof

“We let the client set the cadence, the rhythm for our communication. Because we use a board structure for governance, there are formalities around regular meetings, but those aside, they are generally very busy people whom I only hear from when they have an issue.” Nat Daley

3.5 Wholesale or retail?

Many advisers take advantage of the ability to work with clients on a wholesale or sophisticated investor basis in order to streamline processes and open up a wider range of investment options for their clients. But wealth doesn’t necessarily equate with financial literacy, and some HNW clients will be more suited to a retail approach.

Adviser Insights – Wealth doesn’t mean financial literacy

“Some of our clients may have been great at running a manufacturing business, for example, but that doesn’t always translate into strong financial literacy. And clients need to know what they’re investing in and feel comfortable with those decisions. We have a lot of retail solutions that suit HNW clients, and in our view,

they don’t need to be wholesale unless they are seeking something specific. We will have a very detailed conversation with them upfront before jointly deciding what path we will go down.” Stephen Furness

3.6 Digital engagement

As successful careerists or business owners, many HNW clients, even older ones, are technology savvy. They expect the quality of their digital engagement with their wealth to offer the same personalisation and seamlessness as their interactions with other brands and categories.

What the research says

Globally, over half of HNW individuals believe it is important for their financial adviser or wealth manager to have a strong digital offering – and across the Asia Pacific region that rises to almost two-thirds (even higher for those under 45).12

This expectation is not currently being universally met, especially among younger HNW clients, of whom almost half are dissatisfied with their adviser’s digital maturity, according to Capgemini’s World Wealth Report 2021.11

The 2023 Investment Trends report found that over half (51%) of HNW investors are still using spreadsheets to get a complete picture of their investment portfolio. Nine out of ten UHNWs would like to see improvements to the online portals they use, with enhancements focused on transactional capability (50%), performance reporting (49%) and real-time pricing (45%) at the top of their wishlists.

Increasingly then, a strong digital game is just a hygiene factor for this segment. That includes digital engagement via video conferencing solutions, a trend that accelerated during the pandemic and is now here to stay.

PWCs 2022 survey of HNW investors found the preferred channel for communication with their financial adviser was phone or video call (37%), followed by mobile app or live chat (22%) and email 21%.13

The advisers we spoke to suggested that while HNW clients value the convenience of virtual meetings as much as everyone else, when it comes to discussing important matters, many still prefer face to face, meaning advisers in this space need to be mobile enough to visit their clients, and ensure their office and meeting space is of the highest professional standard.

Adviser Insights – Face to face still important

“A common characteristic of successful businesspeople is their ability to read people and read the energy in a situation. When discussing important matters and making big decisions, they generally prefer to meet in person and be able to look you in the eye.” Brett Roberts

3.7 Fee expectations

As with all advice clients, the topic of fees is an important one. Fees for HNW advice can easily run into the tens or even hundreds of thousands of dollars per year or more.

For HNW clients though, the issue is less around affordability and more around value and transparency.

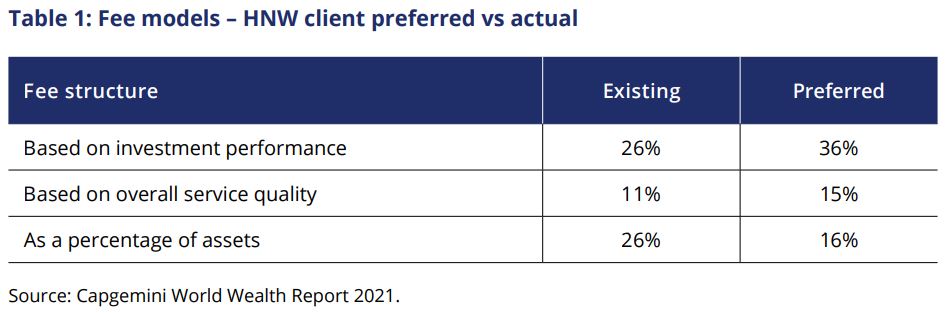

While the trend in retail may be towards flat, fixed fees, this trend isn’t necessarily playing out to the same extent for HNW clients.

