Impact Investing: Perspective Reset

Reframing the adviser conversation on impact investing

In this special production

About this paper

This insights paper is a companion piece to the Ensombl podcast series on Impact Investing, brought to you with the support of T. Rowe Price.

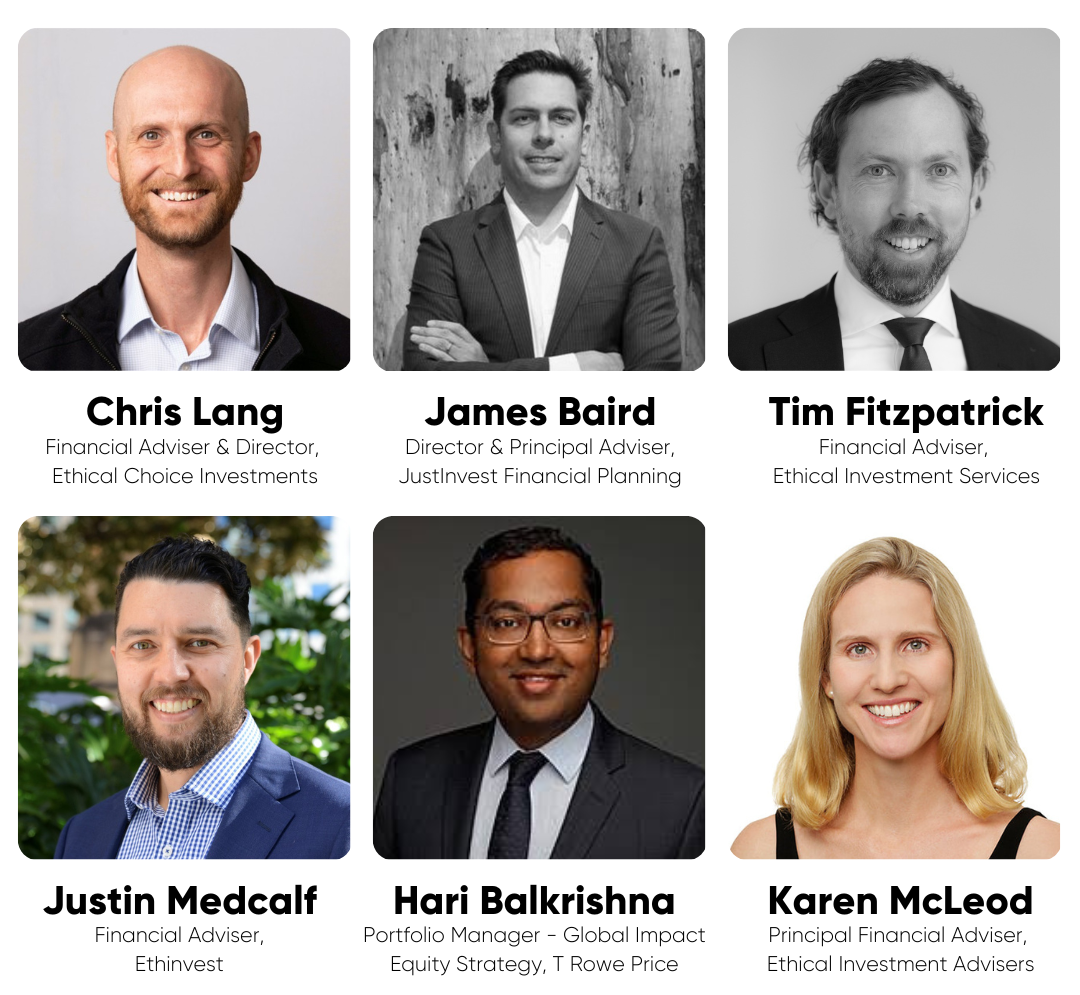

We would like to thank the following adviser/expert contributors:

Introduction –the Impact Investing Context

Impact investing is a rapidly growing investment sector.

Estimated in 2022 by the Global Impact Investment Network (GIIN) to already be worth over $1 trillion USD1, and predicted to grow by as much as 9.5% per annum over the next decade2, impact investing has become well and truly mainstream, and as a topic now features more prominently in both media coverage, and in client conversations.

But notwithstanding this stellar growth trajectory, and the undoubted increased community consciousness of environmental and social issues, impact investing remains widely misunderstood. Often assumed to be the same as ESG integration and responsible investing – the reputations of which have been somewhat tarnished in recent times due to concerns about politicisation, greenwashing, and subdued performance – impact investing is in fact its own distinct category of investment.

