The Art and Science of Trust

Brought to you by Australian Retirement Trust. And its role in effective retirement planning.

In this special production

Foreword

This paper is a companion to Ensombl podcast – ‘The Art of Trust’, sponsored by Australian Retirement Trust. We wish to thank the following contributors:

Introduction

The meaning and importance of trust is one of the longest-standing, and most researched, narratives within financial advice.

It is simultaneously both the reason many existing clients have a deep and enduring relationship with their adviser, and the reason many prospective clients are perhaps hesitant to seek advice at all.

The financial landscape is difficult to navigate, even for experts. The combination of complex products and an increasingly challenging economic environment make it virtually impossible to succeed without expert help. This is especially true around retirement, where individuals have to manage what is probably the largest sum of money they have ever seen and make plans for that money to last for at least two decades or more. All while dealing with the emotional stress of losing their salary and even (in their minds) their purpose.

Vulnerability and trust go hand in hand. Only when we genuinely trust someone can we truly open up, and only then can we be helped.

Produced as a companion to the ‘Art of Trust’ podcast series, this paper explores the drivers and outcomes of trust in the context of retirement planning. By combining global and Australian research with insights from industry experts, thought leaders, and financial advisers specialising in retirement, it aims to provide a valuable context, and practical framework, for advisers to build trusting client relationships. Such partnerships are likely to be deeper and more open, allowing the advice to be more effective, and the value of that advice more readily understood and appreciated.

Why is retirement so stressful?

A generation or so ago, retirement was something many workers – especially those performing manual roles – couldn’t wait to do. It was equated with freedom, and the chance to give one’s body a well-deserved rest after years of toil.

Times have changed.

We are living and working longer, many of us by choice, and for some, retirement has become something to dread, and delay as long as possible. Not for financial reasons, but for emotional ones. For advisers working with clients approaching, or newly in, retirement, the support sought from them is not just to plan retirement finances, it is to help guide their clients, and help them make sound decisions, through one of the most stressful times in their lives.

Adviser Insight – the main stress at retirement can be an emotional one

A lot of my clients are former railway workers, including drivers, conductors, and engineers. They are coming to me at a time when not only is their salary about to stop, but so is the only thing they have known for the last two, three, or even four decades. My focus has to be as much on their mental health as their financials, which is why I have an arrangement with MediMind, an external counselling and wellness service. Richard Pillay

Retirement can see a confluence of Life Stressors

Adding scientific weight to adviser observation is the Homes and Rahe Stress Scale, the outcome of a comprehensive study into the link between stress and illness1. The Stress Scale ranks 43 of the most stressful events an individual can experience in their lifetimes. Each one of these events is serious enough to have a potential health impact on the individual experiencing them.

That list of 43 includes the death of a spouse, divorce, death of relatives and friends, moving house, changing, or losing jobs, a change in financial circumstances, and changes in social interactions and dietary habits.

A closer analysis of that full list (which is easily found online) reveals that retirement can bring forward nearly half the most stressful events in life, often with many of them taking place at the same time.

Even more interestingly, on that entire list of 43, only a handful are financial, whereas the majority relate to mental, social, physical, and spiritual issues.

Could there be a clearer picture of what clients are experiencing when they approach an adviser at retirement?

The Science of Trust

Over the years, academics have proposed numerous constructs and definitions of trust. These include:

Table 1: Selected Academic definitions of trust

Through a synthesis of these and other sources, supplemented by a study of Australian advice clients2, researchers from Griffith University were able to develop a model of trust specific to personal financial planning. That model comprised 7 characteristics of trust found to be evident in financial advice client/adviser interactions:

1. Vulnerability & Risk

There must be an element of vulnerability or risk in order for trust to exist, either due to the situation that a client finds themselves in (retirement), or their lack of knowledge. The risk they face is that the advice may be of no value or may even leave them worse off.

2. Feeling

The cognitive aspects of trust must also be accompanied by ‘affective’ aspects, more simply described by clients as a ‘feeling’

3. Honesty

In an advice context this was found to include honesty about financial information and remuneration. Conversely, clients who rated advisers as dishonest also rated them as untrustworthy.

