How to Use the Valuable Treasure-Trove of Data You Collect to Improve the Client Experience

Technology has reshaped the customer experience in almost every sector. Digital first attackers continue to enter markets with radically new offers, disrupting the ways that companies and customers interact and are setting a high bar for simplicity, personalisation, and interactivity.

Companies like Uber Eats, Amazon and Apple have reshaped the customer experience and customer expectations. Today we don’t compete with other financial advice businesses but against these businesses. And the reason is that “the last best experience that anyone has anywhere, becomes the minimum expectation for the experience they want everywhere” (Bridget van Kralingen, ex VP IBM).

As a business, we need to meet client expectations where they are today, and technology is a way to do this.

In this article we outline the last two customer trends that are happening right now, concluding our first article which looked at five client trends too hard to ignore.

Trend 6: Data and its importance in the client experience

Advice firms collect more data and information about their clients today than ever before – from the fact find, to managing investment portfolios, to sensitive goal-related information.

Savvy businesses, not just in financial advice, are taking advantage of this treasure trove of data in novel ways to better engage with and influence the customers – to better understand or predict customer behaviour and to remove friction or personalise the customer experience.

AdviceTech Stars, our benchmark (as they are exceptionally good users of technology and able to deliver greater outcomes and more benefits to their clients and staff), are leading the way.

According to Netwealth’s 2022 AdviceTech Report, they are using technologies like client surveys plus client behaviour reports and dashboards to track and understand clients better.

And they are trying to remove friction from the client engagement process with document signing technology, and online fact-find tools to collect personal information in a more convenient way.

Moving the fact find online

During the fact-find process, there is a lot of client data collected, including information from banks, existing super funds, insurance and so on. Further, clients are more likely to have relevant information close to hand when they’re at home, whether it’s a paper record or, for example, information that requires logging onto online banking.

Through advanced online fact-find technology the process of collecting this information can be made easier and less time consuming for your future clients – ultimately leading to a more frictionless experience, more akin to that of a leading tech provider.

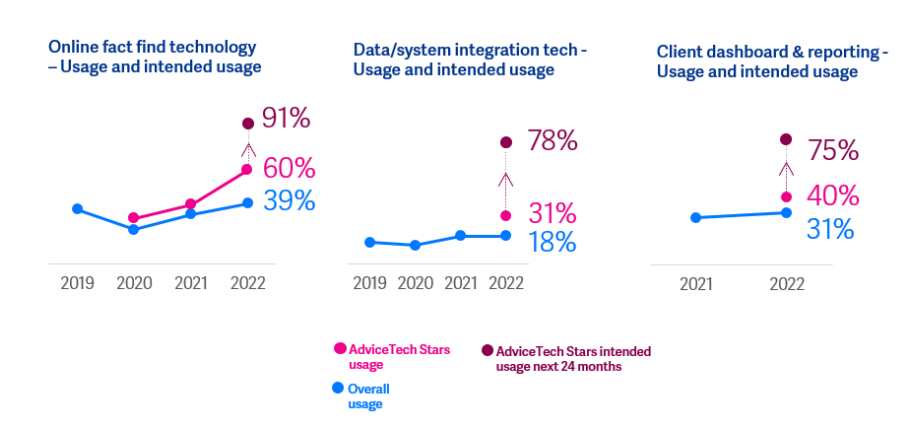

The use of online fact-find tools has increased by AdviceTech Stars with six in 10 using them, having increased from one in three the previous year. And almost another one-third (31%) plan to use them in the next 24 months.

Integrating client data from multiple tech systems

The starting point is to centralise client data from disparate software systems using system integration technology, like Xeppo. This allows it to be used by the business for many customer experience touchpoints and analysis. Almost one-third of AdviceTech Stars use such technology with another half intending on implementing them in the coming two years.

Most advice firms develop in-house solutions to integrating databases and systems. A large proportion use inefficient inhouse or s/sheets, but where specialised systems are used, this most popular supplier is Xeppo used by around one-quarter of advice firms who use them, followed by technologies like Zapier.

Client reporting

Once you have collected the data and integrated it into a centralised place, an obvious thing to do is to analyse the data. Four in 10 (40.0%) AdviceTech stars use digital or online dashboards and reporting tools to gather information to help them better understand clients, with a further 35% of them planning to use in them in the next 24 months.

If you look to the future, with predictive analytics and AI, this use of this data becomes the foundation for a lot more. For example, insights such as recognising asset class deviation based on target returns or encouraging the user to transfer monies into an investment account from a surplus savings account, or such things like when contributions limits have or have not been met, and even more telling might be if a client has changed jobs – ascertained through their employee contribution payments.

Trend 7: The role of data visualisations in advice

Better client engagement is often about managing expectations, especially when markets are volatile or when client goals may seem a long way off.

Expectations can be managed by clearly articulating a strategy and showing how it is performing, and this demands the delivery of relevant and timely information in a way that makes sense and communicates messages clearly to the client.

The adage ‘a picture speaks a thousand words is important in this regard.’

Data visualisation, or the representation of data and information through charts and diagrams, empower advisers to help clients better understand the strategy and their progress against it over time, and to better explain how actions taken today can affect the client’s outcome in years to come.

According to Netwealth’s 2022 Advisable Australian report, clients expect this type of communication from their financial adviser. When asked, over seven in 10 expect their advice firm to use digital tools, such as online calculators and videos, to demonstrate how they’re tracking to goals, how their investment portfolio is performing, and to educate them on financial concepts.

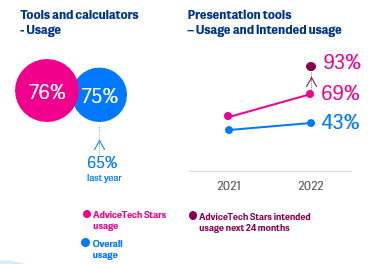

The AdviceTech available for firms to paint this picture with data visualisation tools include super and investment platforms, as well as many planning tools, with their rich reporting capabilities. Calculators, used by 75% of advice firms, that can do what-if? visualisations and presentation software such as PowerPoint and Canva which is growing in popularity, used by 69% of AdviceTech Stars, also have powerful in-built charting capabilities.

Tools to help advice technology selection

Technology selection and implementation is challenging, particularly for more complex systems that impact many people and touch other systems. This is because advice firms have a proliferation of vendors with varying features and capabilities to choose from. Often, it’s also because business leaders either don’t have the time, capabilities or resources to explore and understand their options.

As a result, Netwealth has created a series of tools to help you on your AdviceTech journey, which are free to download.

AdviceTech buyers guide – In this guide we provide you with descriptions of over 35 different advice technologies and the most used suppliers in their categories. The report also examines the factors to consider when selecting a technology partner.

AdviceTech workshop – Prioritise technology selection and develop an AdviceTech roadmap for your business with this 90-minute team workshop.

Disclaimer: This information has been prepared and issued by Netwealth Investments Limited (Netwealth), ABN 85 090 569 109, AFSL 230975. It contains factual information and general financial product advice only and has been prepared without taking into account the objectives, financial situation or needs of any individual. The information provided is not intended to be a substitute for professional financial product advice and you should determine its appropriateness having regard to you or your client’s particular circumstances. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product. While all care has been taken in the preparation of this document (using sources believed to be reliable and accurate), no person, including Netwealth, or any other member of the Netwealth group of companies, accepts responsibility for any loss suffered by any person arising from reliance on this information.