Characterised by a more robust focus on measurability than other categories under the ESG banner, and subject to financial assessment criteria every bit as stringent and comprehensive as traditional investments, impact investing arguably solves for many of the concerns surrounding ESG investing generally.

Impact investing is underpinned by the intention to generate positive environmental or social impact, alongside a financial return. Within this context, leading impact managers are focused on finding companies and opportunities that truly represent best in class solutions to challenges across areas including healthcare, education, sustainable cities, financial inclusion, and of course clean energy. So rich is the variety of investable impact opportunities, almost every client can be catered for.

But first, it is clear that adviser perspectives on Impact Investing need to be reset.

There remains a hesitancy on the part of some advisers to engage clients on the topic of impact and responsible investing more broadly. Much of this hesitancy – about performance, about compliance, about sensitive conversations – can be put down to false perceptions about client sensitivities, performance, and client risks. As this paper demonstrates, the unique characteristics of impact investing arguably solves for many of these concerns.

This paper is a companion piece to the Ensombl/T. Rowe Price podcast series on Impact Investing. Drawing on frontline insights from 5 Australian advisers operating in the impact space, we hope to reframe the understanding of, and attitudes towards impact investing, with the aim of giving advisers the tools and the confidence to make impact a key part of their offering.

Following the overall shape of the podcast series, this paper will aim to reset adviser understanding across 7 key misperceptions:

• Impact and Responsible investing are the same

• Impact investing requires the client to accept lower returns

• Impact investing lacks transparency

• Impact investing is all about the environment and climate change

• Sensitivities around personal values make for awkward client conversations

• Limited impact options hamper portfolio construction

• Impact investing carries a high risk of greenwashing

Perspective reset 1: What we mean by impact investing

What is impact investing?

Both GIIN, and the Responsible Investment Association of Australasia (RIAA) define impact investing thus:

“Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.”3

A number of important concepts are enshrined in this definition:

• Investments can aim to solve environmental and/or social challenges

• The impact must be positive

• The impact must be measurable, and

• The investment must generate a financial return.

These characteristics set impact investing apart from ESG integration and sustainable investing on one side, and pure philanthropy on the other.

Why Impact and ESG investing are different

Much is made of the challenge of inconsistent language, varying measurement methodologies, and often opaque outcomes of ESG style investing. It can be a complex and confusing space, with many shades of grey.

While the RIAA publishes a very handy Responsible spectrum4, a simpler way to think about impact investing versus ESG integration is in terms of focus.

ESG integration can be thought of as internally focused risk management

ESG integration involves analysing companies’ operations and behaviour in how they address environmental, social, and governance risks . Are they operating in a way that places them at risk of being penalised, either by regulators imposing fines, or customers withdrawing their support and buying elsewhere, or shareholders withdrawing support?

Companies might be driven to reduce their greenhouse gas emissions, or change their labour hire policies in developed countries, or do more to promote gender equality amongst senior ranks, in order to manage these risks.

Companies will be rated on the basis of their ESG profile, which in turn determines their suitability for inclusion in ESG oriented funds.

The debate around ESG ratings

One aspect of ESG rating methodologies that can attract controversy is their often-subjective nature, leading to a lack of consistency between different ratings issuers. Related to this, companies can receive positive ratings on the basis of their governance, even if that company is having a neutral or even negative environmental or social impact. (One of the most publicised examples of this was Tesla, removed from the S&P index for ESG ‘stars’, while oil giant Exxon Mobil made the top 10 of the same index5).

Impact investing is externally focused

Impact investing on the other hand is externally focused, aiming to invest in companies that demonstrate an intentional and positive impact by offering products and services that solve a environmental or societal challenge (e.g effects of climate change, polluted oceans, cancer, poverty, social inequality or any of the other challenges we face as a society).

Example of internal v external focus: Trane technologies6

One way to illustrate this differing focus is to look at a company making an impact. Trane technologies make energy efficient heating solutions for some of the planet’s biggest energy users including data centres and other industrial users.

Assessing Trane from an impact perspective means focusing on the way they help their customers reduce greenhouse gases by millions of metric tonnes of CO2 each year.

Viewing Trane through an ESG integration lens would mean looking at Trane’s own carbon footprint and their journey to net zero.

