Practical strategies to mitigate the impact of inflation risk on retirement incomes

Brought to you by Challenger. Case studies from Australian financial advisers.

In this special production

Challenger would like to thank the following financial advisers for participating in the production of this paper:

Executive Summary

1. 2022 saw a perfect storm, with the confluence of stock market losses, falling real estate values, increased mortgage rates and 30-year-high inflation rates

2. Inflation hits retirees especially hard, and, along with longevity, market, and sequencing risks, represents a significant risk to retirement incomes

3. Advisers now rate inflation risk as the single biggest threat to retirees’ incomes

4. In Australia, retiree households have recently experienced higher inflation than that experienced by employed households

5. By working with Australian financial advisers, we have identified a wide range of individual strategies and responses being used by retirees to help mitigate inflation risk

6. These strategies and responses generally fall into one of three categories – client-driven lifestyle changes, asset allocation and product strategies

7. Lifestyle changes can range from major (delaying retirement, downsizing, sea changes), through moderate (delaying an overseas holiday or the purchase of a new car, installing solar energy), to minor (eating out less, switching to cheaper grocery brands, cancelling streaming services)

8. Asset classes that respond well to inflation include infrastructure, commodities, real estate and inflation-linked bonds

9. Advisers are already building robust inflation defence mechanisms into retiree portfolios, and hence the most common strategy is to reinforce, through communication and education, the importance of staying the course and taking the longer-term view on markets

10. In terms of product mix, the cost-of-living crisis has brought into focus the inflation-fighting abilities of the Age Pension and CPI-linked lifetime annuities

11. Legislative changes have enabled innovation in the lifetime annuity category

12. A strategy combining the Age Pension, an account-based pension (ABP), and a CPI-linked lifetime annuity can significantly increase the likelihood of a retiree meeting their retirement income goals

13. Retiree mindsets are slowly shifting away from an ‘inheritance maximisation focus’ to a focus on ‘living their best life in retirement’.

Section 1: The current inflation risk environment

The 2023 retirement income context

For Australians in – or approaching – retirement, 2022 represented a perfect storm.

The confluence of stock market losses, falling real estate values, increased mortgage rates and 30-year-high inflation rates, has hit some retirees hard, particularly those at the beginning of their retirement journey. In 2023, the outlook remains challenging.

To the extent that volatility in equity markets is not uncommon, it’s wealth-destroying, uncertainty-inducing effects will typically be factored into – as much as they can be – the investment strategies and underlying asset allocations of most retirement plans.

Even the current positive correlation between equity and bond prices – which some commentators have suggested represents the ‘death of 60/40’ – is not without substantial historical precedent, and as such represents more of a point-in-time portfolio optimisation challenge, rather than an existential crisis.

But inflation risk may well be different, representing a more insidious risk to retirement incomes and lifestyles as it erodes spending power. When an inflation shock occurs at the same time as an equity market shock, its impact is supercharged, and any sequencing risk is amplified.

In the words of American economist and Nobel Laureate Eugene Fama:

“When there’s a spike, the spike persists for a long time. Inflation tends to be highly persistent once you get it.”1

This sentiment was no doubt front of mind for many upon the release of Australia’s annual Consumer Price Index (CPI) for 2022, which, at 7.8%2 , was at the very top end of most expectations.

Financial advisers understand this and now rate inflation as the biggest risk to their clients’ retirement outcomes, substantially ahead of longevity and market risk.3

Mitigating inflation risk while coping with a volatile market requires strategic responses, across areas such as lifestyle, asset allocation, and product selection, and around Australia financial advisers are working with their retiree and pre-retiree clients on these very responses.

In this paper – a joint initiative between Challenger and the Ensombl advice community – we will examine the nature of inflation risk for retirees and the strategies that can be employed to help mitigate its effects on retirement incomes, within the framework of a curated selection of case studies from Australian financial advisers.

Retirement is risky

Retirement can be a fraught period of life for many people. Notwithstanding the freedom it can represent, retirement comes with its own financial, lifestyle, and emotional challenges, and there are many risks retirees face in ensuring this chapter of their lives is happy, fulfilling, and comfortable.

Experts generally classify retirement risks as falling into five high-level categories:

1. Sequencing risk – if a market downturn or inflation shock occurs early in retirement the negative impact can be amplified

2. Market risk – investment market volatility creates uncertainty over how long retirement savings will last

3. Inflation risk – eroded spending power may force accelerated drawdowns to maintain lifestyle

4. Longevity risk – the risk of outliving one’s retirement savings

5. Emotional risk – behavioural biases can compound the emotional challenges associated with stopping work and can

impede sound decision making

While to a large extent, these risks are interrelated, much of the commentary about retirement risks is understandably focused on those with the most obvious and immediate impact – market risk and sequencing risk.

Why sequencing risk is becoming more important

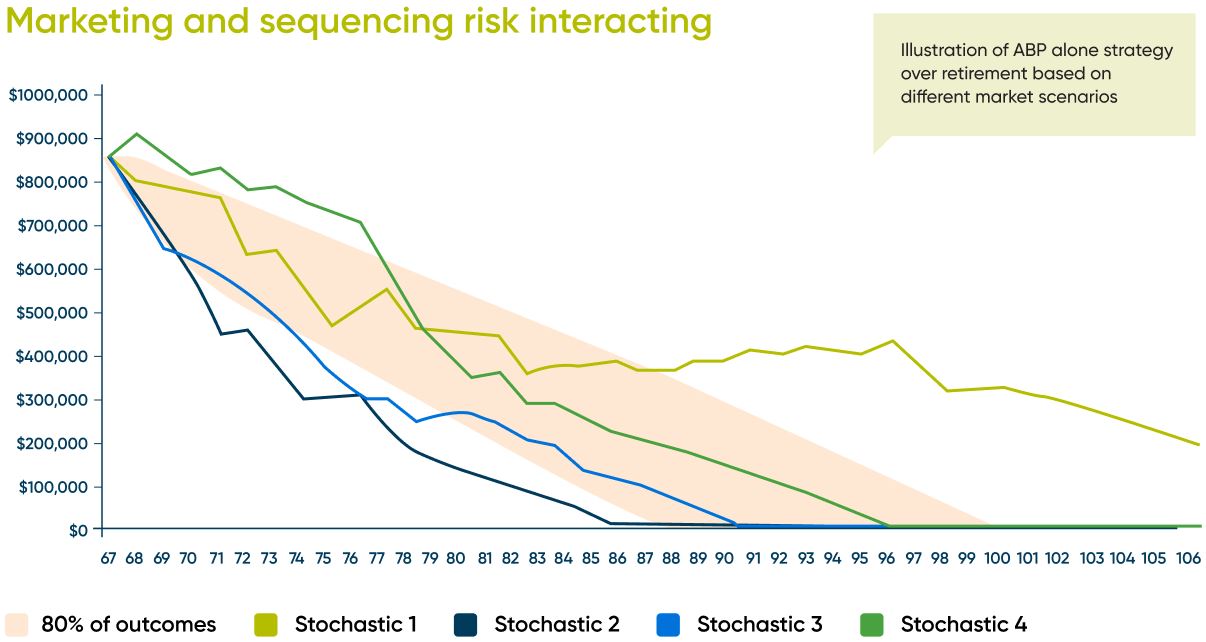

Three charts help explain the potentially devastating impact of sequencing risk.

Figure 1 shows the results when 2,000 simulations of market and inflationary conditions are modelled to show the impact on an investable retirement portfolio derived solely from an account-based pension (the most commonly used retirement income product in Australia).

