Calculating monthly benefits: The three-step process to undertake when comparing Income Protection products

Calculating monthly benefits: The three-step process to undertake when comparing Income Protection products

Dr Jeff Scott, Head of Advice Strategy, MetLIfe Australia

Income Protection insurance exists to meet two basic customer needs in the event of injury or illness: to replace lost income and protect the client’s biggest asset, their ability to generate future income.

The recent introduction of APRA’s Individual Disability Income Insurance (IDII) measures has seen a raft of product changes in the market, with some Income Protection products becoming significantly more competitive.[1]

In fact, it’s a completely new paradigm, with wide differentiation in terms and conditions on Income Protection policies issued from 1 October 2021. With all life insurance companies updating their retail IP products at one time, it can be quite confusing to compare all the new products and variations, to assess what’s right for your client. With product features now differing so much, making a recommendation on the basis of price alone may not meet the best interest duty for each of your clients.

Calculating monthly benefits

There is now a clear three-step process when determining the monthly benefit paid to a claimant:

- Step one: calculation of the monthly sum insured amount

- Step two: calculation of income at risk at the time of claim

- Step three: calculation of monthly benefit payment

It should be noted that the analysis below does not capture all of the numerous income protection variations available, and financial advisers should consult the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD) to confirm relevant terms, conditions and details for the product recommended as each client’s circumstances and needs will vary.

Let’s examine some of the common options in more detail.

-

Step 1 – Calculation of the Monthly Sum Insured Amount

While the indicative replacement ratio as stipulated by the APRA IDII measures is no more than 70% after the first six months on claim, some companies may have adopted a tiering approach.[2]

When a client applies for an Income Protection policy, the first step is always the calculation of the Monthly Sum Insured Amount. Many advisers assume that the Monthly Sum Insured Amount is simply 70% of the client’s income; however, with income tiering this is not necessarily the case.