Expert Insight

“ESG very much had its beginnings in effective risk management tools. For example, thinking about a company’s own environmental or social footprint and making sure that there was nothing out of the ordinary that these companies were engaging in. You might look at an oil company and consider their record on spills. Or with a consumer staples company, you might look at if they were responsibly sourcing their raw materials. You can start to build a picture about risks which could have financial implications for these companies, such as being fined, or losing support amongst customers. And if there are enough red flags, you may decide not to invest in such a company. But it’s all internal to the company and its operations. Frankly, considering ESG in investment decisions these days is simply table stakes.” Hari Balkrishna

Adviser Insight – A simple and clear approach to responsible investing

“I think it’s more advisers and the product providers are the ones that get hung up on the terminology. Clients are more focused on their portfolio doing good. I can often see their eyes just glaze over when I start talking about the differences between ethical, ESG, and impact investing. I think the easiest visual tool that helps here is the RIAA responsible investment spectrum.” Tim Fitzpatrick.

The impact investing sector is growing

Impact investing is one of the fastest growing investment sectors.

• In 2022, GIIN estimated the size of the worldwide impact investing market to be USD 1.164 trillion across all asset classes. Marking the first time that the organization’s widely-cited estimate has topped the USD 1 trillion mark.

• An estimated 2% of these assets (around AUD $34b) are held in Oceania7

• Experts have estimated the size of the impact sector will grow at an annual compound rate of 9.5% between 2022 and 2031.

Perspective reset 2: Busting performance myths

Impact investing does not have to mean discounted returns

Impact investing is about delivering a positive impact alongside financial returns. A common misconception is that investing for impact is always at the cost of foregone returns.

Since 2022, impact innovators have found themselves on the wrong side of a race for oil and commodities, in an environment of extreme uncertainty and shortened investment time horizons. In 2023, global equity markets performance was led by the Magnificent 7 – a group of companies than enable Artificial Intelligence – most of which do not align with most impact frameworks.

While impact strategies typically have smaller investment universes compared to funds that do not pursue impact objectives, this does not necessarily mean they lead to lower returns. Fundamental analysis, careful portfolio construction and risk management approach can help impact investors add alpha.

Building a resilient portfolio

Impact-oriented companies not only offer products in high demand from consumers but also have business models that regulators are incentivising, such as net-zero targets. These companies present significant growth opportunities in terms of topline and bottom line, often outperforming the index over the long-term and aligning with secular change.

In-depth fundamental analysis is critical to identifying the most attractive potential investments from a financial return perspective. Investment candidates must demonstrate strong business moats, industry and management quality, and attractive valuations.

Understanding and managing overall portfolio risk is of utmost importance in impact investing, especially given the differential impact potential across sectors. Building a resilient portfolio is critical, mainly as impact investing requires a long-term approach. This approach is necessary due to the patience our environmental and social transition journey necessitates.

Expert Insight – the fundamental tenets of investing still apply

“If you stick to your fundamental tenets of investing, such as focusing on companies in a good industry structure led by good management teams that allocate capital well, and don’t overpay for an asset, then double-digit IRR is what you should be aiming for.” Hari Balkrishna

Impact in action

Danaher10 is a company providing lifescience tools to the biotech and biopharma sectors, helping to find cures for diseases like cancer and Alzheimer’s, and driving down the cost of life-saving drugs. Investment in healthcare is ramping up globally and a company like Danaher, a leader and innovator in this space, is likely to have a strong growth algorithm, as well as making an impact.

Adviser Insight – clients don’t need to accept lower returns

“Broadly we see impact opportunities as generally being in growth areas, sectors that are growing rather than declining. There’s a line between an investment and a philanthropic donation and we make it clear we are the investment side of the equation. Ultimately, our clients shouldn’t need to accept a discounted return in order to make an impact.” James Baird.

Perspective reset 3: the measurability and transparency of impact investing

Measurement – what sets impact investing apart

In contrast to other sustainable investment styles, which are often criticised for the lack of hard data around social and environmental outcomes, impact investing is characterised by a focus on more transparent and unambiguous metrics, which enable a much clearer line to be drawn between the activities of that business, and impact they are making.

These impacts are generally articulated in terms of progress towards global frameworks such as the UN SDGs which provide a blueprint to protect the environment and end poverty by 2030. Progress is measured by key performance indicators such as the amount of greenhouse gases removed from the atmosphere, the amount of waste recycled, the number of people from underserved areas that are brought in the financial system, the extra years of life created from disease sufferers and so on.

