In this special production

Introduction

Advisers are increasingly seeing a growing trend, where clients and potential clients are requesting to invest in a manner that aligns with their vision for a better future and world. These clients are seeking out a better way to invest, generate solid returns and also contribute to real environmental and social outcomes. One way that investors can “do good while doing well” is to seek opportunities for financial investments that also produce intentional and measurable social or environmental benefits, otherwise known as impact investing.

Financial advisers play an important role in helping their clients make decisions about which investments to choose, demystifying the terminology and options and supporting them to make investment decisions that align with positive change and financial return.

This paper specifically focuses on impact investing as an investment strategy that allows investors to invest their capital with the intention of benefiting society, without sacrificing long-term returns and achieving sufficient portfolio diversification.

Defining Impact Investing

Impact investments are investments made into organisations, projects or funds to intentionally generate measurable positive social and environmental outcomes alongside a positive financial return. Impact investing covers a range of different asset classes and investment strategies.

Impact investments have three layers:

Impact investments are investments made into organisations, projects or funds to intentionally generate measurable positive social and environmental outcomes alongside a positive financial return. Impact investing covers a range of different asset classes and investment strategies.

1. Intentionality: Specifically designed to deliver a positive social and/ or environmental impact.

2. Measurability: Measure and reporting of progress towards the stated impact.

3. Financial Return: Generation of a financial return.

“I think the definition of impact investing has two aspects, intentionality and measurability. It’s not an impact investment if they’re not measuring the impact, and it’s lacking intentionality to create a positive benefit”

– Fiona Thomas, General Manager & Financial Adviser at Ethinvest.

It is this intention that provides investors with the opportunity to make a financial return in alignment with their values and vision for how they wish to see positive improvements made within society or the environment that defines an impact investment.

Many investors participate in impact investing, including public and private foundations; family offices, banks and other institutional investors such as superannuation funds and insurance companies; governments; fund managers; community finance organisations; and individual investors.

When investing for impact, you can invest specifically in a single project that supports a particular strategy, theme or area of investing or seek to invest in a portfolio that provides access to a range of impact-driven strategies and themes.

Impact investments can be made directly into an organisation or via a managed impact investment fund. They will typically come in the form of a loan (debt) or private ownership of an entity (equity) and span different asset classes. In recent years, impact investing has also become available to investors via listed equities. Today, investors can access impact investing through most asset classes, including:

- Fixed income (green bonds)

- Hybrid investments (such as social / sustainability bonds)

- Real estate

- Private equity

- Listed equities

“I see impact investing as having a place within an overall investment strategy, as opposed to the only solution or approach for a client’s portfolio. When it comes to impact investing, it’s a great diversifier because many fund managers select companies that aren’t in your typical traditional investment portfolios”

– Kevin McDonald, CFP, Principal Adviser & Director of Future Focus Financial Planning.

The Factors Driving Demand

The rapid growth in demand for impact investments, particularly since 2012, is driven by a number of factors:

1. Shifting Client Values

The shifting values of consumers and increased consumer consciousness have resulted in a surge in demand for impact investments. Many more clients from retail investors to institutions seek to ensure their investments align with their missions and values.

2. Strong Investment Outcomes

More sustainable companies have demonstrated that they make better investments, with a recent research by the RIAA showing that responsible investments have outperformed the overall market.

“If you look at the fundamentals of an ethically focused business, they’re likely to represent a stronger business model from a longer-term perspective due to the sustainability of their operations and the industries they operate in”

– Hope Evans, Financial Adviser & Director of Simply Ethical Advice.

3. Risk Reduction

It is now apparent that many companies cannot thrive, particularly longer-term, without considering sustainability issues such as environmental issues (pollution, climate change, resource scarcity), social issues (local communities and employees’ health, wellbeing and safety), and governance (prudent management, business ethics, board management and appropriate pay structures) of their business. Assessing these issues alongside financial performance supports better investment decisions.