A theme emerging from our adviser discussions was the extent to which HNW clients expect the adviser to have ‘skin in the game’, meaning if investment performance suffers, the adviser remuneration suffers also. They described this as ‘an alignment of interests’, which is consistent with findings in Capgemini’s World Wealth Report 2021, suggesting a growing preference for fees based on service quality and investment performance.

Section Four: Creating a legacy, investing with purpose

4.1 Philanthropy

HNW clients have a strong and growing interest in philanthropy, with the Crestone Wealth Management: 2021 State of Wealth Report finding the proportion of HNW investors who rated philanthropy among their top three investment priorities doubled between 2019 and 2021.

At higher levels of wealth, philanthropy is generally via ‘structured giving’, where highly specialised legal structures such as Private and Public Ancillary Funds (PAFs and PuAFs) and private foundations allow individuals to maximise the tax effectiveness, flexibility and impact of their philanthropy.

A PAF is a fund set up to manage investments and distribute funds to Deductible Gift Registered (DGR) charities. Each year the trust must distribute at least 5% of its funds to DGRs.

Since being enabled by legislation over 20 years ago, Private Ancillary Funds (PAFs) have grown in popularity to the point that there are now estimated to be around 2,000 PAFs holding $10 billion in assets and making grants of $500 million annually.

While many individuals have favourite causes and charities that they support throughout their lives, structured giving generally goes from an idea to action at the time of a trigger, which can be a change in circumstances (retirement, sale of a business, death or marriage) or a tax event (a major capital gain, the sale of a property or a business).

4.2 Philanthropy is a highly complex, specialised area

There are many steps involved in designing and implementing a philanthropic strategy.

These include, but aren’t limited to:

• Helping the individual or family identify their purpose and their philanthropic objectives

• Identifying the appropriate legal structures for their philanthropy

• Setting up those structures, appointing trustees

• Setting an investment strategy and appointing investment managers

• Identifying suitable causes and charities

• Performing due diligence on potential recipients

• Ongoing administration, compliance, governance and reporting

Navigating these processes clearly takes deep, highly specialised expertise, and while some firms have this expertise in house, many smaller firms lack the scale and instead choose to rely on an external philanthropic consultant. This consultant will typically be deeply connected within the not-forprofit (NFP) sector and will work in conjunction with specialists in other associated areas including trust law and NFP accounting.

4.3 Identifying the right causeand the right recipients

According to the Australian Charities and Not-forProfit Commission (ACNC), there are currently around 60,000 charities in Australia vying for donations. However, not all of them are well-run, sustainable and transparent.15

As well as helping the client identify the broadcause(s) they want to support, targeting and performing due diligence on potential charitable partners can obviously be a complex and timeconsuming process, further underlining the importance of specialist expertise in this area.

4.4 Generational differences

One of the challenges in creating a unifying philanthropic strategy is the extent to which different generations are motivated by different causes and prefer different ways to create impact.

McCrindle research, for example, found that the top causes of interest tend to vary by generation:16

• Millennials – Children’s charities

• Gen X – Animal welfare and wildlife support

• Baby boomers and older – Medical and cancer research

Case Study – A specialist philanthropy consultant helping advisers around Australia

Susan Chenoweth is the Head of Philanthropic Services at Elston, a national firm focused on private wealth, asset management and philanthropy and NFP support. With an extensive background in the not-for-profit sector, she now provides highly specialised consultancy services to Elston’s own HNW clients and to the clients of more than 300 advisers around Australia. These services cover every stage of the philanthropy journey, from identifying a family’s shared purpose, to identifying the right giving structure and strategy and choosing the right charity partner.

“For HNW and UHNW clients, philanthropy can be a galvanising force, creating cohesion across multiple generations of a family. For example, one of our clients had become extremely wealthy after selling his business. His adult children, who were now living all over the world, hadn’t grown up with wealth, and felt disconnected from their parents’ money. We helped them identify a purpose for that wealth which led to the creation of their own foundation. This brought the family closer together, helping unite younger generations around a shared vision.”

