As Australia’s longevity continues to increase, aged care is becoming a live issue for a growing number of families. For a wide range of reasons – everything from cost to human vulnerability, the incidence of dementia and the possibility for family disputes – it’s a subject fraught with emotion. As a result, more and more financial advisers are called on for help – whether by their clients or for the aged parents of their clients.

While old age and the potential need for aged care accommodation is predictable, people find it difficult to plan for. Many clients put off thinking about aged care until the need for it emerges suddenly, through illness, incapacity, injury or the death of a partner. As a result, advisers are often called in to help on short notice.

Even when clients include aged care in their plans, they may not do so explicitly, husbanding their assets to ensure they have money to cover entry and ongoing fees if they eventually need to go into aged care. That can lead to sub-optimal results when compared to a more holistic planning approach.

How advisers can help

When it comes to aged care, clients typically need advice on issues such as:

- Understanding – and funding – aged care fees (including ‘entry’ fees like a Refundable Accommodation Deposit and ongoing fees like Daily Accommodation Payments and Contributions)

- Minimising those fees

- Retaining or maximising social security entitlements

- Dealing with the family home (keep, keep and rent, sell?)

- Investment advice

- Cashflow management

- Estate planning.

As this list attests, much of the work of aged care planning is about integrating it with an overall financial plan. For most people, the primary goal is to maximise aged care amenity at minimum cost. But other issues – such as the disposal of property, ‘Bank of Mum and Dad’ gifts and loans, tax, estate planning etc – make the whole process more complicated.

Social security opportunities

Modern lifetime income stream products offer advisers some strategic flexibility when it comes to navigating these challenges. A client who purchases one of these income streams has only 60% of the purchase price assessed as an asset, and the discount can grow to 100% with time and planning. And there’s no income test on deferred lifetime income streams. These advantages can allow an adviser to gain more Social Security income for their client.

Case study – lifetime income streams and more income in aged care1

Jackie, 78, is a homeowner, receives the full age pension and has $10,000 in the bank. Due to deteriorating health she will soon move into an aged care facility, with a Refundable Accommodation Deposit (RAD) of $500,000.

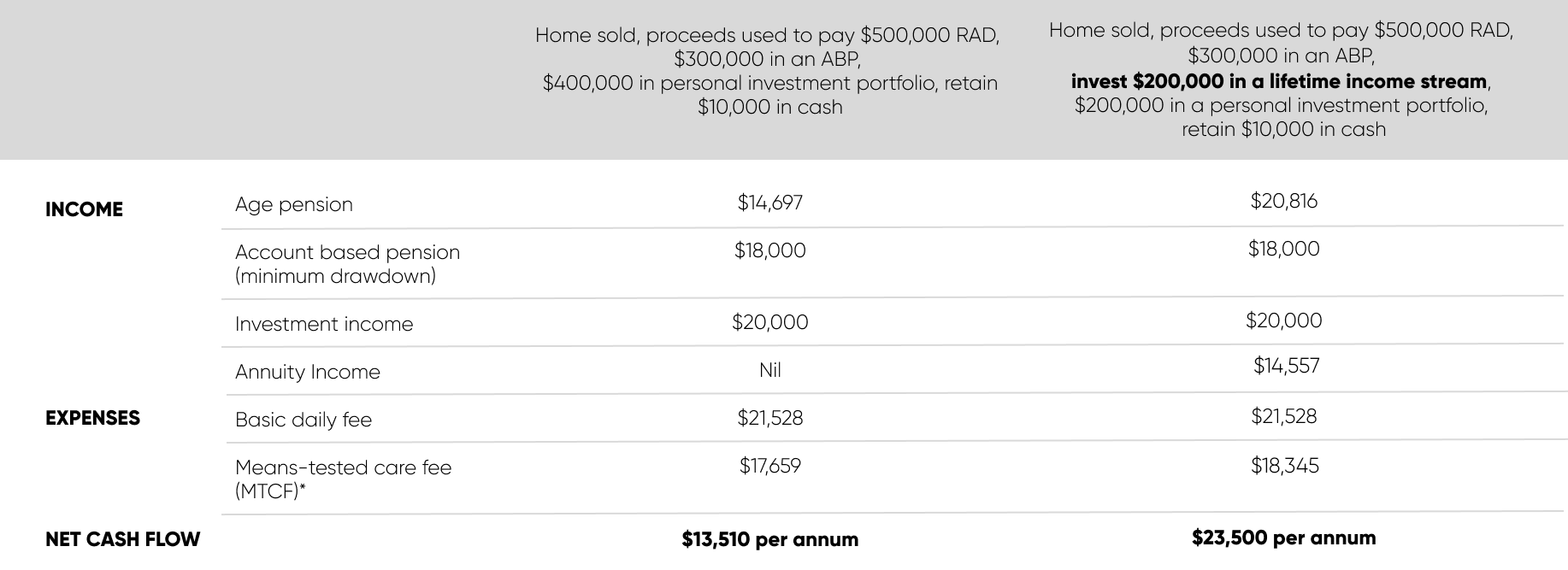

To fund the RAD she sells her home for $1,200,000. The table below compares Jackie’s net cash flow position if she were to use $200,000 of the proceeds to purchase a lifetime income stream (non-super). In both scenarios Jackie uses the downsizer provision to contribute $300,000 to super and commence an ABP (drawing down the minimum). The remaining funds are invested outside super.

By investing part of her home sale proceeds in a lifetime income stream, Jackie and her adviser reduce the amount assessable for the income and asset test, increasing her age pension entitlement. That extra income does increase the Means-Tested Care Fee* by $686 per annum but this is more than offset by the extra age pension of $6,119 in the first year. When she reaches 84, the further reduction in Centrelink accessibility (from 60% to 30%) may further increase Jackie’s age pension entitlement and create a cost savings on the means-tested care fee.

It’s important to look at the results on a client-by-client basis and different assumptions around a range of factors, including life expectancy, investment returns, RAD costs and more could change the results significantly. But an increasing number of advisers see the value of lifetime income streams for clients trying to improve their position when planning for aged care.

AMP’s guide to retirement income

This is an edited chapter from Retire with Confidence – AMP’s guide to the new world of retirement income. If you’d like to read more, download the full paper here.

North has recently launched a retirement space within Ensombl to provide resources to help you assist your clients and answer all your retirement questions. You can join the space here.

1. Numbers in this case study reflect age pension rates, thresholds and aged care fees as at 1 July 2023.

The information in this document is provided by AWM Services Pty Ltd (ABN 15 139 353 496, AFSL No. 366121) (AWM Services) and is general in nature only. This information is for adviser use only and isn’t intended for retail clients. The adviser remains responsible for any advice or services they provide to clients using this information, including making their own inquiries and ensuring that their advice or services are appropriate and in accordance with all legal requirements. This information doesn’t consider any person’s personal goals, financial situation or needs. It’s important a person considers the appropriateness of any advice and reads the relevant product disclosure statement and target market determination available at nothonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them. AWM Services is part of the AMP Group and can be contacted on 131 267 or askamp@amp.com.au. MyNorth Lifetime is a part of MyNorth Super and Pension which is issued by N. M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654) as trustee of the Wealth Personal Superannuation and Pension Fund (ABN 92 381 911 598). MyNorth and North are registered trademarks to NMMT Limited (ABN 42 058 835 573, AFSL 234653) (NMMT), part of the AMP Group. You can read AWM Services’s and NMMT’s Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services it provides. You can also ask us for a hard copy.