4. Accessibility

Until recently access to the majority of impact investments was restricted to high-net-worth individuals, sophisticated investors and wholesale investors. However, access for retail investors is shifting fueled by the increasing demand of investors and the issue of many new and interesting products on the market.

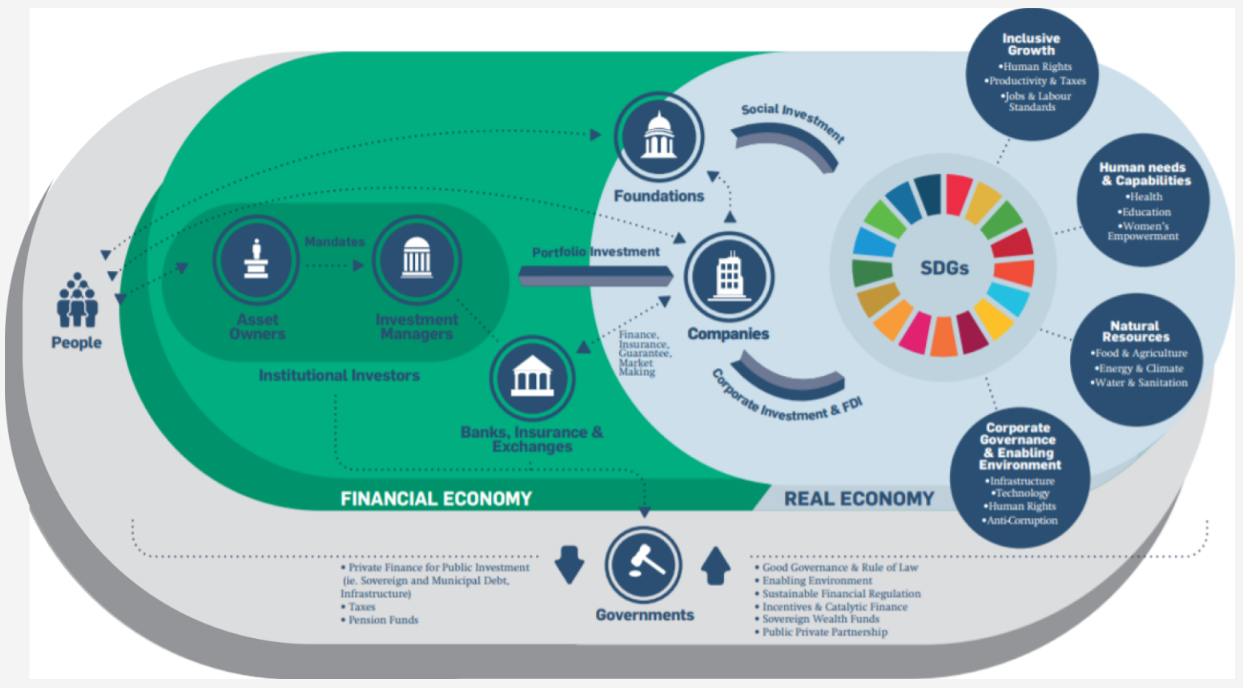

The Role of the Financial Adviser

Financial Advisers are an integral link in the investment chain and an imperative inclusion in the impact investment space. When discussing impact investing with clients, advisers discuss their investment purpose & understand their preferences towards impact investing. Advisers can then provide clients with different options in areas where their investments can make a difference; such as healthcare.

As more clients seek advice to align their super and investments with their values and support the issues that matter most to them, advisers proactively ask their clients about their responsible investment preferences. As more impact investments enter mainstream finance, advisers must embrace the provision of investment advice in this space, or risk being left behind.

Barriers to Recommending Impact Investing

Impact investing is not a new concept, yet it remains so for many advisers. There is a general lack of understanding and awareness about introducing the idea into client conversations and investment portfolio construction.

