A CX boom is happening. Is your advice firm ready?

Financial advisers moved quickly when the pandemic started, balancing the competing pressures of managing portfolios through a black swan event and responding to a sustained escalation of client needs. Clients have reset their expectations of their experience with advice firms in the process, calling for a strategic re-think of your customer experience (CX) in a post-pandemic setting.

The big picture

A recurring lesson from the many global crises we’ve witnessed is that disruption is a catalyst to innovation. In retrospect, we can always see that those people, brands and businesses that embraced social and economic shifts were ultimately beneficiaries of an otherwise challenging time. If you think about this in reverse – rarely do those who held tight to their traditional ways make history.

We don’t need to wait for the dust to settle on the pandemic to know its lessons for financial advice firms. You already know your clients are rightly demanding a trusted, tailored and seamless relationship with you – and the shock the last couple of years has served investment portfolios has accelerated that. In short, CX demands are high, and increasing – and the firms that embrace this shift are primed to capitalise.

CX is a boom topic worldwide

CX is defined in many ways, sometimes complicated by technical jargon, and sometimes inferred as a ‘new’ concept. In truth, it’s as simple as delivering on your promise to clients, and making sure every touch point between you and your firm is a reminder that you are doing just that. That means CX is as much about the emotions you create – how it feels to work with you – as much as it about the outcomes you achieve.

Companies worldwide have realised the value of a strong CX blueprint, reinforcing not only its value for service-based firms, but also its necessity in a competitive market. In fact, 59% of customers globally say the pandemic has raised their standards for customer service, and 80% say the experience a company provides is as important as its products and services.1

Further, financial services companies are now heavily investing in their CX, in a bid to cement their position as a trusted partner, especially during times of profound stress and uncertainty. A recent global study shows that improving CX as a top five priority for financial services firms, with a particular focus on digitising operations.2

We expect financial advice firms will reap the rewards – and feel the pressures – of heightened CX expectations. The financial advice sector already has a benchmark for customised and client-centric services industry-wide, courtesy of a competitive market and years of consistently evolving regulatory landscape. Now more than ever, exceptional experiences will be an expectation, not an add-on.

Why CX is crucial to business strategy

Clients are voting with their feet and voicing their opinions when it comes to CX, making it a critical strategic and growth lever for financial advice firms. One clear outcome of exceptional CX is client advocacy and the potential for boosting your referral network.

“Our research indicates the better the client experience, the greater the advocacy – with 39% of clients hearing about advisers via client referrals,” says Sherise Mercer, Head of Macquarie Virtual Adviser Network (VAN).

“Right now there’s an opportunity to build advocacy through your client experience, and it will directly correlate to business growth.”

There are also financial consequences for poor CX. A study of 10,000 US consumers found 20% completely stopped spending with investment firms after a bad experience, while 21% reduced their spend.3

These are important considerations in an advice context, because though Australians tend to trust their financial adviser, that doesn’t necessarily equate to loyalty and advocacy. In fact, a 2019 survey of Australian financial advice clients found 95% trusted their adviser – but only two-thirds were willing to recommend them to friends and family, and more than half said they didn’t have definitive loyalty to their adviser.4

Collectively, this shows where the market is headed at pace: exceptional client outcomes are not enough for growth and retention, it’s exceptional CX that is proving a deciding factor.

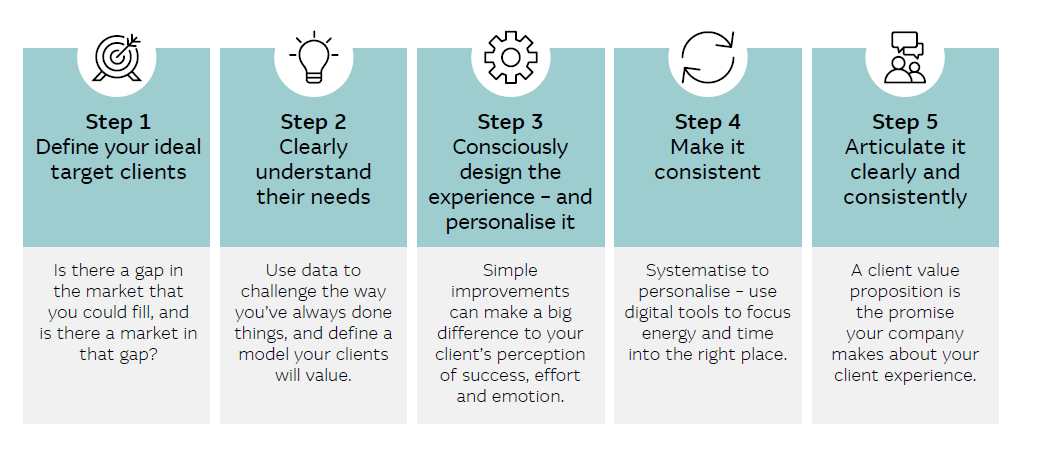

Five steps to CX success

Though we talk a lot about the intangible elements of CX for customers – how they feel about you and your services – there are practical, actionable steps you can take to either create, or refine, your CX that are outlined below.

Test your firm’s CX

Knowing how to define and meet the needs of your ideal client type is key to CX, so we invite you to take this two-minute quiz to help understand if you’ve got the right frameworks in place, or if there’s opportunity for enhancement. We will also recommend resources that can help you, no matter what stage you’re at.

1. State of the Connected Customer, Salesforce, October 2020

2. https://hbr.org/resources/pdfs/comm/salesforce/SalesforceCXFinancialServices.pdf

3. Qualtrics XM Institute Q2 2020 Consumer Benchmark Study, n = 10,000 US consumers

4. Client engagement in the new world – Adviser toolkit, Adviser Voice, 20 April 2021

The Macquarie Virtual Adviser Network (VAN) is provided by Macquarie Bank Limited (‘Macquarie’). The provision of VAN and the contents of this article do not amount to a financial product or financial service nor does it involve the provision of general or personal financial advice. Opinions or recommendations that are expressed are subject to change without notice and no member of Macquarie makes any warranty in relation to, or accepts any responsibility or liability for any loss or damage suffered by any person arising out of or in relation to the material in this article.