4. Faith

Faith is also an important characteristic of trust in personal financial planning as a client must have confidence or faith that their financial adviser can be relied upon to provide the right advice.

5. Best Interests

Clients’ trust in advisers is positively correlated with the extent to which they believe an adviser is acting in the client’s best interests, rather than being driven by self-interest.

6. Accountability

Clients acknowledged that they trusted their advisers because they understood that their advisers were accountable to their employer, regulatory authority or professional body.

7. Competence

This study reveals that competence, as indicated by behavioural skills, technical skills and qualifications, is a vital characteristic of trust in personal financial planning.

Differences in trust over time and between client segments

US-based research3 into current advice clients also provides valuable insights into the different stages of trust and how it can vary over time and between different client groups.

Against a baseline of 81% trust level among advice clients, trust was found to increase with age, wealth, tenure, and financial literacy. This may suggest that the more time a client spends with an adviser, the more they come to understand and appreciate the value their adviser is adding, reinforcing trust in them.

Figure 1: Percentage who gave their adviser a trust rating of ‘high’, by age

Figure 2: Percentage who gave their adviser a trust rating of ‘high’, by wealth

Figure 3: Percentage who gave their adviser a trust rating of ‘high’, by tenure with adviser

Figure 4: Percentage who gave their adviser a trust rating of ‘high’, by financial knowledge

Evidence from this same research suggests that early in the relationship – before the client/adviser relationship has had time to develop – trust is based on the addition of a number of largely functional proof points. These can include credentials, past performance, client testimonials and a referral from a trusted source.

Over time, trust becomes more relational, as a result of repeated and reciprocated interactions. When trust is high, investor satisfaction in the advisory relationship tends to come from personal attention rather than from actual financial returns.

Trust is especially important at retirement

Australian research points to trust being especially important to retirees when choosing a financial adviser. Indeed, one study4 found when selecting an adviser, trust was the strongest driver of choice, followed by facilitating best tailored advice, the ability to explain things simply, and reliability.

Importantly, and notwithstanding that many of the true stressors around retirement are non-financial, the basis on which they are looking to engage an adviser in the first place is to help with their financial affairs. The need for trust at this stage is based on a point in time vulnerability driven by their lack of knowledge, the retirement event, and the need to deal with a superannuation nest egg which is:

• Likely to be largest amount of money they have ever dealt with

• The culmination of their life’s work, and

• Needs to last them for the next 30 years or more, through all ups and downs the world can conjure during that time.

Building trust as a financial adviser

Having examined the characteristics of trust in a personal financial planning context, we now turn attention to how financial advisers can effectively build and maintain trust with their clients.

Based on thousands of data points collected by global researcher Coredata, it has been possible to construct a four-part framework for building trust with advice clients (and prospective clients). By addressing each of these areas and by establishing strength across all four dimensions, advisers will be building and sustaining trust more effectively.

The components of this trust framework are:

• Trustworthy behaviours

• Authenticity

• Reliability, and

• Acting in the client’s best interests

Trustworthy Behaviours

Trust is not something you can ask for. It takes hard work to earn trust over time, sometimes a long time.

The concept of the ‘trust bank’ is one that resonates because it is easily understood. Every time we do something that demonstrates our trustworthiness, credit gets added to the bank.

The fact that trust takes time to build can create challenges at the beginning of a client/adviser relationship because the need for trust is high, but there has been little time to develop that trust (i.e., no time to make any deposits in the trust bank).

So how can you make a head start on the trust journey?

Fortunately, that journey can start before the very first client meeting if they have been referred to you by someone they already trust.

The trusted referral

Trust is a social mechanism that minimises the complexity of decision-making. Whether that decision relates to buying a pair of shoes or building a house, trust allows us to shorten the process and minimise the time and effort it takes us to do our due diligence. In a way, consumer brands act as a proxy for trust, and help speed up our decision-making.

In the context of purchasing an intangible service – like financial advice – a common proxy for that trust is the opinion of someone who has already used that service provider. Those opinions can come from people we don’t know (online reviews and testimonials) and from people we do (family, friends, work colleagues). In the latter’s case, we are more inclined to grant immediate trust to a service provider if someone we already trust – and are close to – has done so themselves.