According to Chenoweth, some clients come with a blank sheet of paper, whereas others have a really clear passion and sense of where they’d like their money to go. An important role of the Philanthropy Consultant is to work with clients to identify the values and purpose they share as a family. .

“Every individual is motivated differently – giving can be rational and emotional. We have one client who built a successful business on the Gold Coast, and their main objective is to give back to the community that supported their success. Others may have been touched by disease and are motivated to invest in finding a cure or supporting patients in treatment. And we have other clients whose objective is to support the maintenance of a particular cultural identity, such as a religious organisation or NFP tied to their heritage.

Whilst there are differences, there are also some common themes in the lenses clients apply to their giving. We find younger clients are generally more motivated to support environmental and social causes, and they also like to get more involved as volunteers. But across the board, we are seeing more focus on gender equity and diversity in giving. Mental health is also an area all

generations are interested in.” ELSTON

4.5 ESG

Whether it be driven by philanthropic objectives, or their investment goals more broadly, HNW individuals have a demonstrably higher-thanaverage propensity to seek ESG investment options.20

In the UHNW space, this trend is likely to be reinforced as more family offices are taken over by Gen X and millennial family members.

What the research says

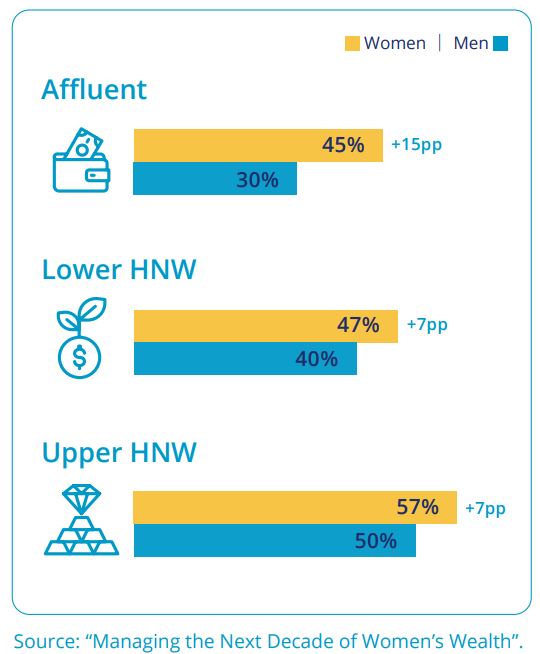

BCG’s “Managing the Next Decade of Women’s Wealth” report published in 2020 made two key observations:

• The priority placed on ESG investing increases with wealth. UHNW investors were more likely to place ESG investing in their top 3 investment objectives than HNW investors, who in turn were more likely to do so than affluent investors.

• Across all wealth levels, females placed a higher importance on ESG investing than males17:

Figure 1: Investors ranking social responsibility in top 3 objectives

These findings are broadly consistent with those of the Capgemini 2023 World Wealth Report, which found that 41% of HNW investors said investing in causes with positive ESG impact is a critical wealth management objective.

Navigating the world of ESG investment options can be challenging, and unsurprisingly, demand for advice around ESG is also strong.

According to the Capgemini report, 63% of HNW investors requested reliable and traceable ESG scores for their assets.2

Adviser Insights – ESG investing and HNW clients

“We see a strong appetite for ESG options amongst our HNW clients. What surprised me was how strong that appetite is among older clients. Their motivation is often around their grandchildren and what sort of world they will grow up in. The themes they are particularly interested in are climate change, clean energy, and electric vehicles. Of course, ESG investing isn’t just about saving the planet, it’s a risk management exercise as well. The savvier clients are very aware of the risk of stranded assets in categories such as energy.” Mark Nagle

Section Five: SMSFs

5.1 SMSF usage continues to grow, notably amongst younger investors

The Self-Managed Super Fund (SMSF) market remains a pivotal player in Australia’s financial sector, providing investors with control and adaptability over their retirement savings. The latest data, gleaned from the Australian Taxation Office (ATO) as of March 2023, offers a comprehensive glimpse into the current SMSF landscape, revealing both time-tested trends and intriguing shifts in investor behaviour.