“For many advisers that have been in the industry for a long-time and may be set in their ways on how they do things and what products they recommend, impact investing can represent something new, and something unknown. I think the barrier for some advisers can be that perhaps they aren’t personally interested in impact investing themselves.”

– Kevin McDonald, CFP, Principal Adviser & Director of Future Focus Financial Planning.

Impact investing is often accompanied by questions about how to assess impact, as well as concerns about potentially unrealistic expectations that social impact and market-rate returns can be simultaneously achieved.

In our research, we note five common barriers to recommending impact investments.

1. Awareness and Understanding

2. Knowledge of Products and Methodology

3. Regulation of Products

4. Transparent Outcomes, Impact Measurement and Reporting

5. Understanding Client Preferences

Advisers who demystify and adopt impact investing in their advice offering are best placed to respond to the rising client requests on this investment approach and can appropriately service their clients to deliver quality financial advice that is in line with their values.

Knowledge of Products and Methodology

Responsible investment has become a major part of the investment landscape across Australasia. The RIAA’s Annual Responsible Investment Benchmark Report 2021 found that 40% of all professionally managed investments in Australia are now managed using a responsible investment approach.

More specifically for impact investing, the impact investment market has mirrored global trends in Australia, more than tripling between 2017 and 2019 to AU$19.9 billion, according to RIAA research.

The same research states that Australian investors indicate they would like to increase their allocation towards impact investments more than fivefold to AU$100 billion over the next five years. Across the Tasman, impact investing activity in New Zealand is also on a steep rise, growing over 13 times from NZ$358 million in 2018 to NZ$4.74 billion in 2019.

This growing interest in responsible investment across the market has resulted in significant growth in investment products and opportunities to invest.

RIAA’S CONSUMER RESEARCH SHOWS THAT:

Research from RIAA (2020), From values to riches- Charting consumer attitudes and demand for responsible investing in Australia 2020; and RIAA & Mindful Money (2019), Responsible investment New Zealand consumer study 2020

“I see sustainability as something that’s particularly important to myself. I see responsible investing as a way to help people create change a bit faster than perhaps Governments can. I also see private capital as leading the way in the change we want to see in the world, and a lot of clients resonate with the fact they can build wealth in a way that feels good for them”

– Kevin McDonald, CFP, Principal Adviser & Director of Future Focus Financial Planning.

Demystifying the Options

Industry-wide standardized definitions between impact, SRI and ESG investing, are at an early stage and this can result in confusion for investors and advisers.

Responsible investing is, in essence, an umbrella term for the various ways that investors can consider ESG issues. Impact investing is one type of approach to responsible investing.

“One way to think about the difference between ESG and impact investments is that impact investments don’t often need to use negative screens. They don’t exclude things because their sole purpose is positive, and their investment teams only look to include companies that create a positive impact or outcome”

– Hope Evans, Financial Adviser & Director of Simply Ethical Advice.

Interesting Note:

What is interesting to note is that all impact funds are ESG compliant, but ESG compliant funds do not necessarily make an impact. For example: Under an ESG investment framework, a fund could exclude or prevent investment in companies that produce significant carbon gas emissions. With an impact investing strategy, they can invest in a product or service that actively helps to reduce carbon gas emissions.

“Many people have different definitions of what Impact Investing means, so it’s often quite blurry. However, if you go to the Responsible Investing website, they have a place where you can learn and the table (below) they use to explain the responsible investing universe provides a clear overview of the options. Impact investing is the step before Philanthropy in that you’re investing for a positive social or environmental outcome while also making a return”.

– Hope Evans, Financial Adviser & Director of Simply Ethical Advice.

FIGURE 1: THE SPECTRUM OF CAPITAL IN THE “IMPACT ECONOMY”

Source: Bridge impact, The Impact Management Project, 2019

As you move from left to right in the table above, it indicated the specificity and intentionality of the strategy and illustrates the impact that is delivered. This means that the further to the right you go, the more definable and measurable the impact becomes. This doesn’t necessarily mean you’re creating more impact – but it does mean you’re able to have greater insight into the impact you’re generating and can demonstrate more accurately what that impact is.