Referrals are thus crucial to helping a relationship get off to the strongest of starts.

In a financial advice context, they are especially important. One study of US advice clients reported that more than half of the clients surveyed had found their current adviser through a referral. The same report found that 94% of investors were likely to make a referral when they “highly trusted” their advisor.

Adviser Insights – referrals are a head start on the trust building journey

For the majority of my clients, the starting point is a referral. I work with many clients from NSW Railways, and most of them have never used an adviser before, so they put a heap of trust in their workmates who have already begun their advice journey. Richard Pillay

All of our new clients come via word of mouth referrals. I think it goes a long way to them understanding how we engage our clients before we even meet, which means that I don’t have to spend much time explaining how we operate. We can get straight to work solving their problems. Garth Collingwood

I only ever get new clients from referrals, meaning a little bit of trust is already there. Anthony Jones

Put them at ease from the start

For many clients, the first meeting with a financial adviser can be a daunting – even intimidating – experience. They will be anxious about many things:

• Meeting you for the first time

• Their potential lack of financial knowledge

• Having no real understanding of the process they are about to go through, and

• The potential cost.

This is all on top of the reason they are approaching you in the first place, and which is likely causing them the most of anxiety of all – their impending retirement.

Getting the trust-building journey off to a positive start requires the adviser to call on all their soft skills to put the client at ease, tease out these anxieties, and respond to them. There are many ways you can do this.

Be human

Demonstrate your human side by sharing a little about yourself, your background and your family, your interests etc, and ask your client to share the same.

Adviser Insights – explore compatibility

I don’t talk about my qualifications, as they have been referred to me; that’s largely taken as a given. I talk more in terms of how I have helped clients just like them. I explain how other clients have anxieties just like them, and that helps reassure them. I also share stories about my own background. Richard Pillay

I always explain the totality of my life to clients, so they know what I have going on. Letting them in certainly helps build trust, and encourages them to open up too. Jane Ryan

I treat that first meeting as a chance to see if we are compatible. The reality is we don’t all click with everyone, and if you are on different pages from the start, it doesn’t augur well for an effective partnership. Anthony Jones

Show them you want to help

Clients are approaching you to help them with complex problems that they can’t solve themselves. Demonstrating that you want to help, and are capable of helping, is a critical builder of trust at the beginning of the relationship.

One of the challenges with solving clients’ problems is that sometimes they themselves don’t actually know what the real problem is. This is the difference between stated beliefs (what they tell you) and revealed beliefs (what is revealed by the way they answer your questions and respond to different prompts).

For this reason, the most successful advisers draw on all their emotional intelligence and use active listening skills to home in on what the client needs help with.

Expert insights – Clients often don’t know what they want

Listen to what they need rather than telling them what you know. Anthony Jones

Everyone wants to be listened to and paid attention to. As well as all the visual clues you can give a client to show you are listening, it’s also important to reinforce that when you are with them, or with other clients, they have your undivided attention. Talking to clients about their businesses and their finances shouldn’t be a half priority; it deserves your full priority. I let my clients know that if I am meeting another client, I won’t interrupt that meeting to take their call, I will call them back afterwards. Jane Ryan

It’s about just listening to them, and hearing what they want. A lot of the time, people can’t quite elaborate on what they want, and it’s about uncovering that. Garth Collingwood

Talk their language

Financial concepts and products can be very complex, and our industry abounds with jargon. While using this jargon may demonstrate your knowledge of the topic at hand, to the vast majority of clients it is off-putting and can make them feel intimated and inadequate about their lack of financial knowledge. It undermines, rather than builds, trust.

Building trust means speaking their language in terms they understand. Simplifying the complex reinforces your professionalism rather than diminishing it.

As adviser Richard Pillay says, talking the client’s language is also about reading the room and adjusting your approach. Engineers for example may be more detail focused (“they love a spreadsheet”).