Source: Challenger Retirement Illustrator model using Social Security rates and thresholds effective 20 March 2022. 2,000 simulations of market returns and inflation provided by Moody’s Analytics. $64,771 p. a. desired income increasing annually with price inflation. Amounts shown are in today’s dollars. See Challenger Retirement Illustrator for default fee assumptions and methodology guide.4

As per the ’80% of outcomes’ shaded area, there is an 80% likelihood that the retiree’s entire savings will be exhausted between 20 and 33 years after commencement (at age 67). However, in some scenarios, such as ‘Stochastic 2’, these savings last as little as 18 years.

The typical retirement horizon is getting longer

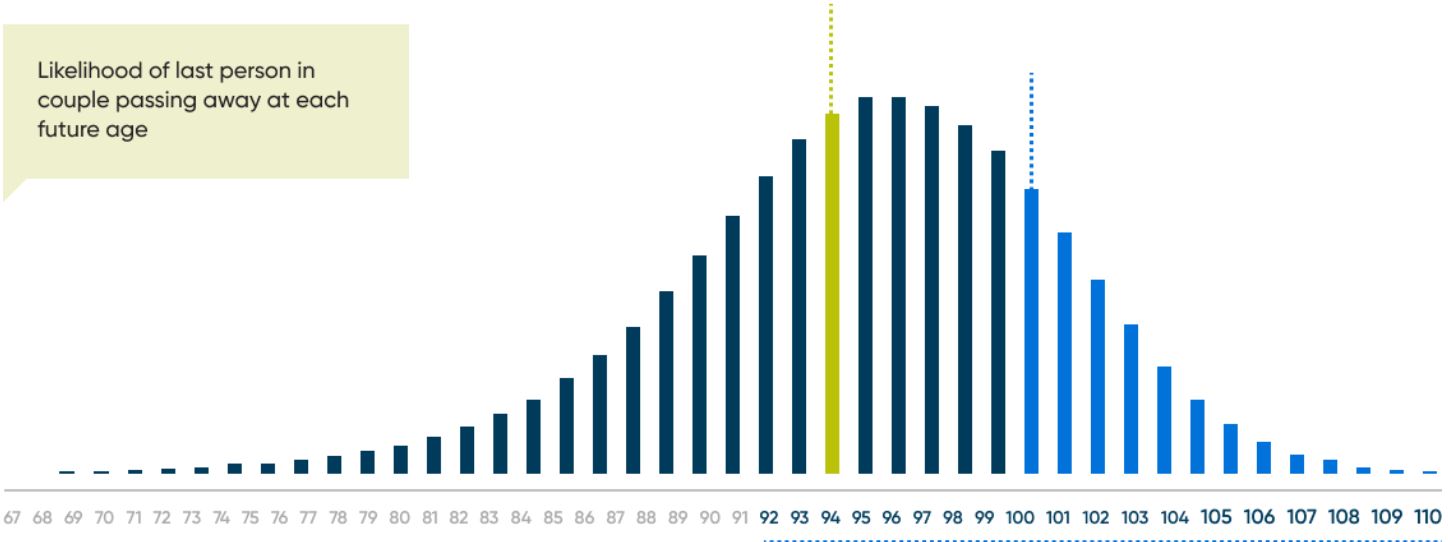

While 33 years may have once seemed an overly optimistic time horizon for a retiree to be aiming for, life expectancies have continued to rise to the point where 1 in 8 couples will need their assets to last beyond age 100 (Figure 2).

FIGURE 2: RETIREES ARE LIVING LONGER

62% change will need income to last past age 92 which is life expectancy without allowing for future improvements

Source: Australian Government Actuary ALT 2015-17, With 25 year improvement factors. Assumes a male and female exactly age 67, calculated at May 20225

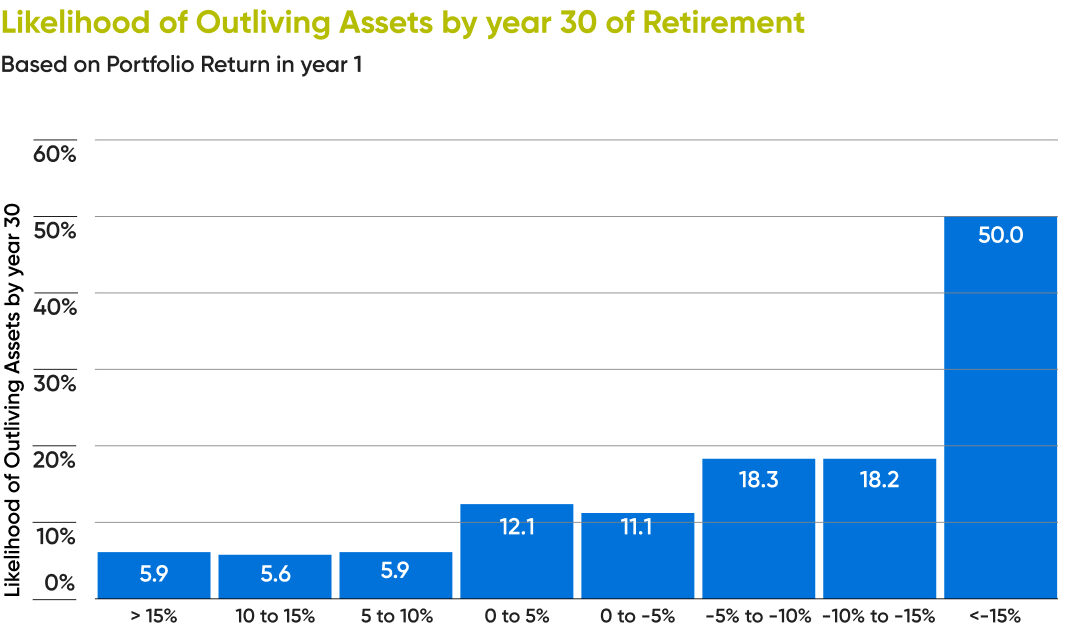

But perhaps the starkest demonstration of the potential impact of sequencing risk is shown in Figure 3.

Based on modelling by Morningstar6, the likelihood of a retiree exhausting their entire retirement savings balance within 30 years becomes a staggering 50% when the portfolio suffers a 1st-year loss of at least 15%. Even a first-year loss in the 5 – 14% region can have a significant impact.

In 2022 the S&P 500 index recorded a full-year loss of over 18%7, while in Australia, after a very bumpy ride, the All Ordinaries finished over 7%8 in the red.

FIGURE 3: LIKELIHOOD OF OUTLIVING SAVINGS AFTER FIRST-YEAR PORTFOLIO LOSS

Source: Morningstar9

Assumptions: $1m starting balance, in a 50/50 stocks & bonds portfolio. 3.3% initial withdrawal, adjusted for inflation each year. 1,000 simulations ran, assuming an average return of 5.2%p.a. and inflation of 2.2%p.a.

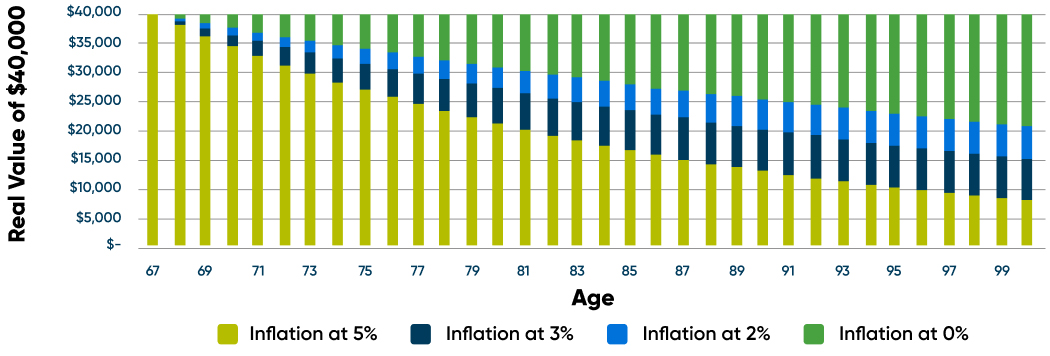

Inflation – once forgotten, now top of mind

The impact of inflation on a retiree’s lifestyle can be dramatic. Without a wage or salary also increasing with inflation, retirees face additional risks to maintaining their lifestyle, as the purchasing power of their investments can erode. As can be seen in Figure 4, even modest rates of inflation can have a dramatic impact over a typical retirement horizon.