The five dimensions of impact

Many impact investors use the Five Dimensions of Impact, created by the Impact Management Project11 (IMP), to guide their approach to measurement. IMP found that understanding impact performance requires collecting data across 5 dimensions:

1. WHAT: Understanding the outcomes the enterprise is contributing to and how important the outcomes are to stakeholders.

2. WHO: Understanding which stakeholders are experiencing the effect and how underserved they were prior to the enterprise’s effect.

3. HOW MUCH: Understanding how many stakeholders experienced the outcome, what degree of change they experienced, and how long they experienced the outcome for.

4. CONTRIBUTION: Assessing whether an enterprise’s and/or investor’s efforts resulted in outcomes that were likely better than what would have occurred otherwise.

5. RISK: Assessing the likelihood that impact will be different than expected.

The data collected across these dimensions is used in conjunction with traditional financial metrics to create a comprehensive framework for measurement.

Expert insight

“A big difference between impact and all other styles of ESG investing tends to be around the measurability. Impact investing is about having a material, positive, measurable impact on the planet or on society, and that has got to be measured and reported on to clients. This forces you to put down metrics that link investment to outcomes, such as megawatt hours of renewable energy generated, or lives extended, or jobs created.” Hari Balkrishna.

Adviser Insight – transparency gives advisers and clients confidence

“That transparency, then the monitoring of the holdings, and the actual measurement of the of the portfolio impact all wrap up into a process that can make you pretty comfortable that clients will be happy with the impact being created. We use resources from various research houses, software tools, impact reports and fund managers, and we can literally take a dollar value the client has invested and match it to real world impacts, such as waste avoided, cars off the road and so on.” Jame Baird.

Adviser Insight – improved reporting allows you to take a deeper look

“The reporting has gotten a lot better so that we can actually look deeper into companies rather than just getting financial data. There are sustainability reports that come from companies and third-party tools that look in depth at companies so you can see what they’re doing well, and what they’re doing not so well.” Chris Lang.

Impact in action: third party research tools and services

As the responsible investing space grows, so too does the range of resources advisers can call on to help them assess companies and opportunities, before, and during, any investment. In addition to the many impact reports issued by impact fund managers, advisers are increasingly using specialised research software and services, including Leaf ratings, Ethos, Sustainable Platform’s impact calculator, and Purpose Made.

Adviser Insight: resources and support to call on

“RIAA have a lot of great resources around impact investing and responsible investing. There’s also the Ethical Advisers Co-operative, which you can call on if you come across a sticky question or something you’re not quite sure about. You can obviously take questions on board from a client and feel confident in saying ‘Well, I’m not quite sure about that, I need to look into it further’ and then knowing where to go and having those resources.” Tim Fitzpatrick.

Perspective Reset 4: Impact investing is just about the environment and climate change

Impact investing is about solving social – as well as environmental – challenges

The ubiquity of the net zero narrative – in our media and our politics – has undoubtedly skewed perspectives towards responsible investing as a whole, creating a misperception that the category is largely focused on solving environmental challenges.

This is far from the truth.

Underpinning many impact investments are aligned to the 17 Sustainable Development Goals12 (SDGs), a set of goals agreed by the member countries of the United Nations in 2015. Encompassing the worlds’ most pressing environmental, social, and economic challenges, examples of the SDG’s include eradicating poverty and hunger, promoting good health and wellbeing, education, gender equality and social justice – along with environment and climate related goals, including clean waterways, sustainable cities, and clean, affordable energy.

The full list of 17 is available here:

Impact investing, with its focus on investments that deliver measurable social and environmental outcomes alongside financial returns, is naturally well placed to lead efforts to align investment strategy and impact management with the SDGs, and many impact investments explicitly incorporate one or more of the SDG’s into their mission and targets.

According to 2024 analysis13 by Impact Investor magazine, the top SDGs by number of aligned funds were:

• SDG 7 (Affordable and clean energy) 915 funds

• SDG 9 (Industry Innovation and Infrastructure) 723 funds

• SDG 2 (Zero hunger) 700 funds

• SDG 3 (Good health and wellbeing) 688 funds

• SDG 11 (Sustainable cities and communities) 684 funds

Adviser insight – make an impact through human empowerment

“Finding the solutions most aligned with the client is becoming easier because there’s an increasing number of products and investment opportunities in the impact investment space.” Karen McLeod.

