General Use: This document is for general use. Modification of content is prohibited unless you have Netwealth’s express prior written consent.

There is a clear appetite for advisers to act as educators, but needs vary according to client segment, financial literacy and personal preferences. Firms wanting to develop this educator offering need to be crystal-clear on these needs and able to leverage tools at their disposal.

Advised Australians are hungry for financial information, and they are not restricted in their sources.

This key message emerged from Netwealth’s Advisable Australian research, Understanding Australian Advice Clients Better, which found that a significant proportion of clients value their adviser as an educator.

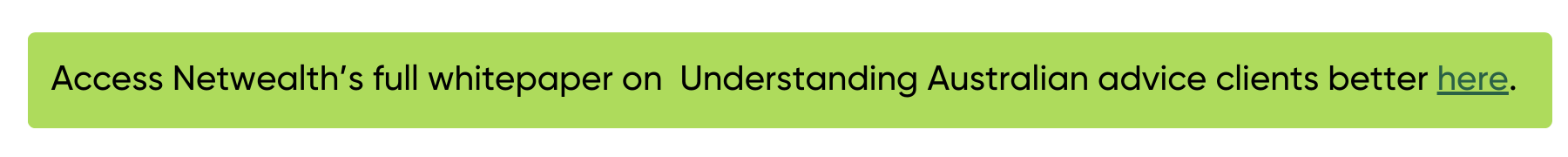

For advisers, it is worth noting that while 42 per cent of advised Australians get investment information and advice from their wealth adviser, they also use a wide range of sources.

Younger Emerging Affluent are the most active, with over a quarter using at least nine sources – both traditional and digital. Being digital native they are twice as likely to use sources such as specialist investment websites, blogs or apps (41 per cent use), social media (31 per cent use), online forums or blogs (29 per cent use) and podcasts (24 per cent use). With that said, four in 10 still do rely on their adviser or family and friends.

Meanwhile, the Established Affluent are more traditional in their approach, with their top sources being their adviser (56 per cent use), company annual reports (40 per cent use), PDS statements, third party research and the ASX website (30 per cent respectively).

And finally, the Established Mass are likely to rely on their wealth adviser (44 per cent), and not on many other sources at all.

Become a single source of knowledge

Based on these facts, advisers should consider doubling-down on becoming the trusted source of investment and wealth information, removing the noise created by the various sources of information. To do this, they can try developing a content marketing plan using tools like newsletters, webinars or events.

Adding educational content to a to-do list might seem overwhelming. To make it work, advisers can try appointing content champions within the business who can help create content, and even set KPIs for staff to produce, say, an article or video a month.

It is also worth considering how AI and AdviceTech can help to scale content production efforts. Firms can look to AdviceTech tools to leverage their efforts, from email marketing systems like MailChimp, to using generative AI tools, like ChatGPT, to kick-start the process.

