A call to arms has been made to portfolio managers and CIOs globally, according to leading global investment and private equity firms, a regime change is occurring and ‘now is the time for all investors to revisit their asset allocation, including portfolio construction¹.

But where should you start when designing an alternative investment strategy? Below we will look into the Who, Why & How of investing in Alternative Assets.

The Who

A key consideration for advisers that are looking to incorporate an Alternative Asset strategy into their portfolio offering is the investor type.

In a broad sense, any investor can invest into alternative assets, subject to accessibility. For example, purchasing an investment property falls into the Alternative Asset bucket.

For those investors looking to access a diversified portfolio of Alternative Assets, that in the past might have been reserved for institutional type investors, or alternatively, are interested in cherry picking investment opportunities that are particular to their interest, then access to these types of investments is limited to wholesale investors.

To meet this eligibility requirement, investors will need to have either a gross income for each of the last two financial years of at least $250,000 or net assets in excess of $2,500,000.

Beyond this requirement, and as with any portfolio recommendations, it’s important to consider the individual investors risk tolerance and financial objectives to determine suitability.

One important factor of alternative assets in determining suitability is liquidity. While it is the illiquidity premium that often provides the payoff for appropriately priced assets, a client’s need to access funds needs to be considered before implement an alternative asset strategy.

The Why

One reason for the inclusion of alternative assets into portfolios stems from consumer demand. There is a growing interest from investors in this asset class with the majority of investors (81%) looking to increase allocations to alternatives².

Additionally, alternatives offer a range of favourable benefits such as increased portfolio diversification, reduced risk and volatility, as well as greater yield.

But perhaps the most compelling reason is in response to the current economic climate and future market outlook.

Released earlier this year (May 2022), KKR’s insights report ‘Regime Change: Enhancing the ‘Traditional’ Portfolio’ discusses how the current economic environment, in particular rising interest rates, higher levels of inflation and heightened geopolitical risks and structural forces (including a changing relationship between stocks and bonds), is driving the need to rethink portfolio construction.

They believe the opportunity lies in building upon the traditional ‘60/40’ portfolio theory, adding value with alternative assets.

The How

Some common questions we get from Advisers that are interested in building out their Alternative Asset strategy are about how they should be approaching integrating this asset type into their portfolios.

There are two core ways to invest in Alternative Assets:

- Directly into investment opportunities. For example, a current Fund Equity opportunity enables investors to co-invest in an equity raise of the Harvest Pub Fund 1.

- Via a diversified pool of alternative assets. For example, the iPartners Core Income Fund.

We typically see financial advisers favour diversified actively managed funds for their clients, which they use to build into their existing model portfolio strategy.

The range of risk-return profiles across the alternative sub-asset classes provides the ability for Advisers to incorporate alternative investments across the risk profile spectrum, customising their portfolios in line with suitable levels of risk and yield.

iPartners currently offers four diversified actively managed funds with varying investment strategies, specifically to enable investors and/or their advisers to tailor their portfolio in line with risk tolerance and investment objectives.

- Core Income Fund

- Conservative Income Fund

- Investment Fund

- Growth Fund

An important consideration when approaching portfolio construction is how much should be allocated to this asset type.

If we look to the global market for guidance, we can see that the role of alternatives in pension fund portfolios globally is increasing. According to the iPartners Alternative Assets Investments guide, alternatives made up 27% of pension fund asset allocations in 2017.

If the largest institutional investor allocations from some of our country’s most prominent investors are used as a guide, this would place the alternatives category weightings in the 15-20% category of portfolios. We suggest advisers consider using this as a baseline when looking at portfolio allocations.

This allocation can then be apportioned across ‘Growth’ type investments, such as Real Estate and Infrastructure assets, and ‘Defensive’ type investments, such as Private Credit, relative to the underlying risk profile’s strategic asset allocation.

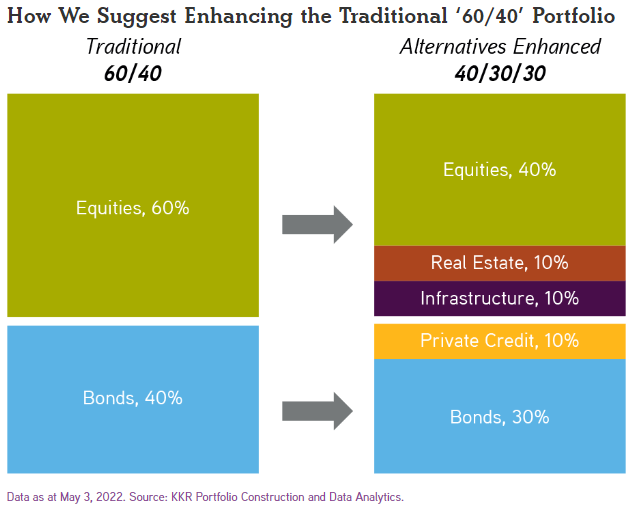

In their report, KKR provided some proposed alternative asset allocation strategies.

- Enhancing the ‘60%‘ Capital Appreciation Component by reducing the allocation to public stocks to 40%, while adding 10% to Private Infrastructure and 10% to Private Real Estate.

- Enhancing the ‘40%’ Income and Hedge Component by reducing the traditional fixed income component to 30%, while adding 10% to Private Credit.

Source: KKR

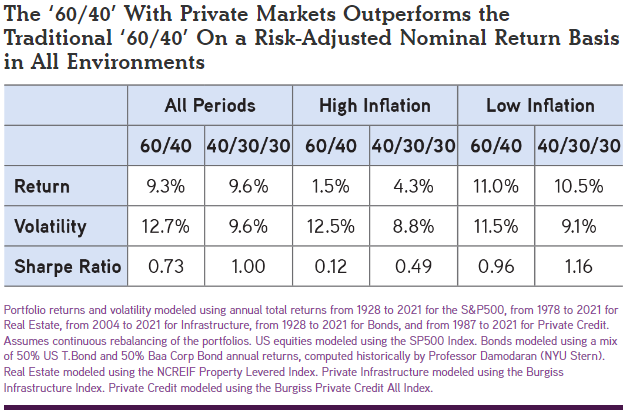

This proposed 40/30/30 portfolio theory, in place of the traditional 60/40 approach, is based on their forecasting of each scenario on a risk-adjusted nominal return basis, across inflationary environments:

Source: KKR

The above outcomes, including higher overall returns and lower volatility, demonstrate the merits of the 40/30/30 approach and incorporating alternative investments into the mix.

So now that you have a better understanding of the Who, Why & How… the only question left is ‘When’ will you look to see how Alternative Assets can form part of your portfolio construction strategy.

iPartners provides self-directed and advised wholesale investors easy access to institutional-grade alternative assets for wealth creation, income generation and portfolio diversification while aligning all parties, offering complete transparency, and helping investors facilitate portfolio diversification with attractive risk/return parameters.

¹‘Regime Change: Enhancing the ‘Traditional’ Portfolio, Henry H. Mcvey, Racim Allouani. 19 May 2022

² ‘Preqin Special Report: The Future of Alternatives 2025 Survey’ Preqin. November 2020