Netwealth’s latest research shows that many women are considering using a financial adviser, but building an attractive offering goes beyond just the advice itself to the types of conversations professionals have and digital tools they use.

Key takeaways

- Client service is as important as the advice itself

- Female clients are looking for either a coach or to outsource entirely

- Digital offerings are a chance to shine, especially to younger clients

When it comes to financial advice, women are in clear need of more tailored services to help them build and manage their wealth.

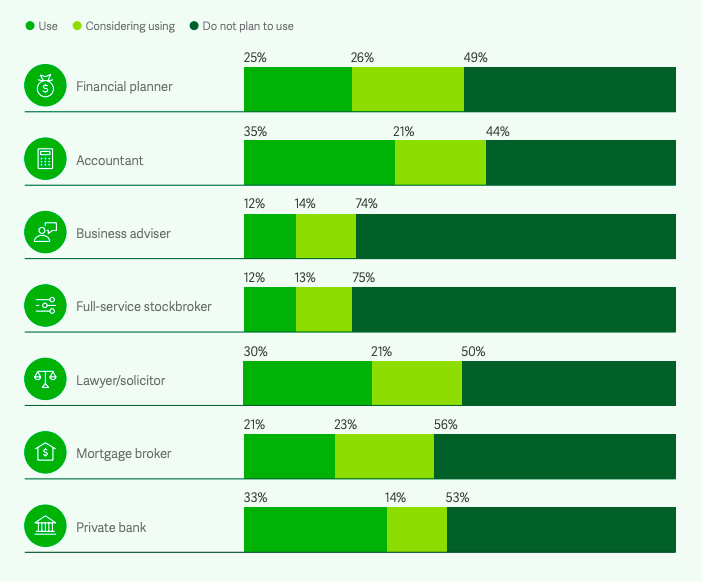

According to the 681 women Netwealth surveyed for the Women as the New Face of Wealth report, 25 per cent of women use a financial planner, which is slightly less than other mainstream service providers such as accountants (35 per cent use), private banks (33 per cent), and lawyers (30 per cent).

At the same time, the appetite and need for more advice is clearly there – 26 per cent of all women surveyed are considering using a financial planner. In some specific ages and life stages, this desire for the services of wealth professionals is even more pronounced, such as Gen Z and Gen Y women (37 and 30 per cent are considering, respectively), those who are employed (30 per cent considering) and running a business (48 per cent considering).

Which of the following do use for your personal/business financial advice?

Source: Netwealth 2023 Advisable Australian (Women 18+ only)

However, to truly appeal to women, it’s important to look beyond just the advice offered to the service provided.

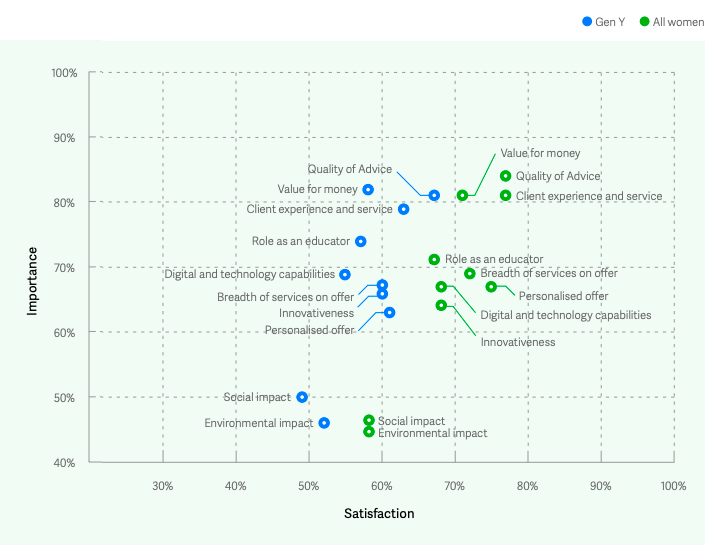

When asked what is important to them, 81 per cent of women who use an adviser today say it’s the client experience and the service of an advice firm, which is about the same as the percentage who value the actual quality of advice provided (84 per cent) and the overall value for money (81 per cent). Also, around seven in ten women expect their advice firm to be an educator, provide a personalised service, to have strong digital and technology capabilities and to offer a breadth of services.