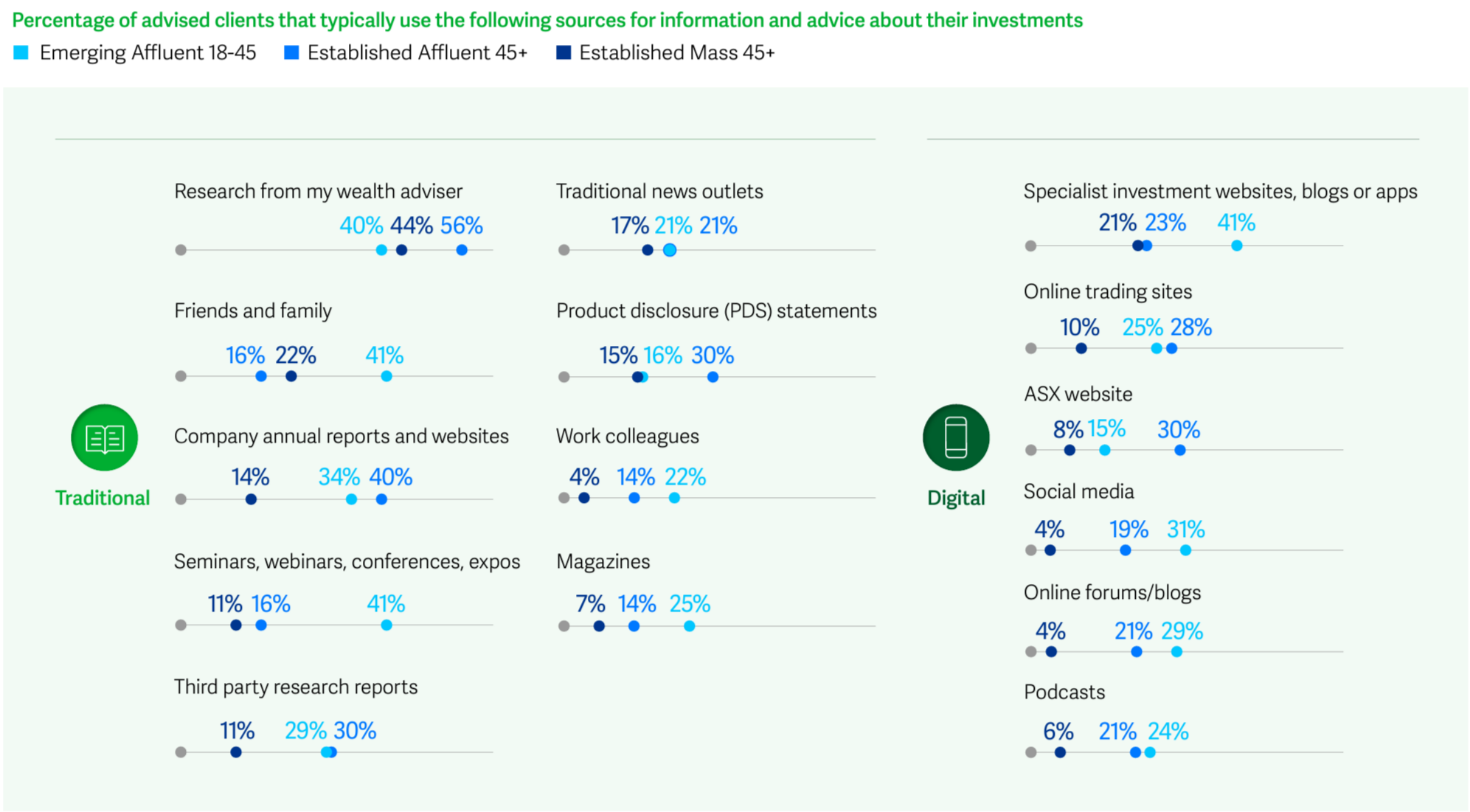

Financial literacy varies amongst client segments

Clients’ financial literacy varies greatly between different segments of advised Australians. While advised clients rate their financial literacy higher than unadvised clients in several areas, such as the relationship between risk and return, the risk and return profile of different investments, and diversification and asset allocation, this is not the case across the board.

For example, Established Mass clients and women are less likely than other Advisable Australian client segments to be financially literate on all the above. They rate their understanding lower by about 20 per cent for the different types of investments that are available, and the fees involved in investing.

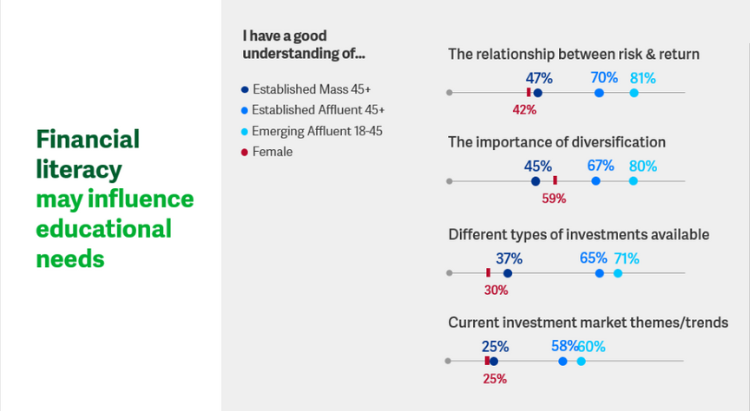

Educating the whole household

It follows that the service model for a couple is very different to an individual. Further, it’s worth considering that 44 per cent of advice clients are women, of which 53 per cent are married, and of the male clients that are advised, 64 per cent are married. Therefore, wealth professionals are often dealing with a household rather than an individual, and both males and females as part of a client relationship.

Another significant insight is that women are more involved in wealth decision making more than ever. Whether they are single, millennial women or women who are married. For example, our Advisable Australian research suggests that 4 in 10 (41 per cent) of married women prefer to get some help in making decisions.

Making education count

Advisers should be conscious of the different needs of each segment, try to understand financial literacy gaps, identify where they can add value, and build content around this.

Another tip is to keep it simple, educating those less informed on the basics while simultaneously educating the more informed on emerging trends like private markets or responsible investing.

To further boost their approach to education, firms can find out what other content services clients are using and what they like about them before trying to replicate or differentiate themselves.

While it might require a lot of thought and additional effort, becoming an educator is an excellent way to deliver increased value to the advisable Australian now and in the future.

This article is part two in our series on the Advisable Australian. You can view our first article discussing Segmenting Clients to Drive your Value Proposition here.

Disclaimer: This article has been prepared by Netwealth Investments Limited (Netwealth), ABN 85 090 569 109. It contains factual information and general financial product advice only. While all care has been taken in the preparation of this information (using sources believed to be reliable and accurate), no person, including Netwealth, or any other member of the Netwealth group of companies, accepts responsibility for any loss suffered by any person arising from reliance on this information. Any person considering a financial product from Netwealth should obtain the relevant disclosure document at www.netwealth.com.au