FIGURE 4: IMPACT OF DIFFERENT INFLATION RATES ON RETIREMENT INCOME

Source: Challenger10

But up until recently, it seems the wealth-eroding power of inflation wasn’t given the attention it deserves. And it would be wrong to say this is because it hasn’t previously been a problem.

Even looking at the last 20 years – a benign period with an average inflation rate of a modest 2.6% p.a. – the CPI rose 76.8% between 1999 and 202111.

Of course, the current inflationary regime means even the short-term impact is dramatic.

The December 2022 CPI figure of 7.8% was the highest since 1990, and if we apply the RBA’s short-term inflation forecasts to the cost of a ‘Comfortable Retirement’, as estimated by ASFA, we can see a very real and very immediate effect.

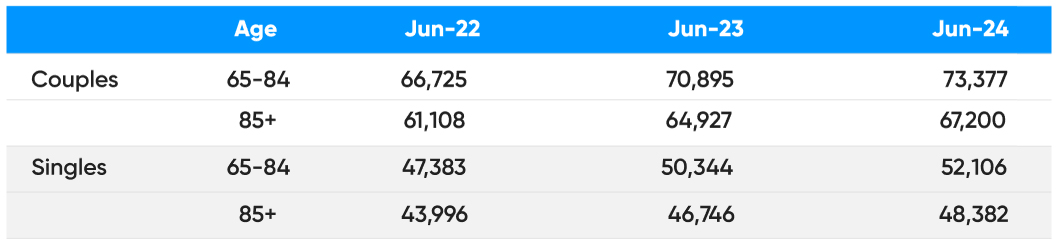

FIGURE 5: IMMEDIATE IMPACT OF INFLATION ON THE ANNUAL COST OF A COMFORTABLE RETIREMENT

Impact of higher inflation on annual retirement expenditure* ($)

*Based on June 2022 annual expenditure for comfortable lifestyle from ASFA. CPI inflation forecasts from the RBA’s August Statement of Monetary Policy

Source: AFR12

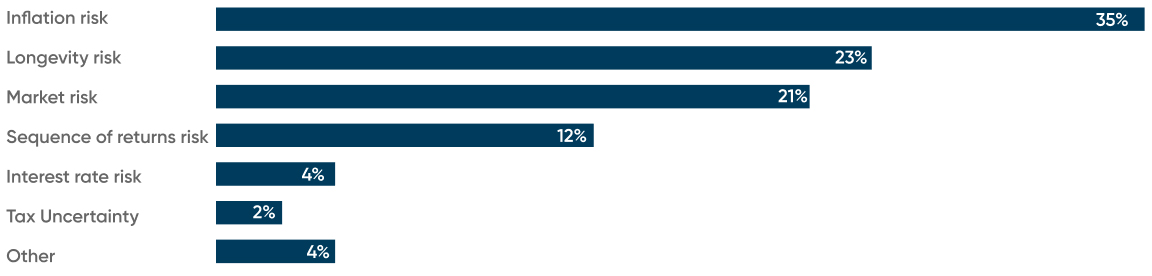

Unsurprisingly, a US survey found that financial advisers, once more concerned about market volatility and longevity risk, now rank inflation risk as posing the biggest threat to retirement incomes of all, a result highly likely to be replicated in Australia.

FIGURE 6: US ADVISER RANKING OF BIGGEST RISK TO RETIREMENT OUTCOMES

Inflation Poses Biggest Risk to Retirement Outcomes, According to Advisers

Which do you feel is the biggest threat to successful retirement outcomes for your clients right now?

Source: PGIM Investments Survey13

Timing matters – sequencing risk can be created by inflation shocks too

Just as market downturns early in retirement can have an amplified impact on retirement savings, the inflationary profile – the shape of inflation – experienced during retirement can also make a big difference, with early inflationary shocks creating their own sequencing risk.

US retirement academic, Wade Pfau, describes the first 10 years of retirement as the “fragile decade” for this exact reason:

“If there’s high inflation early in a person’s retirement, that permanently raises the cost of their retirement,” Pfau says14.”

Inflation experienced early in retirement elevates future spending, whereas inflation further along in retirement will generally have a more muted impact, as can be seen in Figure 7, below.

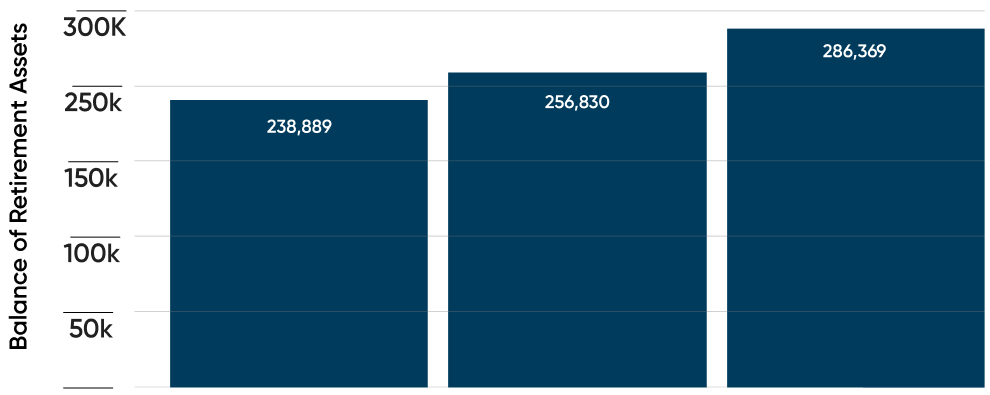

Shown in Figure 7 are the results after modelling the same retirement scenario with the same average annual inflation rate (3.2%) over 30 years, but with three different inflation paths.

1. Profile 1 assumes inflation of 10% in year 1 followed by 3% pa until the end of year 30

2. Profile 2 assumes 3% p.a. for years 1 – 14, 10% in year 15, reverting to 3% until the end of year 30

3. Profile 3 assumes 3% p.a. for years 1-29 followed by 10% in year 30

4. Other assumptions are a $1m starting balance, no market return, and a 1.5% initial withdrawal rate, adjusted for inflation thereafter.

As can be seen, the retiree who experienced higher inflation earlier in retirement finished with a 7% lower balance than the retiree who encountered it mid-way through retirement, and almost 17% less than the retiree who didn’t encounter inflation until the end of retirement.

FIGURE 7: IMPACT OF DIFFERENT INFLATION PATHS ON RETIREMENT BALANCE AFTER 30 YEARS

Balance at End of Year 30 Assuming Three inflation Paths

($ Mil Starting Balance, 0% Market Return, 1.5% Initial Withdrawal Rate, 90% Success Rate)

Source: Morningstar15

1. 10% Inflation in year one followed by 3% annual inflation until the end of retirement

2. 3% annual inflation in years one through 14, 10% inflation in year 15, followed by a return to 3% annual inflation through 29 followed by 10% inflation in year 30

For simplicity. we assumed the retiree earned not market return and withdrew 1.5% of an initial $1 million retirement balance, adjusting withdrawals for inflation thereafter over a 30- year horizon.