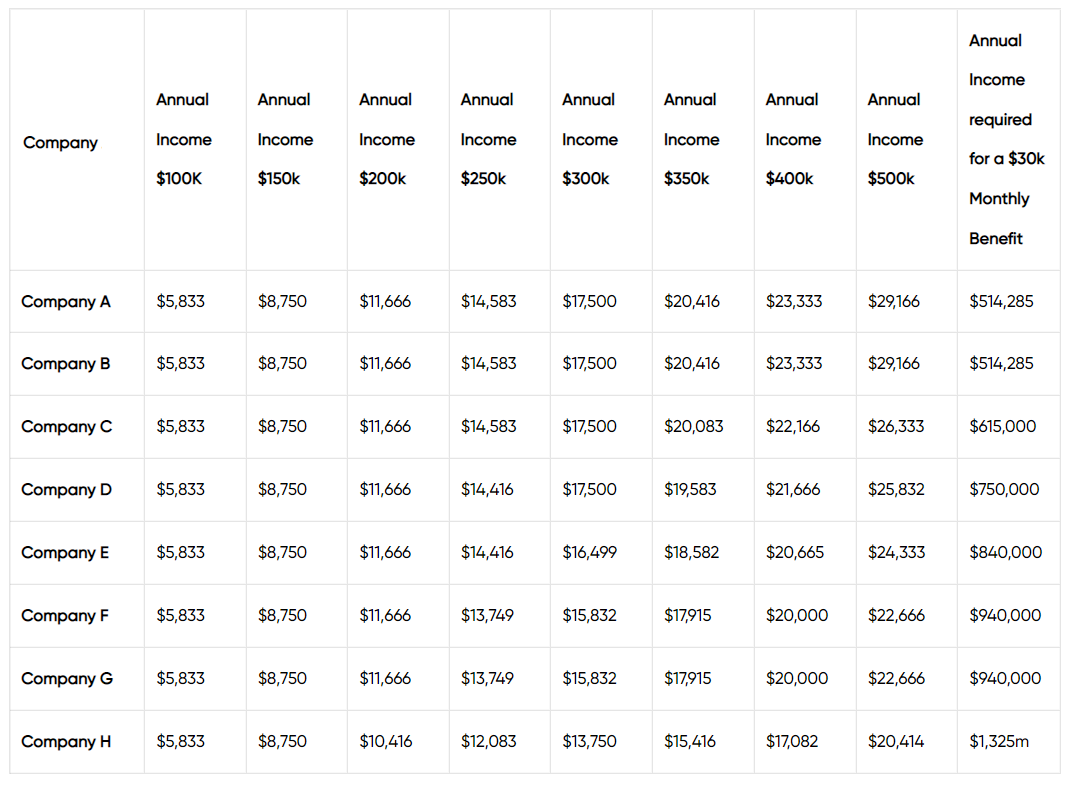

Companies that do not have income tiering provide a simple 70% income replacement ratio to a maximum monthly benefit (for example $30,000 per month). In this example, this would result in a client being able to obtain a 70% replacement ratio for income up to approximately $514,285, which could produce an annual benefit of up to $360,000 per annum.

Where a client is earning less than $150,000 per annum, then the Monthly Sum Insured Amount is consistent across the industry, at 70% of income at the date of application (up to $8,750 per month).

Once the life insured’s income reaches:

- $200,000 per annum, then there are some life insurance companies that will only replace up to 63% of the life insured’s income (up to $10,416 per month), while others will replace up to 70% of the life insured’s income (up to $11,666 per month)

- $250,000 per annum, the replacement ratio varies between insurance companies from 70% (up to $14,583 per month), down to 58% (up to $12,083 per month)

- $300,000 per annum, the replacement ratio varies between insurance companies from 70% (up to $17,500 per month), down to 55% (up to $13,750 per month)

- $350,000 per annum, the replacement ratio varies between insurance companies from 70% (up to $20,416 per month), down to 53% (up to $15,416 per month)

- $400,000 per annum, the replacement ratio varies between insurance companies from 70% (up to $23,333 per month), down to 51% (up to $17,082 per month).

As the life insured’s income continues to rise, the replacement ratio varies dramatically between insurance companies: from 70% (up to $29,166 per month) down to 49% (up to $20,414 per month) for clients earning $500,000 per annum.

This calculation is important because it establishes the maximum Monthly Sum Insured Amount that a life insurance company will pay at the time of claim. Financial advisers should check with each insurer to determine whether income tiering applies and how this may affect the calculation of the Monthly Sum Insured Amount.

Table 1 – Maximum Monthly Benefit received based upon annual income (by insurer)

-

Step 2 – Income at Risk

APRA stated that it was imperative that claim payments be consistent with the principle of indemnity, which is intended to avoid a potential moral hazard with claimants.[3] This resulted in retail Income Protection policies that had either agreed value or endorsed agreed value income calculations being unavailable for new clients from 31 March 2020, as this calculated the life insured’s monthly benefit amount based upon income at the time of application, not at the time of claim.

APRA’s IDII measures state that income at risk can be calculated as either variable income or stable income at the time of claim,[4] as APRA recognises that income may vary considerably from one year to the next for certain segments of the workforce. This has resulted in two possible calculations of pre-disability income at the time of claim for new retail Income Protection policies issued from 1 October 2021:

- Where a policyholder has a predominantly stable income, the income at risk should be based on annual earnings at the time of the claim event, not older than 12 months

- Where income is subject to variability, APRA considers it appropriate for the income at risk to be based on the average earnings over periods longer than the 12-month period prior to the time of claim event. For a policyholder with a variable income, the income at risk should be based on average annual earnings over a period of time appropriate for the occupation of the policyholder and be reflective of future earnings lost as a result of the disability.

What impact does this have at the time of claim?

Example A

The life insured had an income at application of $200,000 per annum (monthly benefit $11,666 or $140,000 per annum), but due to a ‘sea change’ in their working life, their new income is $100,000 per annum at the time of claim. In this case, the maximum Monthly Benefit Payment will be $5,833, or $70,000 per annum, even though they have been paying a premium for the Monthly Sum Insured Amount of $11,666.

Example B

The life insured had an income at application of $200,000 per annum (Monthly Sum Insured Amount of $11,666 or $140,000 per annum), but at the time of claim, due to a series of promotions in their working life, their new income is now $400,000 per annum. In this case, the Monthly Benefit Payment will not be $23,333 (or $280,000 per annum), but the Monthly Benefit Payment will be $11,666 (or $140,000 per annum) as they have been paying a premium for the sum insured monthly benefit of $11,666.

It’s important that you review your clients’ sums insured at least annually, to ensure that their sum insured remains relevant for their current income.