Expert Insights – abolish the jargon, talk their language

To me, the trusted exemplars of any profession, including financial advice, are those who simplify the complex. They also realise that educating the client reinforces, rather than undermines, their professional expertise, as the client better understands and values the advice they receive. Anne Fuchs 5

You’re trying to make them as open as possible, just to try to understand what their concerns are, in plain English. There’s a lot of buzzwords and jargon in the industry, which doesn’t resonate with most people. In my view, it just puts someone off, makes them feel excluded, disempowers them. Garth Collingwood

Tackle their concerns

Identifying client concerns and helping them overcome them helps build trust in several ways: it shows you are listening, it can demonstrate transparency, and it reinforces your commitment to helping them.

A common concern, for example, is the cost of advice. People who have had no prior experience with the financial advice system may have limited reference points about likely costs. This can induce anxiety and can lead them to lose focus during that first meeting.

By dealing with the fee question upfront, Anthony Jones helps put clients at ease and allows them to spend the entire meeting focused on solving their problems.

Adviser Insights – be proactive when addressing concerns

You can see some clients literally sitting there thinking “how much is all this going to cost me?”. I try and put myself in the client’s shoes and immediately lean into all the things they are fearful of, such as fees. By addressing the fee question early, they can move on and pay attention for the rest of the meeting”. Anthony Jones

For clients who have never used a financial adviser, your perceptions of the profession may be shaped by the negative media coverage over the last few years. That’s why I’m very transparent about the journey we have been on as a profession. Richard Pillay

Systemise a trustworthy proposition

Trustworthy behaviours can be systemised – thus becoming more repeatable – by building them into your processes, proposition, and pricing.

In terms of your initial client engagement, this could mean the first – exploratory – meeting is free. Or it could mean that your clients aren’t locked into paying a full year’s fees even if they leave after a few months.

Having a strong emphasis on educating clients, and reflecting this in process steps and in clients materials, is another way trust building behaviours can become automatic. This does not mean what you are doing is artificial, or not genuine. It is more about ensuring a consistency of quality which helps reinforce trust.

Incorporating stories from other clients into the agenda for every first meeting, and having a process for ensuring you gather client reviews, are other examples of a systemised approach to building trust.

Other elements of the advice value chain where trust can be systemised include:

• Remuneration and fees

• Product agnosticism

• Data protection

• Communication

Adviser Insights – structuring trust into your proposition

We have had a few clients who wanted to buy us gifts, because they were happy with the way we helped them. When they ring up asking for suggestions on what to buy, we always tell them we’d rather they just left us an honest review online. Garth Collingwood

I make it easy for clients to stop paying fees at any time – I don’t require a 12-month commitment. I’ve always thought the easier it is to leave, the more genuine loyalty you can build. Richard Pillay

I explain that there is no charge for the initial meeting, it’s really about working out if we can actually help them. If we can, and we do need to do some work, then I provide them with an outline of what the fee is, and say to them, ‘Look, there should be no expectation from you that you have to pay an ongoing fee’. Because once again, we need to sit down and work out whether there’s anything they need on an ongoing basis as well. Anthony Jones.

I transparently offer one level of service, and the same fee scale, to everyone. This helps them avoid feeling anxious that other clients are being looked after better than them. Richard Pillay

Authenticity

Authenticity is about being genuine, real, and honest:

Being authentic is therefore around setting expectations and delivering to those expectations, so there is no gap between what the client thought they would experience and what they actually experience.

The concept of authenticity in brands and its role in shaping consumer behaviour has been extensively studied. In the US, for example, research6 found that 90 per cent of consumers say authenticity is important when deciding which brands they like and support. Where that brand is an individual – such as a professional services provider – that figure could well be even higher.

Authenticity is a strong driver of trust and likeability.

So, what does authenticity look like in a financial advice context?

• An authentic value proposition

• Setting realistic expectations around outcomes

• Having a vulnerable, human side

A number of elements are critical to aligning client expectations and experience, the first of which relates to adviser’s value proposition.

Is the adviser pitching their expertise in a way that they are capable of living up to? If they say they are a retirement specialist, is that reflected in the clientele, in their qualifications, in their service offering, even in their branding, the way they dress, and physical layout of their office?

Authenticity in a value proposition is as much about the people you can’t help as it is about those you can.