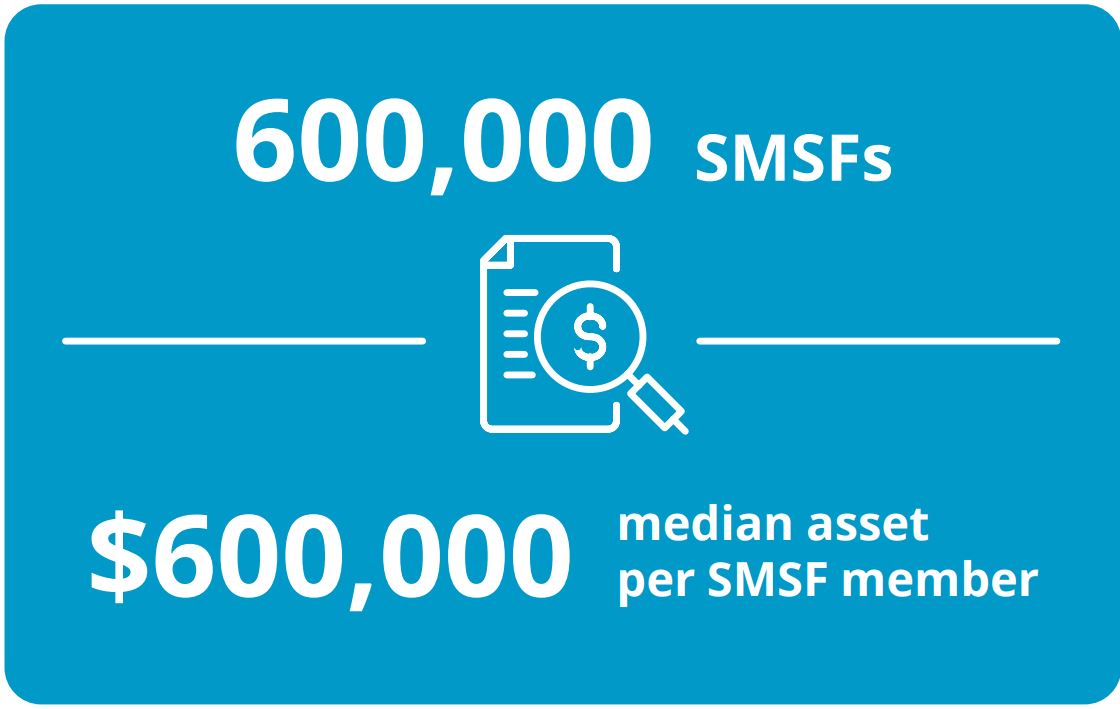

The latest data shows that there are over 600,000 registered SMSFs in Australia. This number underscores the enduring popularity of SMSFs as a preferred retirement savings vehicle, enabling individuals to tailor their investment strategies to their distinct financial objectives.

A noteworthy aspect of the statistics is the median assets per SMSF member, standing at approximately $600,000. In contrast, the median assets held by members of traditional superannuation funds remain notably lower. This divergence suggests that SMSF members generally possess more substantial retirement savings, indicative of their proactive approach to wealth accumulation.

The allure of SMSFs lies in the autonomy they provide to investors. Individuals opt for SMSFs to gain greater control over their investment choices, asset allocation, and overall retirement strategy. SMSFs allow investors to delve into a diverse range of investment options, from stocks and bonds to property and alternative assets. This level of control resonates particularly well with those who have a keen interest and understanding of financial markets.

One particularly compelling facet of the SMSF market is its diverse age distribution. While traditionally favoured by older Australians seeking increased investment autonomy, recent years have witnessed a notable upswing in SMSF adoption among younger age groups. This trend is particularly evident among millennials, who are increasingly drawn to SMSFs for their flexibility, control, and potential to align investments with personal values.