-

Step 3 – Replacement ratio

APRA’s IDII measures state that up to 90% of pre-disability income could be replaced in the first six months of the benefit period, and up to 70% of pre-disability income thereafter.[5] Financial advisers should be aware that not every life insurance company has adopted the same approach, and some products have a replacement ratio below 70% at a particular age or after a particular duration on claim.[6] In particular circumstances, some companies apply income tiering at time of claim when calculating the Monthly Benefit Payment (as discussed in Step 1 above).

What does this mean at the time of claim? It means there will be a couple of approaches the insurer may take when assessing your client’s claim.

Example A

Continuing with Example A from step two, where the life insured had an income at application of $200,000 per annum (Monthly Sum Insured Amount of $11,666 or $140,000 per annum) but $100,000 per annum at the time of claim. This lower amount will be the income on which the payout is based; the Monthly Benefit Payment will be $5,833 or $70,000 per annum, even though they have been paying a premium for the Monthly Sum Insured Amount of $11,666.

Depending upon the life insurance company, if the claim goes beyond two years (or some other defined period of time) there are a couple of approaches the insurer may take:

- The replacement ratio remains at 70% and the Monthly Benefit Payment remains at $5,833

- The replacement ratio reduces from 70% to 60%, which means the Monthly Benefit Payment reduces to $5,000 (or $60,000 per annum).[7]

Example B

Continuing with Example B from step two, where the life insured had an income at application of $200,000 per annum, but at the time of claim their new income is $400,000 per annum. Because they had been paying a premium for a Monthly Sum Insured Amount of $11,666, this is what they receive despite their higher income.

Depending upon the life insurance company, if the claim goes beyond two years there are a couple of approaches the insurer may take:

- The replacement ratio remains at 70% and the Monthly Benefit Payment remains at $11,666 (or $140,000 per annum).

- The replacement ratio reduces from 70% to 60%, although the Monthly Benefit Payment remains at $11,666 (or $140,000 per annum).[8]

Conclusion

With the numerous changes to retail Income Protection policies, it’s essential that financial advisers understand how the Monthly Benefit Payment is calculated to ensure they meet their best interest duty to each client. It is believed that the fundamental reason people buy Income Protection insurance is for peace of mind; as such, it’s important that the policy selected meets their needs today and into the future.

MetLife’s experienced Retail Distribution Team is available to explain the fundamental changes to advisers and to provide assistance to balance meeting APRA IDII measures, allowing advisers to meet their best interest duty, and providing sustainable benefits and features that are valued by clients.

For more information, please speak to your MetLife BDM or click here to find your local BDM.

About Dr. Jeffrey Scott

Dr Jeff has over 25 years experience in the insurance industry and is most notably credited for creating the first terminal illness benefit for life insurance products in Australia. He has also lectured on financial planning, taxation, superannuation and insurance at the University of Technology and the University of New South Wales – and is a regular media commentator on these topics, having conducted over 1,000 presentations in 13 countries.

[1] APRA – Final individual disability income insurance sustainability measures – Wednesday 30 September 2020. https://www.apra.gov.au/final-individual-disability-income-insurance-sustainability-measures

[2] Actuaries Institute – Reference Product – Individual Disability Income Insurance – Disability Insurance Taskforce of the Actuaries Institute – Version 1.0 – April 2021. https://actuaries.asn.au/Library/Reports/2021/IDIIDocumentC2.pdf

[3] https://www.apra.gov.au/final-individual-disability-income-insurance-sustainability-measures

[4] https://www.apra.gov.au/final-individual-disability-income-insurance-sustainability-measures

[5] APRA – Final individual disability income insurance sustainability measures – Wednesday 30 September 2020. https://www.apra.gov.au/final-individual-disability-income-insurance-sustainability-measures

[6] Actuaries Institute – Reference Product – Individual Disability Income Insurance – Disability Insurance Taskforce of the Actuaries Institute – Version 1.0 – April 2021. https://actuaries.asn.au/Library/Reports/2021/IDIIDocumentC2.pdf

[7] IRESS Risk Research – https://iressdirect.xplan.iress.com.au. Accessed 10 March 2022.

[8] IRESS Risk Research – https://iressdirect.xplan.iress.com.au. Accessed 10 March 2022.