General Use: This document is for general use. Modification of content is prohibited unless you have Netwealth’s express prior written consent.

Segmenting can provide additional insight for firms trying to define what is important to their clients. Here, we dive into three key segments identified in Netwealth’s annual Advisable Australian research and investigate their driving needs.

Advice firms are continually developing their value proposition and service offerings to meet the needs and wants of their clients. However, with client demands always evolving, firms may need to direct their efforts to the activities that will deliver the most value.

Segmenting clients beyond life stage can be a great help for advice firms trying to define what is important to them, so Netwealth conducted some research to help them do just this. The results were released in a recent white paper called Understanding Australian Advice Clients Better.

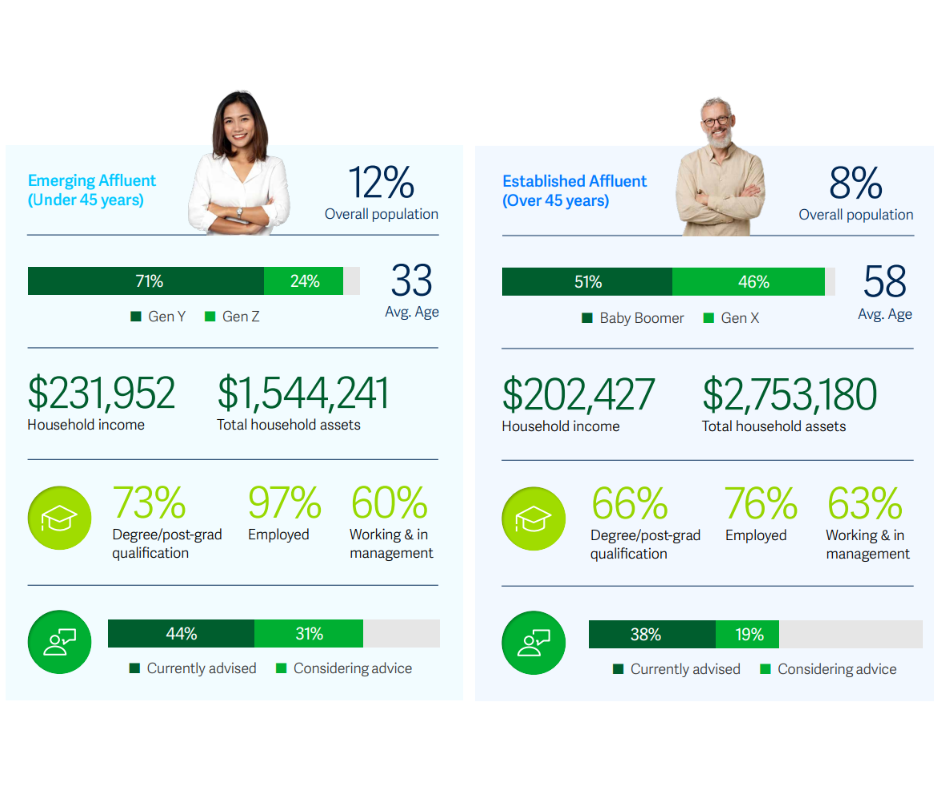

Netwealth’s segmentation was based on age and affluence. Firstly, client personas were divided into emerging (45 years and under) versus established (over 45 years). Then they were segmented into affluence by wealth, which was measured on income, debt levels, property values and household assets.

Netwealth identified three segments that could be of importance to financial advice firms:

• The Emerging Affluent, fondly referred to as ‘millennials with money’.

• The Established Affluent, your typical generation X or baby boomer client.

Together, these two segments of clients represent a quarter of Australians 18+, yet control close to half of Australia’s household wealth.

• The Established Mass. They are important as they are the largest single segment, representing 41 per cent of the Australian population 18+, controlling around a third of household wealth.

How the key segments differ

To set some context, it is important to understand a few of the key defining features of these segments.

The Emerging Affluent are largely Gen Y (71 per cent of them), while the Established Affluent are older, with a mix of Gen X and Boomers. Almost all (97 per cent) of this younger segment are working in a full or part time capacity, often in a senior role. They are also the most educated of the three segments, whilst the Established Affluent have an average age of 58 years, and are typically employed and working in management. Meanwhile, the Established Mass are the oldest, largely Boomer generation, with 50 per cent already retired (only 36 per cent are employed).

Household income for the Emerging Affluent is the highest, possibly due to many being dual income households, whilst the Established Affluent have the largest amount of assets (over 2.75m). As their name suggests, the Established Mass are less wealthy.

When it comes to their appetite for advice, the Emerging Affluent are the most likely to be using a financial adviser today or ‘when needed’ (44 per cent), and are the most likely to be considering advice (31 per cent). With that said, plenty of the other two segments either use or would consider financial advice.

What is important to these segments?