The components of CPI – why retirees are hit particularly hard

The headline CPI figure is a composite of price changes across a range of different categories, including energy, housing, food, beverages, clothing, healthcare, and transport. Price movements are unlikely to be uniform, and different households might experience more or less impact from changes across different categories depending on their own consumption patterns.

As Head of Prices Statistics at the ABS, Michelle Marquardt, said16:

“Living costs for Age Pensioner households have been particularly impacted by increases in food and non-alcoholic beverages, as grocery food items make up a higher proportion of overall expenditure for Age Pensioner households compared to other types of households.”

In effect, retiree inflation can sometimes be higher than that for working households.

Healthcare costs

Healthcare costs are of particular concern for retirees

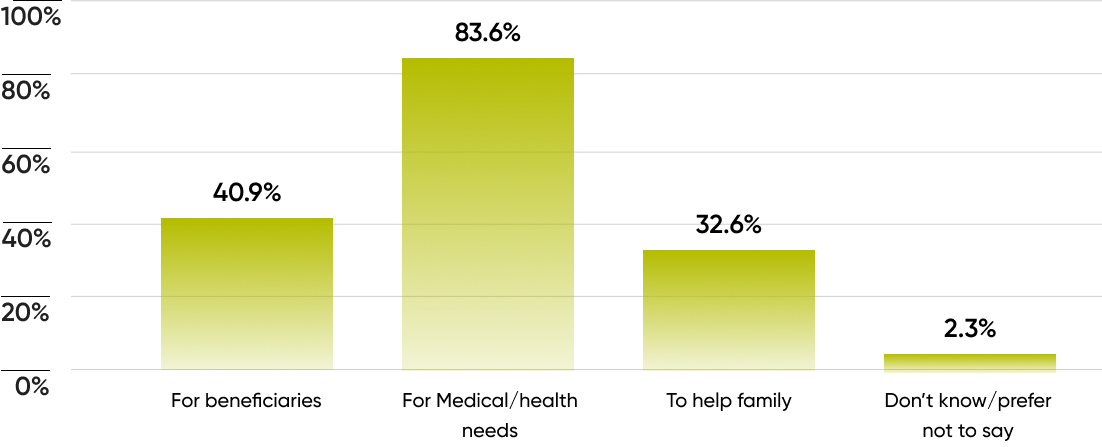

The additional healthcare costs invariably associated with ageing are a particular concern for retirees.

Indeed, according to Australian research17, the ability to meet any potential future health costs is the single biggest reason retirees cite for wanting to preserve capital in retirement.

FIGURE 8: REASONS FOR MAINTAINING CAPITAL IN RETIREMENT

Source: National Seniors/Challenger

FIGURE 9: CPI AND CPI-HEALTH JUNE 2002-2022

This intense focus on healthcare costs is not without justification, with ‘health inflation’ being consistently higher than overall inflation over the last two decades (as shown in Figure 9).

Source: ABS18

Adviser Insight: Client uncertainty around healthcare needs

“There is often a little uncertainty around planning for medical and health care needs. Retirees need to make decisions today that might impact where they are 15 and 20 years into retirement. Many of the costs of accessing the Australian healthcare system are linked to our social security system. MRIs, ultrasounds, or all sorts of different medical tests can be substantially different out-of-pocket costs just on whether that person happens to be eligible for Social Security benefits.” Michael Miller.

Section 2: Strategies to mitigate inflation risk

A more dynamic approach to drawdowns

A commonly used rule of thumb for the optimal pension drawdown rate is 4%, and indeed Australia’s mandatory draw-down limits are consistent with this approach.

Increasingly however, there is recognition that these minimum pension withdrawal limits (4% for those under 65 increasing to a maximum of 14% for those aged 95 and over) are not flexible enough to cope with large external shocks of the type retirees experienced during 2022.

And while the temporary halving of these rates19 until 30 June 2023 is a welcome reprieve for many retirees, as it provides the opportunity to slow drawdown rates and allow a degree of portfolio recovery, there is no doubt a more permanently flexible approach would be welcomed by most.

Academically, there is plenty of evidence supporting a more dynamic approach. Examples of these ‘dynamic spending rules’ include approaches developed by Yale, Guyton-Klinger, and US financial Adviser Michael Kitces20.

Common sense also suggests that regularly assessing the performance of your portfolio and the inflationary environment, then adjusting spending, asset allocation, and drawdown rates accordingly will likely see a dramatic improvement in the odds of one’s retirement savings ‘going the distance’.

Adviser Insight: Dynamic spending puts the odds back in a retiree’s favour

“David Blanchett, Head of Retirement Research for PGIM, studied three different drawdown strategies, fixed dollar, versus fixed percentage, versus dynamic. He concluded the optimal approach, by a large margin, was a dynamic approach, where retirees regularly review changes to their portfolio and the macro environment, and then adjust their discretionary spending – their ‘want spending’ – accordingly. This is the approach we have taken with our retiree clients, who I think are pretty disciplined.” David Reed.

Advisers are tailoring responses to the unique circumstances of their clients

There are many different ways to mitigate the impact of inflation on retirement income, and to the extent that every retiree’s circumstances are different, the specific responses and strategies being employed at an individual client level are both many and varied.

However, after speaking to financial advisers around Australia, it is clear that these responses and strategies generally fall into one of three high-level categories:

1. Client-initiated lifestyle changes

2. Asset allocation and portfolio construction strategies, and

3. Product selection strategies.

Lifestyle changes

Making lifestyle changes designed to lower the cost of living is one obvious way retirees can respond to inflation shocks. This is separate from the lowering that occurs naturally at retirement when the costs associated with working (transport, clothing, takeaway food) are reduced.

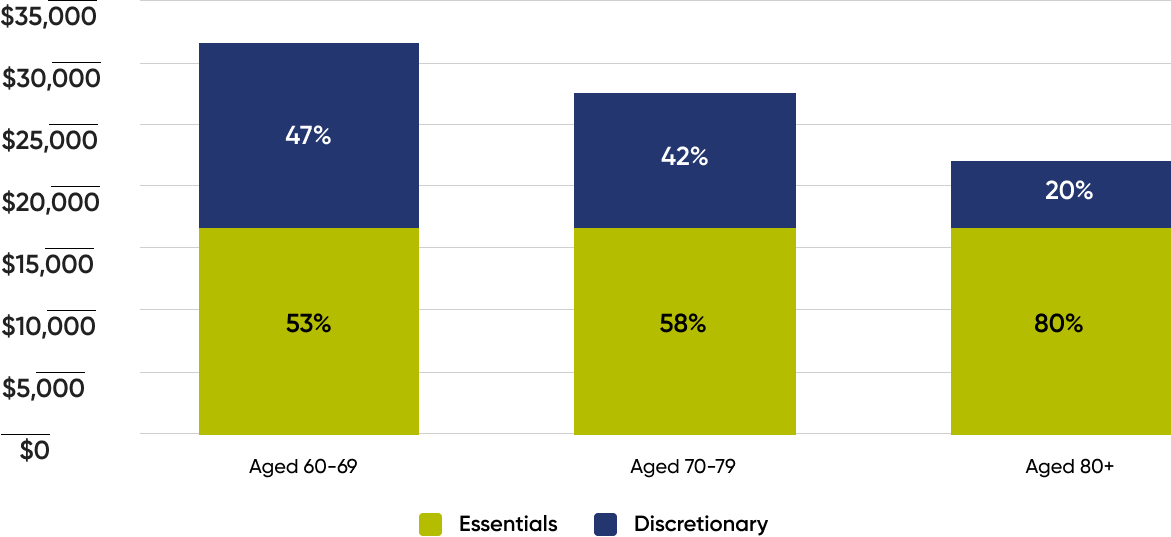

Analysis21 suggests for the first few years, retirement household spending is likely to be split between discretionary (clothing, entertainment, furnishings, travel) and essential items (food, transport, housing, medical), although as they age this pattern shifts.