Perspective reset 5: Talking to clients about responsible investing can be awkward

Client conversations

The growth of impact investing has been driven by the increasing desire of individuals to invest their money in accordance with their personal values. Indeed, 85% of respondents to an RIAA survey said it was important that their financial institution ask them about their values and interests in relation to their investing. Values based investing can help solidify a much deeper client connection, elevating the adviser/client dialogue beyond just investment returns.

But, notwithstanding an obligation under Standard 6 in FASEA’s Code of Ethics to consider a client’s attitude to responsible investing, many advisers leave it up to the client to volunteer these attitudes and preferences, rather than trying to elicit them through their standard fact-finding process. This could be in part because they are fearful of bringing up topics – especially those relating to the environment – that are seen as ‘politically sensitive’.

Going past the politicisation of ESG to understand what matters to clients

While anti-ESG sentiment is nowhere near the levels seen in the US, net zero is still a politically charged issue in Australia, with negative media and political commentary on topics such as clean energy, or vehicle emissions, gaining some traction.

But advisers working successfully in this space counter those concerns in two ways:

• Firstly, asking the question about whether a client has any responsible investing preferences should not be seen as being judgemental, either about your client, or yourself; and

• Secondly, responsible – and impact – investing opportunities extend well beyond environmental issues, as can be seen in the 17 UN Sustainable Development Goals – the majority of which don’t relate to the climate or the environment at all.

Impact investing takes clients into the realm of preventing poverty, eradicating disease, lifting education standards, creating more employment, and reducing injustice, none of which are topics likely to be considered controversial by most people.

Adviser insight – not an adviser’s role to determine a client’s values

“Ultimately, it’s not for us to decide what’s right for the client in the sense of their ethical concerns or their values. But it is up to us to be upfront around the financial and the risk metrics that come with that and provide them with a fuller picture about whether that’s the right investment for them or not.”Justin Medcalf.

Adviser insight – advisers aren’t expected to be ESG experts

“Some advisers might also be worried they don’t understand ESG issues enough to have a credible conversation about them. And what tends to happen is advisers that I’ve spoken tend to think it’s easier to just not go there. And obviously there’s code of ethics concerns around that. But I think there’s nothing wrong with taking things on notice and being able to learn from our clients as well.” Justin Medcalf.

Asking the right questions in the right way and at the right time

The key to removing any potential or perceived awkwardness on the part of the client or the adviser is to normalise questions about ethical/responsible investment preferences, by incorporating them into the normal fact-finding process.

And according to Alexandra Brown14, the CEO and Founder of Ethical Invest Group, these questions should be simple and direct. She recommends three key questions that make for a valuable discovery process:

1. Would you like to support or avoid any particular companies or industries?

2. Are there any ESG issues you would like to support or avoid?

3. Are there any ESG themes you would like to consider for your portfolio?

Advisers can also draw on a number of practical resources produced by the RIAA, including their guide to the client interview process, and their fact find checklist, both of which are available free to their members.

Adviser Insights – the client fact find is where these questions belong

“I think the easiest way is to just to incorporate it into the fact-finding process, so it becomes part of the conversation from the start.” Tim Fitzpatrick.

“You don’t want this to become an odd addition to the process or an extra step. If we can understand the client’s ethical concerns upfront in the data collection stage that allows us some time to look into those issues in preparation for the initial meeting.”Justin Medcalf.

Adviser insights – ask clients about their hobbies or their job

“If you have a client that’s a bit shy, an easy starting point is to ask them about their vocation and their hobbies, so you get a real sense of them as a person. And then you can gradually ask deeper questions that might relate to their investment preferences.” Karen McLeod.

“Talking to clients about their interests outside of work can help you get an idea of whether they are environmentally focused, or socially focused, which can then feed into any conversations about their investments.”Tim Fitzpatrick.

Impact investing helps solidify a deeper client engagement beyond returns

Advisers who work in the impact space often refer to a client engagement dividend, a deepening of the connection with clients that results from engaging over more than just financial returns.

Many clients who care about making an impact with their money will be motivated by some personal story or life experience, which in turns can determine their focus on specific areas. Vegans may be driven by a lifelong love of animals. People touched by the spectre of serious disease may have an interest in making an impact in the healthcare space. A person’s profession can also be a major driver. School teachers, for example, may have a particular interest in educational impact opportunities.