Regulation of Products

There is a lot of jargon in the Responsible Investment space. There are many different ways to measure responsible investing and rating systems that lack consistency in regulation.

Globally, there are various voluntary frameworks and standard-setters, ratings and rating houses. To help with standardisation, it was recently announced at COP26 that International Sustainability Standards Board (ISSB) would be created to provide globally aligned and accepted sustainability reporting standards.

Globally aligned standards will be a powerful tool, particularly for investors with global portfolios, helping to mitigate some of the challenges posed by existing disparate regulatory and voluntary disclosure and reporting frameworks. However, this is still in development, and challenges remain in the interim.

A Note on Greenwashing

From an impact investing perspective, greenwashing is when an investment does not provide the impact that it is marketed to be providing. The risk of greenwashing can be reduced by selecting investments that provide intrinsic transparency around their investment approach, methodology, impact measurement and tracking. Reporting should be clear, concise, timely and transparent.

Transparent Outcomes, Impact Measurement and Reporting

How can Impact be achieved?

An investment can create an impact in several ways, including:

1. Advocacy Activities

Engaging with Governments or International organisations to work for public policy changes, e.g., more aggressive carbon emissions reduction targets. Or to implement divestment strategies.

2. Engagement with Companies

Stewardship and engaging directly with companies to support positive change at that company, e.g., improved diversity in management or tying management compensation to ESG goals.

3. Community Development and Investment

Using a part of fund proceeds or profits to invest directly in community initiatives, such as affordable housing or small business support.

4. Provision of Funding to Companies

Providing capital for the companies they invest in. By selecting companies that are having a positive impact (such as developing renewable energy), fund managers can support that impact.

What’s important to note is that impact areas can be vast, from financing social housing, small business funding and micro-lending, renewable energy, health and education improvements and international development projects. Some examples of impact investing include:

- Investing in companies developing unique technology to improve an environmental or social problem.

- Buying mortgage-backed securities which fund affordable housing for low-income communities.

- Funding projects that improve the quality of life for disadvantaged communities, such as rehabilitation centres, training, education and employment facilities.

- Microfinance loans to support the establishment of small businesses and create economies within developing nations.

- Funding initiatives that provide healthcare solutions, research and development to support the health and well-being of communities.

- Investing in initiatives that tackle the effects of climate change.

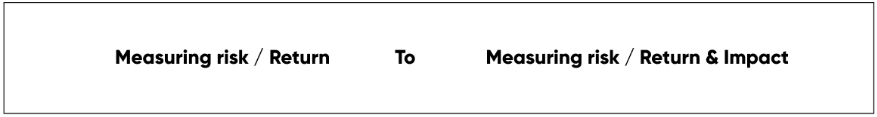

Adding Impact to traditional company analysis

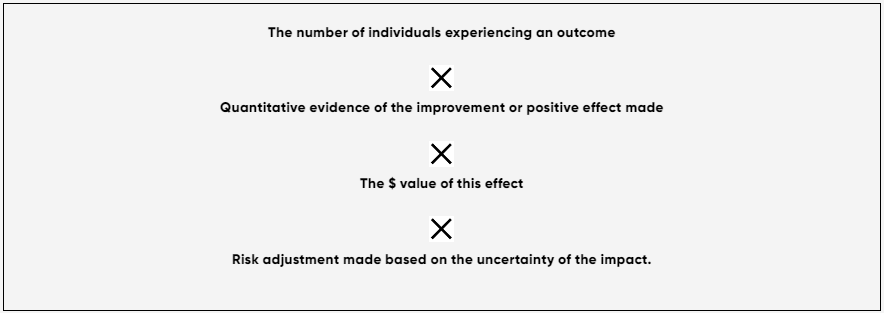

Besides tracking the exposure and targeted returns, impact investors also want to know what each of their investments achieves in terms of impact and measure the contribution that is being made toward their impact objectives.