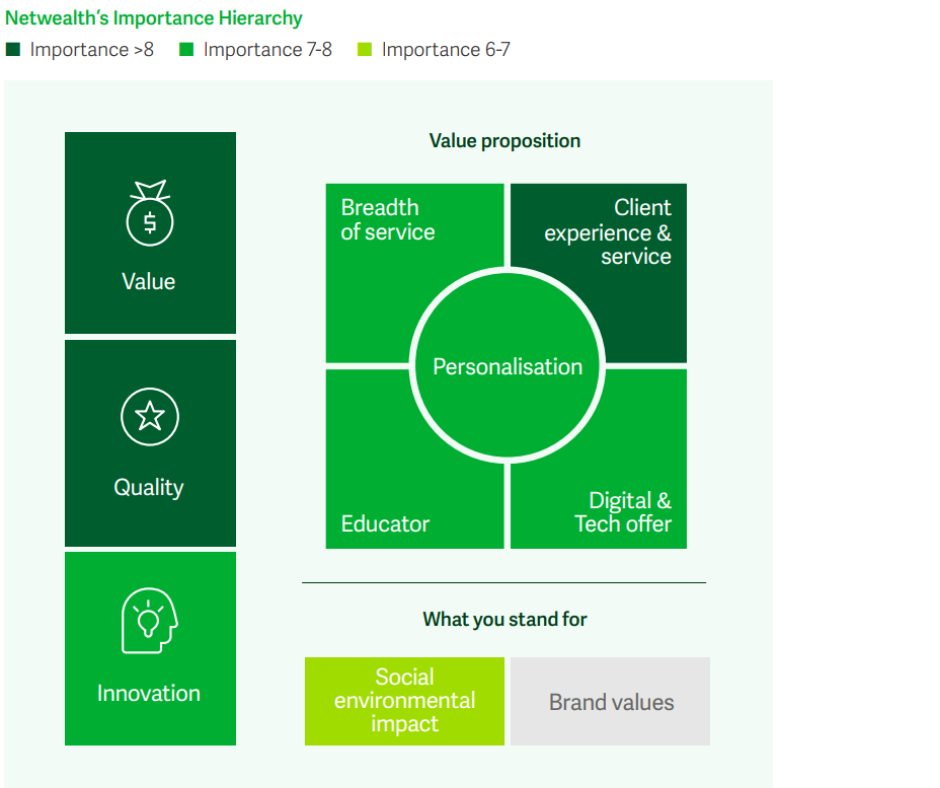

As part of its Advisable Australian research, Netwealth developed a framework to understand the importance of certain characteristics of an advice firm’s offering, called the Netwealth Importance Hierarchy. This framework was based on rating the importance of various aspects of a financial planner and their services out of 10 .

Netwealth found, that clients want it all – rating most things at least a seven out of 10 as ‘important’, with value for money, quality and client experience as the most important.

Other factors like innovation, personalisation, breadth of service, education, and the firm’s digital and technology offering were also rated highly.

Advised Australians are also increasingly interested in what their advice firms stand for, particularly in terms of social and environmental impacts.

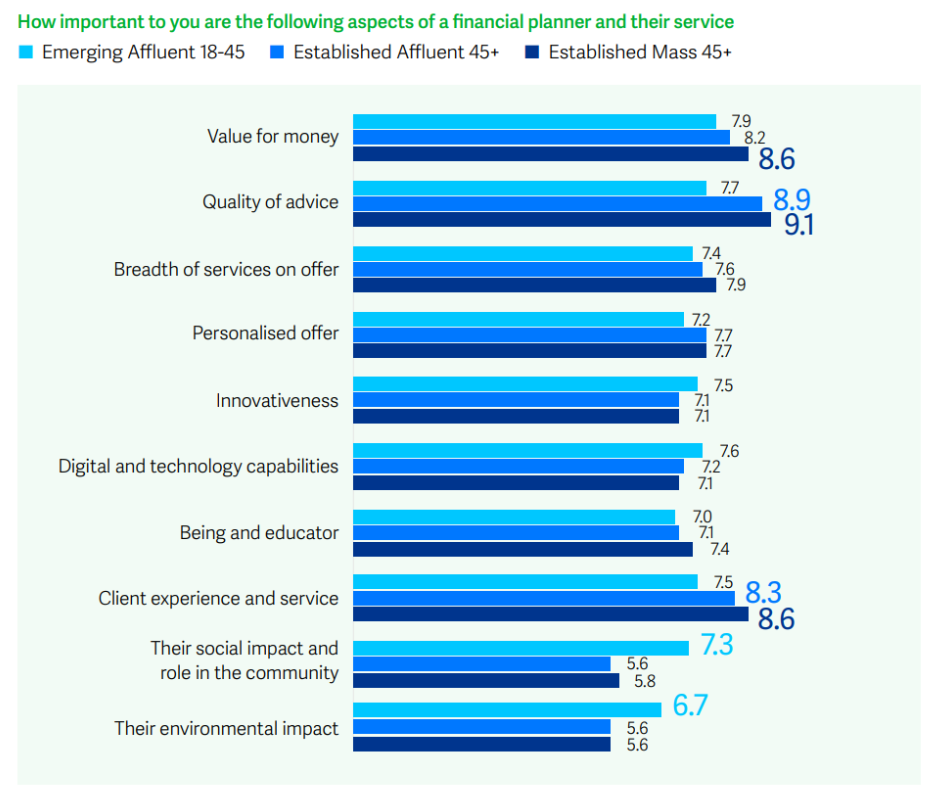

However, once again, there are notable differences between segments here too.

For example, both older groups, the Established Mass and Established Affluent, are more likely to say intangibles such as value for (8.6 and 8.2 out of 10 respectively) and quality of advice (9.1 and 8.9) are important, compared to the younger cohort. As well, they rate the client experience and service as more important than Emerging Affluents.

On the other hand, the Emerging Affluent care more about the firm’s technology offer (7.3) and innovation (7.9), plus the social (7.3) and environmental impacts (6.7) of the firm.

As they seek to deliver enhanced service and enhance their value proposition, advice firms can challenge themselves to better understand their clients and tailor services to their needs.

Read on to learn two important aspects of developing a client value proposition – breadth of service and being an educator.

Disclaimer: This article has been prepared by Netwealth Investments Limited (Netwealth), ABN 85 090 569 109. It contains factual information and general financial product advice only. While all care has been taken in the preparation of this information (using sources believed to be reliable and accurate), no person, including Netwealth, or any other member of the Netwealth group of companies, accepts responsibility for any loss suffered by any person arising from reliance on this information. Any person considering a financial product from Netwealth should obtain the relevant disclosure document at www.netwealth.com.au