Whatever the driver, it will be, in many cases, deeply personal, and be about more than money.

Forging a connection along these lines can have several outcomes:

• There is immediately a tighter client bond, as you have helped build a plan around values that are important and personal to them

• Similarly, they are likely to be more engaged with their plan and investments when it is more aligned with their personal values

• They are likely to be more resilient in the face of market volatility, as investment performance is not the only metric that is important to them

• Client stickiness improves

Adviser insight – client stickiness increases as a result of deeper connections

“When we talk to other advisers who work in this space they all talk about a stickiness that comes from this alignment with client values. You tend to see that clients are less worried about the financial returns, because part of their reason for investing isn’t purely financial, they’re also looking at the positive environmental or social benefits their investments bring.” Justin Medcalf.

“For many advisers, there’s a sense of kinship with their clients, a sense that they are on that journey together, and during times of turmoil, financial disruption or changes to legislation or any bumps along the way, that you’re there to support each other.” Karen McLeod.

“It makes for more interesting clients, the kind of clients you want to deal with. Obviously, you can talk about their portfolio and performance, but it opens up this whole other conversation, which makes for a far more interesting dynamic with your clients.” Tim Fitzpatrick.

Adviser insight – all clients, of all shapes and size, want to make an impact

“We’ve got retirees, right through to people in their 20s. Where I’m based – in WA – we’ve got people that work for mining companies that want to create really good positive impact. It’s not just one particular category of client. It could be a high-income earners, lower income earners, professionals, blue collar. It’s a really diverse mix.” James Baird.

Making impact accessible: framing compelling stories

While the transparency and variety of metrics available within impact investing allows advisers to produce comprehensive data-led reports, this can often overwhelm clients with information overload. This in turn undermines the personal connection they have with their investments as they find it harder to visualise the real-life difference they are making.

The experts we spoke to recommend a story telling approach, which is:

• Short, perhaps focusing on one or two examples from their portfolio

• Highly visual, using images and graphics to communicate impact (as per the T. Rowe Price example referred to earlier)

• Can provide clarity around whether any portfolio adjustments are necessary.

Adviser Insight – demonstrating impact through a traffic light system

“So we actually use a traffic light system at Ethinvest, based on some of the thoughtful work from the impact management project. Red are those investments directly involved in activity that may harm people or the planet. Amber investments that have no direct involvement in activities that harm people or the planet. And then we have green, which are those investments that not only act to avoid harm, but are also involved directly in activities that benefit people and planet. And that allows us to have a very visual representation of the client’s portfolio.”Justin Medcalf.

Adviser insights – using simple case studies and local examples to tell stories

“It’s great to have impact reports from the fund managers. But more often than not, our clients won’t sit down to read a 60-page impact report from one manager, and then the next one and the next one, it’s just a bit too much to ask. So we summarize that info and pull out the really interesting bits into a presentation. We’d typically focus on some short and sharp case studies. It elevates the communication beyond your typical review or annual statements from your super fund.” James Baird.

“I try and tell local stories if I can, like Queensland Treasury Corporation who issued green bonds that have been used to build the Gold Coast light rail, Sunshine Coast solar farms and Brisbane bikeways. Because my clients are local to Queensland, they can identify with those projects. And you can then extrapolate to how similar things are happening all around the world.” Karen McLeod.

Figure 1: Using visuals to communicate impact – examples from T. Rowe Price

Perspective Reset 6: Limited impact options hamper portfolio construction

Not so long ago, the availability of retail impact investment opportunities was relatively narrow, especially in terms of asset class exposure, creating portfolio construction challenges. Today, a wide variety of opportunities are available, across impact areas and asset classes.

Opportunities available span asset classes, investment vehicles, and causes

The range of Impact investment opportunities available is virtually endless, and growing all the time. Within the scope of the 17 UN Sustainable Development Goals there are infinite ways that companies, individuals, governments and NFPs can mobilise capital towards solving those goals.

Whether your client wants to invest in solutions that bring medicine quicker to market, provide education to underprivileged children, empower small businesses in the developing world, there will likely be an investment that allows them to do that – in addition to the more mainstream opportunities such as greenhouse gas reduction.