Overall spending tends to reduce over time (for example as an individual travels or entertains less) and becomes more focused on household essentials, as illustrated in Figure 10 below.

FIGURE 10: SPENDING PATTERNS FOR SINGLE HOUSEHOLDS BY AGE, 2015-16

Source: Minney, A. (2018). “Household spending patterns in retirement” AJAF 2018 Vol 1 pp18-27

In this context, an obvious way to mitigate the impact of inflation – without increasing the rate of drawdown from one’s retirement savings – is to reduce expenditure, on discretionary items (‘wants’), essentials (‘needs’), or both, by making lifestyle changes.

These lifestyle changes could range from:

1. Major (moving to a smaller residence, and/or a new location), to

2. Modest (delaying the purchase of a new car or an overseas holiday, installing solar energy), to

3. Minor (making dietary changes, shopping around for cheaper groceries, wine, and petrol, ceasing streaming subscriptions, going to the cinema less).

Downsizing is obviously a complex, expensive undertaking, with potentially significant Centrelink implications, and would generally be planned years in advance, rather than being a dynamic reaction to increasing inflation. That said, the confluence of a higher cost of living and the share market downturn experienced during 2022 will have prompted many – especially those living in expensive capital cities – to consider the merits of such a strategy.

Adviser Insight: Flexible working makes downsizing more viable for retirees

“We see clients who don’t have enough super to retire, but they’ve got secure jobs that are also quite flexible, offering work-from-home or part-time roles. Suddenly people are saying ‘maybe I don’t need to live in Sydney, maybe I should go live where I want for less, cash up and put more money into super’. What they’re doing is selling their homes and moving to a cheaper location and using the proceeds to put money back into superannuation under the downsizer contribution rules where they can put up to $300,000 each as a couple into super.” Deborah Kent, Integra Financial Services.

While eating less is not really a sustainable strategy, modifying shopping habits certainly is.

Brand substitution, cutting back on more expensive meat cuts and avoiding some fresh foods at their price peak are all common belt-tightening activities. Australia’s East Coast floods threw up some interesting outcomes in the price and availability of some common vegetables, and the $10 lettuce won’t be forgotten in a hurry. UBS analysis22 showed while food prices at the two major supermarket chains climbed 9.2% for the December 2022 quarter, this comprised a 9.6% increase for fresh meat and vegetables, compared to 9% for dry groceries.

Adviser Insight: Cost of living spike acts as a reality check for clients

“The cost-of-living spike has acted as a reality check for many of my retiree clients. It came onto their radar at the back end of 2022. A lot of them are quite conservative from a risk tolerance perspective, which can make recovering from the current volatility more challenging. On the other hand, many can also be quite frugal by nature, which will serve them well as they try to navigate through the current mire. As well as ensuring a regular rebalancing of their portfolio where appropriate, the first action many have taken to mitigate the increased cost of living has been a temporary paring back of their spending, rather than increasing their drawdowns. I do get the sense some of them are even relishing the challenge of trimming their budgets, showing how clever they can be in economising!” Nick Arkoudis.

Energy costs have also proved particularly problematic recently, and strategies here can range from shopping around for cheaper deals from energy providers to capital expenditure in items that can bring down ongoing costs (solar energy, window coverings). The added benefit here is a potential increase in Age Pension payable due to a reduction in assessable assets from the capital outlay. There may also be benefits if electricity fed back into the grid is rewarded as electricity credits rather than financial payments.

Adviser Insight: Living the best life in retirement

“The central objective when building a retirement plan should always be to allow the client to live their best life in retirement, based on the circumstances definitely, but more importantly on their values. If you speak to the children of my retiree clients, their primary concern is that their parents are living comfortable lives and are financially secure. In that context, retirees should only be making short-term sacrifices to shore up their longer-term lifestyles, not to maximise the wealth they can pass on.” James Stephan.

Paying down debt

An increasing number of Australians are entering retirement with mortgage debt. Indeed, recent census data from the ABS23 suggests the proportion of people with mortgages in retirement has tripled since 2001.

Recent interest rate increases (designed ironically to rein in inflation) will mean some borrowers will be faced with close to a doubling in rates, with the associated increase in monthly repayments forcing many into mortgage stress. As such, paying down this debt to bring down monthly outgoings will make sense for many.

Even temporary cuts in spending can help

Lifestyle changes can of course be temporary or permanent, and happily, for retirees, even temporary reductions in spending (and therefore drawdown) can significantly reduce the likelihood of exhausting one’s retirement savings.

Morningstar modelled a scenario with a 10% initial reduction in spending (and drawdown) and compared it with a scenario where the real (inflation-adjusted) rate of drawdown remained fixed. This modelling was done for withdrawal rates ranging from 2% to 5% per annum.24

Figure 11 below compares the two scenarios and shows the effect is amplified at higher starting withdrawal rates.

FIGURE 11: LIFESTYLE EFFECT – THE IMPACT OF A TEMPORARY REDUCTION IN WITHDRAWALS

Source: Morningstar

Delay retirement or re-enter the workforce

A final lever that can be pulled to shore up retirement finances – and extend their life in the face of elevated inflation – is to either delay imminent retirement or re-enter the workforce if you are already retired.

It’s a major step that shouldn’t be taken lightly, and nor is it one realistically open to everyone, but it is certainly one some advisers are urging older Australians to consider.

As well as reducing the need to draw down retirement savings yet to recover from market downturns, making additional superannuation contributions when unit prices are depressed can create the opportunity for more upside as values recover.

The trend towards more flexible working in the wake of Covid, along with a worsening skills shortage, may make such a strategy more viable that it has previously been.

Adviser Insight: Working longer becomes a more viable strategy as attitudes change

“Working from home has changed the landscape – how people plan for their retirement, how they’re working. It’s really a very different environment to what I’ve seen (and I’ve been around for 35 years). Retirees are less hesitant to delay their retirement, shifting from an ‘eager to retire’ mindset to happily continuing to work as they seek a sense of purpose in retirement. Years ago, if I’d said to a client ‘you don’t have enough money to retire, and you’ve got to work till you’re 70’, they’d look at me like I was crazy. But a lot of people are heading towards that 70, and they’re happy to delay, especially if they don’t have to get the train to the city, they don’t have to sit in traffic.” Deborah Kent.

Source: Australian Financial Review.25

A dynamic approach to asset allocation and portfolio construction strategies

Portfolios need to be flexible as the macro-economic environment changes

Retirement investment portfolios are expected to deliver both stability and growth, but the need for each is not uniform over time.

In the same way static spending rules have inherent shortcomings, so too can a set-and-forget approach to asset allocation be problematic. Meaning just like spending, portfolio structures will need to be dynamic over time, in line with the changing macro environment.

The recent inflationary surge experienced around the world is an unexpected shock to the system – in much the same way the pandemic was – and so the asset allocation response of investors is as much about recovery as it is about longer-term positioning.

Of course, individual retirees face a different set of challenges to institutional asset managers. Any drop in portfolio value is more keenly felt, and in this context the somewhat dogmatic belief that the balanced portfolio (50/50 or 60/40) is optimal for retirees is understandable.