Adviser Insights – you can’t be all things to all people

Compatibility is important. If you are more compatible you feel more able to be your real, authentic self. Some of that comes down to your target market. A three-piece suit and tie doesn’t really gel if your market is mums and dads. We also do a lot of appointments in our clients’ homes, and that’s when you really get to understand someone. Anthony Jones

We probably only take on one in 10 people. We want people we can work with. And I want people who, when I see them in my diary, I know I’m going to have a good day, because we get to catch up and chat. Garth Collingwood

The second key element is in the nature of the expectations that are being set, and how realistic they are.

Overpromising on the outcomes that can be delivered to clients (for example investment returns), or failing to reset overly optimistic expectations held by the client themselves, can only lead to disappointment. This means an essential quality for an adviser is the ability to deliver bad news to clients.

Tying adviser value to investment performance can be particularly problematic, particularly during market downturns. Increasingly, advisers are realising this, and are focusing on ways to add value beyond asset allocation.

Adviser Insight – challenging clients and delivering bad news

Sometimes it’s our job to be realistic and shatter some illusions. For example, they may expect that they can earn a healthy investment return with zero risk. And you have to give people the bad news. If they trust you, they will accept what you say. But sometimes it means you never see them again, and that’s fine. Garth Collingwood

Another critical driver of authenticity is vulnerability.

Clients are already vulnerable when they seek the help of an adviser. Demonstrating two-way vulnerability helps humanise the adviser, rather than making them seem like a cold, detached professional, and there a number of ways the adviser can do this.

Firstly, acknowledging that you don’t know everything shows you to be vulnerable, rather than incompetent. Even absolute masters of their profession need to look things up or seek help occasionally. Outsourcing aspects of your advice that need a deep, specialised expertise (such as investment management or estate planning) helps build trust in your professionalism.

Secondly, showing your human side helps break down barriers between client and adviser and encourages more trust and openness.

Adviser Insights – show them the real person behind the professional

I live and work in regional NSW, and when there is an incredibly strong sense of community. You go through a lot together, not just fires, floods, and droughts. When you experience life’s ups and downs together you get to see each other warts and all. There’s no pretence. They’ve seen me as a mother and a financial planner. And that’s incredibly powerful. They see me as one of their own, on their level, they know who I am and whom I am not. But is also means my advice comes from a more authentic space. Jane Ryan

I will sometimes use myself as an example to make my advice more real. I take my own life insurance schedules to my appointments, and if someone says, ‘why do I need that, or do I really need that much?’ I can show them what I do myself. Anthony Jones

Reliability

Just as authenticity is about ‘being who you say you are’, then reliability is ‘doing what you say you are going to do’. And telling people about it.

Every time you honour a commitment, no matter how small, you are making a deposit in the all-important trust bank.

Advisers should be looking to build 5 or more reliability deposits in that trust bank each year, and that regular client communications – whether that be via short SMS or regular newsletters and email updates – are a way of programmatically reinforcing reliability.

Just as expectation setting is important when demonstrating authenticity, it also underpins demonstrations of reliability, by giving clients a reference point or benchmark.

Punctuality is a small but obvious demonstration of reliability and respect.

Timeliness in responding to requests is another way to demonstrate reliability, although this doesn’t always need to mean a fast response.

As a regional based adviser, Jane Ryan can often be on the road for weeks at a time. In some cases, if she is needing to make changes for a client, it might be a few weeks before those changes can be put back in front of the client for approval. But she will always let the client know in advance what to expect in terms of timeframes. Similarly, she actively encourages her clients to contact her directly at all hours of the day with any questions they might have, and promptly acknowledges receipt of their query, even though an actual response might take some time.

Adviser Insights – be accessible to clients

If they’ve got a question, or there’s something that worries them, and it’s 10 o’clock at night, I’m happy for them to shoot me a text or send me an email. I tell them not to worry about waking me up because I turn off the notifications on my phone at night! But it’s important they can get it off their chest at the time. The next day I will acknowledge their message and try and help them, but if it is something I will need to research then I let them know. It’s just as important to tell you why you can’t do something within a particular time frame, so if for some reason you can’t deliver on the date you promised, you need to very upfront with the client about that, explain why, and set a revised date. Jane Ryan

There are a lot of steps in the advice process and it’s important to clearly explain to your client what those steps are and the timeframe for them to happen. Then obviously delivering to those timeframes. A common thing we hear from clients who have had another adviser in the past is ‘we never heard from them, and we didn’t know what was happening’. Anthony Jones

Social Trust

Social trust is based on the integrity and reliability of a business and its services. One of the most common ways to build social trust is to demonstrate that other clients have used your services. This can be done via client testimonials and client reviews.

