Ethics play a vital role in developing an effective insurance framework. Whilst conversations about ethical principles can bring either optimism or frustration, their significance to financial advice extends beyond meeting continuing professional development requirements.

Ethics are important not just for risk specialists but as philosophy shared across other professions: medical, legal and countless others. For financial advice and particularly insurance advice in an era of significant change and disruption, it’s these core ethical beliefs that serve a critical role as advisers are challenged more than ever before, balancing old products against new, facing structural disruption across direct insurance, and generational mergers and acquisitions in the group insurance segment.

In a post-COVID era and within the new APRA income protection framework in place, ethics must be at the forefront of an effective insurance strategy. An ethical decision-making framework must be applied in the delivery of highly personalised and tailored insurance advice, the dealing of clients’ personal financial, health and lifestyle information, and assisting in underwriting and claims management.

“Discussing highly personal health matters is part of the role. The way to make your client feel more comfortable is by showing them that you are comfortable yourself. And the best way to do this is to keep it very professional and dispassionate – demonstrate you are confident in what you are doing, that’s when they relax and open up”, says AVA Insurance Consulting Group Owner and Financial Adviser, Anita Muecke.

From an ethical perspective, due to the nature of information advisers have access to, Anita’s view is a commendable one. By demonstrating a level of professionalism and being dispassionate an adviser can build rapport and confidence early on in the client relationship.

Clients are placing a high value on adviser’s ethics

A recent survey found that clients view an adviser’s Interpersonal skills as the most important quality they seek in their adviser. This includes their communication skills, empathy, care, listening ability and ability to understand the client’s needs. These qualities all require ethical consideration which leads to ethical qualities being ranked as the second highest quality that clients seek in their advice relationships.

Factors such as fairness, integrity, diligence, objectivity, honesty and professional reputation ranking are of higher importance to clients than an adviser’s technical knowledge and skills.

What is ethical to one, may be different to another

Ethics can mean different things to different people, including your client, licensee and regulator. Whilst there can be a general consensus on some principles, what is ethical to some may differ from what is seen to be ethical to others.

From the regulator’s perspective

The FASEA Code of Ethics established 12 high-level ethical standards for financial advisers to meet, including:

- acting in the best interests of clients

- avoiding conflicts of interest

- ensuring that clients give informed consent and understand the advice they receive

- ensuring that clients clearly agree to the fees they will pay

- maintaining a high level of knowledge and skills

In the eyes of the regulator, ASIC Commissioner, John Price believes that an ethical culture focused on honesty and fairness can serve to help protect a business from misconduct, poor business practices – even poor decision-making.

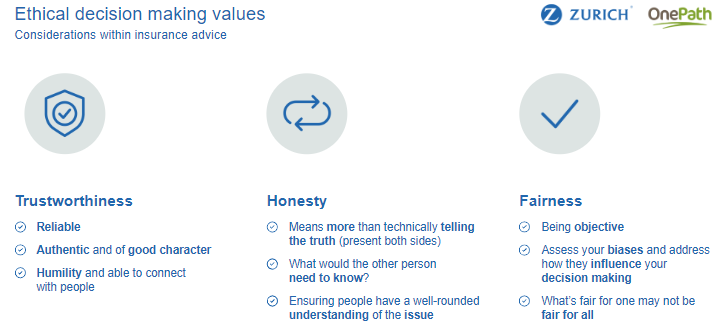

Exploring ethical decision-making values

There are three ethical values designed for advisers as a framework to consider when making recommendations, interacting with clients and giving advice. They give clarity on what to apply when thinking about what it means to be trustworthy, honest and fair at all times.

Trustworthiness, in the eyes of a client, is built and maintained through engagement with clients in a reliable manner, being authentic of good character and acting with a level of humility or modesty. From an insurance advice framework this can include following through on the things you promise, turning up on time, and generally being reliable. It also requires a level of humility when dealing with the sensitive information that is received and authentic in how conversations are handled and approached.

Honesty, to many, means telling the truth. But what’s interesting, under an ethical framework, to be honest means telling no more than the truth. This means offering clients all the facts which can often be achieved by telling both sides of the story. From an insurance advice framework, this has particular reference to client discussions around exclusions with offsets, being open with clients to explain the way in which they are treated and the impact of disclosure or non-disclosure. Another way to achieve this is to put the client into the shoes of someone at a particular point and have them consider both sides of the story, to establish the reality of what could actually happen in that event.

The third ethical value is centred around fairness. Fairness is objective and can mean different things to different people. It’s important for advisers to assess their own biases to uncover how their own views, preferences or judgements may be impacting conversations, client relationships and advice and recognise the diversity and inclusion principles when working with diverse client groups. It’s important to note that what is fair for one person, may not be necessarily fair for all.

Advice based on specific and individual circumstances

Whilst trust, honesty and fairness stand as a base framework, Standards 5 and 6 of the FASEA Code of Ethics detail further ethical requirements of taking into account the broader effects arising from the client acting on the advice, based on their specific and individual circumstances.

From an insurance advice perspective, this means relying on product research alone does not meet this ethical responsibility. Research remains an important tool for advisers, however significant variations in product design require a full understanding of the longer-term implications of advice on a client’s personal and financial situation. Ethical decision-making in insurance advice includes the need to tailor advice to the client’s unique situation and circumstances.

If an adviser does find themselves at a crossroads on a decision or recommendation the guidance is to simply reflect on the ethical considerations, like fairness and honesty, but also consider the questions and steps below.

The critical elements of ethical thinking and making a ‘good’ decision include:

If in doubt, ask more questions

In the event that an adviser finds themselves in a quandary about what to do, and which direction to take, then the collective advice amongst many risk specialists and the regulator is that asking more questions – not only of your clients but of yourself can help to steer you and your advice through to a clear, unimpeded view of the best interest outcome – each and every time.

—–

This article is a summary of part 1 of the Exploring Ethical Principles and the Role in insurance advice presentation presented at the XY All Licensee PD Day by Adam Crabbe.

Part 1 of a 2-part series, the next part explores the practical application of ethical principles through case studies to dive deeper into the ethical decision-making process required in the context of providing appropriate life insurance recommendations that support your client’s best interest post APRA life insurance changes.

This general information does not take into account the personal circumstances, financial situation or needs of any person. This article is intended for the general information of licensed financial advisers only and is dated September 2022. The information collected is given in good faith and is derived from sources believed to be accurate as at this date, which may be subject to change. It should not be considered to be a comprehensive statement on any matter and should not be relied on as such. You should consider these factors, the appropriateness of the information and the relevant Product Disclosure Statements (PDS) and Target Market Determinations (TMD), if applicable, before making any decisions or recommendations. You can find these on our website at zurich.com.au

Zurich Australia Limited (Zurich), ABN 92 000 010 195, AFSL 232510