The growth in SMSF usage among younger Australians aligns with their desire for more active participation in their financial future. The digital era has facilitated access to information, empowering millennials to engage in investment decision making. This shift underscores the changing perception of SMSFs, from being viewed as a vehicle for experienced investors to becoming an attractive option for individuals at various life stages.

While SMSFs continue to appeal to established investors seeking control over their retirement strategies, they are also evolving to accommodate the preferences of a new generation. This dual trajectory of growth, spanning both traditional and younger age groups, cements the SMSF market’s significance in Australia’s financial landscape.

5.2 SMSFs remain popular with HNW investors with complex estate planning needs

Since their original inception, the surge in SMSF usage among HNW individuals is particularly noteworthy for a few key reasons.

Firstly, while the ability to have more control over the fund’s investments is certainly part of the appeal of SMSFs, most true HNW investors outsource the investment management of their SMSF to professionals, meaning the market volatility is unlikely to have influenced their thinking.

Secondly, an arguably more critical benefit HNW investors see in SMSFs is their flexibility to accommodate the more complex, tax-effective estate planning strategies they require.

As such, the recently announced capping of superannuation fund contributions, as proposed by new Federal Treasurer Jim Chalmers in the Australian Federal Budget 2023-24, is likely to be of more concern than market fluctuations.

Adviser Insights – SMSFs suit the complex estate planning needs of HNW clients

“SMSFs really fit HNW clients like a glove.” Mark Nagle

“The majority of our HNW clients would use SMSFs, for cost and investment choice reasons but also because their estate planning needs are more complex, and most retail offerings lack the flexibility to accommodate these strategies.” John Kazakof

Section Six: How are they reacting to the current climate?

6.1 Inflation is on their minds

Decades-high levels of inflation and associated interest rate movements are without doubt the dominant economic themes around much of the world right now. And evidence suggests the silent wealth-eroding effects of inflation are weighing more heavily on the minds of HNW investors than market volatility.

What the research says

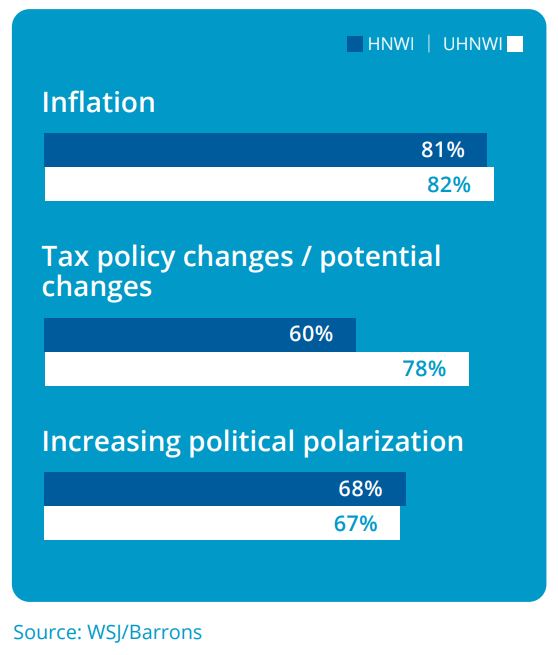

According to Investment Trends’ 2023 High Net Worth Investor Report, inflation, military conflict, and the Australian economy (rather than market volatility) were the top 3 concerns amongst HNW and UHNW investors.

Figure 2: Top 3 current issues for HNW and UHNW investors

A UK survey of 200 HNW investors, conducted by the Charles Stanley Group also found inflationary fears to be paramount. 59% of those surveyed said they were concerned about the threat of recession, and high inflation, a figure which rose to 69% for the over 55s.19

A global study by Standard Chartered, released in late 2022, similarly found inflation to be dominating HNW investors’ thinking.20

Respondents to the study, which examined shifts in investor decisions for more than 15,000 HNW investors in 12 countries, cited inflation (34%), an uncertain global economy (27%) and the threat of recession (22%) as their key concerns.