Service features of an advice firm – Importance vs. Satisfaction

Source: Netwealth 2023 Advisable Australian (Women 18+ only)

Satisfied clients

Broadly, advisers are meeting the needs of female clients, with around seven in ten who receive advice today indicating they are satisfied with many aspects of the offer, including value for many, quality of advice, client experience, breadth and personalisation of service. Gen Y women are less impressed, although still largely satisfied.

Despite the majority being satisfied, there is still room for the savvy adviser to build on the client experience they offer to women, whether that’s to increase satisfaction among existing clients, target those that are unsatisfied with their current adviser, or those who are looking to start using one.

Here are some things to consider.

- Personalise your language

To begin to deliver a tailored service, it’s important for advice practices to be careful about the conversations they have with women, and to avoid making assumptions based on deep-seated gender biases.

According to a US-based survey conducted by BCG in 2020, 30 per cent of women who were receiving advice reported their advice relationship manager had spoken to them differently because of their gender. An example of where this might inadvertently happen is when advising a married couple. In this case, it’s important for advisers to keep these conversations equal, talk to both people, and personalise the service to both parties.

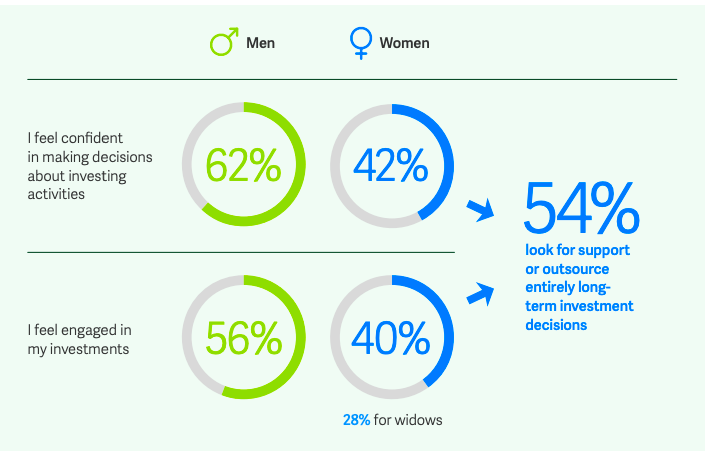

- Determine whether to coach or control

You need to decide whether your female client wants a coaching or an outsourcing relationship. In this case, the numbers show it’s impossible to guess one way or the other – respondents were roughly evenly divided between those who partially rely on their adviser to explain things or provide information or high-level ideas (51 per cent), and those who see their adviser as a critical source of support who they outsource mostly everything to (49 per cent).

The best way to determine your client’s needs is to simply ask their preferred relationship style.

Confidence and engagement in investment activities by gender

Source: Netwealth 2023 Advisable Australian (Women and Men 18+)

- Upping the digital ante

Another key element of superior experience for female clients is digital capabilities. Generally, women are tech savvy, with 20 per cent saying they’re tech early adopters, and another 46 per cent understanding technologies and happy to try them if someone else has first. Unsurprisingly, this is higher for Gen Y and Z women, with 80 per cent rating themselves as either early tech adopters or understanders.

However, to stand out to this segment, wealth firms need to double-down on their digital experience. While an online and social media presence is good, digital needs to encompass the actual advice offering itself, including services like online fact-finds, client portals, digital document vaults, and online calculators.