However, even the humble balanced portfolio has been under threat recently. For the first time in decades, both equities and fixed interest have produced negative returns, meaning the effectiveness of fixed income as a hedge against falling equity markets has been diminished, leaving investors nowhere to turn, and some experts speculating over the ‘death of 60/40’.26

Adviser insight: A liability matching approach to building retiree portfolios

“We look at a client’s capital needs over time and match them to asset classes accordingly, using an evidence-based approach. We then look at how that compares with a portfolio based approach purely on their stated risk tolerance. Where there is a divergence between the two, we will revisit with the client, but always with a view to taking risks off the table. Protecting the capital critical to their lifestyle needs is one risk, but so is the risk of outliving savings because of overcaution.” James Stephan

A diverse range of views on how investors should respond to inflation

As you would expect, the question of how to optimise portfolio construction in high inflationary times has spurred much research, commentary, and often conflicting opinions.

Sorting through the many diverse views, however, it is clear (and pleasing) that there are several points on which most experts agree, and are likely to be reflected in portfolio responses.

Equities deliver the best real growth over the long term

One obvious response to an inflationary shock is to pursue growth that exceeds inflation.

Notwithstanding the fact that more sustained inflation is likely to be associated with higher cash rates, market-linked investments such as stocks – with their higher growth potential – are likely to be a more effective way of keeping ahead of inflation, certainly compared to fixed-interest and cash, as illustrated in Figure 12 below.

FIGURE 12: STOCKS V BONDS V CASH AFTER INFLATION AND TAX, 1970 – 2020 (US)

Source: Schwab Centre for Financial Research27

The first response retirees should therefore be to not panic and not abandon their market exposures.

Adviser Insight: Staying the course and not panicking

“With markets depressed, we want to leave it as long as possible for their capital to recover. If an unexpected expense comes along then the option is always there to draw a lump sum, so they’ve always got a safety net. Of course, I keep counselling them that markets will turn the corner and the longer they can hang in the better in terms of recovery and being to handle an increased cost of living.” Nick Arkoudis.

The next priority is to consider how different equity types react to inflation.

For the purposes of this paper, we examined the views of a large number of different fund managers and other experts, as expressed through commentary in financial and trade media, and through multimedia channels including webinars and podcasts.

Emerging from all this commentary were several common themes, including the merits of commodities, infrastructure, real estate, inflation-linked bonds, and alternatives, as inflationary hedges.

Some assets are better positioned for high-inflation environments

Commodities and infrastructure are two of the best examples of asset types that generally respond positively, and quickly, to inflation, and stocks linked to these assets have indeed performed relatively well recently. Other examples include alternatives, real estate, and inflation-linked bonds.

– Commodities

Commodities are one of the few asset classes that generally benefit from rising inflation. As demand for goods and services increases, the price of those goods and services usually rises as well, as do the prices of the commodities used to produce those goods and services.

Commodities typically have a low correlation with bonds and with the broader equities market.

To the extent that the demand pressures seen around the world are related to our gradual recovery from Covid, and the associated supply chain issues, the strength of underlying demand in many categories is uncertain. Certainly, the ratcheting up of interest rates by central banks – reflected in mortgage rates – is likely to be already having the intended demand-suppressing effect.

During 2022, the RBA’s Index of Commodity Prices increased by 16.6 per cent in Australian dollar terms, led by higher thermal coal, LNG, and iron ore prices.28

– Infrastructure

Infrastructure investments are also capable of being an effective mitigant against inflation, and indeed global listed infrastructure has delivered returns in excess of inflation over the long term.

1. Economic infrastructure (solar or windfarms, toll roads, airports)

2. Social infrastructure (schools, prisons)

3. Industrial infrastructure (waste treatment facilities)

Most infrastructure assets have an explicit link to inflation through regulation, concession agreements or contracts. They are generally characterised by long-term contracts where cash flows are linked to CPI.

Commodities typically have a low correlation with bonds and with the broader equities market.

Analysis29 by First Sentier Investors in 2018 found that more than 70% of assets owned by listed infrastructure companies have effective means to pass through the impacts of inflation to customers. Examples can include:

1. CPI-linked toll increases for users of roads, bridges, and tunnels (as seen in Australia)

2. Construction contracts where higher input prices (wages, materials) can be passed on to the end customers, and

3. Water, electricity, and gas utilities with an explicit link to inflation through regulated pricing

The quicker the impacts of inflation can be passed onto end users, the better an infrastructure business will perform in inflationary times. In NSW for example, some road tolls are indexed quarterly, at the greater of either CPI or the predetermined minimum.

– Real estate

Similar to infrastructure, real estate has a degree of ‘pass-through’ ability and can therefore perform well in inflationary times. An obvious example of this is the way higher mortgage rates are passed on in the form of higher rents, and those retirees with investment properties are no doubt benefiting from this at the moment (along with the lack of supply which is driving rents up in many capital cities).

Adviser Insight: Retirees with investment properties fare well in the face of inflation

“A lot of my clients are pretty conservative and love old-fashioned bricks and mortar. Short-term downward movement in house prices isn’t a concern for them, they are more focused on rental income, and from that perspective, the upward trend in rents means they are well-positioned to cope with increased inflation.” Nick Arkoudis.

As well as being accessed directly, real estate exposure can be achieved via listed vehicles such as Real Estate Investment Trusts (REITs).

While historical analysis30 has shown US-listed real estate to have consistently outperformed equities in periods of moderate to high inflation, the structural change to working patterns since Covid means the outlook for office accommodation remains uncertain, diminishing the extent to which past trends may predict the future in this specific area.

– Alternatives

Some alternative asset classes also have built-in interest rate hedges, and as such are starting to come onto the radar of more investors.

Private debt, for example, is often structured as a floating rate instrument, meaning cash flows increase in line with increasing interest rates (and therefore, indirectly, in line with inflation.

– Inflation-linked bonds

Australian Treasury Indexed Bonds (TIBs) are medium to long-term securities for which the capital value of the security is adjusted for movements in the CPI. Interest is paid quarterly, at a fixed rate, on the adjusted capital value. At maturity, investors receive the adjusted capital value of the security – the value adjusted for movement in the CPI over the life of the bond.

While not traditionally popular with Australia’s mainstream investment community, the uniquely challenging post-pandemic investment climate may well see sentiment towards TIBs become more positive.

The US equivalent of these instruments is the TIPS – Treasury Inflation-Protected Security.

What does this look like in asset allocation terms?

How individuals and institutional investors respond within the above parameters will of course vary with underlying circumstances, objectives, and constraints.

For illustrative purposes however, we include US modelling by Morgan Stanley31, showing how a fund might optimally reposition itself as we evolve from a low inflation/high growth regime to a high inflation/low growth regime.

Table 1: Illustrative portfolio changes when moving to high inflation/low growth regime

Source: Morgan Stanley

Individual investors are less likely to be making short-term adjustments

As significant as the recent inflationary shock may be, the average retiree portfolio will naturally be structured around a long-term time horizon and will factor in assumptions about volatility in both returns and inflation. Individual investors are taught to stay the course and avoid knee-jerk reactions to volatility, and consistent with this message, we are unlikely to see the constant, reactive, portfolio adjustments undertaken at an institutional level.

Adviser Insight: The risk of inflation is ever-present

“People have obviously become a lot more conscious of inflation because of the recent spike, however just because it has been ‘dormant’ doesn’t mean it hasn’t been lurking in the background, eroding spending power. In truth, it is ever-present, and every retirement plan should include mechanisms to minimise its impact.” Jacie Taylor

The real lesson is diversification

Perhaps the most obvious and practical take out from the various analysis is the importance of diversification – across asset classes, industries, even styles – as a mitigant against inflation. Broadening exposure will not only reduce correlation effects but will also increase the ability of a portfolio to respond positively to either inflation shocks or growth shocks. As such we would expect to see most retirement portfolios already incorporate an allocation to the ‘inflation-friendly’ asset types mentioned above.

