The current economic market conditions have created the perfect storm for alternative asset classes to thrive in.

With recent low-interest rates, high traditional asset prices, and growing volatility – investors are being driven to think outside the traditional investment box in search of better returns and lower portfolio risk.

According to Preqin’s Future of Alternatives 2025 survey, 81% of investors have indicated that they are intending on increasing allocations to alternative investments within the next five years.

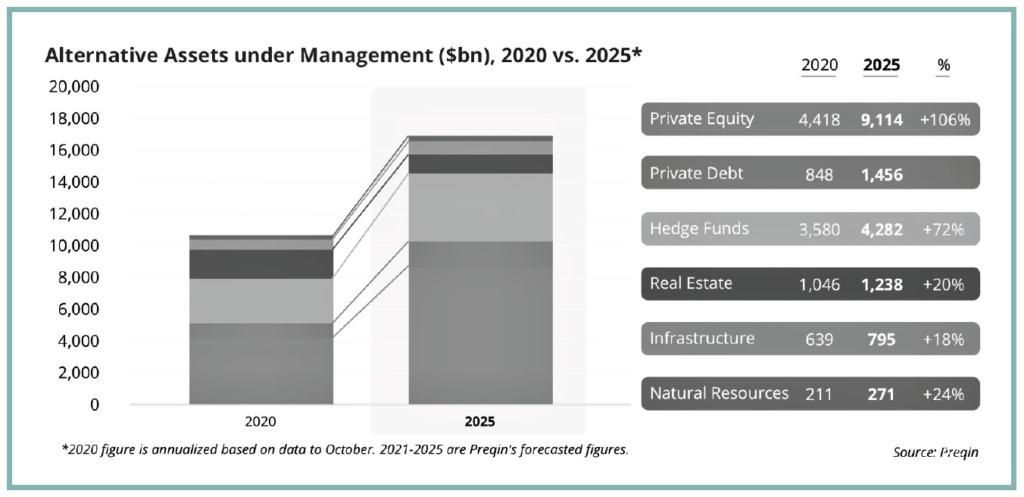

This shift has research houses expecting to see the alternative investment market grow by just under 10% per annum through 2025.

Source: iPartners’ Alternative Assets – Investment Guide

Aside from growing client demand, there is a wide range of reasons advisers should be considering incorporating and/or increasing allocations to alternative assets within their investment strategy.

Alternative Assets provide greater portfolio diversification, can offer higher returns relative to risk, have a focus on the absolute return of an investment, and open up investors to a wider range of opportunities beyond only listed securities.

However, there are also some factors that need to be considered when investing in Alternatives to ensure this asset class is suitable for the investor’s objectives. Alternative assets might have unsuitable initial and ongoing commitment terms and can often be illiquid, resulting in difficulties when it comes to valuing assets. They also often lack transparency due to limited reporting obligations.

It’s clear that there is a growing interest in this Asset Class and that there is a wide range of benefits for investors, when invested appropriately – but what exactly does an investment into alternative assets look like?

A look at the major alternative asset classes

Private Credit

This asset sub-class is made up of various forms of non-bank institutional lending to private companies, such as bilateral corporate loans and asset-backed debt portfolios.

Bilateral Corporate Loans – This is a privately sourced loan to a business whereby the investor will receive a fixed income type return.

Asset-Backed Debt Portfolio – This is a portfolio of debt assets, such as a pool of mortgages, consumer and SME loans etc, which is secured against a pool of assets. This investment type also generates a fixed income type return. The benefit of this asset type is that the investment is diversified over a pool of assets, as opposed to a single asset, which assists with reducing risk.

Private Equity including Venture Capital

Private equity involves investing in private companies and can occur at any stage of a company’s life cycle. Whereas, venture capital typically involves investing in the early stages of a company.

This sub-class represents the largest portion of alternative assets and is expected to double in size from 2020 until 2025, which demonstrates the demand for this asset type.

Hedge Funds

Hedge funds are a pooled investment vehicle, often with specialist investment strategies, intended to maximise returns or reduce risk, as well as act as a buffer against retracting traditional asset markets.

When investing in hedge funds, it’s important for investors to have a comprehensive understanding of the fund’s investment strategy and mandates to determine the suitability of the investment, as these can vary widely.

Property / Real Estate

Perhaps the most widely known asset sub-class, due to its tangible nature, real-estate investments include all residential and commercial (retain, office. Industrial etc) property investments.

Investors can choose to invest either directly, by buying all or part of physical property, or by buying into a pooled property fund.

Similar to asset-backed debt portfolios, investing via a pooled property fund can offer lower risk to investors where the fund is invested into multiple assets.

Agriculture

Investments in this asset sub-class can range from ownership and/or debt funding of primary production, as well to freehold and/or leasehold ownership of farming land.

Investors can choose to invest through a variety of different options, including through specialist agricultural fund managers and via co-investing into individual projects.

Understandably, agriculture has and always will be a critical sector, offering a low-risk investment that generally keeps pace with inflation and valuations over time however, it’s not without its challenges particularly as environmental impacts and concerns continue to grow.

Project Finance

Project financing typically involves the funding of key infrastructure projects. Due to the large scale of these projects, and the significant level of funding required, financing is typically sourced via multiple lenders.

One of the most common ways of structuring project finance is through non-recourse loans, secured over project assets, with returns to investors being funded from project cashflows over the long term.

Given Australia’s heavy reliance on the resource and agriculture sectors, there is often high demand from companies needing project financing, which provides significant opportunities for investors.

Infrastructure

This asset sub-class involves investing in a range of services, facilities, and systems such as ports, rail, energy/water plants, roads, bridges, and airports.

Similar to the Agriculture asset sub-class, investors can choose to invest through a variety of different options, including through specialist infrastructure fund managers and via co-investing into individual projects.

This asset class provides investors with long-term, generally low risk, returns and income, however, investments in this asset class are most commonly held by institutional investors.

While investing in Alternative Assets has typically been the domain of major institutional investors in the past, iPartners are looking to change the future of this asset class by making alternative assets more accessible to the everyday investor. We believe this can be achieved through greater education, flexibility, liquidity and transparency, providing investors with the knowledge and confidence they need when investing in this asset class.

For a deep dive into this investment type, you can find the iPartners’ Alternative Assets – Investment Guide: A look into the World of Alternatives here.

You can also access a wide range of insights, resources, and education tools via the iPartners website.