This additional layer of consideration shifts how companies’ performance is measured away from the traditional risk / return analysis towards a three-layered approach of risk, return and impact.

Companies that can deliver an intentional positive social and/or environmental impact can help investors achieve the outcome that they would like from their investment. Some sectors are potentially better positioned to deliver this (think healthcare, for example).

Measuring Impact

For advisers and investors alike, when it comes to measuring impact, the first question should be: what is actually going be to measured?

When considering the myriad of impact investment opportunities on offer, a clear, well-defined mandate for particular impacts is the first step towards having a result that can be measured.

The second question is: how to measure the impact?

And in short, the answer is that good data collection is a crucial way to measure impact.

Financial First Vs Impact First

Impact investors are seeking out a better way to invest by optimising the social and environmental outcome and impact of their investment while generating solid returns. It is important to note that impact can be subjective and may change depending on the client’s values, preferences, lifestyle, goals and objectives.

Financial first investors prioritise maximising the market investment returns supported by the social and environmental outcomes. Financial objectives are also subjective and may change depending on the client’s lifestyle, goals and personal objectives.

Financial Return Expectations

Impact investors have diverse financial return expectations, which often largely depend on whether they are “impact first” or “financial first” in their investment priority or a combination of both.

An impact investor may seek market-rate returns or market-beating returns, with the majority most likely to seek competitive market-rate returns.

According to the RIAA Responsible Investing & Benchmark Report published in September 2022, responsible investment products are outperforming the overall market in the multi-asset category on all timeframes, as well as the domestic equity category.

Impact Returns

It is acknowledged that for an investment to be counted as an ‘impact investment,’ it is the inherent impact the investment can achieve that must be considered. Measuring impact can be subjective as an enterprise can create impact in several ways.

Impact: Outputs Vs Outcomes

The theoretical framework that underlies the assessment of enterprise impact makes an essential distinction between outputs and outcomes.

An output is a product or service produced by an enterprise; The (ultimate) outcome is the effect of the output in improving people’s lives.

1. To what extent will the intended output (whether a product or operational benefit) occur?

2. To what extent will the output contribute to the intended outcome?

With this in mind, the following impact measurement framework can be applied:

UN Sustainable Development Goals (SDG)

To create consistency and measure output and outcome, many impact investments are adopting the UN Sustainable Development Goals (SGD) framework to measure and report against.

The Sustainable Development Goals or Global Goals are a collection of 17 interlinked global goals designed to be a “shared blueprint for peace and prosperity for people and the planet, now and into the future”. The SDGs were set up in 2015 by the United Nations General Assembly and are intended to be achieved by 2030.

The United Nations (UN) 2030 Agenda provided the framework of Sustainable Development Goals and measurable targets. Each goal is interlinked with other SDG goals to “develop mutually reinforcing policies so that policies work together to achieve national goals and objectives while avoiding or minimising negative impacts in other policy areas.” In other words, from a systems design and thinking perspective it’s the recognition that working towards any SDG may create implications and impact on other SDGs.

Understanding a client’s preference for impact investing

Education is Key

There’s some opposition and misinformation in the media around impact investing. That’s why the education of the adviser and the client is vital for impact investing.

Adviser confidence and competence in this space is vital to develop investor trust when advising on impact investments. Advisers do not need to know all the answers but do need to be able to show people that they know what the relevant questions are. Advisers also need to overcome objections, build confidence, and increase awareness and understanding of clients.

Client education is key in helping identify priorities, demystify options and clarify confusion relating to impact investing. Many advisers recommend developing scripts and FAQs that address the common questions and objections that your clients have with respect to investing and impact strategies.