Expert Insight – avoiding surprises

For me reliability is about making sure the client doesn’t get surprises. Our members certainly don’t appreciate any surprises when it comes to administration, or investment performance. We did some research recently, where I think it was close to 65% of our members said the things most important to them about their superannuation fund were security and reliability. Anne Fuchs7

Acting in your client’s best interests

The concept of best interests is firmly entrenched in the financial advice profession in Australia, codified into adviser behaviours via the Best Interests Duty and the FASEA Code of Ethics. This codification reflects the fact that acting in someone else’s best interests – rather than their own – is arguably the single most important building block when building trust.

As mentioned above, research8 by Griffith University found that clients’ trust in advisers is positively correlated with the extent to which they believe an adviser is acting in the client’s best interests, rather than being driven by self-interest.

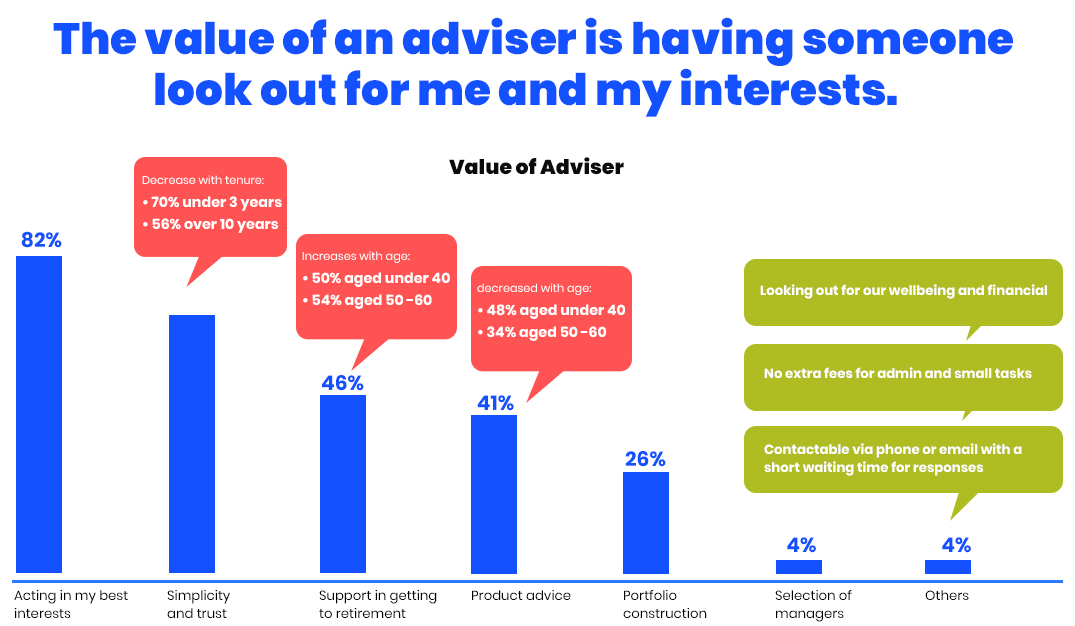

Research by Australian Retirement Trust also reinforced the importance of best interests, finding it to be the attribute clients most value in their financial adviser.

Figure 5: Most valued attributes in a financial adviser

Source: Australian Retirement Trust Research. 9

The various compliance and disclosure obligations applying to advisers and advice processes go a long way to ensuring that acting in the client’s best interests is ‘programmed in’ to advice. Notwithstanding the extent to which these obligations can be seen as cumbersome red tape, advisers can use them to build trust by explaining to clients how they are designed to protect them.

Of course, acting in the best interests of your clients isn’t just about fulfilling the ASIC definition. There are other ways to demonstrate you have your client’s best interests at heart, arguably the most powerful of which is to educate your clients.