Product strategies to mitigate inflation risk

For many retirees, the optimal retirement income strategy will comprise a tailored mix of Age Pension, ABP, and a lifetime annuity. Adjusting this mix can therefore be just as important as rebalancing allocations within the market-exposed elements of their portfolios. Adjusting this mix takes on increased importance in times of higher inflation, as some product solutions, and some options within product categories, are more effective inflation mitigants than others.

Adviser Insight: Matching products to different needs within a retirement strategy

“Growth assets are critical to fighting inflation. Our rule of thumb is to try and ensure the client has the equivalent of three years’ income needs allocated to cash, giving them plenty of buffer and ensuring they can leave the growth portion of the portfolio untouched during the inevitable downturns.” Jacie Taylor

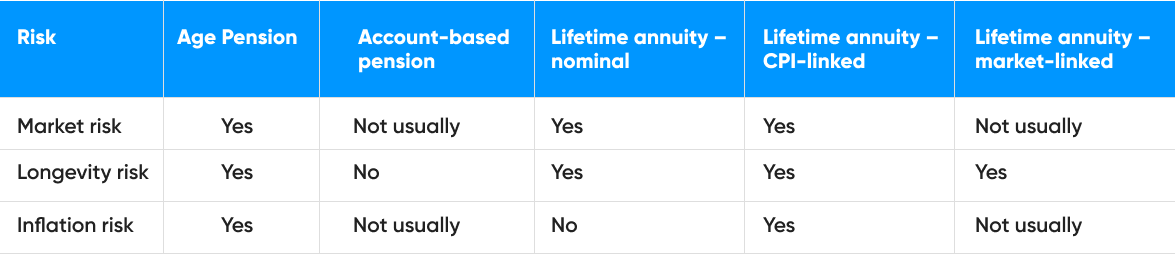

Table 2 below provides a useful comparison of how different product solutions can mitigate inflation risk, as well as market and longevity risk. (For the purposes of this paper, we are regarding the Age Pension as a product.)

Ideally, retirees will manage their exposure to longevity, market, and sequencing risks through a mix of products, each performing its own different role.

Table 2: Effectiveness of products in mitigating key retirement risks

The Age Pension

Australia’s Age Pension provides protection from inflation in several ways.

The first level of protection comes from the twice-yearly indexation of Age Pension payments. Age pension payments are increased by the percentage increase in either the CPI or the Pensioner and Beneficiary Living cost index (PBLCI), whichever is the higher. The PBLCI is similar to the more familiar CPI measure, but it is weighted to reflect the spending by households in receipt of the Age Pension or other Government benefits.

A second component is a benchmark requirement for the combined base payment for a couple on the full-Age Pension to be at least 41.76% of Male Total Average Weekly Earnings (MTAWE).

For those receiving a part pension, additional inflation protection occurs because the means test operates to reduce payments from the maximum Age Pension. When this maximum is increased in line with inflation, the reduction is not changed, meaning part pensions benefit from the same dollar increase as the full pension.

There are also two supplements paid to full and part pension recipients, the pension supplement, and the energy supplement, although at the moment only the pension supplement is indexed.

While entitlement to even a small amount of Age Pension has long been highly prized, for its predictability and associated benefits such as healthcare, transport and pharmaceutical concessions, its performance as an inflation fighter will undoubtedly attract further focus and may well change the way its role within a retirement strategy is perceived.

Adviser Insight: Discounts on rates, utilities and more – why a dollar of pension is so valuable

“When you add up the value of discounts and concessions available to clients receiving the Age Pension, it can be worth in the region of $2500 to $3500 per year. And these discounts –including rates, car registration, water and electricity, public transport, and pharmaceuticals – apply even if you only receive one single dollar of pension. Obviously, in the current environment, these benefits are becoming more sought after. Optimising pension entitlement is paramount.” Michael Miller.

– Account-based pensions

As a mechanism via which superannuation balances are paid as a regular income stream, ABPs are the mainstay of many Australian retirees.

ABPs generally offer a choice of investment options, including market-linked ones, allowing holders to pursue growth as an inflation mitigant. They can also be structured to pay a fixed income as long as the minimum drawdown requirements are met. However, unlike lifetime annuities, when the account balance is exhausted, the income will cease.

The flexibility of ABPs means they can work very well in conjunction with the Age Pension and lifetime annuities, and subject to mandatory minimums, can be integral to a dynamic drawdown strategy. However, they are not in themselves, an effective inflationary mitigant because, while income payments can be increased to allow for a higher cost of living, this accelerates the rate at which the account balance is being diminished, making the exhaustion of that balance more likely.

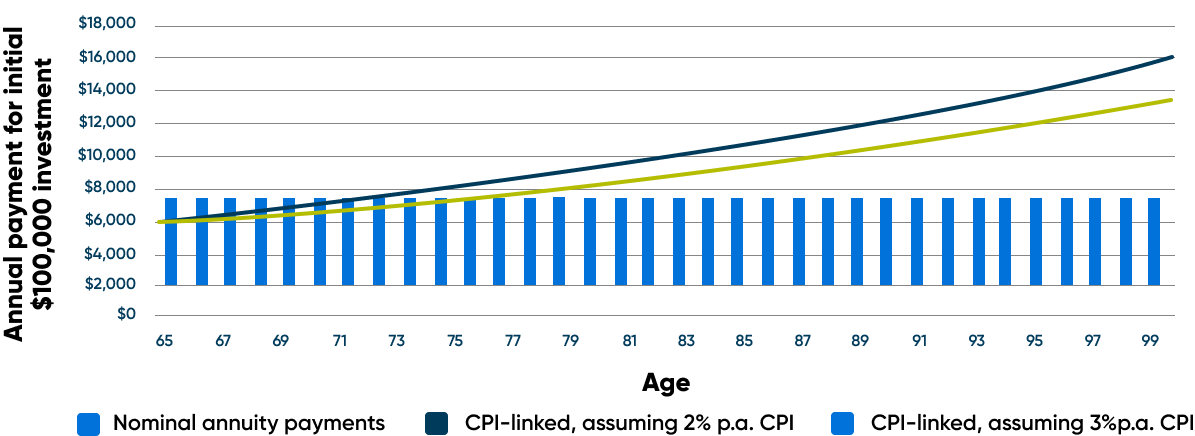

– CPI-linked lifetime annuities

A lifetime annuity pays a pre-agreed income stream for life, no matter how long a person lives, and regardless of equity market performance. As such, they can be a very effective mitigant of both longevity and market risk.

A variation on the ‘nominal’ lifetime annuity is the CPI-linked lifetime annuity. While initial payments under such an option are lower than those under the nominal annuity (reflecting the cost of providing that CPI protection), the heightened awareness of inflation risk, along with a medium-term expectation of elevated inflation, has increased the appeal of this particular option. As shown in Figure 13 below, even assuming a moderate inflation rate of 3%, the CPI-linked option will, over the longer term, deliver higher payments.

Adviser Insight: Priceless peace of mind as well as an inflationary hedge

“We use CPI-linked lifetime annuities with many of our clients. When used in conjunction with the Age Pension they can help ensure a substantial percentage of your annual income needs are always inflation protected. But as effective as they are as an inflationary hedge, I’d argue their true value is that they effectively allow retirees to buy peace of mind, which is priceless.” Jacie Taylor

FIGURE 13: COMPARISON OF NOMINAL AND CPI-LINKED ANNUITY PAYMENTS OVER TIME

Source: Calculations based on payment rates as at October 10 2022.

Source: Challenger32

Adviser Insight: Lifetime annuities – increasingly on the radar

“The certainty of annuities really appeals to retirees and while to date the majority have been using fixed-term annuities in lieu of term deposits, the current perfect storm has increased their willingness to consider an allocation to lifetime annuities, especially CPI-linked offerings. We are definitely having more of those conversations.” Nick Arkoudis.