Investment Philosophy

Advisers need to have a comprehensive and robust investment framework that helps set their clients on the path to achieving their values and goals over the long term.

“I think for advisers wanting to recommend impact investments, they need to consider how Impact Investing fits into the entire investment ecosystem because you’re unlikely to recommend investing someone’s entire wealth in impact investments. It’s about considering how impact investing fits into the client portfolio”

– Fiona Thomas, General Manager & Financial Adviser at Ethinvest.

The foundation of an impact investing framework is the overarching Investment Philosophy and how impact investing and responsible investing fit into this framework. And for the client, the foundation of this framework is the expanded Investment and Impact Policy Statement that talks not only about broad investment goals and objectives, asset allocation, risk tolerance, etc., but also layers in responsible investing and their individual values and investing preferences.

Conversations that Matter

Almost all advisers agree on the importance of client questions to uncover a client’s values and investing preferences for impact investing.

Example questions to uncover a client’s investing preferences for impact investing:

- Do you want to include a responsible investment strategy in your portfolio?

- Do you know the difference between ESG, SRI and impact investing?

- Do you want to make a difference to society or the environment based on your investment choices?

- Do you actively want to pursue specific strategies that seek to provide a positive impact on the environment or society?

- Do you want to be able to measure the impact that your investment is having?

- Would you consider your approach to impact investing as impact first or finance first?

- What outcome would you like to see from your investments?

- What level of reporting is important to you?

Discussion and Measurement Tools

The development or use of visual aids and tools can support the client discovery process, fact-finding, and ascertain the individual preferences that a client may have when investing for impact.

Visual tools can help guide the conversation, creating a framework for discovery and articulation of what is of most importance to an investor. These can be presentations, questioning prompts, surveys and quizzes.