But how does this translate into reality?

6.2 True HNW individuals take an extremely long-term view

The consensus of all the advisers we spoke to is that the recent volatility experienced in financial markets is of little concern to their HNW clients, and if anything, represents an opportunity to acquire assets.

Common observations include:

• The time horizon HNW clients work on is across multiple generations and so the current market volatility is merely a blip

• Many see current market conditions as an opportunity

• Regulatory volatility and geopolitical conflict are bigger concerns to HNW clients

• Traditional asset allocations are not necessarily applicable and so portfolio re-balancing is less of a priority

• Investment returns are often driven as much by structuring as by asset selection

6.3 Sticking the course but seeing opportunities

Unsurprisingly then, despite the reality of an inflation rate that represents the largest wealth erosion rate seen in decades, the response of most HNW clients seems to be ‘muted’.

Certainly, this is reflected in global research.

• Only 25% of respondents to the Standard Chartered survey referenced above said they were looking to make new decisions around their portfolios.

• 86% of respondents to the Charles Stanley survey said they planned to invest and save in the same way as they always have.

Adviser Insights – Different time horizon puts volatility into perspective

“Short-term to a family office is 30 years. Long-term is 100 years. 18 months of volatility doesn’t even register. At the moment they are very opportunistic. Many are cashed up, and they are going bananas buying assets at a discount.” Nat Daley

“The more aggressive clients are licking their chops at the moment. They have a very long-term horizon, and they are seeing value in equities.” Brett Roberts

“The market dislocation and the change to discount rates used for valuing assets should present real opportunities for investors, and I expect many clients will want to take advantage.” Stephen Furness

“For a mum and dad investor with $900k in super, market movements can have an immediate and real impact. For HNW clients with more capital than they could ever outlive, it’s an entirely different mindset.” Mark Nagle

Conclusion

The advisers who successfully serve the HNW segment act as connectors, augmenting their own deep technical expertise with a network of the very best leaders and thinkers across a broad range of specialist disciplines including investing, finance, tax, law, accounting and philanthropy.

Importantly, they position themselves not as investment experts but as trusted advisers solving complex problems, using strategies and structures to bring wealthy families together, and helping them protect, grow, transfer and make an impact with their wealth.

7 key take-aways for advisers looking to grow relationships with HNW clients

![]()

Determine your HNW target market

Is there a specific niche of HNW client you’d like to attract? For example, if you’re interested in working with medical professionals, there are organisations and industry groups that could be good sources of information or potential referrals for your business. Would you target people from a specific company, similar to how the team at Arrive Wealth works with executives from PwC? There are many opportunities available for specialisation – choose what best suits your interests and business strengths.

![]()

Refine your CVP specifically for HNW clients

What sets your business apart for HNW clients? It could be a specific investment approach, such as liability-driven investing (mentioned by Stephen Furness at MDG Wealth). Maybe it’s a skillset you bring to the table, such as in-house tax and accounting specialists or aged care advice.

Create capacity to deliver service excellence

Some businesses create capacity through client segmentation—developing consistent experiences and pricing clients can choose from or directing clients toward the experiences and price points to suit their needs. Other advisers save time and create efficiencies by maximising the use of digital or outsourced solutions.

Build your ‘matrix’ of experts

What kinds of experts would interest your target market? Think about the types of providers your HNW clients are already working with – or providers they may need down the line. Typically, HNW advisers will work with estate planning attorneys and accountants. But your HNW clients may need a wide range of expertise that could be very niche, such as UK pension specialists to provide services for British expats or Australians living in the UK, for example.

![]()

Streamline life admin for HNW clients

Clients love it when you make their lives easier – and HNW clients are no exception. How can you streamline key administrative tasks for them? HNW clients may be looking for a complete view of their wealth (including assets held on and off an investment platform), support for staying up-to-date on their estate plans or the timely tracking of key tax and legislative changes that impact them.

