Against an uncertain market backdrop the more risk averse investor could be forgiven for moving into cash to wait for a “better” time to come back into the market. But in reality there is no “better” time. Instead, making small adjustments to try and help mitigate the challenges can actually help deliver better outcomes.

Investing is hard – let’s be clear on that. And one of the hardest things is dealing with the uncertainty of markets. However, this volatility—the degree to which your investment results vary from one period to another—is not something that investors should deal with by either ignoring it or trying to jump in and out of markets as the cycles are about to turn.

Now cycles are a natural part of economics, and understanding them is an essential part of investing. But understanding cycles is not the same as timing them, which is extraordinarily difficult. As the old saying goes: “it is time in the market that matters, not timing the market.”

And more than 30 years of investing experience has taught us that in the short term, the market can be fickle. Prices reflect every ray of hope and flicker of fear, whether warranted or not. The single most important lesson we have learned is to remain relentlessly focused on the long term.

And for a long-term investor, volatility is an absolutely critical variable, right up there with investment longevity—where you stay invested and benefit from compound returns—and performance.

Let’s explain our thinking using an example.

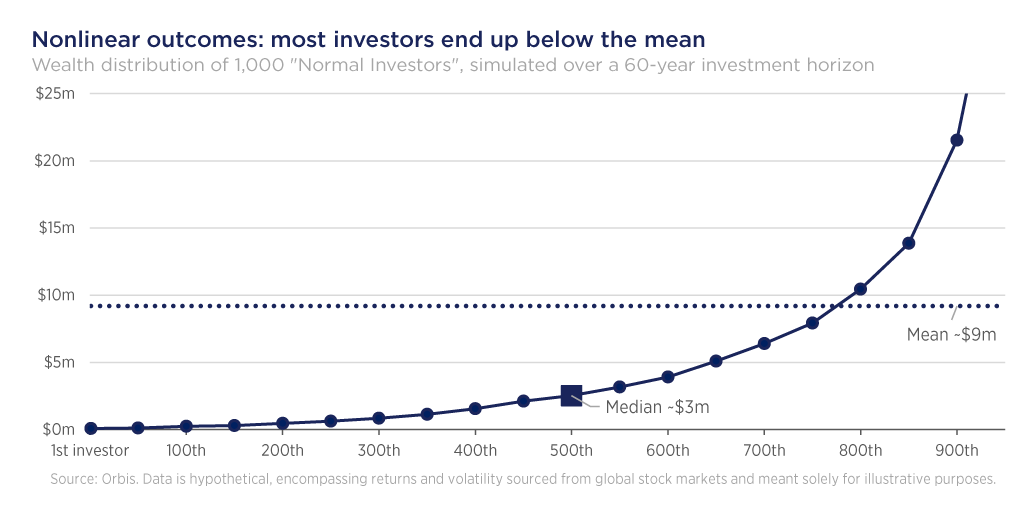

Imagine there are 1,000 hypothetical investors. Each starts with $10,000 and invests for 60 years—roughly a lifetime of investing if you start with your very first pay packet. Each investor’s returns are random, sampled annually from the same distribution of returns from global stockmarkets, with the same volatility. All of our imaginary investors are therefore equally skilled (or unskilled) and equally good (or bad) at risk management.

The chart below plots the ending wealth of this group—let’s call them the ‘normal’ investors. Interestingly, even with a completely random simulation we end up with a wealth distribution curve that looks strikingly similar to real world outcomes. A lucky few accumulate hundreds of millions and are literally off the chart. These investors help pull up the average (mean) result to about $9m. But this is hardly the typical outcome.

About 80% of our investors are below this number—most of them come nowhere near it. Investor #500—bang in the middle (i.e., the median investor)—ends up with about $3m.

It is clear from the chart that the shape of the curve is nonlinear. This means as the curve steepens, there is a big difference between the average and the median outcome, and although you can’t see it on the chart, there are even meaningful differences between investors within the top 1%.

The good news is that this can work in your favour. It means that small things add up, and every little improvement can make a big difference—even if you never end up joining Warren Buffett and Elon Musk in the top right corner.

Now, let’s take this example a step further. Let’s ask ourselves a question which may lead to a different outcome.

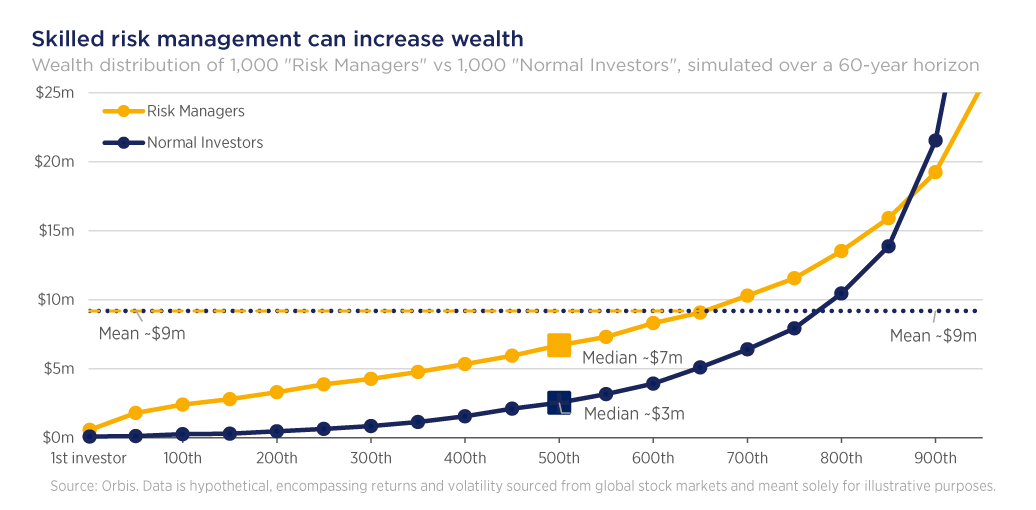

What would happen if our fictional investors were equally skilled or unskilled, but were notably better risk managers? We can answer this question by keeping all of the original assumptions in place, but by reducing the chances of extreme losses and gains (i.e., narrowing the distribution used to randomise returns).

The chart below compares the results of this second group—call them the ‘risk managers’—with the first. The median investor in this group has a far better outcome simply by reducing volatility. In fact, only 10% of this new group ends up worse off than the original ‘median’ investor. In other words, good risk management can significantly raise your wealth generation potential.

The reasoning behind this is that big losses are extremely tough to recover from. As the saying goes, a 50% loss requires a 100% return to regain. Or as Buffett says, “Rule #1: Never lose money. Rule #2: Never forget Rule #1.”

Now, clearly investing in the real world is a lot more complex than in this example, but there are still lessons that investors can apply. In particular, it’s not that investors should avoid risk altogether—it’s essential if you wish to compound your investments over time—but rather that no amount of skill or patience matters if you get wiped out from excess risk taking driven by unrealistic expectations.

This is all the more important in the current market environment, where gradually reversing trends around interest rates and inflation means the range of outcomes is unusually wide and increasingly difficult to manage.

The last 10 or so years were truly exceptional, but they are not the norm. Future returns may be lower if history is any guide, but by reframing expectations on risk and returns and making incremental adjustments as a long-term investor, the next 10 years might be better than expected.

Learn how the investment world is changing and how you can prepare your clients for the next decade. Click here.

This article contains general information at a point in time and not personal financial or investment advice. It should not be used as a guide to invest or trade and does not take into account the specific investment objectives or financial situation of any particular person. The Orbis Funds may take a different view depending on facts and circumstances.