Behind the Behaviours: Using Revealed Preferences to Understand What Clients Can't Tell You

Part I: Finding Client Loss Aversion Before It Finds You

Financial advice stands on the brink of an era shift in client diagnostics, much as medicine went through in the early 20th century with the Xray and lab-based blood tests. The key parallel to advice? This new generation of diagnostics enables advice professionals to see what is going on beneath the surface with clients—to go beyond cursory exams and what dialogue alone could tell you—just as physicians experienced in the medical diagnostic revolution.

About the Series

This is the first in a series of articles that will delve deeper than the typical surface level, pop psychology view of behavioural finance (you’ve probably read them…all about the biases and nudges and such). All of that is interesting and useful on the margins, but hard for most advisers to apply with clients systematically or with any rigor.

We’re going to take you on a journey into the deeper, more rigorous and applicable view of behavioural finance – into the domain of preferences and insights that clients can’t tell you. It’s called “revealed preferences”. It combines standard and behavioural economics with decision science and gamified experiences.

In essence, it’s about the difference between what clients say they want and what they actually want.

Part I: We’ll start in this article with a quick intro to revealed preferences, with a focus on detecting loss aversion in clients—especially useful in choppy markets, and something clients can’t self report.

Part II: We’ll go inside the world of advising couples—and how we can look beneath the surface to avoid a hidden pitfall that advisers often don’t detect until it’s too late.

Part III: We’ll look at how hard it is for clients to self-report their changing preferences over time, and what advisers can do to stay ahead of that.

Part IV: We’ll dive into the world of sustainable investing (SI), where a growing number of clients have high interest, but shallow understanding of what’s possible in SI…and what their preferences even could be.

Loss Aversion – Clients’ Hidden Weakness in Volatile Markets

Imagine two clients—Matt and Martha. We’re in 2019, just ahead of the Covid market downturn. Matt is a 40-year-old swashbuckler of a client, engaging a financial adviser for the first time. His risk tolerance questionnaire (RTQ) profiles him as aggressive. Another first-time client, Martha is a 38-year-old executive, whose RTQ profiles her as aggressive, also.

Covid downturn hits—Matt is furiously checking his portfolio balance and is the first to call his adviser, stressed. Martha is cool as a cucumber. What happened?

Why are some investors (even among those who profile the same on an RTQ) better at staying the course through choppy markets than others?

Unlike Martha, Matt has significant loss aversion. Loss aversion, as most of you know, is the observation that human beings experience losses more severely than equivalent gains. It comes from prospect theory, originally documented by Kahneman and Tversky.

We won’t go into the mechanics of Loss Aversion here except to say that it is distinct from Risk Tolerance. And it is measurable, much as a patient’s white blood cell count is measurable with a blood test. About 50% of clients have a meaningful amount of loss aversion.

Professor Shachar Kariv explains loss aversion.