Impact opportunities can be:

• Wholesale or retail

• Found in most asset classes including private and public credit (e.g., bonds, including green bonds and blue bonds), private and listed equity, infrastructure, real assets

• Direct investments or managed funds

• Global and domestic

Adviser insight – a wide range of impact investments to suit more clients

“It’s fantastic as an adviser, there’s so many solutions available for retail investors. It’s true that many opportunities still lean towards more private markets, whether that be VC funds or private equity funds or real assets, infrastructure, funds, and so on. We tend to not talk too much to retail clients about all the wholesale solutions available, because we don’t want them to have this sense of fear of missing out.” Justin Medcalf.

“The number of asset classes offering impact investments has broadened significantly. If you think about the roots of impact investing, a lot of it started in social impact bonds and has gradually morphed into social impact companies on private side, and environmental impact companies on the private side. And now you can see a lot more cases and applications including listed equities, listed credit, green bonds, and blue bonds and so on.” Hari Balkrishna.

“Previously it was generally only wholesale investors and investment funds that were able to access these sorts of investments. A half a million dollars minimum investment entry knocked out your standard mum and dad investor. But that’s changed and we’re seeing a lot of different ways people can access and support these sorts of investments at a more retail level.” Chris Lang.

Impact in action – uncovering opportunities in unexpected places

Impact can often be found in unexpected places. While green bonds and other sustainable finance instruments are simple to understand and easy to source, a glimpse at the portfolios of professionally managed impact funds can be highly enlightening in terms of the breadth and quality of companies that represent investable opportunities.

These include companies that are:

• Making decking from recycled plastic (Trex15)

• Are at the forefront of finding a cure for cancer (Danaher)

• Reducing financial inequality by providing banking to previously unbanked communities (Nu16)

• Providing cooling solutions for data centres (Trane)

All these companies are examples of companies that fulfil the criteria of intentionality, materiality and measurability. Recognised as leaders in their respective industries, they are companies with strong underlying growth algorithms, providing investors with the opportunity to ‘do well, while doing good’.

Adviser Insight – looking for best in class impact companies

“I’d probably have three measures of company. One is impact. What’s that company doing? And is it a positive impact? Measurability is another, if you can’t measure or see that impact, then there’s not really any indication that it’s there. So it needs to be something that you can be sure it’s more than just talk from the company. And thirdly, intentionality. Is the impact they’re having a core part of that company? Is that front and centre one of their goals? Or is it just kind of a business as usual, and nothing particularly special for the sector that they’re in? So to have an impact, I feel companies need to be out in front of the norm, doing new things, and doing things in a way that will lead to change. If there’s a company that’s doing a really good job of solving an issue that no one else is, that’s probably going to be successful company.” Chris Lang.

“We are also looking for the best-in-class impact companies. I think it’s really important that companies need to be able to demonstrate something out of the ordinary in terms of their product and the impact they are having. We find only about 400 to 500 companies in the global index out of roughly 3000 or so could even potentially get close to qualifying as impact investment. So the bar is, is pretty high.” Hari Balkrishna.

Assessing impact managers

Due diligence is crucial when selecting an impact manager or a specific impact opportunity.

While assessing government issued instruments can be relatively straightforward, assessing private market and overseas opportunities can be harder for Australian advisers to truly understand.

As well as the research available through organisations like the RIAA and GIIN, advisers can access specialised impact research software services, including a number of impact research software offerings. Impact reports and of course traditional financial metrics relating to specific opportunities are also crucial inputs into the process.

Adviser insight – advisers need to do their research to stay ahead

“Advisers wanting to give advice on impact investing need to be prepared to do thorough research initially, and then ongoing due diligence, to ensure that they stay ahead of the waves of constant change.” Karen McLeod.

Perspective Reset 7: Impact investing comes with a high risk of greenwashing.

An approach to Impact investing that mitigates greenwashing risk

Greenwashing is undeniably a major barrier to client and adviser adoption of responsible investing. In Australia, ASIC has recently issued penalties to several highly reputable, well known fund managers, found guilty of greenwashing. In almost all cases, the greenwashing was inadvertent, and the result of minor exposures, via indexed funds, to stocks that were inconsistent with the stated ESG credentials of the product.

Regardless of the intent, the widespread news coverage of the greenwashing phenomenon, and the priority ASIC has allocated to greenwashing enforcement, has left many stakeholders in this space feeling hesitant. Advisers – quite rightly – are fearful of recommending a fund subsequently found to not be true to label.