![]()

Support the whole family

Consider how you can start building relationships with the families of your HNW clients early on, bringing them into key conversations and meeting their individual needs. Are there any special social or educational events you could host for HNW clients and their families? Do you have services or products that might appeal to the children or grandchildren of your HNW clients?

![]()

Help HNW clients build a legacy

The concept of ‘legacy’ frequently came up in our conversations with HNW experts. Is there more you can do to support HNW clients in creating a legacy with their wealth – whether it’s through detailed estate planning or philanthropic advice? Do you have in-house expertise or would you work with an external partner?

Empowering HNW advice – a message from HUB24

At HUB24, we’re empowering financial advisers and brokers to deliver better financial futures for their clients. For HNW advisers, that includes holistic solutions on and off of platform, for super and nonsuper and for both wholesale and retail clients. Some of Australia’s leading private wealth institutions, brokers and financial advisers have chosen HUB24 as their platform of choice for over 15 years.

But don’t just take our word for it – advisers rated us Overall Best Advice Platform in Australia.21

Key benefits for HNW advisers:

Build a complete view of wealth

Create interactive client presentations on HUB24 Present to provide your HNW clients with a complete picture of their wealth, including their investments on the HUB24 platform along with their other investments (e.g. investment property, private equity funds, direct shares and more). Spreadsheets? No longer required.

Streamline tax reporting and recordkeeping

In the 2023 Investment Trends High Net Worth Investor Report, HNW clients using investment platforms cited these capabilities as top benefits of using a platform. We offer streamlined reporting to support your HNW clients’ needs.

Give your HNW clients access to an innovative, secure digital portal

With data feeds from HUB24 to myprosperity, your clients can access an all-in-one secure client portal that has innovative, digital tools for fact finds, collaboration and compliance to maximise business efficiencies and client engagement.

Connect to a matrix of expertise, choice and flexibility

HUB24 features products from a wide mix of global and Australian investment managers with retail and wholesale offerings, along with multiple insurance providers.

Offer access to SMSFs early to your emerging affluent clients

HUB24 SMSF Access is an affordable solution designed to meet the needs of clients who want to experience the benefits of their own SMSF without the associated costs and administration complexity of establishing and managing a traditional SMSF. It’s a solution that might appeal to your emerging affluent clients early in their wealth journeys.

Save time and create business efficiencies

Drive efficiencies in your business with technology, such as our ROA generation capabilities, aggregated trading and tailored daily activities email.

Experience the benefits of a market-leading platform

Open client accounts online with ease. Offer your clients peace of mind with multi-factor authentication providing secure access to their account information. And provide your clients with the convenience of e-signature capabilities.

Find enhanced platform capabilities to meet HNW client objectives

We’re continually enhancing our platform and have some exciting platform capabilities in the works to meet the objectives of HNW clients, such as the ability to trade domestic fixed interest securities and direct foreign currency.

Together we’re creating australia’s best platform

References

1. Investment Trends. 2023 High Net Worth Investor Report. August 2023.

2. Capgemini Research Institute, World Wealth Report 2023. https://www.capgemini.com/insights/research-library/world-wealthreport/

3. Morrison, Stella (2023, 21 February). How Most Millionaires Got Rich. Business News Daily. https://www.businessnewsdaily.com/2871-howmost-millionaires-got-rich.html

4. Knight Frank Research, The ‘next generation’ of Australia’s ultra-wealthy population. https://www.knightfrank.com.au/blog/2022/06/22/the-next-generation-of-australias-ultrawealthypopulation

5. Zakrzewski, Anna, Kedra Newsom Reeves, Michael Kahlich, Maximillian Klein, Andrea Real Mattar, and Stephen Knobel (2020, 9April). Managing the Next Decade of Women’s Wealth. BCG. https://www.bcg.com/publications/2020/managing-next-decade-womenwealth