Market-linked lifetime annuities

A relatively recent innovation in lifetime annuities has been to provide payments that increase in line with either an underlying diversified portfolio or a nominated basket of market indices.

When the income stream is payable for the lifetime of the retiree and their access to capital is constrained appropriately, government legislation permits the beneficial application of the means test rules for users of such income streams. This provides the same treatment as guaranteed lifetime annuities and can increase the entitlement to the Age Pension, particularly early in retirement.

The common theme in these market-linked annuities is that changes in income payments are linked to investment market returns. The income payments will go up and down with markets, meaning their effectiveness as an inflation hedge is market-dependent and variable over time. Over the longer term these products can be expected to provide income streams in excess of inflation, unless a particularly defensive portfolio or index is chosen.

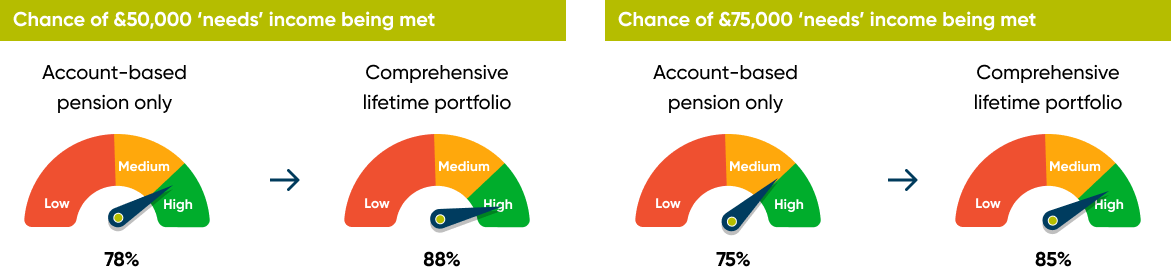

Lifetime annuities – improving the odds

To demonstrate in practical terms the value of lifetime annuities as an inflation mitigant, we have illustrated below two example scenarios using CPI-linked lifetime annuities. Results are presented in terms of the likelihood of meeting different income thresholds for the duration of retirement and compare an ABP-only approach, versus a strategy using both an ABP and a lifetime annuity.

As can be seen, the incorporation of the lifetime annuity into the portfolio substantially improves the odds of the retiree couple being able to meet their retirement income goals, for both essential spending (‘needs’) and discretionary spending (‘wants’).

– Scenario:

1. Self-funded retiree couple, both aged 67

2. Homeowners

3. Each with $750,000 in super

4. 50/50 defensive investors

5. $20,000 in non-financial assets

6. Need $50,000 for essentials pa

7. Want to spend $75,000 pa

The charts below compare the potential outcomes when either 10% (Figure 15) or 20% (Figure 16) of superannuation savings are allocated to a CPI-linked lifetime annuity, in conjunction with an ABP and the Age Pension.

FIGURE 15: ABP V ABP + CPI-LINKED LIFETIME ANNUITY (10% ALLOCATION)

Source: Challenger33

FIGURE 16: ABP V ABP + CPI-LINKED LIFETIME ANNUITY (20% ALLOCATION)

Source: Challenger33

Adviser Insight: Lifetime annuities and the ‘barbell approach’ to asset allocation

“The fundamental problem we face with all our retiree clients is the trade-off between wanting downside protection to ensure a sustainable spending stream and also wanting portfolio growth and greater upside to mitigate inflation and even allow some more aspirational spending.

We think the 4% rule of thumb is a bit inflexible in this regard, which is why I advocate, for some clients at least, a floor leverage rule. This aims to lock in a high level of total desired income and then leverage up the remaining exposure to market risks in an attempt to improve the available income to spend. This is an example of a barbell strategy, with one end of the barbell comprising very conservative assets and the other comprising riskier assets (with nothing in between). A common approach might be cash and fixed interest at one end and equities at the other, with the combination being structured in such a way that an acceptable standard deviation on the overall portfolio can be achieved (say around 6 – 7% for a conservative portfolio).

As we have seen, even fixed-interest investments can be volatile. By using a lifetime annuity with no standard deviation, you can effectively dial up to riskier, more growth-focused assets on the other end and still achieve the same overall standard deviation, but with more upside potential.” David Reed.

Ultimately, a retiree’s mindset is critical when responding to any disruption

Ultimately, perhaps the most fundamental change retirees can make when dealing with inflation and other risks to their retirement income – and therefore their lifestyle – is to their expectations.

One of the greatest challenges to retirement income policymakers is the inheritance maximisation mindset prevalent amongst previous generations of retirees. This preference to sacrifice the quality of their retirement lifestyle in order to pass on a bigger estate to their children makes it harder to ride out volatile times, and perversely may underpin a risk tolerance that is too cautious for a long investing horizon. It might see retirees enduring an unnecessarily frugal life, devoid of the joy and indulgences earned over a long working life.

Are mindsets changing? Perhaps.

Adviser Insight: Retiree mindsets are changing

“I think the desire to leave a legacy or inheritance for future generations is less so now than perhaps in the past. There is now much more of an expectation or desire to provide an upfront inheritance and support to establish children earlier on, such as with a substantial contribution to education funding or support to enter the housing market. This has meant that come retirement; many retirees have shifted expectations to say, ‘the resources I have here and now are primarily for my benefit. There is also a common theme of ‘when I’m going, if there are resources left, then my family is most welcome to them, but they are there to be used to support me and my needs first’.” Michael Miller, Director of Capital Advisory Financial & Business Advisers.

References

01. https://www.dimensional.com/us-en/insights/inflation-an-exchange-between-eugene-fama-and-david-booth

04. Challenger presentation ‘Retirement Incomes’, November 2022

05. Challenger presentation ‘Retirement Incomes’, November 2022

06. Assumptions: The retiree invested their $1 million retirement savings in a portfolio split 50/50 between stocks and bonds. That retiree then took an initial 3.3% withdrawal and adjusted their spending for inflation each year thereafter. To estimate how the value of the retiree’s retirement savings could vary over the 30-year horizon, 1,000 random trial simulations were modelled, assuming an average annual portfolio return of 5.2% and inflation of 2.2% per year. https://www.morningstar.com/articles/1129750/how-worried-should-new-retirees-be-about-market-losses-and-high-inflation

08. https://au.investing.com/indices/all-ordinaries-historical-data

11. https://www.superguide.com.au/retirement-planning/how-inflation-affects-retirement-income-forecast

17. https://nationalseniors.com.au/uploads/Final-Challenger-report-22.8.22.pdf

19. https://www.ato.gov.au/Rates/Key-superannuation-rates-and-thresholds/?page=9

20. https://www.forbes.com/⦁Adviser⦁/retirement/dynamic-spending-rules/

27. https://www.schwab.com/learn/story/how-should-retirees-respond-to-inflation

28. https://www.rba.gov.au/statistics/frequency/commodity-prices/2022/icp-1222.html

30. https://www.quaygi.com/insights/news/higher-inflation-can-be-friend-real-estate-investors

33. Challenger Retirement Illustrator (04/10/2022) using Social Security rates and thresholds effective 20 September 2022. 67 year old male/female client couple. $750,000 each in account-based pension. Assumes returns of 3.0% p.a. for defensive assets and 6.0% p.a. for growth assets before fees. $50,000 cash/TDs earning 3% p.a. interest. Non-financial assets of $20,000. $75,000 p.a. desired income including $50,000 p.a. essential income. Amounts shown are in today’s dollars. CPI of 2.5% p.a. See Challenger Retirement Illustrator for all assumptions. Reference number: RIC221004000264.