Talking Alternatives – How to bring alternative investing into the client conversation.

Alternative Assets – An asset class that was once seen as opaque, illiquid, complicated, inaccessible, non-traditional, and/or something to be avoided… is now becoming a must-have for modern-day, forward-thinking portfolio managers.

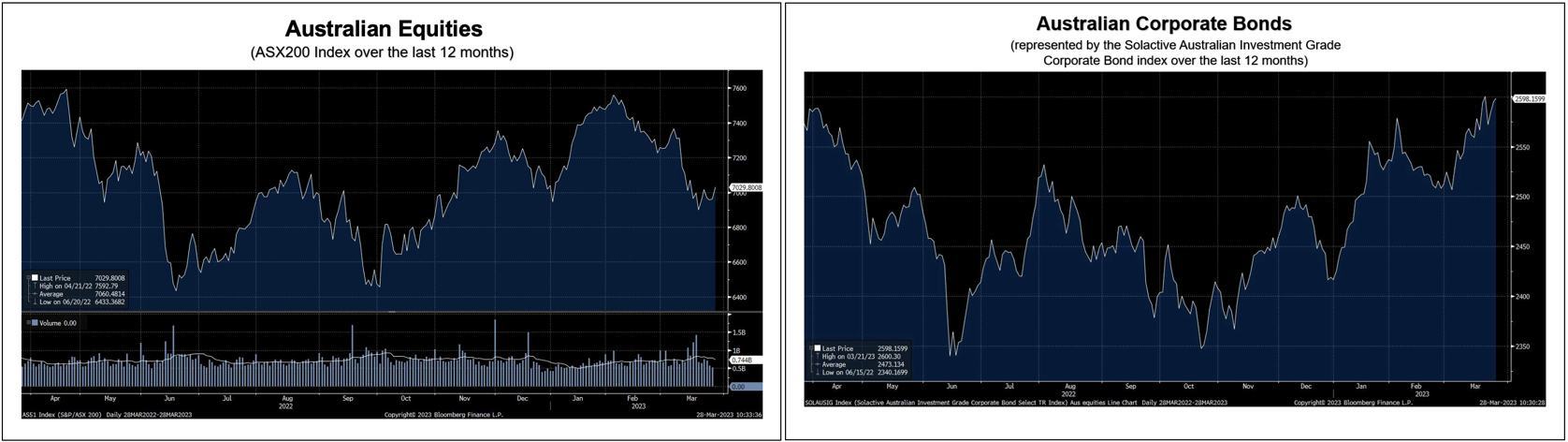

We’re in non-traditional times, economically speaking, where traditional assets aren’t behaving in traditional ways. What worked in the past, isn’t working now, and likely won’t work in the future, which has created the need for a new norm.

The solution – Alternative Assets. This is no longer an asset class that is reserved for institutions only and is now more accessible to advisors and clients than ever before.

But how do you bring alternative investing into the client conversation?

Establishing a Purpose

As with any strategy, there needs to be a strong answer to ‘Why?’.

Why should your clients invest in Alternative Assets? What purpose do they serve?

Helping your clients to understand the ‘Why’ is one of the most critical elements of bringing alternatives into the conversation, and there is no shortage of reasons and benefits for why this varied asset class deserves a seat at the table.

Offering increased diversification, lower potential overall portfolio risk, and higher possibility for returns relative to risk… Alternative Assets can provide income consistency at a time where traditional assets prices are highly volatile.

Providing Education

While “Alternative Assets” might sound like they could be some weird and wonderous investments, when you delve further into the alternative asset sub-classes, this asset type becomes a lot less foreign.

An investment into property, infrastructure or a loan to a private company is a lot easier to understand or comprehend than simply an investment into something that is “alternative”.

By educating clients about what exactly is an alternative asset, they will have greater context and better knowledge and understanding, providing further confidence around investing in this type of asset.

In an earlier article, we provided a high-level overview of the major alternative asset classes.

Building confidence

When discussing Alternative Assets with clients, it’s important to instil confidence in Alternatives as a legitimate asset class, alongside the more traditional asset classes such as stocks and bonds.

Alternative Assets already represent a significant market share of funds under management and research houses are expecting this asset class to experience unprecedented growth over the coming years.

This growth is being driven by both portfolio managers and investors alike, as they recognise the invaluable role this asset class plays in modern day portfolios.

Having a strong portfolio construction methodology

When introducing Alternative Asset investing to clients, this should be accompanied by a strong portfolio construction methodology.

This demonstrates a considered approach to how Alternative Assets can be used to enhance their existing portfolio of traditional assets, to assist them with reaping the benefits that this asset class has to offer.

In this article, we took a deep dive into how you can design an alternative investment strategy for your practice. We also demonstrated that an alternatives enhanced 40% equities / 30% bonds / 30% alternatives portfolio outperforms a traditional 60% equities / 40% bonds portfolio on a risk-adjusted nominal return basis in all inflationary environments.

Benefits

The benefits of incorporating alternative assets into your client’s investment portfolio mix are clear.

The challenge now is to bring alternative investing into the client conversation in a way that assists clients to understand the value of alternative assets and to enable them to feel confident in investing in this asset class.

This is best achieved through educating clients on what Alternative Assets are, why they are important, and how you are best equipped to assist them on their alternative asset journey.

Partnering with a quality investment provider

At iPartners, our focus in on breaking down the barriers to investing in private, institutional grade alternative investments for wholesale investors.

Our market leading alternative asset investment platform has been built to provide both direct investments and diversified portfolios of alternative investments, in a way that is accessible, transparent, straightforward and offers liquidity.

Investments are sourced as co-investments which are validated by experienced investment partners, with the risk / return equation biased toward investors. By directly investing alongside product matter experts, investors can be assured that a thorough due diligence process has been undertaken not only by iPartners, but also by the selected manager.

If you’re ready to bring Alternative Assets in to your client conversations, you can find the iPartners’ Alternative Assets – Investment Guide ‘A look into the World of Alternatives’ here.

You can also access a wide range of insights, resources, and education tools via the iPartners website.