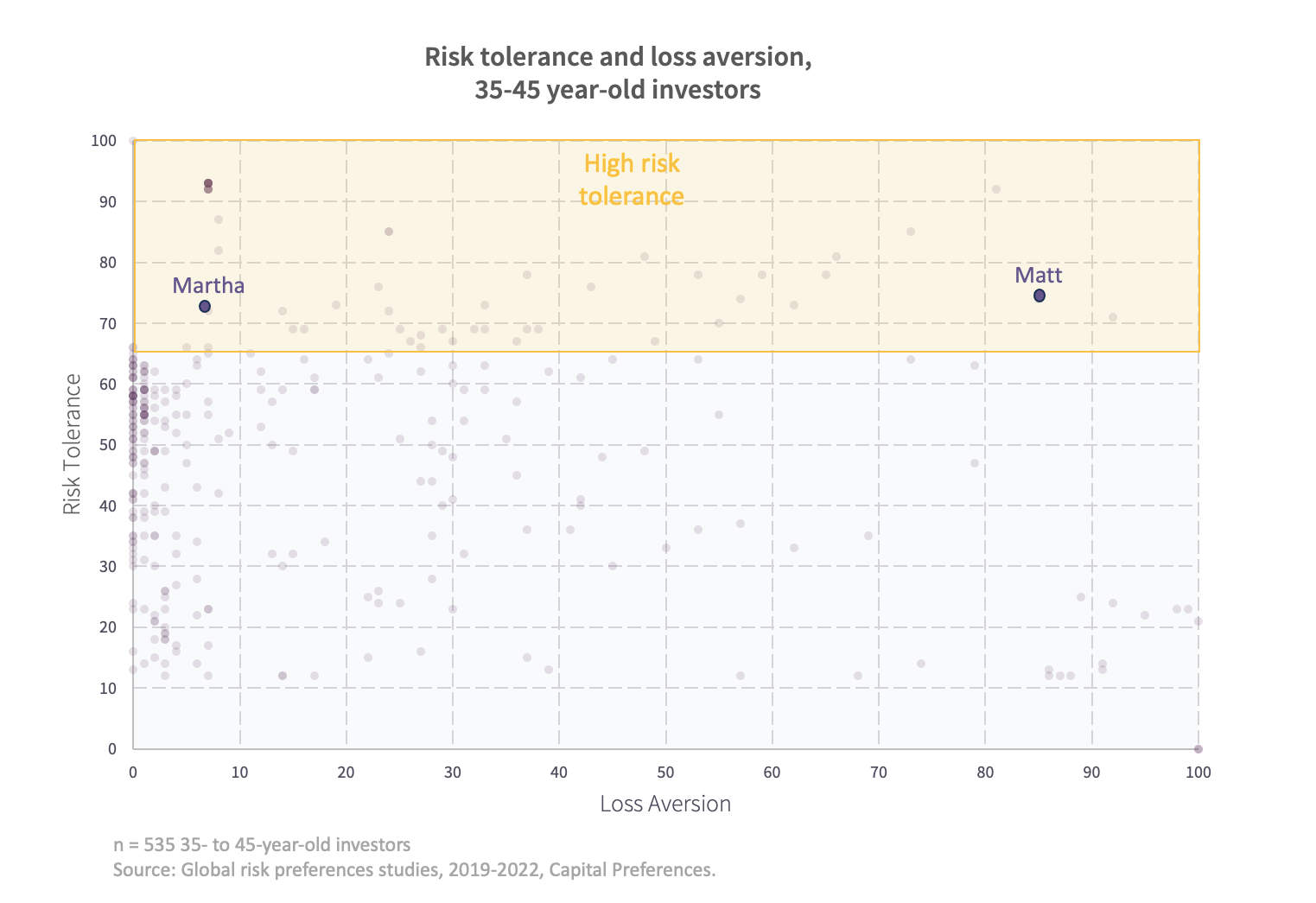

The scatter plot below shows revealed risk preferences for real clients, aged 35 to 45 years old. We’ve yellow highlighted a band of clients with high Risk Tolerance, which include Matt and Martha. Note the wide range of loss aversion just within this band.

To get this level of measurement precision—to tease loss aversion apart from risk tolerance, such that advisers can pick out Martha from Matt in advance of a market downturn—advisers can’t rely on RTQs or clients to self-report. Rather, they must observe a series of decisions their clients make that reveals their loss aversion.

Revealed Preferences—Actions Speak Louder Than Words

That brings us to the Xlab at University of California at Berkeley. Xlab is short for “Experimental Social Science Laboratory”—it’s a place for behavioural and social decision-making experiments.

Revealed preference methods were honed at Xlab through rigorous experiments by Professor Shachar Kariv. Professor Kariv is an economics professor and two-time department chair of Berkeley’s globally esteemed Economics Department.

With revealed preference methods, individuals “play” decision games, in which they make a series of tradeoff decisions using a graphical interface on their mobile device. Their decisions reveal – and enable mathematical modelling of – their preferences.

Sample revealed preference decision.

We’ve used our own tool to illustrate this. In the example shown, Clients make a trade-off decision on a series of risk-reward scenarios by moving a slider to choose their preferred point.

Professor Kariv explains the difference between stated preferences (RTQs and client dialogue) and revealed preferences.

When clients spend a couple minutes to make six risk-reward tradeoff decisions like this, we can model their risk tolerance separately from their loss aversion. In other words, we can pick out the “Matts” from “Marthas”, so that as advisers we can stay ahead of anxieties and behaviours that hamper long-term wealth building.

Moreover, as Professor Kariv would say, we can understand the “topographical map” of a client’s risk preferences, just from these six decisions.

Professor Kariv explains how six decisions can yield such robust results, including a “topographical map” of an individual’s risk preferences.

Preference domains go beyond risk, to include social and time preferences, as well. All three play into life’s financial decisions, large and small.

• Risk preferences of course govern the tradeoffs between uncertainty and expected returns.

• Time preferences reflect how one trades off consumption today vs. consumption in the future. They play strongly into a client’s behaviour in saving for retirement, for example.

• Social preferences describe how individuals trade off their own wellbeing vs. the wellbeing of others. These preferences are central to estate planning and sustainable investing, for example.

Advisers can use revealed preference methods to build a fuller picture of their clients’ preferences – beyond simply finding a best-fit portfolio. For example, they can measure social preferences as an input into sustainable investing recommendations (as we’ll see in Part IV). Likewise, time and risk preferences both play into pinpointing each client’s best-fit retirement income strategy.

The Big “So What?”

Back to the medicine example – if advice professionals can now use revealed preference diagnostics that are the equivalent of the Xray and blood test, it opens up important new possibilities that come with understanding clients at a deeper level.

• Behavioural insights – It equips advisers with insights into how their clients are likely to behave across market conditions, the better to guide the Matts of the world, especially, and help them stay the course.

• “Lightbulb” moments – It puts advisers in a powerful position to teach clients something they didn’t realise about themselves – to spark more “lightbulb” moments in the advisory experience.

• Client preference tracking – It gives us a systematic way of measuring and tracking client preferences as they change, much as a physician can track critical markers in blood tests over time to see trends and stay ahead of problem spots with patients.

• Compliance – It ensures a more accurate risk profile, thereby increasing informed consent and lowering the risk of complaints from a client/risk profile mismatch.

• Ongoing value – All of these build deeper trust and create more surface area for advisers to deliver value to their clients on an ongoing basis.

With that introduction to revealed preferences, we’ll next venture into the world of advising couples, and how to detect hidden differences in risk preferences between partners that, if unaccounted for, can undermine long-term trust and retention.

You can access more information on how revealed preferences can be used within your business and with clients here