Client education as a driver of trust

The adage ‘give a person a fish, feed them for a day, teach them how to fish, feed them for a lifetime’ seems particularly apt in the context of financial education.

Financial concepts, products, and regulations are becoming increasingly complex. It is neither unusual or surprising that many people who may have been complete experts in their field, and masters of their craft, know very little about financial matters.

This lack of knowledge, and their own self awareness of it, creates an immediate vulnerability and power imbalance when a client first approaches an adviser, and the adviser must make concerted efforts to assuage this vulnerability as soon as possible for trust to be built. As already mentioned, talking on the clients level, in plain, simple language is one way to correct this power imbalance. Another is to educate the client.

Educating clients has both short- and long-term advantages:

• Achieves more informed consent and a greater appreciation for the value your advice has added

• Reduces the likelihood of panic and knee jerk reactions

• Helps the client feel more empowered and in control

More importantly, imparting an adviser’s training, wisdom, and experience to the client as financial education can be the ultimate demonstration of putting self-interest to one side. Holding onto knowledge can create a dependency on you, whereas sharing your knowledge theoretically lessens the dependence on you – putting your client’s interests ahead of your own.

Adviser Insights – the client education dividend

You need to educate them because they need to own what they do. They need to understand how much they can spend. They need to understand there is a risk return trade -off. If they own that and understand it, they are more likely to accept the path you have put them on, with all its pros and cons. Richard Pillay

I can recall another planner sitting in a client meeting with me five or six years ago, saying, ‘Why are you explaining everything to them? You’re giving it all away. They can do it themselves now.’ And that kind of stuck of with me because I believe the opposite is true – you are explaining their options so that they can understand their situation, and make an informed decision. Clients are paying for solutions, not instructions. Garth Collingwood

I have clients who outright say, ‘Yes I trust you’. But while that’s a lovely compliment, I still need them to understand, because at the end of the day it’s their money and their pathway. So, I explain what we are doing and keep explaining and educating so they have an absolute understanding of what we are doing and why. Jane Ryan

In Summary

Retirement is one of the most stressful times in a person’s life. The majority of this stress can often be emotional, rather than financial, as the retiree grapples with the perceived loss of the certainty and purpose their career represented.

At the same time, retirees must deal with the challenge of managing the largest sum of money they have likely ever seen and must plan for it to last for the rest of their lives.

Trust in a financial adviser is therefore paramount.

But for those who have had no experience with financial advice, there is a pressure to be able to build trust in a relatively short period of time.

Decades of academic research into trust has been distilled down to 4 key drivers:

• Trustworthy behaviours

• Authenticity

• Reliability, and

• Acting in a person’s best interests.

Leading advisers understand that influencing these drivers requires a focus across the entire value chain of advice, systemising the building of trust into every touchpoint, with a particular emphasis on:

• Having a clear value proposition and target market

• Avoiding Jargon

• Being more relatable

• Proactively addressing client concerns

• Regular communication

• Setting clear timelines and expectations

• Remuneration framework, and

• Client education.

References

01 https://www.forbes.com/sites/robertlaura/2018/05/24/why-is-retirement-so-stressful/?sh=294e20302579

04 https://www.ifa.com.au/news/27439-only-one-in-four-retirees-seek-advice-report-finds

05 Expert Insights – abolish the jargon, talk their language – Anne Fuchs

06 https://www.nosto.com/blog/report-consumer-marketing-perspectives-on-content-in-the-digital-age/

07. Expert Insight – avoiding surprises – Anne Fuchs

09. Figure 5 – Most valued attributes in a financial adviser

While Australian Retirement Trust Pty Ltd (ABN 88 010 720 840, AFSL 228975) (Trustee), the trustee of Australian Retirement Trust (ABN 60 905 115 063), has sponsored this paper, this content has been prepared solely by Ensombl Pty Ltd (ACN 45 606 168 781)(Ensombl). Unless stated otherwise, all opinions expressed in this paper are the opinions of Ensombl.

All Australian Retirement Trust products are issued by the Trustee. Read the applicable product disclosure statement (PDS) and target market determination (TMD) before deciding whether to acquire, or continue to hold, any Australian Retirement Trust products.