Impact investing is different in a number of important respects:

• They are focused on solving a particular problem, usually SDG aligned

• They have intentionality and materiality

• There is a higher bar set in terms of outcome measurability

• Engagement with companies drives transparency and accountability

Impact investment funds typically select individual companies who are very focused on solving a particular problem, to the extent that it represents a major – or even the only – source of revenue for the business. This is a manifestation of two key impact concepts:

• Intentionality – the company is intentionally making that impact, and

• Materiality – the revenue generated from that activity is material to the business.

Rather than ESG investing which often relies on the screening out of particular companies seen to be creating an adverse social or environmental impacts, impact investing tends to be about the proactive inclusion of companies that are single-mindedly solving a problem (e.g., disease, poverty, or polluted oceans).

Impact investors generally set a high bar in terms of the measurability of outcomes – or impact – ensuring there is tangible evidence of the impact being claimed.

Engagement is another key characteristic of impact investing which helps mitigate greenwashing risk. Impact managers will typically engage with senior management of constituent companies in its fund, as part of a typical ESG risk analysis process. The transparency and accountability demanded by impact managers helps minimise the incidence of ‘surprises’.

“As an impact investor, we solve for the greenwashing issue across three dimensions. The first one is the materiality aspect, which is about ensuring that the overwhelming majority of a company’s revenue is aligned towards that positive impact solution. So in our case, we defined it as greater than 50% of revenues, aligned with a positive impact activity. So if you take Trane, for example, pretty much the whole business exists to decarbonize customer carbon footprints. When that materiality of revenue exists, it significantly reduces our risk of greenwashing already. Secondly, we engage with all these companies, to test intentionality. We want to make sure these companies that genuinely care about making a difference, and they care strongly about their products. And thirdly, we still apply traditional ESG integration tools to all our stocks, to make sure there’s no risk out there that we’re unaware of”. Hari Balkrishna.

“Getting to know the different managers out there is crucial. Knowing who has been greenwashing, inadvertent or not, is critical. It’s not just about what’s in a particular portfolio now, it’s about understanding their philosophy and culture, so you can try and forecast what type of investments they may put in there in the future. We don’t egg on our face, or any surprises about what turns up there in the future, which can happen from time to time. If you are having ongoing conversations with a fund manager you can ask the question “why did you decide to put XYZ stock in the portfolio, given they have had some environmental issues recently?”. If you have a good relationship with the manager, you can generally have a pretty open conversation with them.” James Baird.

“Well, I guess, the way I see it is that if you’ve got the choice between a sort of standard investment that has a financial return, or an impact focused investment, which has a similar return, but also improves the whole planet and our society, then it’s really a bit of a no brainer.” Chris Lang.

Summary

Impact investing is a rapidly growing investment sector, driven in part by a growing desired by investors to affect positive change.

The opportunity to own businesses that create a positive environmental or social impact is greater than ever before, as governments and companies shift their investments

to address environmental and societal pressure points. Within the sustainability investment spectrum, impact investing can help address clients’ ESG scepticism and greenwashing concerns by providing measurement and transparency.

From an adviser’s standpoint, simplicity is crucial. Effectively matching clients’ needs with the extensive opportunities that impact investing offers requires approaching the values conversation with curiosity and empathy.

Impact investing does not require sacrificing financial returns over the long term. Thorough fundamental security analysis and rigorous portfolio construction is key to build a resilient dual mandate portfolio over the long-term.

As impact investing is being backed by an explicit choice of a growing population of investors who want to be part of global and sustainable solutions, asset managers and advisers now have a unique opportunity to play a key role in helping deliver positive environmental and social outcomes that the world is increasingly seeking.

References

1.https://thegiin.org/publication/research/impact-investing-market-size-2022/

3.https://responsibleinvestment.org/what-is-ri/ri-explained/

4. https://responsibleinvestment.org/what-is-ri/ri-explained/

5. https://time.com/6180638/tesla-esg-index-musk/

6. https://www.tranetechnologies.com/en/index.html

7. https://thegiin.org/publication/research/impact-investing-market-size-2022/

8. https://www.msci.com/documents/10199/67a768a1-71d0-4bd0-8d7e-f7b53e8d0d9f

9. https://www.msci.com/www/fact-sheet/msci-kld-400social-index/05954138

10. https://lifesciences.danaher.com/

11. https://iris.thegiin.org/document/iris-and-the-five-dimensions/