6.KPMG. Wealth in Transition: Family offices in plain view – Research into the Family Office Market in Australia, Hong Kong, New Zealand and Singapore. October 2021. https://kpmg.com/ au/en/home/insights/2021/10/family-office-wealth-in-transitionreport.html

7. Maddock, Lachlan (2021, 12 April). The rise of the high-net-worth advice ‘validators’. Ifa. https://www.ifa.com.au/news/29422-the-riseof-high-net-wealth-advice-validators

8. Australian Bureau of Statistics. Census of Population and Housing 2016 and 2021. https://profile.id.com.au/australia/familyblending?BMID=20

9. Fitzsimmons, Caitlin (2022, 3 July). Divorce applications up as marriages hit the rocks. The Sydney Morning Herald. https://www.smh.com.au/national/divorce-20220628-p5axco.html

10. Hughes, Duncan (2019, 27 December). Big increase in inheritance feuds among blended families. Australian Financial Review. https://www.afr.com/wealth/personal-finance/big-increase-in-inheritancefeuds-among-blended-families-20191212-p53jbs

11. Capgemini Research Institute for Financial Services Analysis. World Wealth Report 2021. https://www.capgemini.com/insights/research-library/world-wealth-report/

12. PwC (2016). Sink or swim: Why wealth management can’t afford to miss the digital wave. https://www.strategyand.pwc.com/gx/en/insights/archive/sink-or-swim/sink-or-swim.pdf

13. PwC (2022). HNW Investor Survey 2022. https://www.pwc.com/us/en/industries/financial-services/asset-wealth-management/high-networth-investor.html

14. Fundraising and Philanthropy (2021, 15 June). Happy birthday PAF!https://fandp.com.au/how-pafs-reshaped-philanthropy-379495/

15. Australian Charities and Not-for-profits Commission. Are there too many charities in Australia? https://www.acnc.gov.au/for-public/understanding-charities/are-there-too-many-charities-australia

16. McCrindle Research Pty Ltd (2021). Australian Communities: Understanding Australian givers to maximise the impact of not-forprofit organisations. https://mccrindle.com.au/app/uploads/reports/Australian-Communities-Report-2021.pdf

17. Boston Consulting Group (April 2020), Managing the Next Decade of Women’s Wealth. https://www.bcg.com/publications/2020/managingnext-decade-women-wealth

18. Australian Taxation Office (2023, 24 May). Highlights: SMSF quarterly statistical report March 2023. https://www.ato.gov.au/Super/SMSFnewsroom/General/Highlights–SMSF-quarterly-statistical-reportMarch-2023/

19. Charles Stanley (2022, 12 December). Have high-net-worth investors planned for inflation? https://www.charles-stanley.co.uk/insights/commentary/high-net-worth-investors-inflation-plan

20. https://www.africa.com/two-thirds-of-investors-changinginvestment-strategies-to-combat-inflation/

21. Adviser Ratings 2023 Australian Financial Advice Landscape Report. HUB24 was rated Overall Best Platform and #1 for Best Client Experience, Ease of Onboarding, Best Functionality, Best Adviser Support and Best Investment Options.

IMPORTANT INFORMATION

This document has been issued by HUB24 Custodial Services Ltd (ABN 94 073 633 664, AFSL 239 122 (HUB24). HUB24 is the operator of HUB24 Invest (an investor directed portfolio service), promoter and service provider of HUB24 Super which is a regulated superannuation fund. The trustee and issuer of interests in HUB24 Super is HTFS Nominees Pty Limited (ABN 78 000 880 553, AFSL 232500, RSE L0003216). The information in this document is intended to be general information only and not financial product advice. The views expressed in this document by persons who are not representatives of HUB24 are their own, and do not necessarily represent HUB24 views. HUB24 has not validated or verified the views expressed in this paper, make any representation as to the completeness or reliability of the material in this paper, accept any liability for loss attributable to use of this paper, including liability for any statements which are incorrect or misleading. Readers should not rely on the information in this paper and should undertake their own investigations and use their own commercial judgment. This document must not be copied or reproduced without the prior written consent of HUB24. © HUB24