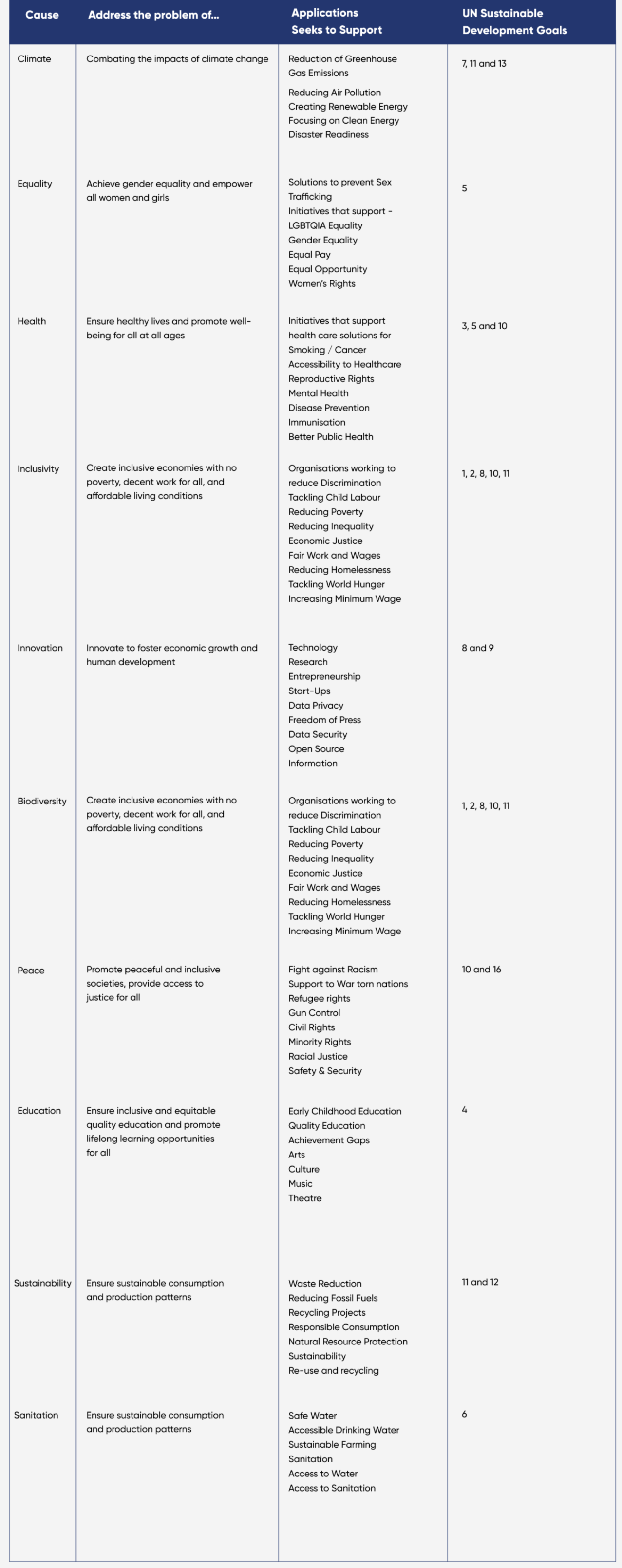

As an example, the below table provides a framework for supporting the discovery of a client’s values and investing preferences as follows:

Step 1. Review the table below and choose the causes of the most importance / highest value to you.

Step 2. Rank the causes in order of priority. Whilst all factors are equally important, rating them relative to each other helps to create a more personalised impact investing strategy.

Step 3. Consider the application and which aspects are specifically important to you within each category you’ve ranked priority

Impact Investment Preferences Worksheet

Researching Options

There are several research rating houses and tools available to advisers to use to support the recommendation of investment products that suit a client’s values and objectives. Many advisers in this space recommend using the RIAA reports, LEAF ratings system and the ETHOS online tool when researching options and making recommendations. As impact investing is a personal and tailored investment approach, it requires time to ensure the appropriate due diligence is completed before finding the appropriate match for a client’s objectives.

Reporting Impact

Reporting on the impact is a necessity. It is vital to communicate with your clients what is being done and how their money is being invested.

Reporting on the achievement of values and goals, both financial and non-financial, is one of the most valuable deliverables advisers have to keep their clients engaged on their impact journey.

Depending on how you have implemented the solution for your clients, this could be reporting on actual tangible metrics such as greenhouse gas emissions or this could be providing a metrics-based assessment. Your clients must understand that metrics and ratings are subjective and a reflection of the provider’s interpretation of standards, etc.

Integral to this is also regular communication to clients through the sharing of stories. Stories are what make the impact tangible and real to clients. When the impact measured is clear and easily identifiable, the sharing of stories on what is being achieved becomes a valuable tool for advisers, i.e. lives saved or quality of life improvements that a healthcare impact strategy has delivered.

Guides Tools & Training

Guides

Responsible Investment Association Australasia Responsible Edition 3 2021

Ethical Advisers Co-Op, Ethical Fund Ratings

Tools & Training

RIAA benchmark and values

Ethical Invest Group Accelerator Program

Leaf Ratings System

ETHOS Values alignment and impact strategies assessment

References

01 Morningstar Global Sustainable Fund Flows Report

02 Responsible Investment Association Australasia From Values to Riches 2020

03 Responsible Investment Association Australasia 2021 Benchmark Report

04 Responsible Investment Association Australasia 2022 Benchmark Report

05 Investment Trends 2021 ESG Adviser Report

06 Investment Trends 2021 ESG Investor Report

07 RIAA Benchmarking Impact – Insights, Activity and Performance Report 2020

08 XY Adviser Podcast – Ethical Investment Series

With Thanks to Contributors

Fiona Thomas, General Manager & Financial Adviser at Ethinvest.

Kevin McDonald, CFP, Principal Adviser & Director of Future Focus Financial Planning.

Hope Evans, Financial Adviser & Director of Simply Ethical Advice.