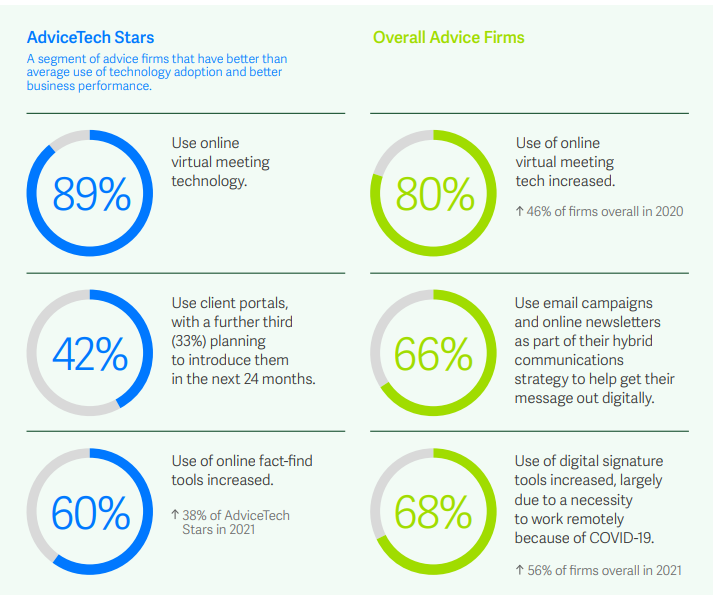

Encouragingly, advice firms are doing well on the digital adoption front – according to Netwealth’s 2022 Advice Tech Report, 80 per cent of firms hold meetings online, 66 per cent use email newsletters in communications, and 68 per cent use digital signature tools to remove friction.

Selected use of AdviceTech by wealth firms

Source: Netwealth 2023 Advisable Australian (Women 18+ only)

- Becoming an educator

Many women’s tendency towards conservatism can lead to lack of diversification – something which advisers can educate them about. One in three (31 per cent) of women are very conservative and avoid exposure to risky assets, while a further 26 per cent are conservative and want to invest for guaranteed returns and minimal exposure to risky assets.

It follows, therefore, that female investors favour the familiar, with 64 per cent of women preferring to invest in more commonly known and available investments. This skews their portfolio to asset classes such as Australian equities (17 per cent currently invest in them), term deposits (15 per cent), residential property (14 per cent) and cash (23 per cent).

Advisers can look to educate their clients more to help them understand the benefits of diversification, proper asset allocation and the variety of asset classes available to them to help meet their short and long-term investing goals, particularly for older women.

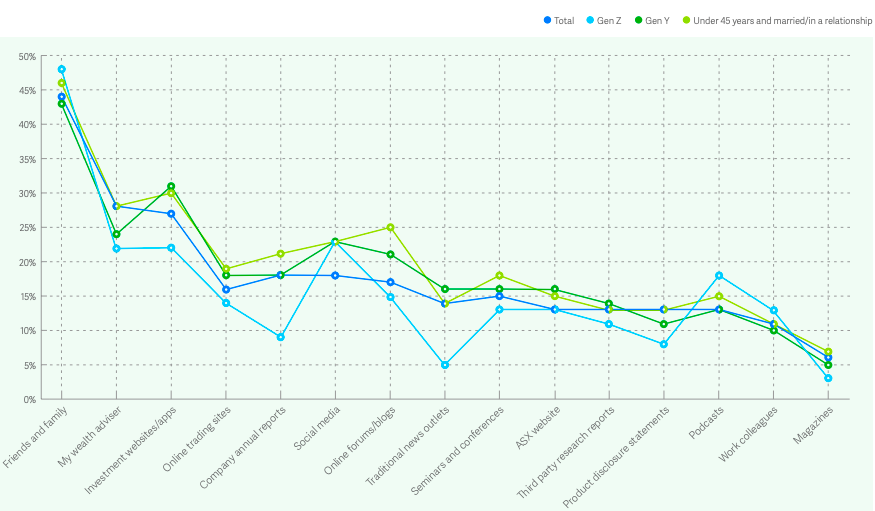

Where do you typically go for information advice about investing (of those that look for it)?

Source: Netwealth 2023 Advisable Australian (Women 18+ only)

There’s also room to increase education around responsible investing. Currently, only a quarter of women surveyed hold responsible investments in their portfolio. However, over half of women say they care deeply about environmental issues (59 per cent) and social issues (54 per cent). And 67 per cent of those who don’t currently have responsible investments would consider doing so if they didn’t need to pay more, sacrifice returns, and the investment made a quantifiable difference to the environment or society.

A strong client experience is important in attracting the significant proportion of women looking for financial advice. Honest conversations, personalisation and a strong digital presence are good places to start when going beyond the basics in advising female clients.

[1] https://www.bcg.com/publications/2020/managing-next-decade-women-wealth